Economy

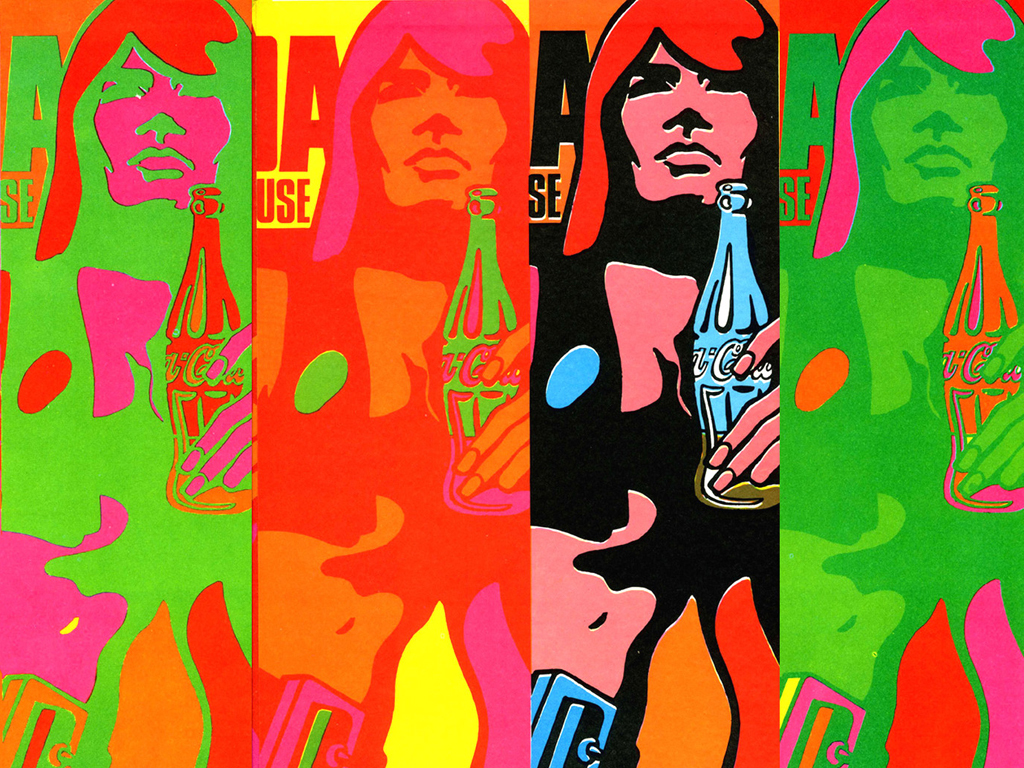

Related: About this forumWeekend Economists Celebrates Psychedelia - March 14 - 15

Psychedelia never really died it seems, it just changed and morphed with the times. While in the past, psychedelia was associated with music and art; these days it's morphed into a psychotic subculture, highly associated with politics and banking and media. How else to explain the mind-altering (and mind-boggling) things that politicians and bankers and media would want us to believe? You either have to be on mind-altering substances to say such nonsense or to believe such nonsense. Or possibly both.

From Wikipedia:

Psychedelia is a name given to the subculture of people who use psychedelic drugs, and a style of psychedelic artwork and psychedelic music derived from the experience of altered consciousness that uses highly distorted and surreal visuals, sound effects and reverberation, and bright colors and full spectrums and animation (including cartoons) to evoke and convey to a viewer or listener the artist's experience while using such drugs. The term "psychedelic" is derived from the Ancient Greek words psychē (ψυχή, "soul"and dēloun (δηλοῦν, "to make visible, to reveal"

, translating to "mind-revealing".

A psychedelic experience is characterized by the striking perception of aspects of one's mind previously unknown, or by the creative exuberance of the mind liberated from its ostensibly ordinary fetters. Psychedelic states are an array of experiences including changes of perception such as hallucinations, synesthesia, altered states of awareness or focused consciousness, variation in thought patterns, trance or hypnotic states, mystical states, and other mind alterations. These processes can lead some people to experience changes in mental operation defining their self-identity (whether in momentary acuity or chronic development) different enough from their previous normal state that it can excite feelings of newly formed understanding such as revelation, enlightenment, confusion, and psychosis.

Psychedelic states may be elicited by various techniques, such as meditation, sensory stimulation or deprivation, and most commonly by the use of psychedelic substances.

http://en.wikipedia.org/wiki/Psychedelia

Now tell me, isn't that a pretty damn good description of what going on in the world these days?

But today, let's celebrate the Psychedelia of the 1960's, when altering one's mind didn't end up altering the planet through psychotic nonsense like "there's no such thing as global warming" or "the global financial system is completely solvent" or "we can totally fight and win 20 wars at the same time, including nuclear ones."

So like they said in the military back then, "smoke 'em if you've got 'em."

Please note! Music and art are mandatory this week! (If you ain't got them, there's this thing called the internet. Check it out)!

The motto of most Americans these days. (Does not apply to those in the State Department or the DoD or the CIA).

I'd love to change the world

But I don't know what to do

So I'll leave it up to you

And we all know what happens when you leave these things up to the State Department or the DoD or the CIA! So don't leave it up to them!

Egads! Can you imagine a stamp like this these days? Can you imagine anything costing 10¢ these days? Can you imagine what type of cow Republicans (and many Democrats) would have if the Postal Service advocated preserving the environment?

Scootaloo

(25,699 posts)If the modern age ought to be compared to the effect of substances on the human body, I nominate caffeine withdrawal.

I have indulged in psychotropics, and these times, sir, are no mescaline.

bravenak

(34,648 posts)This is more like meth or crack.

magical thyme

(14,881 posts)bath salts are where it's at. bath salts and eating people's faces off ![]()

bravenak

(34,648 posts)And fake weed. And Krokodil. ![]()

I cannot understand krokodil.

magical thyme

(14,881 posts)here in Maine, bath salts are where it's at.

We just had somebody in town jailed for stealing ice cream from the local supermarket. They also wanted to get her for stealing bath salts from the little store next to the supermarket, but the store owners pled the 5th to avoid incriminating themselves. ![]() They added they didn't realize bath salts were illegal...

They added they didn't realize bath salts were illegal...![]()

![]()

![]()

DemReadingDU

(16,002 posts)A person would be crazy to take that stuff

Alittleliberal

(528 posts)MDPV is, but just because a small amount of shops were selling MDPV as Bath Salts doesn't mean all bath salts are drugs.

magical thyme

(14,881 posts)and they ended up losing their store here. The latest episode is that they're re-opening a couple towns away (I think nobody here would lease to them again).

MattSh

(3,714 posts)Walter Russell Mead, a dedicated conservative who for some strange reason insists on calling himself a liberal, is a prolific observer of foreign affairs. Mead is regularly published in a number of centrist, establishment publications and for that reason is extremely useful as a bellwether of elite opinion: he’s not too far right to anger big-time Democrats, and he’s rightwing enough to please Republican “thought leaders.”

Mead recently wrote an article "The Open Ukrainian Society and Its Enemies" in which he describes the emerging Washington consensus about Ukraine, and outlined a strategy that would work to isolate, and eventually defeat, Vladimir Putin's Russia.

Mead's strategy is internally consistent and logical. It astutely recognizes that any push-back against Russia must be multifaceted and rely on a combination of military, economic and political pressure. So if Mead's strategy is logical and if it recognizes what needs to be done, why does it fail? A very simple reason: it takes no account of political reality.

Mead understands that the only way Ukraine will ever be able to stand up to Russia is if its economy is put on a much sounder footing. Apart from cheering the International Monetary Fund (IMF) lending package, his economic prescription amounts to the following:

One approach would be to create a mutually beneficial system of credits that Ukraine could use to purchase needed goods from Eurozone countries — stimulating their economies and creating jobs where Europe badly needs help, but also helping Ukraine get a leg up. Again, this unifies the West rather than divides it.

It’s unclear what planet Mead has been on for the past five years if he thinks that a programme of aggressive Keynesian stimulus would “unify rather than divide” the West. The odds of the EU engaging in this particular policy is somewhere between “infinitesimally small” and “zero.” Why? The answer is extremely simple: the German voter.

Stimulus a dirty word

In both words and deeds since the onset of the global financial crisis, Germany has been incredibly consistent in the belief that Europe already spends too much money and that “structural reforms” are the only way to jolt the economy back to life. “Stimulus” is a dirty word to German voters and to the center-right government now running the country.

