Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 20 February 2015

[font size=3]STOCK MARKET WATCH, Friday, 20 February 2015[font color=black][/font]

SMW for 19 February 2015

AT THE CLOSING BELL ON 19 February 2015

[center][font color=red]

Dow Jones 17,985.77 -44.08 (-0.24%)

S&P 500 2,097.45 -2.23 (-0.11%)

[font color=green]Nasdaq 4,924.70 +18.34 (0.37%)

[font color=red]10 Year 2.12% +0.03 (1.44%)

30 Year 2.73% +0.03 (1.11%)[font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

pscot

(21,024 posts)Demeter

(85,373 posts)There are still too many liars in the mix for anyone to get a good idea of where things stand and where they are headed. I think Warren Buffett getting out of oil is a telling gesture, though.

Demeter

(85,373 posts)Last year it hit 100%...

It is also -1.4F at 9 PM Thursday, heading for -14F Friday morning, with windchills of -26F predicted.

I live in hairy, ugly, itchy wool socks. And 3 layers. Look and move like the Michelin Man

pscot

(21,024 posts)is an awesome sight. But layers are a must.

xchrom

(108,903 posts)1. The eurozone's finance ministers will meet again today to negotiate Greece's debt deal.

2. Two powerful cyclones hit Australia's Northern Territory Friday morning.

3. Greek finance minister Yanis Voroufakis last night tweeted out a link to an anti-German op-ed, which argues that Greece should take a stand against its European creditors.

4. An assault to retake the Iraqi city of Mosul from the Islamic State is set to begin in May.

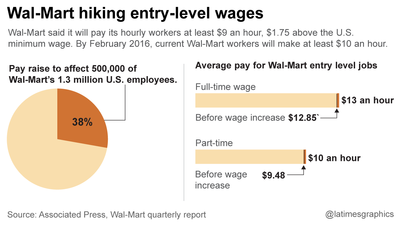

5. Wal-Mart will raise US minimum wage to $9 (£5.83) an hour for 500,000 of its associates in April and to $10 (£6.48) an hour in 2016.

Read more: http://www.businessinsider.com/the-10-most-important-things-in-the-world-right-now-feb-20-2015-2#ixzz3SHUqV3cs

xchrom

(108,903 posts)Here's what we've had:

France - 52.2. That's France's strongest PMI score in three and a half years, going all the way back to mid-2011.

Germany - 54.3. That's Germany's best for a while too - the best in seven months.

The whole eurozone - 53.5. That's a seven month high too.

It's the flash estimate, so we don't get any more of a breakdown than that - just Germany and France are split off from the whole eurozone figure.

Read more: http://www.businessinsider.com/eurozone-pmi-day-february-2015-euroboom2015-2015-2#ixzz3SHVzisap

xchrom

(108,903 posts)TOKYO (Reuters) - Japanese stocks rose to a fresh 15-year high on Friday and the dollar was on the front foot again on upbeat U.S. data, but continuing

again on upbeat U.S. data, but continuing uncertainty over the Greek debt negotiations weighed on the euro.

U.S. weekly jobless numbers released overnight proved better than expected, diffusing some of the pressure on the dollar that followed dovish-sounding minutes from the last Federal Reserve policy meeting.

The minutes had dented expectations for an early interest rate hike by the Fed, driving U.S. debt yields and the dollar lower.

The greenback was also supported as the ebb and flow of confidence in the difficult talks between Greece and its lenders capped th

Read more: http://www.businessinsider.com/r-japan-stocks-hit-new-15-year-high-upbeat-data-lifts-dollar-2015-2#ixzz3SHWhwttA

dixiegrrrrl

(60,010 posts)Guess they did not learn from Greenspan.

xchrom

(108,903 posts)NEW YORK (AP) -- The biggest obstacle for Coca-Cola and Pepsi these days isn't tied to taste tests, the declining popularity of sugary drinks or even their century-long rivalry. It's the surging U.S. dollar.

The two soda giants rely on overseas customers for roughly half of their revenue. When they turned in their quarterly results last week, both reported a drop in sales. The strong dollar made all the difference: strip it out and shrinking sales suddenly rise.

xchrom

(108,903 posts)KEEPING SCORE: France's CAC 40 lost 0.3 percent to 4,820.34 in early trading, while Britain's FTSE 100 was little changed in early trading, inching down 0.03 percent to 6,886.55. Germany's DAX slipped 0.2 percent to 10,976.63. U.S. shares were set to drift lower with Dow futures down 0.1 percent at 17,946. S&P 500 futures dipped 0.1 percent to 2,092.70.

xchrom

(108,903 posts)Bloomberg) -- Productivity is probably the most important measure of economic health that policy makers know the least about.

