Economy

Related: About this forumWeekend Economists Be Mother May 8-10, 2015

What does it mean to be a mother? Many different things, based on context.

Long ago, in a distant galaxy far away....no, that was last Weekend! This Weekend, it's in an Empire 200 years away...the British Empire. Consider the quaint English construction:

It's used because pouring the tea has traditionally been seen as a mother's role.

(OR THE HOSTESS' ROLE, OR THE HONORED FEMALE, OR THE FEMALE LEAST LIKELY TO BE ABLE TO GET OUT OF IT, OR...)

I suspect it's now heard less than it once was for various social rather than linguistic reasons. It's not slang and it's not facetious, but because of the nature of tea-drinking it's likely to be heard in informal situations.

TEABAGS HAVE ELIMINATED THIS USAGE, AS WELL

http://english.stackexchange.com/questions/61370/be-mother-etymology-and-usage

It is also a saying that stems from the superstition that a female guest should never pour the tea in another woman's household - for then she would fall pregnant.

So should a woman offer to pour the tea in another woman's household ("I'll be mother"

From author and folk historian Dr. Alec Gill:

Tea-drinking and fertility were intermingled. Indeed, the tea-pouring cliche‚ "I'll be Mother" stems directly from primitive superstition. The consequences of two people pouring from the same pot could be dire.

During the 1930s, if a man and woman took turns in pouring, a child would be born to them. A female visitor must not pour tea in another woman's house - otherwise, she would fall pregnant. This evolved to having twins and - even worse at the superstitious level - ginger-headed twins.

Thus, an early form of birth-control was to let only one person do all the pouring in company!

Or, consider what it means in THIS Empire, today:

http://rt.com/usa/255617-america-worst-mother-report/

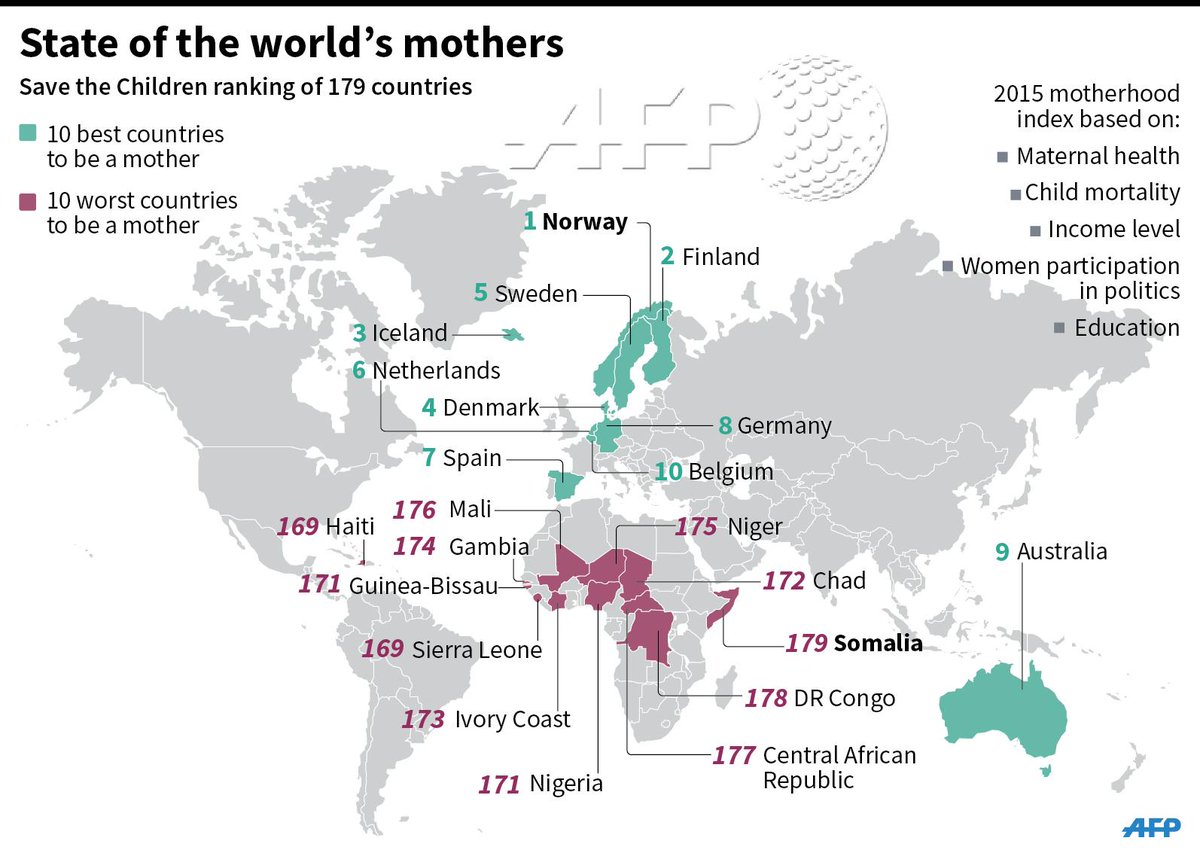

America is the worst developed country in the world to be a mother, ranking 61st globally in maternal health, a groundbreaking analysis of global health inequalities has found. The US performed worse than last year, when it was in 31st place overall. This year it is 33rd. Although it did well on economic and educational status, according to this year's Mother's Index the country lags behind on children's well-being, where it is 42nd, and on maternal health, ranking 61st.

A woman in the United States is more than 10 times as likely as a woman in Austria, Belarus or Poland to die from a pregnancy-related cause, according to a comprehensive report, State of the World's Mothers 2015, published by Save the Children. Women in the US face a 1 in 1,800 risk of childbirth-related death. It's the worst performance of any developed country in the world, the report, released ahead of Mother's Day, celebrated on the second Sunday in May, has warned.

“Other countries are passing us by,” CEO of Save the Children, Carolyn Miles, told reporters at the United Nations. Save the Children also scrutinized infant mortality rates in 25 capital cities of wealthy countries and found that Washington DC had the highest, at 6.6 deaths per 1,000 live births in 2013. This rate is a historic low for the District of Columbia, but is still three times the rates in Tokyo and Stockholm. In 2012, the district had an infant mortality rate of 7.9 deaths per 1,000 live births (while Stockholm or Oslo had infant mortality rates at or below 2.0, according to the report.)

Many major American cities, meanwhile, have even higher infant mortality rates. In 2011, Cleveland and Detroit reported infant mortality rates of 14.1 and 12.4 per 1,000 live births, respectively. A Detroit News investigation last year found that infant deaths accounted for 130 of the 208 Detroit children who died before the age of five in 2011. Prematurity was cited as the leading killer of Detroit babies, according to the report. Other factors which served as a catalyst for infant deaths also included "pervasive poverty, young and uninformed mothers and poor prenatal care." Poverty among disadvantaged minorities could also be a factor. In many American cities, poor, unmarried and young African American mothers are losing their babies at much higher rates than the national average of 6.1 deaths per 1,000 live births, Save the Children stated. In San Francisco, for example, an African-American mother is six times as likely as a white mother to lose her baby before her child’s first birthday. The under-fives mortality rate is 6.9 per 1,000 live births in the US, roughly on a par with Bosnia and Herzegovina, Macedonia, Serbia and Slovakia. "At this rate, children in the US are three times as likely as children in Iceland to die before their fifth birthday," the report said.