One thing about which almost everyone agrees is that Angela Merkel is a canny and astute politician. It’s not an accident that she's won so many elections and has such consistently high poll numbers. A recent Vanity Fair profile made clear one of the reasons for Merkel’s long winning streak: she conducts a ridiculously large number of polls on the German electorate's opinions, more than 600(!) between just 2009 and 2013. That is to say that Merkel, on average, commissions more than one poll a week. She is clearly someone with their finger on the pulse of the German public.

Complete story at - http://www.bne.eu/content/story/comment-germans-dont-want-bail-out-ukraine

MattSh

(3,714 posts)With each passing day, France’s blockbuster $22 billion Rafale fighter jet deal with India dies another death.

Western main stream media says very little about the blowback from Hollande’s disastrous Mistral pullback with Russia.

Their silence may have to do with the fact that Hollande’s decision to break off, the paid in full, Mistral ship deal with Russia has not only lead to India’s hesitation to do business with France’s Military Industrial Complex, but the country that will now be handling India’s massive fighter jet order is non other than Russia. Karma!

How big of a loss is this for Hollande, and how big of a win is this for Putin…let’s put it into perspective.

• By not delivering the Mistral ships, France will have to return the $1.45 billion (already paid for) back to Russia.

• France’s reputation as a trusted military arms provider has been irreparably damaged. Hollande cowered to pressure from Washington and failed to honor a contractual business agreement.

• India, seeing that France cannot be trusted to conduct business in good faith and with sovereignty, is now pulling back from a massive $22 billion Rafale fighter jet deal with France.

• The money allocated to the French industrial complex will now go to Russia’s military industrial complex.

• Russia may have lost two Mistral Helicopter ships, but it will get it’s $1.45 billion back from France, plus another cool $25 billion deal with India.

Who is isolated again?

Complete story at - http://redpilltimes.com/mistral-blowback-india-forgets-frances-22-billion-rafale-fighter-jet-deal-and-pivots-to-russian-5th-generation-fighter-jet-25-billion-deal

MattSh

(3,714 posts)Poland’s farmers are in a very important and very good fight with their government and with their parliament. They are literally fighting for the future health and safety of their families, their grandchildren’s generation, their countrymen and even for the health and safety of the rest of the European Union that believes they have a right to enjoy eating healthy, nutritious food. That’s good and in my view should get more attention for the good it is.

In the week of February 12, all across Poland, thousands of farmers with tractors protested the right-wing Polish government’s planned farm legislation. Many were organized by the farmers’ arm of the Solidarność trade union organization. More than 150 tractors have blockaded the A2 motorway into Warsaw since February 3, hundreds more have closed roads and are picketing governmental offices in other regions. The farmers are vowing to continue the struggle until the government agrees to enter talks with the union and commit to addressing what they see as a crisis in Polish agriculture. And they are right.

ICPPC directors, Jadwiga Lopata and Julian Rose, joined more than 200 farmers at a Solidarity protest in Kielce, South East Poland. The actions represent a dramatic escalation of protests that have been taking place on a smaller scale across the country over the last year. Edward Kosmal, chairman of the farmers protest committee for West-Pomeranian Region said: “We are ready for dialogue. We look forward to meeting with you Prime Minister and beginning a comprehensive government commitment to solving the problems of Polish agriculture. If you do not enter into a dialogue with the Union, we would be forced to tighten our forms of protest.”

What is of vital importance are the demands of the farmers to the new government of Prime Minister Ewa Kopacz. They are four:

• Land rights: implement regulation to prevent land-grabs by Western companies and to protect family farmers’ rights to land. Beginning 2016 the government plans to allow foreign buyers to buy Polish farmland for the first time.

• Legalize direct sales of farm produce: the government must take action to improve farmers’ position in the market, including the adoption of a law enabling direct sales of processed and unprocessed farm products (Right now Poland has the most exclusionary policies in Europe around on-farm processing of food products and direct sales, making it impossible for family farmers to compete with bigger food companies. Oppressive ‘food hygiene’ and other regulations effectively prevent small scale farmers from selling their produce on-farm and in local markets, where their mostly organic but ‘uncertified’ produce is widely respected as of higher quality than food gown on modern industrial agribusiness farms.

• Ban the cultivation and sale of Genetically Modified Organisms in Poland. A new EU rule passed in the European Parliament in January essentially leaves it up to national governments to permit GMO planting or not.

• Extend inheritance laws to include land under lease as a fully legal form of land use.

Complete story at - http://journal-neo.org/2015/03/11/the-good-fight-of-the-polish-farmers/

MattSh

(3,714 posts)Remember when the infamous Goldman Sachs delivered a thinly-veiled threat to the Greek Parliament in December, warning them to elect a pro-austerity prime minister or risk having central bank liquidity cut off to their banks? (See January 6th post here.) It seems the European Central Bank (headed by Mario Draghi, former managing director of Goldman Sachs International) has now made good on the threat.

The week after the leftwing Syriza candidate Alexis Tsipras was sworn in as prime minister, the ECB announced that it would no longer accept Greek government bonds and government-guaranteed debts as collateral for central bank loans to Greek banks. The banks were reduced to getting their central bank liquidity through “Emergency Liquidity Assistance” (ELA), which is at high interest rates and can also be terminated by the ECB at will.

In an interview reported in the German magazine Der Spiegel on March 6th, Alexis Tsipras said that the ECB was “holding a noose around Greece’s neck.” If the ECB continued its hardball tactics, he warned, “it will be back to the thriller we saw before February” (referring to the market turmoil accompanying negotiations before a four-month bailout extension was finally agreed to).

The noose around Greece’s neck is this: the ECB will not accept Greek bonds as collateral for the central bank liquidity all banks need, until the new Syriza government accepts the very stringent austerity program imposed by the troika (the EU Commission, ECB and IMF). That means selling off public assets (including ports, airports, electric and petroleum companies), slashing salaries and pensions, drastically increasing taxes and dismantling social services, while creating special funds to save the banking system.

These are the mafia-like extortion tactics by which entire economies are yoked into paying off debts to foreign banks – debts that must be paid with the labor, assets and patrimony of people who had nothing to do with incurring them.

Complete story at - http://dissidentvoice.org/2015/03/the-ecbs-noose-around-greece/

MattSh

(3,714 posts)The Greco-Germanic war of words continues... Having pissed off The Greeks with his "Troika" remarks, Germany's Schaeuble went on today to more ad hominum attacks by reportedly calling the Greek FinMin "foolishly naive." The Greek ambassador has 'officially' complained to "friend and ally" Germany about the personal insult. But The Greeks had the last laugh, as first Varoufakis and then Tsipras explained respectively that "Greece would never pay back its debts," and "Greece cannot pretend its debt burden is sustainable." The German response, via tabloid Bild, "there must be an end to this madness. Europe must not be made to look stupid."

As Bloomberg reports, Germany and Greece confirmed Thursday that the Greek ambassador in Berlin made an official protest late Tuesday to the German Foreign Ministry over comments made by Schaeuble.

Schaeuble and his Greek counterpart Yanis Varoufakis have traded barbs in recent weeks, with Schaeuble on Tuesday suggesting that Varoufakis needed to look more closely at an agreement that Greece signed in February: “He just has to read it. I’m willing to lend him my copy if need be.”

“It was a complaint after what he (Schaeuble) said about Mr. Varoufakis. As a minister of a country that is our friend and our ally, he cannot personally insult a colleague.”

Koutras did not specify what the insult was, but Greek media had reported that Schaeuble had said that Varoufakis was “foolishly naive.”

Complete story at - http://www.zerohedge.com/news/2015-03-12/germans-furious-after-varoufakistsipras-admit-greece-will-never-repay-its-debts

MattSh

(3,714 posts)I was shocked today by the absolute gaul of the Fed releasing a statement about Net Worth in America reaching record levels. Now I get that they are under extreme pressure to sell the story that everything is rainbows and butterflies. But surely they understand that working class Americans are going along with the story because they really don’t have any say in our nation’s policies anymore. That doesn’t mean they want it thrown in their faces that the Fed has spent 6 years now inflating the wealth of the top 10% so much that it actually lifts the total wealth of the nation’s citizens to record highs.

The ugly reality is that the bottom 80% of Americans experienced none of that gain. That’s right a big ole goose egg. And so when the Fed via its ass pamper boy, Steve Liesman, start banging on about the fact that some sliver of society is being handed extraordinary wealth while the working class has lost 40% of their net worth since 2007, well a big fuck you right back at ya bub! The Fed is very aware that the bottom 80% of Americans own less than 5% of US equity markets. And so the Fed is very aware that its manipulation of stock prices such that it creates immense unearned wealth to those in the markets doesn’t reach the bottom 80%. So why celebrate the results of the stock market price manipulation??