Its pace will help determine how soon Federal Reserve Chair Janet Yellen and her colleagues increase interest rates and how far rates ultimately will rise.

Demeter

(85,373 posts)

Demeter

(85,373 posts)al-Mart's advertising slogan is "Save money, live better," but for years the world's largest retailer has been criticized for not paying its workers enough to do that.

Now, facing rising minimum wages in California and other states, competition for employees and a poor corporate image, Wal-Mart Stores Inc. said Thursday it would raise the minimum pay to $9 an hour for nearly 40% of its U.S. workforce.

The action is a major milestone in the growing movement to lift the pay of the nation's lowest-paid workers as the gap between rich and poor has widened. It's also a nod to a strengthening economic recovery in which the labor market has expanded by more than 200,000 jobs every month, giving workers more choices.

Advocates for low-wage workers cheered the news after years of pressuring the company to raise wages. But they said the pay increases fell short of what workers need and demonstrated that the federal minimum wage needs to be raised...Starting in April, about 500,000 Wal-Mart employees will get a raise to the new level — $1.75 an hour more than the federal minimum wage — as part of major changes to the company's hiring, training, scheduling and compensation programs. Next February, current employees will receive another raise, to at least $10 an hour...The changes will bump up the average hourly wage for a full-time worker to $13 an hour from $12.85, the company said. In addition, the company said it is raising the caps on pay ranges for jobs, giving hope to those in states such as California where the minimum wage already is $9 an hour.

Wal-Mart said the pay raises will cost the company more than $1 billion this fiscal year, which began Feb. 1. Wall Street balked: Shares fell $2.77, or 3.2%, to $83.52.

SUDDENLY IT'S VIRTUOUS AND GOOD BUSINESS TO PAY AN EMPLOYEE...MAKING A VIRTUE OUT OF A NECESSITY!

xchrom

(108,903 posts)(Bloomberg) -- The German economy picked up momentum this month as manufacturing continued growing and services expansion accelerated.

Markit Economics said its composite Purchasing Managers Index of both industries increased to 54.3 from 53.5 in January. A reading above 50 indicates expansion and the gauge is now at its highest in seven months. Demand rose for a second month.

Germany’s economy grew 0.7 percent at the end of 2014, leading expansion in the euro area. With GDP forecast by the European Commission to rise 1.5 percent this year, the country will remain the driving force of the recovery as politicians haggle with Greece over its bailout and try to prevent tensions from harming confidence and growth.

Demeter

(85,373 posts)Among the arguments for why Americans should risk nuclear war with Russia over Ukraine is that the regime that took power in a coup last year “shares our values.” But one of those “values” – personified by Finance Minister Natalie Jaresko – may be the skill of using insider connections - Ukraine’s new Finance Minister Natalie Jaresko, who has become the face of reform for the U.S.-backed regime in Kiev and will be a key figure handling billions of dollars in Western financial aid, was at the center of insider deals and other questionable activities when she ran a $150 million U.S.-taxpayer-financed investment fund.

Prior to taking Ukrainian citizenship and becoming Finance Minister last December, Jaresko was a former U.S. diplomat who served as chief executive officer of the Western NIS Enterprise Fund (WNISEF), which was created by Congress in the 1990s and overseen by the U.S. Agency for International Development (U.S. AID) to help jumpstart an investment economy in Ukraine. But Jaresko, who was limited to making $150,000 a year at WNISEF under the U.S. AID grant agreement, managed to earn more than that amount, reporting in 2004 that she was paid $383,259 along with $67,415 in expenses, according to WNISEF’s public filing with the Internal Revenue Service. Later, Jaresko’s compensation was removed from public disclosure altogether after she co-founded two entities in 2006: Horizon Capital Associates (HCA) to manage WNISEF’s investments (and collect around $1 million a year in fees) and Emerging Europe Growth Fund (EEGF) to collaborate with WNISEF on investment deals.

Jaresko formed HCA and EEGF with two other WNISEF officers, Mark Iwashko and Lenna Koszarny. They also started a third firm, Horizon Capital Advisors, which “serves as a sub-advisor to the Investment Manager, HCA,” according to WNISEF’s IRS filing for 2006. Regarding compensation, WNISEF’s 2013 filing with the IRS noted that the fund’s officers collected millions of dollars in bonuses for closing out some investments at a profit even as the overall fund was losing money. According to the filing, WNISEF’s $150 million nest egg had shrunk by more than one-third to $94.5 million and likely has declined much more during the economic chaos that followed the U.S.-back coup in February 2014.