There are also alarming gaps between rich and poor in Washington, according to the report. "Babies in Ward 8, where over half of all children live in poverty, are about 10 times as likely as babies in Ward 3, the richest part of the city, to die before their first birthday," the report said. In some US cities, urban child survival gaps between rich and poor are even greater than those in developing countries. Urban mothers in the US also have different life expectancies, with ethnicity being a factor. In most US cities, the largest gap in female life expectancy is between Asian American and African American women, the report stated. The gaps are greatest in Chicago, where Asian American women outlive African American women by more than 14 years.

Save the Children’s 16th annual Mothers’ Index assesses the well-being of mothers and children in 179 countries – 46 developed nations and 133 in the developing world. Nordic countries dominate the top positions on the 2015 Mothers’ Index, while countries in sub-Saharan Africa fill the lowest ranks once again. The contrast between the top-ranked country, Norway, and the lowest-ranked country, Somalia, speaks for itself. While maternal death is a rare event in Norway (the lifetime chance of dying in pregnancy or childbirth is 1 in 15,000), one Somali woman in 18 is likely to die of a maternal cause. While nearly every Norwegian child has a chance for good health and education, almost 15 percent of Somali children don't even live to see their fifth birthday (in Norway, it’s only 0.3 percent, according to the report). Children in Somalia can expect to receive less than 2.5 years of formal education, while an average Norwegian child stays in education for over 17 years.

It's a shocking, illuminating glimpse into these United States. Too bad it comes from Russia...the bigots will ignore it.

Demeter

(85,373 posts)

Demeter

(85,373 posts)Government-controlled mortgage finance company Fannie Mae said on Thursday it will pay the U.S. Treasury $1.8 billion this quarter, its smallest dividend to taxpayers in five years as falling long-term interest rates hit its derivatives holdings. Fannie Mae reported a first-quarter profit of $1.9 billion, up from $1.3 billion in the fourth quarter. Fannie Mae Chief Executive Officer Timothy Mayopoulos said the company expected to be "profitable on an annual basis for the foreseeable future."

The company, together with competitor Freddie Mac, was bailed out by taxpayers in 2008 during the height of a financial crisis and housing market meltdown. Both Fannie Mae and Freddie Mac, which fund most new mortgages and are backed by taxpayer money, are unable to build up capital under the terms of the rescue. With this quarter's dividend payment, the company will have paid $138.2 billion in dividends, well above its $116.1 billion bailout. According to terms of the bailout all profits must be given to the Treasury indefinitely, a policy that shareholders in both firms are challenging in court.

A lackluster housing market and derivatives losses have weighed on Fannie Mae over the last year. Mayopoulos declined to comment on a regulator's invitation that Fannie Mae and Freddie Mac submit proposals for pay raises for their CEOs. The Federal Housing Finance Agency (FHFA) said on Tuesday such a move could help them retain talent or attract future executives. Mayopoulos said the invitation was made to the firm's board of directors, not management. Asked if he might leave the company, he said: "I don't have any plans to go anywhere."

Falling capital cushions will mean Fannie Mae and Freddie Mac will come under increasing risk that a quarterly loss could lead them to draw more money from the Treasury. Mayopoulos said changes in interest rates and home prices could lead to volatility in earnings from quarter to quarter. The FHFA warned in April that Fannie Mae and Freddie Mac could require up to $157 billion in taxpayer aid if the United States entered a severe recession.

Demeter

(85,373 posts)Fannie Mae, the mortgage-finance company operating under U.S. conservatorship, will pay the Treasury Department $1.8 billion after reporting net income of $1.9 billion for the first quarter.

The company, which was seized along with smaller rival Freddie Mac during the credit crisis in 2008, will have returned $138.2 billion to the federal government after it makes the payment next month, according to a regulatory filing Thursday.

“This was another quarter of strong financial performance,” Timothy J. Mayopoulos, Fannie Mae’s chief executive officer, said in a statement. “While we experienced some interest rate volatility again this quarter, we expect to remain profitable on an annual basis for the foreseeable future.”

Under terms of their conservatorships, Fannie Mae and Freddie Mac are required to turn over all profits above a minimum net worth threshold. The payments count as a return on the U.S. investment and not as repayment of the aid, leaving them no existing path out of U.S. control.

Demeter

(85,373 posts)Navinder Singh Sarao, the British trader accused of contributing to the 2010 flash crash, will file an appeal over his bail terms on Friday, according to his lawyer. Sarao’s appeal at the U.K. High Court follows his failed attempt on Wednesday to cut his 5 million-pound ($7.6 million) bail after it emerged his assets have been frozen by U.S. authorities.

The appeal is expected to be heard next week, his lawyer, Richard Egan, said in an e-mail. Sarao remains in custody in London’s Wandsworth prison.

This week’s bail ruling, which came on the fifth anniversary of the flash crash, could keep Sarao behind bars for months pending the resolution of the U.S. extradition bid. The 36-year-old was charged by American prosecutors with 22 counts of fraud and market manipulation last month. He was responsible for one in five sell orders during the frenzy on May 6, 2010, when investors saw almost $1 trillion of value erased from U.S. stocks in minutes, according to U.S. authorities. As he left a London court on Wednesday, Sarao shouted to reporters that he’d “not done anything wrong apart from being good at my job.”

At the hearing, James Lewis, a lawyer for the trader, disclosed the existence of a worldwide freezing order on his client’s assets that precludes him from raising the 5 million-pound bail. Judge Elizabeth Roscoe rejected a request to release Sarao solely on a 50,000-pound security put up by his parents, saying the bail amount had to satisfy her that he isn’t a flight risk. Following a terse exchange with Roscoe, in which she threatened to revoke bail entirely, Lewis said he would appeal the ruling. A full hearing on the U.S. extradition request is scheduled for September.

Demeter

(85,373 posts)Former Bank of Italy Governor Antonio Fazio has been definitively acquitted of market rigging in a 2005 bank takeover battle.

The takeover pitted Italian insurer Unipol against Spain's BBVA for control of Banca Nazionale del Lavoro (BNL).

After nearly a decade of trials and appeals, Italy's top court ruled on Wednesday night that Fazio and 12 other defendants, including former Unipol chief Giovanni Consorte, were innocent of the charges.

In the end neither bid for BNL was successful and the bank was taken over by French group BNP Paribas.

Fazio was definitively found guilty of market-rigging in 2012 for his role in another bank takeover case, also in 2005, in which Banca Popolare di Lodi tried to buy Banca Antonveneta.

Due to the controversy surrounding that case, Fazio was forced out of the Bank of Italy at the end of 2005 to be replaced by Mario Draghi, now head of the European Central Bank.

Demeter

(85,373 posts)FUNNY MONEY--TOO MUCH OF IT

Japan's monetary base stood at a record 305.88 trillion yen ($2.56 trillion) at the end of April, up 35.6 percent from a year earlier, as the Bank of Japan continued to provide more liquidity to raise the inflation rate to its targeted 2 percent, BOJ data showed Thursday.

The monetary base reached an all-time high for the ninth straight month and topped the 300 trillion yen line for the first time. The central bank took additional monetary easing steps last October to raise the pace of supplying funds.

The balance of financial institutions' current account deposits at the BOJ, the biggest part of the monetary base, came to 210.22 trillion yen, up 57.1 percent.