It is embarrassing that our policymakers are either that inconsiderate or that stupid to celebrate such a brutal dislocation between the haves and have nots. I don’t know what one can even say about the Fed making a celebratory statement like that today. It is somewhat beyond words. And really paints the picture as to how little thought goes into the lives and well being of the bottom 80%.

Just to give you something to compare and contrast the situation of the bottom 80% here in the US to counter the Fed’s celebration today. I want you to think about how lucky we are not being in one of the PIIGS nations of Europe. These are the nations that are essentially bankrupt and just hanging on by the kindness of the Troika. Glad we’re not there right?? Well allow me to show you a chart published by CNN Money some 8 months ago.

So there it is. While the average net worth of Americans is 4th in the world pulled up by the top 10%, the median net worth of Americans comes in the 19th spot. Yep, behind Spain, Italy and Ireland so 3 of the 5 PIIGS nations. Meaning the bottom 80% in these broke ass barely hanging on nations have more wealth than the bottom 80% of us here in America.

Complete story at - http://www.firstrebuttal.com/2015/03/12/wow-the-fed-gives-a-giant-fuck-you-to-working-class-americans/

Demeter

(85,373 posts)I've just had my mind expanded...I would never have gotten there on my own.

And the first posts are magnificent. Maybe you'd like a regular gig? On your schedule, of course!

I will need someone to do the April 24-26 Weekend, in any event.

The cards were not with me....again I split the quarters, but only two ways. The last round we racked up 20 points, and my partner for that round took the 1st place prize with 61 points, and I had half that...maybe I needed better partners, along with better cards?

MattSh

(3,714 posts)I was out cruising on the information superhighway earlier this week, then came across some 60's music. Then you mentioned the WEE availability and the rest is history, so to say.

But I do think a few people upthread tripped across this earlier in the morning and were not at all sure what they found here. But I guess if you're up at that time, any mention of psychedelia will get one's attention.

Demeter

(85,373 posts)Maybe it will break the pattern in other parts of DU. Talk about psychedelic....but not the good stuff.

MattSh

(3,714 posts)4. And the Yanukovych kelptocracy it replaced was somehow pereferable?

They stole as much money from Ukraine as the Somoza family did from Nicaragua, and it took the Somozas 40 years.

And my response:

16. Let me answer that one...

I live here and I can tell you that yes, Yanukovich most definitely was preferable.

Under Yanukovich...

• There was no war...

• Inflation was basically negligible

• The money retained it's value

• The economy was growing

Under the junta (and yes, there are a lot of people here that use that term)

• There is a war (blame Russia if you want, but anyone who paid attention to the Nazis were not surprised when they expressed their genocidal beliefs, and have already expressed their intent to overthrow Poroshenko if he does not pursue the war further).

• Inflation is expected to run over 250% this year, by some estimates

• The currency has lost 65% of its value during the previous 12 months

• Ukraine now has a lower standard of living than most of Africa, and by far the worst in Europe.

• Two of the largest employers in the country are on the verge of shutting down (though I understand that Boeing might be interested in purchasing one of those companies for about 10% of what it was worth a year ago).

• The war has devastated Ukrainian industry, most of which was based in the east.

• 50,000 dead (German estimate)

• 1 million plus refugees, most fleeing to Russia. Looks like a lot of people don't believe the government's propaganda about Russia.

• It's generally agreed that corruption is now worse than it's ever been in Ukraine.

• Pensions, education, healthcare have all been slashed

He claims to have relatives in Ukraine, but no rebuttal to anything I said yet.

mother earth

(6,002 posts)at DU's Economy board. Don't start your day without it. ![]()

DemReadingDU

(16,002 posts)March 14, 2015

or

3.1415

Demeter

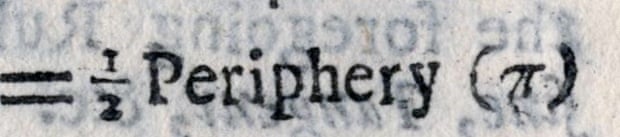

(85,373 posts)Anglesey-born William Jones was the first person to use the Greek letter π for the ratio of a circle’s circumference to its diameter. But who was this little-known figure?

In 1706, William Jones – a self-taught mathematician and one of Anglesey’s most famous sons – published his seminal work, Synopsis palmariorum matheseos, roughly translated as A summary of achievements in mathematics. It is a work of great historical interest because it is where the symbol π appears for the first time in scientific literature to denote the ratio of a circle’s circumference to its diameter.

THAT GOBBLEDEGOOK IN THE TITLE OF THIS POST IS THE HTML TRYING TO COPE WITH THE GREEK LETTER...

Jones realised that the decimal 3.141592 … never ends and that it cannot be expressed precisely. “The exact proportion between the diameter and the circumference can never be expressed in numbers,” he wrote. That was why he recognised that it needed its own symbol to represent it. It is thought that he chose π either because it is first letter of the word for periphery (περιφέρεια

The symbol π was popularised in 1737 by the Swiss mathematician Leonhard Euler (1707–83), but it wasn’t until as late as 1934 that the symbol was adopted universally. By now, π is instantly recognised by school pupils worldwide, but few know that its history can be traced back to a small village in the heart of Anglesey.

When he was still a small child the family moved a few miles further north to the village of Llanbabo. He attended the charity school at nearby Llanfechell, where his early mathematical skills were drawn to the attention of the local squire and landowner, who arranged for Jones to go to London, where he was given a position as a merchant’s accountant. He later sailed to the West Indies, an experience that began his interest in navigation.

When he reached the age of 20, Jones was appointed to a post on a warship to give lessons in mathematics to the crew. On the back of that experience, he published his first book in 1702 on the mathematics of navigation as a practical guide for sailing. On his return to Britain he began to teach mathematics in London, possibly starting by holding classes in coffee shops for a small fee. Shortly afterwards he published Synopsis palmariorum matheseos, a book written in English, despite the Latin title.

EVERY KNOWN FACT ABOUT THIS MAN FOLLOWS...SEE LINK

Demeter

(85,373 posts)Saturday is the once-in-a-century event when the year, ’15, brings the full date in line with the first five digits of pi’s decimal expansion — 3.1415. Typical celebrations revolve around eating pies and composing “pi-kus” (haikus with three syllables in the first line, one in the second and four in the third).

Don’t Expect Math to Make Sense

Demeter

(85,373 posts)In keeping with today's theme!

Demeter

(85,373 posts)...The date—which also happens to be Einstein's birthday—inspires a variety of events every year. This weekend will feature the ultimate Pi Day, as adding the year to our date notation, 3/14/15, encompasses even more digits in the sequence. We won't get this much pi again for 100 years.

Here are some notable moments in the history of pi:

1900-1650 B.C.

Although the term pi wasn't yet in use, a Babylonian tablet gave a value for the ratio of the circumference of a circle to its diameter of 3.125, which isn't bad! In another document, the Rhind Papyrus, an Egyptian scribe writes: "Cut off 1/9 of a diameter and construct a square upon the remainder; this has the same area as the circle." This implies that pi is 3.16049, which is also fairly accurate, according to David Wilson of Rutgers University's math department.

800-200 B.C.

Passages in the Bible describe a ceremonial pool built in in the Temple of Solomon: "He made the Sea of cast metal, circular in shape, measuring ten cubits from rim to rim and five cubits high. It took a line of thirty cubits to measure around it." (I Kings 7:23-26.) This puts pi at a mere 3.

250 B.C.

Archimedes of Syracuse approximated the value of pi by finding the areas of two shapes—a 96-sided polygon inscribed within a circle and one drawn outside it. The areas of the polygons sandwiched the area of the circle, giving Archimedes upper and lower bounds for the coveted ratio. Though he knew he had not found the exact value of pi, he was able to set it between 3.1408 and 3.1429.

Late 1300s

Indian mathematician and astronomer Madhava of Sangamagrama was the first on record to posit that pi could be represented as the sum of terms in an infinite sequence—for example, 4 - 4/3 + 4/5 - 4/7 + 4/9 – 4/11 … ∞. His efforts yielded a value for pi that was correct to 13 decimal places, and he helped lay some of the groundwork for the development of calculus.