But prior to the coup and the resulting civil war, Jaresko’s WNISEF was generously spreading money around. For instance, the 2013 IRS filing reported that the taxpayer-financed fund paid out as “expenses” $7.7 million under a bonus program, including $4.6 million to “current officers,” without identifying who received the money. The filing made the point that the “long-term equity incentive plan” was “not compensation from Government Grant funds but a separately USAID-approved incentive plan funded from investment sales proceeds” – although those proceeds presumably would have gone into the depleted WNISEF pool if they had not been paid out as bonuses. The filing also said the bonuses were paid regardless of whether the overall fund was making money, noting that this “compensation was not contingent on revenues or net earnings, but rather on a profitable exit of a portfolio company that exceeds the baseline value set by the board of directors and approved by USAID” – with Jaresko also serving as a director on the board responsible for setting those baseline values. U.S. AID apparently found nothing suspicious about these tangled business relationships – and even allowed WNISEF to spend millions of dollars helping EEGF become a follow-on private investment firm – despite the potential conflicts of interest involving Jaresko, the other WNISEF officers and their affiliated companies.

MORE FEATHER-BEDDING AT LINK

DISGUSTING WASTE OF TAXPAYER MONEY

Demeter

(85,373 posts)–Mathew D. Rose, It’s a revolution, Stupid! Naked Capitalism

–Paul Mason, Germany v Greece is a fight to the death, a cultural and economic clash of wills, Guardian

If you haven’t been following developments in the Greek-EU standoff, you’re really missing out. This might be the best story of the year. And what makes it so riveting, is that no one thought that little Greece could face off with the powerful leaders of the EU and make them blink. But that’s exactly what’s happened. On Monday, members of the Eurogroup met with Greece’s finance minister, Yanis Varoufakis, to decide whether they would accept Greece’s terms for an extension of the current loan agreement. There were no real changes to the agreement. The only difference was semantics, that is, the loan would not be seen as a bailout but as “a transitional stage to a new contract for growth for Greece”. In other words, a bridge to a different program altogether.

In retrospect, Varoufakis’s strategy was pure genius, mainly because it knocked the EU finance ministers off balance and threw the process into turmoil. After all, how could they vote “thumbs down” on loan package that they had previously approved just because the language was slightly different? But if they voted “thumbs up”, then what? Well, then they would be acknowledging (and, tacitly, approving) Greece’s determination to make the program less punitive in the future. That means they’d be paving the way for an end to austerity and a rethink on loan repayment. They’d also be conceding that Greece’s democratically-elected government had the right to alter the policies of the Eurogroup. How could they let that happen? But, then again, how could they vote it down, after all, it was basically the same deal. As Varoufakis pointed out in a press conference on Monday:

See? It’s the same deal.

This is the conundrum the Eurogroup faced on Monday, but instead of dealing with it head-on, as you would expect any mature person to do, they punted. They put off the loan extension decision for another day and called it quits. Now maybe that was the smart thing to do, but the optics sure looked terrible. It looked like Varoufakis stared them down and sent them fleeing like scared schoolchildren. Now, remember, Monday was the absolute, drop-dead deadline for deciding whether the Eurogroup would approve or reject the new terms for Greece’s loan extension. That means the Eurogroup’s task could not have been more straightforward. All they had to do was vote yes or no. That’s it. Instead, they called ‘Time Out’ and kicked the can a little further down the road. It was not a particularly proud moment for the European Union. But what’s even worse, is the subterfuge that preceded the meetings; that’s what cast doubt on the character of the people running EU negotiations. Here’s the scoop: About 15 minutes before the confab began, Varoufakis was given a draft communique outlining the provisions of the proposed loan extension. He was pleasantly surprised to find that the document met all his requirements and, so, he was prepared to sign it. Unfortunately, the document was switched shortly before the negotiations began with one that backtracked on all the crucial points.

I’m not making this up. The freaking Eurogroup tried to pull the old switcheroo on Varoufakis to get him to sign something that was different than the original. Can you believe it? And it’s only because Varoufakis studiously combed through the new memo that he was able to notice the discrepancy and jam on the brakes. As it happens, the final copy was just a rehash of the same agreement that Varoufakis has rejected from the onset. The only difference was the underhanded way the Eurogroup tried to slip it by him.

Now you tell me: Would you consider people who do something like that “trustworthy”?

Of course not. This is how people behave when they don’t care about integrity or credibility, when all that matters is winning. If the Eurogroup can trick the Greeks into signing something that’s different than what they think they’re signing; then tough luck for the Greeks. “Caveat emptor”. Buyer beware. The Eurogroup has no problem with that kind of shabby double-dealing. That’s just how they play the game. But their trickery and bullying hasn’t worked, mainly because Varoufakis is too smart for them. And he’s too charismatic and talented too, which is a problem for the EU bigwigs who resent the fact that this upstart Marxist academic has captured the imaginations of people around the world upsetting their little plan to perpetuate Greece’s 6-year long Depression. They never anticipated that public opinion would shift so dramatically against them, nor had they imagined that all of Europe would be focused laserlike on the shady and autocratic workings of the feckless Eurogroup. That’s not what they wanted. What they wanted was carte blanche to impose their medieval policies on the profligate Greeks, just like the good old days after Lehman Brothers tanked. After all, that’s how a “anti-democratic imperialist project” like the EU is supposed to work, right?