Under the stimulus measures, the BOJ aims to boost the monetary base at an annual pace of about 80 trillion yen, up from 60 trillion to 70 trillion yen under its previous policy.

The BOJ has been trying to get rid of lingering deflationary pressure on the economy with its drastic quantitative easing.

But lower crude oil prices and a slow economic recovery following the 3-percentage-point consumption tax hike to 8 percent in April 2014 have prompted the BOJ to delay the timing of reaching the inflation goal.

The central bank now says it is expecting to achieve the price hike goal around the first half of fiscal 2016, starting next April. It earlier forecast hitting the target during a period centering on the current fiscal 2015.

Demeter

(85,373 posts)Last edited Sat May 9, 2015, 06:46 AM - Edit history (1)

http://www.reuters.com/article/2015/05/07/us-markets-cenbanks-taper-idUSKBN0NS1U020150507Investors spooked by the "taper tantrum" of 2013, when global markets took fright at the U.S. Federal Reserve's first hint that it might taper its monetary expansion policy, take note: 2016 could be the year of the "triple taper tantrum". That's the prediction of analysts at Morgan Stanley, who argue that the Fed, European Central Bank and Bank of Japan might all taper their super-loose monetary policies next year if growth and inflation across the three regions pick up enough. The world's three biggest central banks are at different stages of post-crisis management, so it's a bold call. But it shows just how much markets have turned since the start of the year, when deflation was their worst fear.

"What is unknown is whether the economic situation will pan out as we see it," said Manoj Pradhan, global economist at Morgan Stanley in London and co-author of the report. "We've had a few surprises recently, but the trajectory of monetary policy and growth is leading in that direction."

The Fed has stopped its bond-buying program and its next move will almost certainly be a rate increase. The ECB has just begun a 1 trillion-euro quantitative easing program, which is set to run to September 2016. The BOJ's QE program has paused but could resume at any stage. If growth and inflation pick up in the euro zone and Japan, however, the ECB and BOJ will not need to provide further monetary stimulus.

Pradhan says the "triple taper tantrum" is likely to pan out as follows: The Fed divests its mortgage-backed securities portfolio in the first half of 2016 and both the ECB and BOJ run down their QE programs in the second half of 2016.

"None of these are yet on investor screens in a manner that affects their investment decisions, if our conversations are anything to go by," Pradhan said.

In late May 2013, then-Fed chair Ben Bernanke dropped the strongest hint to date that the Fed would begin winding down its bond purchases. The yield on the 10-year Treasury note started rising from around 1.4 percent. Bernanke appeared to back off from those comments a month later, sparking more market volatility, particularly Treasuries. The 10-year yield rose to 1.80 percent, fell, then climbed back above 2 percent that September. That pales against the gyrations across all bond markets this week. Suddenly spooked by near-zero or even negative yields and a 50 percent rise in oil prices since January, investors have dumped German bonds in a manner not seen for decades. The yield rose to a high of just under 80 basis points on Thursday from only five basis points in mid-April. Bund volatility soared to its highest since German reunification and bond prices were on course for the biggest fall since then.

The 10-year Treasury yield hit a five-month high above 2.30 percent, marking a rise of 50 basis points in only a month.

MattSh

(3,714 posts)I'm posting this again for the 70th anniversary of the end of WW2.

Demeter

(85,373 posts)Ignoring the contribution of the USSR to the defeat of Hitler, the massive suffering and sacrifice of all USSR citizens, the constant abrogations of treaties...by the US and NATO.

Makes a body proud.

MattSh

(3,714 posts)Very large turnout. But now I'll be away from the internet for the next 24-30 hours. Will have more tomorrow.

MattSh

(3,714 posts)It's already 9PM here and I've got a list of things to do.

Hotler

(11,424 posts)MattSh

(3,714 posts)Robert Parry hits it out of the park with this one...

Gifting Russia ‘Free-Market’ Extremism | Consortiumnews

By Robert Parry

If the Washington Post’s clueless editorial page editor Fred Hiatt had been around during the genocidal wars against Native Americans in the 1870s, he probably would have accused Sitting Bull and other Indian leaders of “paranoia” and historical “revisionism” for not recognizing the beneficent intentions of the Europeans when they landed in the New World.

The Europeans, after all, were bringing the “savages” Christianity’s promise of eternal life and introducing them to the wonders of the Old World, like guns and cannons, not to mention the value that “civilized” people place on owning land and possessing gold. Why did these Indian leaders insist on seeing the Europeans as their enemies?

But Hiatt wasn’t around in the 1870s so at least the Native Americans were spared his condescension about the kindness and exceptionalism of the United States as it sent armies to herd the “redskins” onto reservations and slaughter those who wouldn’t go along with this solution to the “Indian problem.”

.....

And, while these U.S. economic advisers helped put Russia onto its back, there was also the expansion of NATO despite some verbal promises from George H.W. Bush’s administration that the anti-Russian alliance would not be pushed east of Germany. Instead, Bill Clinton and George W. Bush shoved NATO right up to Russia’s border and touched a raw Russian nerve by taking aim at Ukraine, too.

But Russian President Putin simply doesn’t appreciate the generosity of the United States in making these sacrifices. The “paranoid” Putin with his historical “revisionism” insists on seeing these acts of charity as uncharitable acts.

.....

Hiatt and his cohorts do acknowledge that not everything worked out as peachy as predicted. There were, for instance, a few bumps in the road like the unprecedented collapse in life expectancy for a developed country not at war. Plus, there were the glaring disparities between the shiny and lascivious nightlife of Moscow’s upscale enclaves, frequented by American businessmen and journalists, and the savage and depressing poverty that gripped and crushed much of the country.

Or, as the Post’s editorial antiseptically describes these shortcomings: “Certainly, the Western effort was flawed. Markets were distorted by crony and oligarchic capitalism; democratic practice often faltered; many Russians genuinely felt a sense of defeat, humiliation and exhaustion. There’s much to regret but not the central fact that a generous hand was extended to post-Soviet Russia, offering the best of Western values and know-how.

“The Russian people benefit from this benevolence even now, and, above Mr. Putin’s self-serving hysterics, they ought to hear the truth: The United States did not come to bury you.”

Or, as a Fred Hiatt of the 1870s might have commented about Native Americans who resisted the well-intentioned Bureau of Indian Affairs and didn’t appreciate the gentleness of the U.S. Army or the benevolence of life on the reservations: “Above Sitting Bull’s self-serving hysterics, Indians ought to hear the truth: The white man did not come to exterminate you.”

Complete story at - https://consortiumnews.com/2015/05/05/gifting-russia-free-market-extremism/

Demeter

(85,373 posts)Such as, how much time she spends with her child doesn’t matter as much as we think...For all we think we know about moms, here are some fresh conclusions researchers have drawn about them since last Mother’s Day.

Look Ma, two hands: A study at the University of Illinois concluded that teenagers are safer drivers when their moms are with them. No surprise there. But that’s not all they found. The researchers determined that having Mom nearby actually affected activity in a teen’s brain. Twenty-five teen drivers were asked to complete a driving simulation test as quickly as possible. At each of the intersections, the driver had a choice of running a yellow light or stopping for it, which cost them three extra seconds of time. When they were by themselves, drivers ran the yellow light 55 percent of the time; when Mom was nearby, that dropped to 45 percent. Here’s the best part: When a driver was alone, scans showed his or her brain’s reward center became more active when they ran yellow lights. But when their mothers were next to them, the same thing happened in their brains when they stopped at lights.