1706

Welsh mathematician William Jones began to use π as the symbol for the ratio of the circumference of a circle to its diameter. Famed Swiss mathematician Leonhard Euler adopted this usage in 1737, helping to popularize it through his works.

1873

Amateur English mathematician William Shanks calculates pi to 707 digits. His number was written on the wall of a circular room—appropriately named the Pi Room—in the Palais de la Découverte, a French science museum. But his number was only correct to the 527th digit. The error was finally caught in 1946 and corrected on the wall in 1949.

1897

Lawmakers in Indiana almost pass a bill that erroneously changes the value of pi to a solid 3.2. Cajoled by amateur mathematician Edwin Goodwin, the Indiana General Assembly introduced House Bill 246, which offered up "a new mathematical truth" for free use by the state. The purported truth was Goodwin's attempt to square the circle—a puzzle which requires that a circle and square of the same area be constructed using only a geometrical compass and a straightedge. The bill unanimously passed the House, but the Senate—and hence the state—was spared from embarrassment by C.A. Waldo, a Purdue mathematics professor who happened to be in the State House that day. "Shown the bill and offered an introduction to the genius whose theory it was, Waldo declined, saying he already knew enough crazy people," Tony Long of Wired wrote. Waldo gave the senators a math lesson, and the bill died.

1988

Larry Shaw of San Francisco's Exploratorium introduces the first Pi Day celebration.

2005

Chao Lu, then a graduate student in China, becomes the Guinness record holder for reciting pi—he recited the number to 67,980 digits in 24 hours and 4 minutes (contest rules required that no more than 15 seconds could pass between any two numbers).

2009

Pi Day becomes a national event! Democratic Congressman Bart Gordon of Tennessee, along with 15 co-sponsors, introduced HR 224, which "supports the designation of a Pi Day and its celebration around the world; recognizes the continuing importance of National Science Foundation math and science education programs; and encourages schools and educators to observe the day with appropriate activities that teach students about Pi and engage them about the study of mathematics." The resolution was approved by the House of Representatives on March 12 of that year, proving that a love of pi is non-partisan.

I GUESS I AM GOING TO HAVE TO MAKE PI(E) TODAY!

99,959 0's

99,758 1's

100,026 2's

100,229 3's

100,230 4's

100,359 5's

99,548 6's

99,800 7's

99,985 8's

100,106 9's"

— David Blatner, The Joy of Pi

Demeter

(85,373 posts)He is the most talked-about person in Russia - even when he's nowhere to be seen. Moscow is buzzing with talk about the whereabouts of Vladimir Putin who took a week-long hiatus from public appearances from March 5, fuelling wild rumours about the president's health, political future and love life. On Twitter, critics of the president have been tweeting morbid jokes and memes under the hashtag "Putin is dead", while Russian bloggers and pundits pore over the official Kremlin website looking for discrepancies in Mr Putin's alleged work schedule.

Andrei Illarionov, a former adviser to Mr Putin now based in Washington, claimed in a blog post that Mr Putin had fallen victim to a palace coup and fled abroad, while Konstantin Remchukov, an influential Moscow editor, alleged that the state-owned oil company Rosneft's chairman Igor Sechin was about to get the boot, indicating that a big government shake-up was looming.

In Switzerland, the news outlet Blitz.ch ran a report claiming that Alina Kabaeva, a former gymnast and Duma deputy who has been linked romantically with Mr Putin, had given birth to a child this week in Switzerland's Italian-speaking region of Ticino, suggesting that the Russian president had taken time off for a "baby mission".

The Kremlin's press service has brushed off the various allegations, with Mr Putin's spokesman repeatedly insisting that the president's health is "fine". On Friday, the Kremlin announced that he would be meeting the president of Kyrgyzstan - publicly - in St Petersburg on Monday. Later, Russian state television channels co-ordinated to show Mr Putin at a Kremlin meeting with the head of Russia's supreme court. However, at least one blogger claimed that the footage was dated, noting that the president's desk had a clock on it that was supposed to have been given away as a gift a few days earlier.

While most world leaders have been known to take a short sick leave, Mr Putin has rarely spent more than a day or two out of the spotlight during his 15 years in power, with the exception of two scandals early into his career: the Kursk submarine disaster in 2000 and the Moscow theatre hostage crisis in 2002...In 2012, reports surfaced that he was suffering from a spinal injury, or an even more serious illness, after reporters noticed him limping, and many of his meetings were rescheduled to take place at his residence rather than the Kremlin. However, any signs of an illness gradually disappeared and Mr Putin returned to being the picture of perfect health, aided by regular swimming workouts, hockey scrimmages and a strict diet of healthy eating and low alcohol intake.

Nikolay Petrov, a political analyst at the Higher School of Economics in Moscow, said he believed that Mr Putin's disappearance could be connected to a serious rift in Russia's political elite, but said the 62-year-old president could also simply be feeling the strain of his position - a very one-man job.

"I think he got tired, and perhaps there are some psychological problems or light health problem," said Mr Petrov. "Putin has been extremely active. He has had a very huge burden on him. And the fact that there is hands-on management means that he has to make decisions on a daily basis."

Though Mr Putin is likely to resurface on Monday, as promised, the kerfuffle surrounding his absence has further driven home the extent to which the Russian political system seems to be predicated on one person, said Konstantin von Eggert, a political commentator for Kommersant FM radio. He said: "We know there is a constitutional process in case the president is incapacitated, but Putin has definitely left his stamp on the Russian system to the extent that now his temporary disappearance throws everyone into disarray...It shows the system is based on one pillar."

VIDEO AT LINK

Demeter

(85,373 posts)

The question obsessed Moscow and much of Russia on Friday, as speculation mounted as to why President Vladimir V. Putin had not been seen in public for more than a week. He abruptly canceled a trip to Kazakhstan and postponed a treaty signing with representatives from South Ossetia who were reportedly told not to bother to fly to Moscow. Most unusually, he was absent from an annual meeting of the top officials from the F.S.B., Russia’s domestic intelligence service. The rumor mill went into overdrive, churning out possible explanations from the simple to the salacious to the sinister. He had been stricken by the particularly devastating strain of flu going around Moscow just now. He sneaked off to Switzerland for the birth of his love child. He had a stroke. The victim of a palace coup, he was imprisoned within the Kremlin. He was dead, aged 62...Dmitry S. Peskov, the presidential spokesman, treated all the health questions with a certain wry humor initially, coming up with new and inventive ways to say, “He’s fine.”

Yet, the fact that the story proved impossible to quash underscored the uneasy mood gripping the Russian capital for months now, an atmosphere in which speculation about the health of just one man can provoke fears about death and succession. There have been periodic glimpses of the tension behind the high red walls of the Kremlin, infighting over the wisdom of waging war in Ukraine that has only deepened as the value of the ruble crumbled under the combined weight of an oil price collapse and Western economic sanctions over the annexation of Crimea. Those pressures seemed to culminate in the Feb. 27 assassination of Boris Y. Nemtsov, the opposition leader and former deputy prime minister who was gunned down near the Kremlin. Mr. Nemtsov’s supporters blamed the atmosphere of hate that has been brewing in Russia, with the state-controlled news media labeling him a ringleader among the “enemies of the state.” All that seemed to feed some of the darker interpretations of Mr. Putin’s disappearance. Andrei Illarionov, a former presidential adviser, wrote a blog post suggesting that the president had been overthrown by hard-liners in a palace coup endorsed by the Russian Orthodox Church. Russians could anticipate an announcement soon saying that he was taking a well-deserved rest, the post said. Conspiracy theorists bombarded Facebook, Twitter and the rest of social media with similar intrigue.

Of course, the “wag-the-dog” grandfather of all the conspiracy theories surfaced as well, that Mr. Putin disappeared on purpose to distract everyone from the problems and economic pressures piling up around them. Given that Russia sometimes seems to be reverting to the dusty playbook of the Soviet Union, some concerns seemed to feed off old habits. In the early 1980s, when three Soviet rulers — Leonid I. Brezhnev, Yuri V. Andropov and Konstantin U. Chernenko — died in quick succession, the public was among the last to be informed.

“If an American president dies, not that much changes,” said a reporter who has covered Mr. Putin for years, not wanting to be quoted by name on the subject of the president’s possible demise. “But if a Russian leader dies everything can change — we just don’t know for better or worse, but usually for worse.”

The White House declined to say if it had any information about Mr. Putin’s whereabouts or whether President Obama has been briefed.