MUCH REVELATION, THEN YANIS' PLAN:

...Nationalize the banking system, create a Euro-wide bond market, and establish mechanisms for fiscal transfers to the weaker states like we do in the US via welfare, food stamps, gov contracts, subsidies etc. to create some balance between the very rich and productive states like California and New York and the poorer states like South Dakota and Oklahoma. That’s what it’s going to take to create a viable United States of Europe and escape these frustratingly recurrent crises.

Varoufakis knows this, but of course he’s not pushing for this. Not yet at least. Instead, he’s decided to take it slowly, one step at a time. Incremental change, that’s the ticket. Just keep plugging away and building support until the edifice cracks and democracy appears. That’s Varoufakis’s plan in a nutshell: Revolution from within. Just don’t tell anyone in Berlin.

Mike Whitney lives in Washington state. He is a contributor to Hopeless: Barack Obama and the Politics of Illusion (AK Press). Hopeless is also available in a Kindle edition. He can be reached at fergiewhitney@msn.com.

Demeter

(85,373 posts)Russia started supplying gas to rebel-held eastern Ukraine today (19 February) after Kyiv suspended supplies because of damage to the networks from heavy fighting, which is continuing despite a ceasefire. Responding to an order from Russian Prime Minister Dmitry Medvedev to supply gas to east Ukraine as humanitarian aid, gas company Gazprom said it had started supplies via the Prokhorovka and Platovo pumping stations on the border with east Ukraine. Gazprom's Chief Executive Officer Alexei Miller said gas deliveries were reaching 12 million cubic metres of gas per day (cm/d).

Sergei Kupriyanov, a Gazprom spokesman, said the 12 million cm/d was in addition to the 30 million cm/d Ukraine was already receiving, taking total deliveries to 42 million cm/d. He declined to comment further, saying the additional supplies were being shipped under an existing contract with Ukrainian state company Naftogaz. Naftogaz said it had suspended supplies on 18 February "due to the extensive damage of the gas transport networks".

"The resumption of gas supplies is not yet possible because of the ongoing hostilities in the region," it said in a statement.

Relations between Russian and Ukraine have plunged since Moscow annexed the Crimea peninsula and Kiev accused the Kremlin of supporting rebels fighting government troops in east Ukraine. Russia denies arming the rebels. Russian supplies of gas to Ukraine have further complicated relations after Moscow cut supplies last year over unpaid bills. Supplies resumed in December but Gazprom says Ukraine still owes $2.44 billion - a figure Kyiv disputes.

Eugene

(61,899 posts)Source: Reuters

BY MARTY GRAHAM

SAN DIEGO Fri Feb 20, 2015 4:47am EST

(Reuters) - A former director of sales for U.S. chipmaker Qualcomm Inc (QCOM.O) pleaded guilty in San Diego on Thursday to insider trading, officials said.

Derek Cohen, 52, admitted that he netted about $200,000 from a series of stock and options trades made after learning that the company planned to buy Atheros Communications in 2011, a statement from the U.S. Attorney's Office in San Diego said.

As knowledge of pending Atheros acquisition spread within Qualcomm, Cohen spent about $430,000 on stock and call options. When the deal was reported in the media, the stock's value leapt higher, the statement said.

Cohen, who had earlier pleaded not guilty, was the fifth person to admit guilt in connection with the deal, according to court records.

[font size=1]-snip-[/font]

Read more: http://www.reuters.com/article/2015/02/20/us-qualcomm-insidertrading-idUSKBN0LO0H620150220

Demeter

(85,373 posts)This is absurd.

It's +28F in Nome, where it's only 4 AM.

It's +37F and raining in Helsinki, Finland, where it's 3 PM.

It's +28 F and snowing in Reykjavik, Iceland, where it's 1 pm.

I'm going out in that deep freeze, and if I don't come back, I thought the 100 years since the Armenian Genocide might make a suitably cheerful Weekend Thread...

Once more, unto the breach, dear friends...

a record low temperature of -5 degrees was set at Detroit mi today.

This breaks the old record of -4 set in 1936...wunderground.com

Fuddnik

(8,846 posts)It got down to 34, at 4am this morning. I had to get up to check on the wife, who had surgery Wed. She seems to be improving, and it's a job keeping the dogs out of her lap. The last freeze we had here was in 2011. But we're talking low '70s tomorrow, and almost 80 Sunday.