Quality rules: For all those mothers who don’t think they spend enough time with their kids, cut yourself a break. Research published in the April issue of the Journal of Marriage and Family says the quantity of time parents spend with their children doesn’t make much of a difference in how they turn out, particularly during what would seem to be an impressionable period between ages three and 11. The quantity of parent-child time matters a bit more with teenagers—more one-on-one time can help adolescents stay out of trouble. But overall, the researchers suggest that it’s all about the quality of that time spent together. What makes a big difference, they say, is how warm and affectionate mom is.

Listen to your mother: It’s long been believed that a mother who talks to her baby before it’s born can help the child’s development. Now a study at Brigham and Women’s Hospital in Boston suggests that a mother’s heartbeat and the sound of her voice can actually help the baby’s brain grow. The scientists studied 40 babies born eight to 15 weeks premature—infants who spent most of their time alone in an incubator and not with their mothers. But, using tiny speakers in the incubators, they exposed half the babies to the sounds of their mothers’ voices and heartbeats for three hours every day. And, according to the study, published in Proceedings of the National Academy of Sciences, the babies who heard those mama sounds developed significantly larger auditory cortex, the hearing center of the brain.

Mom hearing: Why is it that mothers always seem to be able to hear their babies cry before anyone else does? It appears to have to do with oxytocin, also known as the “cuddle hormone.” Scientists at New York University say that as oxytocin surges in a mother’s brain after childbirth, it actually changes the way auditory signals are processed and makes her brain more sensitive to the sound of her baby’s cries. Not only did the researchers find that to be the case with mother mice, but even when virgin mice were given oxytocin, they started to act like moms, responding to the cries of baby mice and even carrying them back to the nest.

A matter of degrees: More highly educated women—those with a master’s degree or higher—are becoming moms than was the case 20 years ago. A new report from the Pew Research Center concludes that one out of five women between 40 and 44 years of age who have graduate degrees now choose to remain childless, compared to 30 percent of those women in 1994. Overall, childlessness among American women between 40 and 44, regardless of education, is at its lowest point in a decade. One big factor, according to the researchers, is that during the past 20 years, more women have risen into management positions and that has helped change attitudes about balancing work and family.

Don’t be so bossy: Kids tend to have warmer feelings about mothers who respect their autonomy and don’t try to control them too much. So say researchers at the University of Missouri, who found, in a study of 2,000 moms and their children, that mothers who tightly controlled the activities of their children when they were toddlers often continued to behave that way when the child was in the 5th grade. When those kids became adolescents, they were less likely to want to engage with their moms. Said Jean Ipsa, one of the study’s authors, “We found that mothers who supported their children’s autonomy were regarded more positively by their children than mothers who were highly directive.”

MORE

Read more: http://www.smithsonianmag.com/science-nature/10-new-things-science-says-about-being-mom-180955215/#4G04DHWYhvU3oRIL.99

Give the gift of Smithsonian magazine for only $12! http://bit.ly/1cGUiGv

Follow us: @SmithsonianMag on Twitter

Demeter

(85,373 posts)...On Friday, a Manhattan jury concluded that it could not reach a verdict in the trial of Pedro Hernandez, who was charged with killing Etan on the basis of a confession that his lawyers argued was a figment of an unstable mind. The district attorney has not decided whether to retry Mr. Hernandez, but no verdict, nor lack of one, could change the impact the 6-year-old boy’s disappearance had on parenting. His abduction in 1979 transformed the experience of childhood for many boys and girls his age and set the mold for the sort of fathers and mothers they themselves would become.

He was not famous when he vanished, his family not a wealthy target of kidnappers seeking ransom. And that made the case all the more haunting in its randomness. An early police theory, that a lonely woman had snatched up the boy to raise as her own, in hindsight seems startlingly naïve, quaint. The disappearance of Etan Patz changed what parents feared.

“In some ways, it is the most important case, culturally,” said Paula S. Fass, a historian and author of the book “Kidnapped: Child Abduction in America,” published in 1997. “This case served as a wellspring of the idea that when little boys and little girls — but especially boys — were taken, that it was almost certainly by a pedophile.”

Statistically, abductions by strangers remain rare. According to the National Center for Missing & Exploited Children, 194 Amber Alerts involving 243 children were issued in 2013, the most recent year analyzed. The vast majority of abductors were relatives or people who knew the children. But Etan’s was the first of a small number of cases stretching over a generation, including those involving Adam Walsh and Amber Hagerman, that were rare but still saturated news coverage, creating the impression of an epidemic. Ms. Fass became a mother in New York City two years after Etan disappeared. “The reason I began researching this book is I became what I describe as one of the victims of that cultural craziness,” she said. Children who grew up in the city at the time Etan disappeared remember the search, the police helicopters hovering over SoHo, the volunteers shouting his name in the street...Most of these children grew up to become, by their own definition, helicopter parents. Mr. Spaedh, with an 11-year-old son, said he knows he acts more like his parents did after Etan disappeared than they did before that day.

***************************************************************

Ms. Skenazy said what was typical parenting before that day in 1979 would look radical now, and likewise, parents then would not recognize today’s norms. They “would see what today we call regular parenting and call it overparenting,” she said.

Last month, her Free-Range Project declared May 9, which happens to be Saturday, “Take Our Children to the Park…and Let Them Walk Home by Themselves” Day, the latter goal a direct response to the latest free-range cause célèbre, the Maryland couple accused of neglect for letting their two children, ages 10 and 6, walk alone in the neighborhood.

That case, and the free-range debate in general, has become a constant topic of conversation at the city’s playgrounds, parents say, although it is clear that each parent’s definition of “free” and “range” differs in scope.

MORE

Demeter

(85,373 posts)THE ELITE SIMPLY CAN'T UNDERSTAND WHY WE AREN'T MAXING OUT CREDIT CARDS...WHILE THE ORDINARY PERSON ASKS: "WHAT WINDFALL?"

...More than two thirds of consumers say they’ve used their gas windfall to pad their savings account or pay down debt, according to Visa, while only 30% say they’ve spent it.

Why? Perhaps because they aren’t sure cheap gas will last.

“What drives consumer spending are expectations of future gas prices, not prices today,” says Visa’s chief economist Wayne Best.

Gas prices have certainly ticked up this year, with the average cost of a gallon of gas hovering around $2.66 now, above its January low of $2.09. Perhaps unsurprisingly, some 70% of people expect gas prices to rise over the next three months, says Visa.

This has impacted the way people are treating the extra jangle in their wallets....

AND THERE'S THE FACT THAT IT DOESN'T AMOUNT TO ANYTHING LIKE REAL MONEY...JANGLE, INDEED!

Fuddnik

(8,846 posts)That makes the vehicle fleet an Electric, a Hybrid, and a Hawg. It's saying something when the Harley gets the worst gas mileage out of the bunch.

I was kicking around the idea of maybe leasing a cheap car to replace the 2002 Corolla, which was going to need some repairs. Then glancing through the paper, I saw a deal on a new Volt I couldn't pass up.

Demeter

(85,373 posts)now that the gas prices are so cheap...I thought vaguely that perhaps now one could pick up a used Prius for something less than the $150k they were going for last time I looked...