“I have enough trouble keeping track of the whereabouts of one world leader,” said Eric Schultz, a White House spokesman. “I would refer you to the Russians for questions on theirs. I’m sure they’ll be very responsive.”

The last confirmed public Putin sighting was at a meeting with Prime Minister Matteo Renzi of Italy on March 5, although the Kremlin would have one think otherwise. That was another aspect of the Soviet past that seemed to actually emerge from the grave: efforts to doctor the president’s timetable to confirm that all was hunky-dory. The daily newspaper RBC reported that a meeting with the governor of the northwestern region of Karelia, pictured on the presidential website as taking place on March 11, actually occurred on March 4, when a local website there wrote about it. A meeting with a group of women shown as March 8 actually happened on March 6, RBC said. On Friday the Kremlin released video and still pictures of Mr. Putin meeting with the president of the Supreme Court to discuss judicial reform. The footage got heavy play on state-run television, but given that it was not live it did little to douse the flaming rumor mill. The simplest explanation appeared to come from an unidentified government source in Kazakhstan, who told Reuters “it looks like he has fallen ill.”

Since half of Moscow seemed racked with a flu that knocks people onto their backs for days at a time, that seemed the most likely explanation. (Who knows how many hands he shakes in a day?) But there seemed to be a certain reluctance to admit that Russia’s leader, who cultivates a macho image of ruddy good health, might have been felled like a mere mortal. His spokesman told any media outlet that called (and most did) that his boss was in fine fettle, holding meetings and performing other duties of the office. “No need to worry, everything is all right,” Mr. Peskov said Thursday in an interview with Echo of Moscow radio. “He has working meetings all the time, only not all of these meetings are public.”

As new theories emerged practically by the hour, Mr. Peskov denied them all. A Swiss tabloid reported that Mr. Putin had spent the past week accompanying his mistress, the Olympic gymnastics medalist Alina Kabayeva, to give birth in a clinic in Switzerland’s Ticino canton favored by the family of Silvio Berlusconi, the former Italian prime minister. (It would be the third child, none confirmed.) Mr. Peskov swatted that one down, too. Of course, Mr. Putin’s opponents next door in Ukraine lost no time celebrating the possible news. One set up a clock using a joyous chorus from “Swan Lake” to count off the time since Mr. Putin last appeared alive.

One of Mr. Putin’s predecessors, Boris N. Yeltsin, used to disappear frequently as well. But that was due either to drinking bouts or, at least once, an undisclosed heart attack. His spokesman settled on a standard explanation that Mr. Yeltsin still had a firm handshake and was busy working on documents. Mr. Peskov drolly resorted to both explanations, telling Echo of Moscow that Mr. Putin’s handshake could break hands and that he was working “exhaustively” with documents. By Friday, Mr. Peskov’s patience appeared to be wearing thin as he told Reuters: “We’ve already said this a hundred times. This isn’t funny anymore.” But he also mused aloud about finding a wealthy sponsor to underwrite a prize for the funniest hoax invented about Russia’s leader.

Early in his presidency, Mr. Putin infamously dropped out of sight when the submarine Kursk sank in 2000 and again two years later when terrorists seized a Moscow theater, trapping hundreds of hostages. But since those two crises, which spawned all manner of questions about his leadership skills, he has been very much a public figure.

A key sign that Russians seemed to be taking it in stride, despite the weird and wild tales, was that the value of the ruble barely budged. Farther away, on world markets distant from rumor central, there were gyrations attributed in part to the Putin uncertainty.

Now all eyes are on Monday, when the president is scheduled to meet with the president of Kyrgyzstan in St. Petersburg.

Putin Has Vanished, but Rumors Are Popping Up Everywhere

MAYBE HE GOT WORD OF A CIA ASSASSINATION PLOT, AND IS WAITING FOR THE ROUND-UP OF CONSPIRATORS AND INTERROGATION TO GIVE AN ALL-CLEAR....

Demeter

(85,373 posts)Man. For a minute there, it looked like Republicans were getting serious about this whole income inequality thing. We had Jeb Bush calling it "the defining issue of our time" (OK, he used the phrase "opportunity gap," but you get the idea), and Ted Cruz and Rand Paul lamenting how much worse it's gotten lately...Ha, never mind! On Friday, Politico ran a depressing profile of Stephen Moore -- a professional right-wing economy talker best known for advocating tax cuts for the wealthy and being constantly wrong. Like John McCain recommending a bombing raid, Moore has a policy prescription for every economic problem: more tax cuts for the rich. And as Politico's Darren Samuelsohn reports, it turns out that Moore is being courted by just about everybody on the GOP presidential circuit as a potential adviser -- wining and dining with Cruz, Paul, Bush and Scott Walker. Moore hasn't decided where he wants to go, but as Samuelsohn notes, he sees a glitzy gig with a political campaign as the perfect pinnacle to his career in economic policy.

For those who don't take Moore seriously, that career has been really fun to follow. He once compared raising the capital gains tax to shooting people who are good at dancing. He helped craft Herman Cain's infamous "9-9-9" tax plan. After people starting making fun of it, Moore suggested swapping out one of the 9s....He hasn't lost his edge. Last summer, Moore penned an op-ed for The Kansas City Star attempting to strike a public blow to Paul Krugman's math skills. Krugman had recently mentioned Moore in a New York Times column about Kansas' economy going downhill after the state cut income taxes. Moore claimed that actually, a host of states that had recently cut taxes had also seen huge job gains. "No-income-tax Texas gained 1 million jobs over the last five years, California, with its 13 percent tax rate, managed to lose jobs. Oops," he wrote. "Florida gained hundreds of thousands of jobs while New York lost jobs. Oops." Take that, Krugman! Except when the Star's own editorial writer fact-checked the column a few weeks later, he discovered that Moore's numbers were totally wrong, and the actual data didn't support his claims. The paper ran a detailed correction. Oops!

Moore's predictive skills are also great fun. Back in the 1990s, Moore said Bill Clinton's 1993 tax increases would "torpedo" the economy. They didn't. In 2010, he predicted that gold would soon soar to $2,000 an ounce amid spiraling inflation. When the inflation didn't materialize, he insisted that Washington was peddling bogus statistics.

None of this silliness has seriously damaged Moore's career. He's bounced from one elite conservative Washington institution to another -- the Club for Growth, the Wall Street Journal editorial page, the Cato Institute, Fox News and, currently, the Heritage Foundation...People like Moore can keep getting Washington jobs because Washington doesn't really care about getting stuff right. Washington cares about keeping donors happy and making sure you play for the right team. Often, the worse you screw up, the better it turns out for your career. It's a bipartisan phenomenon. After Timothy Geithner presided over a colossal financial disaster as president of the New York Fed, President Barack Obama named him secretary of the Treasury. Geithner was succeeded in that role by Jack Lew, who'd been chief operating officer of Citigroup's horrid Alternative Investments unit while it was hemorrhaging money and the government was bailing it out.

But we were talking about inequality. In a 2011 appearance on "The Rachel Maddow Show," Moore denied that income inequality worsened during the Reagan years, arguing that "the lowest-income people had the biggest gains." In fact, inequality did worsen during that time, as gains for the rich wildly outpaced those of everyone else. This fall, Moore called Federal Reserve Chair Janet Yellen "Class Warrior In Chief" for acknowledging the increase in income inequality over the past three decades in a speech.

It will be hard to deal with the defining issue of our time if we can't even talk about it.

Demeter

(85,373 posts)Demeter

(85,373 posts)MattSh

(3,714 posts)I Had Too Much To Dream Last Night - The Electric Prunes

Demeter

(85,373 posts)Demeter

(85,373 posts)There was an op-ed published Friday in the Los Angeles Times about the complete calamity that is California's water supply...The state is in its fourth year of drought conditions. California's official drought site notes that this January was "considered the driest January since meteorological records have been kept." Reservoir levels remain way below average.

Resevoir levels are so low that the LA Times op-ed says this:

You could write this off as hyperbolic. But look at the description of the author, from the bottom of the story:

"Jay Famiglietti is the senior water scientist at the NASA Jet Propulsion Laboratory/Caltech and a professor of Earth system science at UC Irvine."