DemReadingDU

(16,000 posts)Hotler

(11,424 posts)I remember watching C_SPAN about 5-6 yrs. ago and the banksters were all lined up in front of the Senate Banking Committee being grilled about credit card high interest rates they were charging people and they were cry bagging about people that would pay their balance off each month, they referred to them as "deadbeats". Pissed me off so bad that my card went right in the drawer for a couple of years and I started paying cash for stuff. I had a few mom and pop shops give discounts for cash. I use my card more now days since I joined a credit union.

Deadbeat A "deadbeat" is the unflattering term sometimes used in the credit card industry to describe consumers who pay off their balances every month, using the lenders' money but paying no interest on it. The more-polite, official term is "transactor." Since the recession's end, deadbeats -- or transactors -- have been on the rise, since more consumers see the wisdom of using credit cards as a tool of convenience, not an instrument of debt.

http://www.creditcards.com/glossary/term-deadbeat.php

Demeter

(85,373 posts)I CANNOT FIND A SINGLE QUOTE FROM THIS THAT DOESN'T TRIGGER MY HURL REFLEX...READ IT IF YOU DARE

Demeter

(85,373 posts)The sharp rise in the U.S. dollar's value is hitting American exporters and forcing layoffs at makers of everything from steel to machinery, taking the shine off stronger job creation across the broader economy. Exports make up about an eighth of America's economic output and helped power the initial economic recovery from the 2007-09 recession. But exporters' job losses do raise some concerns about economic growth as the Federal Reserve moves closer to its first interest rate rise since 2006.

The nation's top 10 exporting industry groups outside of agriculture shed 1,700 jobs in the three months through April even as employers in the rest of the economy added staff, according to a Reuters analysis of government data released on Friday. The U.S. dollar is up about 20 percent against major currencies since June last year, making goods and services sold abroad more expensive for foreign customers.

The appreciation in the currency weighed on first quarter profits across corporate America, including at soft drink giant PepsiCo Inc and toothpaste producer Colgate-Palmolive. For steelmaker U.S. Steel, the rise in the value of the dollar reduced profits from its sales to Europe, while also making steel from South Korea more competitive abroad, helping to force layoffs of 2,800 U.S. employees so far this year. "It's starting to wind down here," said David Clark, the president of the local chapter of the United Steelworker Union in Fairfield, Alabama, where U.S. Steel is idling plants that supply the auto, appliance and oil industries. Clark is one of about 9,000 U.S. steel employees who have received notices they could be laid off.

The top exporting industry groups had been creating about 11,000 new jobs a month over the last year but added just 300 in April. The job losses since January were the first for a three-month period since the summer of 2013.

The dollar's gain has been powered by Fed guidance that it could soon raise interest rates to keep inflation in check. "It is part and parcel of the tightening," said Phil Lachowycz, an economist at Fathom Consulting who is advising investors to buy shares of companies that serve the U.S. market. With interest rate rises in Europe and Japan looking much more distant than in the U.S., investors are crowding into U.S. securities to take advantage of higher yields, given a likely Fed interest rate rise this year.

One risk for the U.S. economy is that the dollar might be dragging on growth more strongly than policymakers anticipate. Economic growth stalled in the first quarter partly because of plunging exports and surging imports. An analysis by Jesse Edgerton, a former Fed economist now at JPMorgan, found the currency's appreciation appeared to be stunting exports more than in the past. "We're not sure why," he said, adding that recent West Coast port strike disruptions and slowdown in the oil industry, as crude oil prices tumbled, also weighed on exports. Several of America's export-heavy sectors with job losses are the same ones Edgerton found suffered sharp hits to their orders. About 40 percent of primary metals get shipped abroad, when including the goods made with them, and new orders of primary metals have tanked by 9.0 percent since June. Machinery output is similarly being hit by sagging orders.

Despite the bad export sector news, rising consumer spending and falling unemployment could still indicate the economy's underlying health is improving...

OF COURSE IT IS...EVERYBODY SAYS SO!

Demeter

(85,373 posts)VIDEO REPORT AT LINK, AND TEXT

BLAH, BLAH, BLAH

Demeter

(85,373 posts)May 8. Today’s payroll jobs report is more of the same. The Bureau of Labor Statistics claims that 223,000 new jobs were created in April. Let’s accept the claim and see where the jobs are:

- Specialty trade contractors are credited with 41,000 jobs equally split between residential and nonresidential. I believe these are home and building repairs and remodeling.

- The rest of the jobs, 182,000, are in domestic services.

- Despite store closings and weak retail sales, 12,000 people were hired in retail trade.

- Despite negative first quarter GDP growth, 62,000 people were hired in professional and business services, 67% of which are in administrative and waste services.

- Health care and social assistance accounted for 55,600 jobs of which ambulatory health care services, hospitals, and social assistance accounted for 85% of the jobs.

- Waitresses and bartenders account for 26,000 jobs, and government employed 10,000 new workers.

- There are no jobs in manufacturing.

- Mining, timber, oil and gas extraction lost jobs.

- Temporary help services (16,100 jobs) offered 3.7 times more jobs than law, accounting architecture, and engineering combined (4,500 jobs).

As I have pointed out for a number of years, according to the payroll jobs reports, the complexion of the US labor force is that of a Third World country. Most of the jobs created are lowly paid domestic services. The well paying, high productivity, high value-added jobs have been offshored and given to foreigners who work for less. This fact, more than the reduction in marginal income tax rates, is the reason for the rising inequality in the distribution of income and wealth.

Offshoring middle class jobs raises corporate profits and, thereby, the incomes of corporate owners (shareholders) and executives. But it reduces the incomes of the majority of the population who are forced into either lowly paid and part time jobs or unemployment. The extraordinary decline in the labor force participation rate indicates shrinking opportunities for the American labor force. No economist should ever have accepted the claim that the economy was in recovery while participation in the labor force was declining.

The officially documented decline in the labor force participation rate casts additional doubt on the claimed increases in payroll jobs. If jobs are growing, the labor force participation rate should not be declining. Having looked at the actual details of the payroll jobs report, which are seldom if ever reported in the financial media, let’s look at what else goes unreported in the media.

The government’s economic statistical agencies are under pressure not to roil the financial markets. Consequently, initial reports, which are always the headline reports, are as close as possible to the “consensus forecast” prepared by economists in the financial sector, whose jobs are to maintain a good atmosphere for financial instruments. This practice results in optimistic advanced estimates and first estimates. The real reporting comes later in revisions. For example, today the headline was 223,000 new jobs, recovery on track, stock market up. What was not reported by the media is that the prior month’s (March) payroll jobs growth was cut to 85,000 jobs, substantially below population growth. The same thing happens with the reporting of GDP growth. The first quarter GDP advanced estimate was kept in positive territory with a 0.2%–two-tenths of one percent–growth. When the revisions arrive, which we already know will be negative GDP growth due to the trade figure, they will not receive the same attention...There are many additional problems with the economic reporting. I have written about a number of them in past reports. Here I will provide one more example. According to the payroll jobs report oil and gas extraction lost 3,300 jobs in April. This low number is inconsistent with what we know about layoffs from fracking operations. According to Challenger Gray, a private firm that tracks job cuts announced by corporations, in April 20,675 jobs were lost as a result of falling oil prices. That is more than six times the loss reported by the payroll jobs report. Challenger Gray reports that during the first four months of this year, corporations have announced 201,796 job cuts. Obviously, corporations are not creating new jobs. That is why the BLS looks to waitresses, bartenders, remodeling contractors, government, and social services for employment growth.

Jobs offshoring has shriveled the employment opportunities for Americans. These shriveled opportunities are largely responsible for stagnation and decline in real median family incomes, for the falling labor force participation rate, for the rising inequality in the income and wealth distribution, and for student loans that cannot be repaid from the lowly paid jobs available. Corporations and Wall Street in pursuit of short-term profits have given the economy away. Much of the former US economy now belongs to China and India. Corporate executives and shareholders got rich off of this give-away.

Dr. Paul Craig Roberts was Assistant Secretary of the Treasury for Economic Policy and associate editor of the Wall Street Journal. He was columnist for Business Week, Scripps Howard News Service, and Creators Syndicate. He has had many university appointments. His internet columns have attracted a worldwide following. Roberts' latest books are The Failure of Laissez Faire Capitalism and Economic Dissolution of the West and How America Was Lost.

Demeter

(85,373 posts)Goldman Sachs Group Inc is expected to pay $129.5 million to settle its portion of a lawsuit that accuses banks of rigging prices in the foreign exchange market, The Wall Street Journal reported, citing a person familiar with the matter.

The Journal said in its report that a final agreement may be reached in the next several weeks.

The lawsuit accused traders at a dozen banks of improperly sharing confidential information about their clients' orders through electronic chat rooms, then using that information to make money at the expense of their clients.

In April, Bank of America Corp had agreed to pay $180 million to settle the lawsuit. JPMorgan Chase & Co settled for $99.5 million in January, and Switzerland's UBS AG settled for $135 million in March.

Demeter

(85,373 posts)More Americans living outside the U.S. gave up their citizenship in the first quarter of 2015 than ever before, according to data released Thursday by the IRS.

The 1,335 expatriations topped the previous record by 18 percent, according to data compiled by Bloomberg. Those Americans are driven to turn in their passports in part because of laws that have expanded bank reporting and tax compliance requirements for expatriates.

The increase in early 2015 follows an annual record in 2014, when 3,415 Americans gave up their citizenship.

An estimated 6 million U.S. citizens are living abroad, and the U.S. is the only country within the Organization for Economic Cooperation and Development that taxes citizens wherever they reside.

In many cases, those choosing to give up their citizenship have limited connections to the U.S. and have lived outside of the country for most of their lives. Anyone born in the U.S. automatically receives citizenship, and people born abroad to U.S. parents are typically citizens as well....

London Mayor Boris Johnson, who had a tax dispute with the IRS, said earlier this year that he would give up the U.S. citizenship he received because he was born in New York. His name isn’t on the IRS list. Eduardo Saverin, a Brazilian-born co-founder of Facebook Inc., gave up his U.S. citizenship in 2012.

U.S. citizens who live abroad can exclude as much as $100,800 in earned income and in many cases can receive tax credits for payments to foreign governments.

Demeter

(85,373 posts)Warren Buffett’s derivatives wagers sapped earnings during the financial crisis at his Berkshire Hathaway Inc. and were part of the reason the company lost its triple-A credit rating. Things are looking rosier now. Liabilities on the contracts shrunk to $3.5 billion on March 31 from about $15 billion six years earlier. Some of the derivatives are long-term bets that equities will rise, while others protect bondholders against losses if borrowers fail to meet their obligations.

Surging stock indexes in the U.S., U.K., Europe and Japan and a stronger dollar have helped reduce the liabilities on the equity-linked derivatives for years. The improvement accelerated in the first quarter, helping profit climb 9.8 percent to $5.16 billion, according to a company report Friday.

“Unless the world falls apart over the next couple of years, it’ll be another bet that he’s won,” said Meyer Shields, an analyst at Keefe Bruyette & Woods.

It didn’t always look that way. Liabilities on the derivatives ballooned during the financial crisis and contributed to a first-quarter loss in 2009. Moody’s Investors Service and Fitch Ratings cited the contracts when they stripped Berkshire of its top credit grade that year.

The large derivatives book seemed at odds with Buffett’s earlier statements. In 2003, he called them “financial weapons of mass destruction,” a phrase that would later be cited during the credit crisis that forced some of the nation’s largest banks and American International Group Inc. to take government bailouts...

A CASE OF "IF YOU CAN'T BEAT THEM, JOIN THEM?"

Fuddnik

(8,846 posts)Everywhere I look around here, vacant land and new office buildings, they all seem to have Berkshire-Hathaway signs. And I mean everywhere.

Demeter

(85,373 posts)Greek Finance Minister Yanis Varoufakis said his government is prepared to go “down to the wire” in talks with its creditors as policy makers signal they’re losing patience with the country after months of brinkmanship.

Varoufakis, who denies he’s been sidelined by Greek Prime Minister Alexis Tsipras in the negotiations, said he expects an agreement in the next two weeks, though one is unlikely to be announced when euro-area finance chiefs meet on Monday.

Greece has less than a week to prove to the European Central Bank that it’s serious about reaching an agreement with international lenders. Failure to make progress in bailout talks or repay about 745 million euros ($839 million) owed to the International Monetary Fund on May 12 may prompt the imposition of tighter liquidity rules on its banks.

“Europe works in glacial ways and eventually does the right thing after trying all alternatives,” Varoufakis, 54, told BBC World on Thursday. “So we probably won’t have an agreement on Monday, but certainly we’re going to have an agreement in the next couple of weeks or so.”

NOW THERE'S AN OPTIMIST!

MORE

Demeter

(85,373 posts)A brief update on the negotiations between Greece and its creditors...A number of Greek officials seemed to regard it getting at least some funds approved by the Eurogroup at its May 11 meeting as critical to being able to make a €750 million payment to the IMF on May 12. But on Thursday, Finance Minister Yanis Varuofakis said Greece will be able to meet that obligation, se we’ll assume that yet again the government has managed somehow to stump up the needed funds. But while that move in theory buys the government more time, in practice, it’s not clear what the point is, given the following...The two sides remain hopelessly at odds. The only progress has been on “shape of the table” issues. As the Financial Times notes:

With such an endorsement, Athens hoped the European Central Bank would be persuaded to increase its cap on the amount of short-term debt the government could issue — a key relief valve that would have eased, at least temporarily, the government’s cash crunch. But no such relief is now expected.

The Greek government continues to take steps to maintain support at home, such as rehiring 4000 government workers, in defiance of the previously-agreed “reforms”. While the number of employees involved is sufficiently small as to qualify as a symbolic gesture rather than one with any real economic impact, Greece’s critics can use it to argue that there’s no reason to trust them, that if the creditors give them new funds or restructure debt, the lenders have every reason to doubt that Greece will live up to any commitments it makes.

The new drop-dead date is in theory late May, which probably really means mid June. Greece has pushed back the apparent day of reckoning by a bit more than a month. Again from the Financial Times:

Most officials believe the last week of May would be the best-case scenario, leaving a full month for eurozone parliaments — including the increasingly hostile German Bundestag — to approve the deal and for Greece to pass and implement new laws.

We found with the February negotiations that the participants were able to compress the timetable and at least one country that was thought to have to get Parliamentary approval (Finland) decided that it could skip that. But an actual disbursement of funds is a bigger matter, so it’s doubtful that any government will try to finesse legislative approval this time. So I’d guesstimate that the real cutoff date is somewhere between June 14 and June 20.