Not generally the type of guy whose op-ed about water you write off.

antigop

(12,778 posts)antigop

(12,778 posts)antigop

(12,778 posts)Sorry...not the theme

Pi by Hard 'n Phirm HD (Extended Pure Numbers)

Demeter

(85,373 posts)Federal health officials were advised in 2009 that a formula used to pay private Medicare plans triggered widespread billing errors and overcharges that have since wasted billions of tax dollars, newly released government records show. Privately run Medicare Advantage plans offer an alternative to standard Medicare, which pays doctors for each service they render. Under Medicare Advantage, the federal government pays the private health plans a set monthly fee for each patient based on a formula known as a risk score, which is supposed to measure the state of their health. Sicker patients merit higher rates than those in good health. The program is a good fit for many seniors. Some 16 million people have signed up — about a third of people eligible for Medicare — and more are expected to follow. Supporters argue that Medicare Advantage improves care while costing members less out of pocket than standard Medicare. The Medicare Advantage industry is lobbying hard to block budget cuts sought by the Obama administration. Medicare Advantage plans are "clearly an important force to be reckoned with when it comes to making public policy," said Dr. Robert Berenson, a former government health official, who is now at the Urban Institute.

But overspending tied to rising risk scores has cost taxpayers billions of dollars in recent years, as the Center for Public Integrity reported in a series of articles published last year. And concerns that some health plans overstate how sick their patients are date back years, according to records recently released to the Center for Public Integrity under the Freedom of Information Act. The documents include an unpublished study commissioned by the agency that runs Medicare and the Centers for Medicare and Medicaid Services, and dated Sept. 29, 2009; the study tracked growth in risk scores starting in 2004, the year after Congress created the billing tool. The study found that risk scores for Medicare Advantage enrollees grew twice as fast between 2004 and 2008 as they would have had the same person remained in standard Medicare. The study said it was "extremely unlikely" that people who enrolled in the plans actually got sicker and noted that coding inflation "results in inappropriate payment levels."

The lead author was Richard Kronick, then a researcher at the University of California, San Diego. Kronick now heads the federal Agency for Healthcare Research and Quality, a research arm of the Department of Health and Human Services. He had no comment. Other authors listed included three CMS employees. A CMS spokesman said on Thursday that the agency sought to publish the findings on a government run research site, but was told it needed to be "substantially shortened" to be considered. "Given competing workload demands we were not able to revise and resubmit the article," the official said in a statement.

The study cited diabetes as an example of the billing problem.

The private Medicare Advantage health plans reported rates of diabetes with medical complications more than twice as often as for people in standard Medicare. "It seems extremely unlikely that the actual distribution of diabetics changed substantially in MA plans ... and almost surely reflects MA efforts to more fully document members' diagnoses," the study said. The authors noted that "a number of companies have successfully marketed services to help MA plans increase their risk scores." They also said that the problem was worsening over time. The study said that a number of large Medicare health plans, which were not named, raised risk scores far above their peers. But the agency chose not to ferret out the worst offenders and discipline them. Instead CMS cut rates industrywide in 2010 by 3.41 percent to offset the jump in risk scores.

Berenson, of the Urban Institute, said cutting rates across the board was a kind of "rough justice."

"It seems to me that they need to identify the plans that are bending the rules," Berenson said. "It's not so easy to focus in on plans that are overly aggressive in billing," he said.

Medicare Advantage plans are currently mounting an aggressive lobbying effort to stave off proposed new federal budget cuts. Fifty-three senators signed a recent letter opposing the cuts. The Coalition for Medicare Choices, run by the health insurance industry, even rolled out a "Medicare Advantage"-themed food truck that parceled out free cookies and coffee near the U.S. Capitol. Utah Sen. Orrin Hatch was among those who stopped by. Separately, an advocacy group called the Better Medicare Alliance on March 10 unveiled a pair of advertisements arguing any cuts would cause seniors to pay more for their medical care.

Clare Krusing, a spokeswoman for America's Health Insurance Plans, said in a statement:

Though Medicare Advantage has built formidable support in Congress, the risk-based payment system has critics in other areas of government. Earlier this week, the Government Accountability Office, the audit arm of Congress, cited more than $12 billion in improper payments to Medicare Advantage plans among a total of nearly $60 billion in misspent Medicare funds for 2014. A broader GAO audit of how well federal officials have monitored the industry to curb overbilling is underway; it's due to be released later this year...The industry has a good track record when it comes to building the political support to silence its critics. For instance, an ad campaign run by the industry in 2013 turned a proposed 2 percent cut in rates into a 3 percent rate hike. In backing down, CMS officials said the revised rates would give patients "more value in the care they receive and greater protections against increasing costs."

President Obama's proposed 2016 budget seeks more than $36 billion in Medicare Advantage cuts over the next decade, mainly by taking aim at risk scoring. A final decision on the payment rates for 2016 is due in April.

This piece comes from the Center for Public Integrity, a nonpartisan, nonprofit investigative news organization. For more, follow the center on Twitter @Publici, or sign up for its newsletter.

IF THE SYSTEM CAN BE GAMED, IT'S A CON GAME!

UNIVERSAL SINGLE PAYER, NOW!

Demeter

(85,373 posts)" We could have a Cultural Revolution except you need culture and intellectuals and stuff like that. All we have is TV."

http://www.counterpunch.org/2015/03/13/the-omega-man-wealth-syndrome/

It's a sci-fi/economics/future history short story! I laughed, I cried, I give it 3 stars and two thumbs up for entertainment value!

MattSh

(3,714 posts)here's something I put together about Poroshenko!

Demeter

(85,373 posts)YOU ONLY NEED ONE REASON: DESPERATION!

MattSh

(3,714 posts)Picked this version for a couple of reasons...

• Get a load of the intro to the song

• Dang, that looks like a Technics turntable they've got there. A bit fancier than the one I had, though.

Demeter

(85,373 posts)The bull market turned six years old this week, and the big Dow and Nasdaq-100 ETFs have delivered returns of more than 200%.

But the SPDR Dow Jones Industrial Average ETF DIA, -0.79% and the PowerShares QQQ ETF QQQ, -0.43% also have suffered more outflows than any other U.S. equity ETFs since the stock market’s bull run began in March 2009.

The Dow play has endured a net outflow of $3.1 billion since March 9, 2009, while the Nasdaq-100 ETF has seen a net outflow of $3.9 billion, according to XTF.com data. As the table below shows, the only nonleveraged U.S. exchange-traded fund that has seen more money exit in the past six years is the SPDR Gold ETF GLD, +0.14% which has been hurt by that commodity’s 28% slide in 2013 and 1.5% dip in 2014 after a 12-year winning streak....

Demeter

(85,373 posts)The Fed has created a very very dangerous situation. Ever since 2009, anytime the markets came close to breaking down, “someone” (read: the FED) has stepped in a propped the markets up:

This same madness has continued despite the Fed ending its QE efforts. In October of last year the markets took a nosedive to critical support. This time around rather than launching a new monetary policy, a Fed President stepped out and hinted that the Fed should consider postponing the end of QE (a mindless statement given the Fed had only $5 billion in QE left at the time. Logic aside, the markets took the hint and erupted higher again.

In simple terms, the Fed has completely conditioned the markets to believe that NO MATTER WHAT stocks will be held up. This policy has worked fine… but eventually it will fail, just as all market props do. Eventually the investment herd will begin to sell/ take profits. And at some point there will be a selling panic. Gauging when this will happen is impossible as we are now talking about crowd psychology, not market fundamentals or economic data (neither of which have mattered for over two years). However, the fact remains that all bubbles burst. This bubble will be no different other than the fact that it was in fact been the FED that created and perpetuated it long after it normally would have burst.

Put another way, when the next crisis hits, the Fed will effectively be out of ammo as it will be a crisis of faith in the Fed. Whenever investors themselves begin to comprehend that the Fed is now more leveraged than many of the investment banks were when they went bust in 2008, the end game will begin.

mother earth

(6,002 posts)bread_and_roses

(6,335 posts)mother earth

(6,002 posts)& Nash & Young (my fave, edited for Young, so silly to have left him out), and Santana...no shortage of gems. ![]()

Come on, go forth & bring it forth. ![]() with love of and for music

with love of and for music ![]()

Demeter

(85,373 posts)There's a currency war going on, and the United States is losing. As of Wednesday, the euro had fallen to a 12-year low of $1.05, down from as much as $1.39 just last year. That's a 24 percent drop in 11 months, to be exact, and there's no reason to expect it to stop anytime soon...Now a strong dollar is good for anyone who's planning a trip overseas, but it's bad news for anyone who's planning on selling stuff there. That's why stocks fell, with markets sliding into negative territory for the year this week, as multinationals that depend on foreign sales took another hit. After all, it's not just the euro that's falling against the dollar, but almost every other currency in the world, too — with Turkey and South Africa's falling more than most on Tuesday.