Greece remains in the sweatbox. Remember that Greece no longer has a primary surplus, and has been scraping the bottom of the barrel to make payments to its creditors. Moreover, it was already delaying domestic payments. With revenues less than regular outlays, meeting its obligations to domestic payees, like government employees and vendors, is going to be a strain. Moreover, the withheld and delayed payments will apply more downward pressure on an already depressed economy. The government is having to impose austerity merely to continue in the negotiations. Will the ruling coalition’s approval ratings deteriorate further as the squeeze continues?

As Herbert Stein said, “Things that can’t continue, won’t”. But that dictum gives no guidance as to how long it take before the break finally occurs. Greece has managed to hold on for far longer than its officials led outsiders to believe, but it can’t make the payments due to the ECB in July and August without coming to a deal. Unless one side blinks, that seems as remote as ever.

Demeter

(85,373 posts)By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

“If I had an easy way and a non-risk way of shorting a whole lot of 20- or 30-year bonds, I’d do it,” said our favorite uncle Warren Buffett on CNBC. These kinds of bonds have been on a terrific bull run ever since Paul Volker, as Chairman of the Fed, cracked down on inflation. But now, even the avuncular face of capitalism would bet against them...He was behind the curve. On April 22, Bill Gross, at Janus Capital, tweeted that 10-year German government debt was “The short of a lifetime.” The “only question” was “Timing.” Other bond gurus have jumped into the fray. Selling bonds outright, or selling them short if you didn’t already own them, particularly European government bonds, has become the thing to do in certain circles. Now valuations are falling, and yields are soaring off their ludicrously low levels.

So within the last 30 days, the 10-year US Treasury yield jumped from 1.83% to 2.23% as I’m writing this; the German 10-year Bund yield, instead of dropping below zero, skyrocketed from 0.05% to 0.60%; the Italian 10-year yield soared from 1.18% to 1.93%. And so on. Sharply rising long-term yields are percolating through the system. In the era when several trillion dollars of even crappy government debt is so overpriced that it sports negative yields, thanks to central-bank machinations, this bout of selling is somewhat inconvenient. Bonds with long maturities are particularly vulnerable. That’s what Buffett, the ultimate “smart money,” would focus on. And selling them is exactly what companies are doing at a record pace while there are still eager buyers for them out there.

When Oracle sold a bunch of bonds, it included $1.25 billion in bonds due in 2055. That’s 40 years from now. In return, Oracle will pay a coupon of 4.375%. Investors are dying for this kind of yield. Microsoft sold $2.25 billion of 40-year bonds back in February with a coupon of 4%. For both of them, it was a first. Massachusetts Mutual Life Insurance issued 50-year bonds. So far this year, according to Bloomberg, companies have sold $39 billion in bonds that mature in over 30 years. That’s over five times more than during the same period in 2014.

Companies have pushed out duration – though it costs them more to do, for now. But they’re locking in the cheap money for a generation. Maturities for bonds issued so far this year average 16.4 years. If it stays the same for the full year, it will be a record, and far above the average going back two decades of 10.7 years. Companies have sold $627.2 billion in bonds so far this year, up 6.57% from last year at this time, which had already been a record year. For the full year 2014, total issuance hit a vertigo-inducing $1.57 trillion. So, companies are borrowing a record amount to fund share buybacks, acquisitions, and other mouthwatering hocus-pocus goodies. They’re leveraging up their balance sheets with these records amounts of debt, and they’re venturing at a record pace into maturities that exceed the remaining lifespan of many bond-fund investors. These companies, too, are the ultimate smart money. They’re doing what Buffett would like to do, and what the shorts are now doing, this being the deal of a “lifetime”: they’re selling bonds that mature so far in the future that redeeming them is going to be another generation’s problem.

IBG-YBG I'LL BE GONE, YOU'LL BE GONE...BUT THE LUCKLESS SOULS THAT COME AFTER WILL HAVE THEIR FUTURES LOCKED IN...

Demeter

(85,373 posts)And the nerves in my entire side of the face are screaming. The dentist says it should settle down within a week. Otherwise, I'll be getting a root canal.

The way it's hurting, that might be the better option. The weather isn't helping: heat, drizzle, humidity, pollen...sinuses are not happy, either. I got complimented on the circles under my eyes at euchre last night, and my poker face (trying not to scream and grimace face, actually).

I came in for half of the third-place pot, which means (1) I got a chance to actually play some cards (2) I'm only down $1.75 plus fuel and the potluck contribution for the night...

Under the circumstances, I'm going to stop here and post more later, today if anything gets better, tomorrow if not.

But that's no reason for anyone else to slack off....see you later!

Demeter

(85,373 posts)Federal Reserve Chair Janet Yellen on Wednesday said high equity valuations could pose potential dangers but that stability risks across the U.S. financial system remained in check.

"I would highlight that equity market valuations at this point generally are quite high," Yellen said. "There are potential dangers there."

Yellen's view on the run-up in stocks was an answer to questions from International Monetary Fund Managing Director Christine Lagarde, who joined the Fed chief for the opening session of the "Finance and Society" conference here.

"We’ve also seen the compression of spreads on high-yield debt, which certainly looks like a reach for yield type of behavior," Yellen said.

U.S. stocks were trading lower following the comments, building on earlier declines triggered by weak private job data...Another potential trouble spot that Yellen pointed out was low long-term interest rates, which could spike as the Fed normalizes its policy, causing disruption across the financial system.

“When the Fed decides it’s time to begin raising rates, these term premiums could move up and we could see a sharp jump in long-term rates. So we’re trying to ... communicate as clearly about our monetary policy so we don’t take markets by surprise,” she said.

U.S. Treasuries continued to slide for a ninth straight day on Wednesday amid a global bond sell-off, with longer-maturity Treasuries declining the most.Yellen tempered these remarks by saying that she did not see any bubbles forming at the moment, and she described risks to financial stability as "moderated, not elevated."

The question and answer session with Lagarde occurred after the two delivered similar speeches highlighting the need to continue reining in risk across the banking sector. Yellen also noted concerns about potential liquidity problems facing certain asset-managers should they face a wave of redemptions. In her remarks, Yellen outlined the contributions of the banking system to society and the economy. But she quickly turned her speech to the distorted system of incentives and weak controls throughout the financial industry that set the stage for the 2008 financial crisis.

"A combination of responses to distorted incentives by players throughout the financial system created an environment conducive to a crisis," Yellen said.

Lagarde also cast a critical eye on the behavior of bankers and the need for change.

“What is needed is a culture that induces bankers to do the right thing even if nobody is watching,” Lagarde said in her prepared remarks.

IT'S CALLED RULE OF LAW, CHRISTINE...AND THE IMF SHOULD TRY IT

Demeter

(85,373 posts)OR SHAME. SEE JOSEPH MCCARTHY

http://www.theguardian.com/media-network/2015/may/08/trans-pacific-partnership-obama-irony

The president’s statement that there’s nothing secret in the classified agreement is plainly wrong, writes Evan Greer...Last week, the president, who claims he’s running the most transparent administration in history, went on the record saying there’s nothing secret in the Trans-Pacific Partnership (TPP), as he asked Congress for special authority to “fast track” the agreement.Today (FRIDAY), President Obama will give another speech defending the TPP from critics who say the deal is a corporate power grab.