You could see the dramatic decline in the Euro in this chart:

https://www.washingtonpost.com/wp-apps/imrs.php?src=

&w=1484

&w=1484

Source: Bloomberg

Why is the dollar up so much? Well, the simple story is that the stronger your economy, the stronger your currency. The slightly more complicated version, though, is that currencies go up when monetary policy is relatively tight, and down when it's relatively loose. Now these should just be different ways of saying the same thing — since central banks raise rates when growth is too strong and cut them when it's too weak — but that's not always the case. Sometimes central banks make mistakes, like Europe did, and tighten policy when the economy is still weak, and sometimes they mistake zero interest rates, like Japan did, for easy policy when the economy is so weak it needs even more help than that.

But in any case, it's a lot simpler now. The U.S. economy is doing well enough that it's getting ready to raise rates, and the rest of the world is slowing down enough that it's cutting them. Indeed, the not-so-short list of countries that have eased monetary policy the past few months, some of them multiple times, includes Australia, Canada, Chile, China, Denmark, Egypt, India, Indonesia, Israel, Peru, Poland, Singapore, Sweden, Switzerland, Turkey and, above all, the euro zone. It's finally started buying bonds with newly printed money, a.k.a. "quantitative easing," to try to get its economy out of the low inflation, low growth trap that it's fallen into. And that's not to mention the fact that Japan, which has been stuck in the same kind of one for the better part of two decades, has also been buying bonds this whole time, and recently started buying even more of them. So it's no surprise that the dollar is shooting up so much... the Fed might want to wait to raise rates. Even though unemployment is down to a normal-ish 5.5 percent, there's no rush to normalize policy since there still isn't any sign of inflation or bubbly behavior. The Fed doesn't want to be the only central bank raising rates — a strong dollar is like a tariff against our exports and a subsidy for our imports — unless it really has to, and right now it doesn't.

The only way to lose a currency war is to refuse to fight it, and let yours go up too much. The dollar is already going to go up plenty more no matter what we do, but we can at least try to limit the damage. Because sometimes a strong dollar is a weakness.

Matt O'Brien is a reporter for Wonkblog covering economic affairs. He was previously a senior associate editor at The Atlantic.

xchrom

(108,903 posts)Berlin—Weimar-era hyperinflation, Prussian thrift, the staggering cost of German unification: These explanations, among others, are regularly trotted out (by outsiders) to explain Germany’s unflinching tight-money policies—at a time when Europe is staring deflation in the eye.

Yet if you ask around in Berlin and Brussels, you’ll get no single answer (and zero allusions to Weimar or Prussia) to the question that so perplexes: Why is Germany so stubborn in its insistence that Greece—and all of Europe—stick to suffocating austerity and restrictive monetary policies when the continent is teetering on the brink of another recession?

After all, German eurozone policy has come under immense criticism from foes and friends, including the French and Italian leaderships, the global financier George Soros and Nobel Prize–winning economists (Joseph Stiglitz among them), as well as American Keynesians like Paul Krugman and the New York Times editorial board. Even European Central Bank director Mario Draghi and much of Europe’s business community agree in essence that Germany’s refusal to create fiscal leeway to ignite growth in Europe could have disastrous implications for the continent’s economy—including Germany’s. There’s no way, economists of different stripes concur, that Greece will ever manage to pay off its €315.5 billion arrears—so why not cut it now, as the Greeks plead for, and open up a path to recovery?

Demeter

(85,373 posts)But, they always do! So, neurosis drives the EU....and Merkel is a neoliberal. What a deadly combination!

"The fact that neither German nor other European voters back these kinds of policies at home, yet the leaderships of Germany, the Netherlands, Austria and Finland force them through on the European level, is a striking example of what is called the EU’s democracy deficit: policy made in backrooms by a handful of member states, which are accountable only to their own electorates."

This article is excellent!

Demeter

(85,373 posts)One of the recurring myths following the Great Recession has been that recovery in the labor market has lagged because workers don’t have the right skills. The figure below, which shows the number of unemployed workers and the number of job openings in January by industry, is a useful way to examine this idea. If today’s labor market woes were the result of skills shortages or mismatches, we would expect to see some sectors where there are more unemployed workers than job openings, and others where there are more job openings than unemployed workers. What we find, however, is that there are more unemployed workers than jobs openings in almost every industry. SEE LINK FOR IMBEDDED GRAPH...The notable exception is health care and social assistance, which has been consistently adding jobs throughout the business cycle, and there are signs that workers in that industry are facing a tighter labor market. However, we have yet to see any sign of decent wage gains yet, which would be the final indicator that the labor market, at least for those workers, was approaching reasonable health...Other sectors have seen little-to-no improvement in their job-seekers-to-job-openings ratios. There are, for example, still nearly six unemployed construction workers for every job opening. In other words, despite claims from some employers, there is no shortage of construction workers.

Taken as a whole, these numbers demonstrate that the main problem in the labor market is a broad-based lack of demand for workers—not available workers lacking the skills needed for the sectors with job openings.

About the Author

Elise Gould is senior economist and director of health policy research at the Economic Policy Institute (EPI). Her research areas include wages, poverty, inequality, economic mobility and health care. She is a co-author of The State of Working America, 12th Edition.

Demeter

(85,373 posts)If Vladimir Putin is remotely capable of laughter (the jury is out on that one…) then he’s probably doing so right now...Russia is once again Arch-Enemy of the United States. It’s like living through a really bad James Bond movie, complete with cartoonish villains. And for the last several months, the US government has been doing everything it can to torpedo the Russian economy, as well as Vladimir Putin’s standing within his own country...The economic nuclear option is to kick Russia out of the international banking system. And the US government has been vociferously pushing for this. Specifically, the US government wants to kick Russia out of SWIFT, short for the Society of Worldwide Interbank Financial Telecommunications. That’s a mouthful. But SWIFT is an important component in the global banking system because it lays the foundation for banks to communicate and transfer funds with one another. It’s a network protocol of sorts. Whenever a bank in Pakistan does business with a bank in Portugal, the funds will clear through the SWIFT network. According to the SWIFT itself, they link over 9,000 financial institutions worldwide in over 200 countries, which transact 15 million times per day. Bottom line, being part of SWIFT is critical to conducting business with the rest of the world. And if Russia gets kicked out of SWIFT, it would be a disaster.

Now, SWIFT is technically organized as a ‘Cooperative Society’ and governed by a board of directors. There are 25 available board seats, and each seat is allocated for a three-year term to a specific country. The United States, Belgium, France, Germany, UK, and Switzerland each hold two seats. A handful of other countries hold just one seat. And of course, most countries don’t hold any seats at all.

Here’s what’s utterly hilarious—

On Monday afternoon, not only did SWIFT NOT kick Russia out… but they announced that they were actually giving a BOARD SEAT to Russia. This is basically the exact opposite of what the US government was pushing for. Awkward…But this story is even bigger than that.

Because at the same time that the US government isn’t getting its way with SWIFT, the Chinese are busy putting together their own version of it called CIPS. CIPS stands for the China International Payment System; it’s intended to be a direct competitor to SWIFT, and a brand new way for global banks to communicate and transact with one another in a way that does NOT depend on the United States. We’ll talk about CIPS in more details in a future letter. But in brief, it addresses some serious weaknesses, inefficiencies, and technological challenges of SWIFT. And it should be ready to go later this year.

Make no mistake, this is the beginning of the end of the US dollar’s global hegemony. It’s time to stop hoping that it won’t happen and time to start preparing for it.

Demeter

(85,373 posts)A slew of Chinese companies are investing in Russia, according to the CEO of Russia's sovereign wealth fund, who said it was helping to negate the void caused by international sanctions.

Speaking at the Egypt Economic Development Conference (EEDC) in the resort of Sharm El-Sheikh, Kirill Dmitriev, CEO of the Russian Direct Investment Fund (RDIF), underlined the importance of China's relationship with Russia.

"We have a special program where we co-invest with people to localize their production in Russia, and frankly we see (a) major surge of strategies from China," he told CNBC on the sidelines of the event.

"So a little bit less European countries are coming in right now, but lots of Chinese companies are coming in in mass. So we believe that for Russia it's important to continue working with China, but also to have a strategic relationship with Europe."

MattSh

(3,714 posts)(Bloomberg) -- China will build a 7,000-kilometer (4,350-mile) high-speed rail link from Beijing to Moscow, at a cost of 1.5 trillion yuan ($242 billion), Beijing’s city government said on the social networking site Weibo.

The rail line seeks to facilitate travel across Europe and Asia, Beijing’s municipal government said Jan. 21 in a post on Weibo, China’s equivalent of Twitter. The journey from Beijing to Moscow would take “two days” on a route passing through Kazakhstan, the post said.

The proposed rail line comes as Russia’s economy struggles to recover from the fall in the price of crude oil and as relations with the U.S. and Europe deteriorate over the Ukraine conflict, and as China pushes to market its high-speed rail technology internationally.

The rail line was mooted in November, after Russia and China last year agreed on the largest natural-gas supply deal in history. Alexander Misharin, a first vice-president at state-owned OAO Russian Railways, said in a Nov. 18 interview that the plan would cost $60 billion to reach Russia’s border, and would cut the Beijing-Moscow journey from five days to 30 hours.

Complete story at - http://www.bloomberg.com/news/articles/2015-01-22/china-russia-plan-242-billion-rail-link-from-beijing-to-moscow

Demeter

(85,373 posts)REVIEW OF CIA HISTORY, WHICH CONCLUDES:

...So, when people write of America’s secret government or of its government within the government, it is far more than an exaggeration. It is actually hard to imagine now any possibility of someone’s being elected President and opposing what the CIA recommends, the presidency having come to resemble in more than superficial ways the Monarchy in Britain. The Queen is kept informed of what Her government is doing, but can do nothing herself to change directions. Yes, the President still has the power on paper to oppose any scheme, and then so does the Queen simply by refusing her signature, but she likely could exercise that power just once. In her case the consequence would be an abrupt end to the Monarchy. In a President’s case, it would be either a Nixonian or Kennedyesque end.

Demeter

(85,373 posts)Like a hospital soap opera, much of this week will boil down to what happens to the “patient.”

On Wednesday, the Federal Reserve will release the statement from its two-day Federal Open Market Committee meeting, and investors are keeping a sharp lookout for whether the word “patient” still appears in the statement, a key reference to when the Fed will begin hiking interest rates.

That one detail is crucial for how already-beaten-up stocks fare this week. Last week, the Dow Jones Industrial Average DJIA, -0.82% shed 0.6% and the S&P 500 Index SPX, -0.61% declined 0.9%, putting both indexes into negative territory for the year to date. The Nasdaq Composite Index COMP, -0.44% shed 1.1% for the week but is still up 2.9% for 2015.

“The biggest short term question with regard to the March FOMC is whether the committee chooses to include the ‘patient’ term in their policy statement or drop it,” said Guy LeBas, chief fixed income strategist at Janney Montgomery Scott, in a recent note.

“In terms of impact, retaining the word would imply a first rate hike would be most probable after June and by September 2015,” he said.

For quite a while, the consensus estimate had been that the Fed would start hiking rates in June, but analysts and economists are increasingly nudging the move out to September. LeBas believes the Fed will leave “patient” in its statement, signalling a rate hike closer to September than June.

Another thing to look for in the statement is the Fed’s newest “dot plot,” which should reflect the trajectory of tightening once the first rate hike goes though, LeBas said. The dot plot from the last FOMC meeting appears below:

?uuid=e6444e00-c41d-11e4-b1fb-99640ae08ee5

?uuid=e6444e00-c41d-11e4-b1fb-99640ae08ee5

“As for why we believe September rather than June, it really boils down to one simple fact; the Fed’s preferred measure of inflation, the headline change in personal consumption expenditures, has not been north of 2.0% since spring 2012,” Greenhaus said.

“Our view is that after such a long period of missing their target, Fed members will ultimately want/need just a few additional months of data before being╉reasonably confident╊ inflation will return to trend,” he said.

Demeter

(85,373 posts)For a world economy coming to terms with a soaring dollar and a plunge in oil prices, this week will be all about the U.S. Federal Reserve's policy meeting and its intentions on interest rates. A combination of the European Central Bank printing lots of euros and expectations of a first U.S. rate rise has caused turmoil on the foreign exchanges and in emerging markets. The euro, which peaked at nearly $1.40 in the middle of last year, is now languishing around $1.05 and apparently headed for parity. After successive months of strong jobs data, expectations have been growing that the Fed will point towards a June rate rise by dropping a pledge to be "patient" in considering such a move.

But the dollar's surge, crimping U.S. exports and cutting imported inflation, could cause its policymakers to pause for thought. St. Louis Fed President James Bullard, generally viewed as a hawk, said last week the central bank risked delaying too long given the fall in unemployment. Others expect the absence of inflation to hold sway. A Reuters poll of around 70 economists found an almost even split between the first move coming in June or later in the year.

"Under our base case, continued inflation weakness will get the Fed to change its tune and refrain from hiking rates in June," said Michael Hanson, senior economist at Bank of America Merrill Lynch in New York.

"But the Fed does not appear ready to capitulate yet, and will probably keep a June rate hike front and center in the minds of market participants."

One question is whether the world's big powers, which have hitherto accepted dramatic currency moves as part and parcel of efforts to galvanize growth, will start to grumble about competitive devaluations and a race to the bottom. The euro has dropped a hefty 25 percent versus the dollar since around the middle of 2014. International Monetary Fund chief Christine Lagarde flagged the risks of divergent monetary policies, given expectations of the Fed normalizing policy while the ECB and Bank of Japan continue to print money.

"This will clearly involve more volatility and it will also have currency impact in that those countries or corporates that have borrowed extensively in dollar-denominated loans are going to suffer," she said.

Goldman Sachs now expects the euro to slide to $0.80 by the end of 2017.

CENTRAL BANK FRENZY

It's a big week for central banks, and they have been busy. Twenty-four of them have eased policy this year in an attempt to revive sluggish economies.

Away from the central banking world, Britain's last annual budget before a national election in May will be a big political and economic moment. With growth solid and public finances starting to surprise on the upside, finance minister George Osborne has scope for vote-winning giveaways. But that would run counter to his mantra of more austerity to come to put the UK back on track. Osborne has talked about a cost-neutral budget, which may leave him some room for largesse.

Demeter

(85,373 posts)Uber, you might recall, is very rich. It’s racked up billions of dollars in funding for a valuation somewhere in the realm of $40 billion. Lyft, its main rival, isn’t doing too shabbily either. Late on Wednesday, Lyft confirmed a new $530 million funding round that brings its valuation to more than $2.5 billion. There are lots of reasons for those eye-popping estimates: good service, smart algorithms, aggressive expansion. But another one, which often gets forgotten, is the employment agreements both companies have with their drivers. On Uber’s and Lyft’s platforms, drivers are treated as independent contractors; they are responsible for paying on-the-job costs like gas and vehicle maintenance out of their own pockets and don’t receive any benefits, which translates to huge savings for their companies. Now though, Uber and Lyft are facing a serious legal challenge to the independent-contractor portion of their business model—and, by extension, the rest of the “sharing economy” is as well.

On Wednesday, U.S. district judges said in two rulings that they could not determine whether Uber and Lyft drivers should be classified as independent contractors and that the question in each case would have to be resolved by a jury. That's a major setback for Uber and Lyft, which had hoped to avoid trials by persuading their respective judges to issue summary judgments in their favor. The judges, on the other hand, both concluded that the employment question was too ambiguous for them to decide, and therefore must proceed to a jury under California law. “The test the California courts have developed over the 20th Century for classifying workers isn’t very helpful in addressing this 21st Century problem,” U.S. District Judge Vince Chhabria wrote in his ruling on Lyft. “But absent legislative intervention, California's outmoded test for classifying workers will apply in cases like this.”

Historically, the line between employee and independent contractor has been easier to draw. In California, independent contractors are generally treated as workers who serve multiple clients, have a high level of control over their work, and complete specific jobs over a limited period of time that fall outside the usual scope of their current employer’s business. Employees, by contrast, tend to be employed, supervised, and paid for a long period of time by the same one or two employers; their hours are more regular, and the way they do their work is more regimented. The legal problem for Uber and Lyft is that, by these standards, their drivers seem to fall squarely in the middle. Their hours are flexible—but only to a point. Uber, for example, has threatened to suspend the accounts of drivers who accept less than 90 percent of rides. The same is true of drivers’ control over their work. Uber and Lyft might not make drivers wear uniforms, but the companies do instruct them on other points—how to interact with passengers, what kind of music to play during rides—and threaten to deactivate drivers who don’t meet standards.