The TPP is a massive, legally binding, agreement involving 12 countries that has been negotiated entirely behind closed doors by government officials and industry lobbyists. The text of the TPP agreement is classified. The public can’t see it. Even members of Congress’ access to the text is severely restricted, and they face criminal prosecution if they tell their constituents what they’ve read.

In fact, the only portions of the TPP text the public is able to see are those released by Wikileaks, an organisation President Obama has all but personally chased to the ends of the earth. Thanks to the leaked draft texts, we know the TPP could impact everything from internet freedom, to jobs, to national sovereignty, and even how much we pay for the medicines we need....

ROUSING HARANGUE--MORE

Demeter

(85,373 posts)Vermont Sen. Bernie Sanders is urging President Barack Obama to cancel a planned visit to Nike’s headquarters over the low wages it pays foreign workers.

Obama is scheduled to travel to the sneaker giant’s Beaverton, Ore., headquarters Friday, part of the president’s effort to galvanize support for the Trans-Pacific Partnership, a multinational trade deal between the United States and 11 other countries, including Vietnam — where Nike manufactures most of its shoes.

“Given Nike’s legacy of offshoring American jobs and exploiting low-wage workers, I would strongly encourage you to cancel this meeting,” Sanders wrote in a letter to Obama Wednesday. “Nike epitomizes why disastrous unfettered free-trade policies during the past four decades have failed American workers, eroded our manufacturing base and increased income and wealth inequality in this country.”

The independent senator and Democratic presidential candidate cited a recent study by the Institute for Global Labor and Human Rights which found that 330,000 workers manufacture Nike products in Vietnam, where the minimum wage is “about 56 cents per hour.”

“If Nike can sell a pair of LeBron XII Elite iD shoes online for $320 in this country, it should be making these shoes and other products here, not in Vietnam or China,” he wrote. “It is no secret why Nike is supporting the Trans-Pacific Partnership. It would … increase the profits of Nike … but do nothing to encourage Nike to create one manufacturing job in this country.”

Demeter

(85,373 posts)OR, LYING IN HIS TEETH, IF YOU VALUE HONESTY

http://www.cepr.net/blogs/beat-the-press/president-obama-is-badly-confused-about-the-trans-pacific-partnership

That was the main takeaway from a NYT article on his trip to Nike. According to the article, he made many claims about the Trans-Pacific Partnership (TPP) and opponents of the deal which are clearly wrong.

For example, the article tells readers:

"he [President Obama] scorned critics who say it would undermine American laws and regulations on food safety, worker rights and even financial regulations, an implicit pushback against Ms. Warren. 'They’re making this stuff up,' he said. 'This is just not true. No trade agreement’s going to force us to change our laws.'"

President Obama apparently doesn't realize that the TPP will create an investor-state dispute settlement mechanism which will allow tribunals to impose huge penalties on the federal government, as well as state and local governments, whose laws are found to be in violation of the TPP. These fines could effectively bankrupt a government unless they change the law.

It is also worth noting that rulings by these tribunals are not subject to appeal, nor are they bound by precedent. Given the structure of the tribunal (the investor appoints one member of the panel, the government appoints a second, and the third is appointed jointly), a future Bush or Walker administration could appoint panelists who would side with foreign investors to overturn environmental, safety, and labor regulations at all levels of government. (Think of Antonin Scalia.)

President Obama apparently also doesn't realize that the higher drug prices that would result from the stronger patent and related protections will be a drag on growth. In addition to creating distortions in the economy, the higher licensing fees paid to Pfizer, Merck, and other U.S. drug companies will crowd out U.S. exports of other goods and services.

Obama is also mistaken in apparently believing that the only alternative to the TPP is the status quo. In fact, many critics of the TPP have argued that a deal that included rules on currency would have their support.

This issue is hugely important, since it is highly unlikely that the U.S. economy will be able to reach full employment with trade deficits close to current levels. (It could be done with larger budget deficits, but no one thinks this is politically realistic.) Without a considerably tighter labor market, workers will lack the bargaining power to achieve wage gains. This means that income would continue to be redistributed upward.

The only plausible way to bring the trade deficit down is with a lower valued dollar which would make U.S. goods and services more competitive internationally. The TPP would provide an opportunity to address currency values, as many critics of the trade agreement have pointed out. It seems that Mr. Obama is unaware of this argument.

Demeter

(85,373 posts)On Friday, President Obama chose Nike headquarters in Oregon to deliver a defense of his proposed Trans-Pacific Partnership.

It was an odd choice of venue.

Nike isn’t the solution to the problem of stagnant wages in America. Nike is the problem.

It’s true that over the past two years Nike has added 2,000 good-paying professional jobs at its Oregon headquarters, fulfilling the requirements of a controversial tax break it wrangled from the state legislature. That’s good for Nike’s new design, research and marketing employees.

Just before the President spoke, Nike announced that if the Trans Pacific Partnership is enacted, Nike would “accelerate development of new advanced manufacturing methods and a domestic supply chain to support U.S. based manufacturing,” thereby creating as many as 10,000 more American jobs.

But that would still be only a tiny fraction of Nike’s global workforce. While Nike makes some shoe components in the United States, it hasn’t assembled shoes here since 1984.

Americans made only 1 percent of the value of Nike products that generated Nike’s $27.8 billion revenue last year. And Nike is moving ever more of its production abroad. Last year, a third of Nike’s remaining 13,922 American production workers were laid off.

Most of Nike’s products are made by 990,000 workers in low-wage countries whose abysmal working conditions have made Nike a symbol of global sweatshop labor.

As wages have risen in China, Nike has switched most of its production to Vietnam where wages are less than 60 cents are hour. Almost 340,000 workers cut and assemble Nike products there.

In other words, Nike is a global corporation with no particular loyalty or connection to the United States. Its loyalty is to its global shareholders.

I’m not faulting Nike. Nike is only playing by the rules.

I’m faulting the rules. MORE

Fuddnik

(8,846 posts)That's the best case scenario. More likely, he's lying through his teeth, and hoping that nobody else does.

Him and that other big shot lawyer from Arkansas and Wal-Mart.

DemReadingDU

(16,000 posts)Taking a guess.

Demeter

(85,373 posts)Demeter

(85,373 posts)Working families have much to celebrate this Mother’s Day as city councils and state legislatures across the country take up President Obama’s challenge to provide parents with paid time off so “they can afford to be there when their families need them most.” California, New Jersey, and Rhode Island now provide paid maternity and paid family leave so parents can bond with a newborn or adopted child. Nineteen cities plus Connecticut, Massachusetts and California now allow workers to earn a few days of paid sick leave. Still, much remains to be done.

Employers understand that paid leave helps their companies with recruitment and retention, improves productivity, and reduces costly turnover. Indeed, employer-provided paid leaves are quite common for workers in the top quarter of the earnings distribution: 84 percent have paid sick days and 91 percent have paid vacation. Fewer than a quarter, however, get paid family leave, though most managers and professionals can cobble together at least some paid-time off for the birth or adoption of a child.

Among workers in the bottom quarter of the earnings distribution, though, 70 percent do not have even one paid sick days, barely half (49 percent) get paid vacation, and just 5 percent get paid family leave. Across the earnings distribution, 43 million private sector workers are without any paid sick days. These are the workers the President noted who “can’t even get a paid day off to give birth to their child.”

The Family and Medical Insurance Leave (FAMILY) Act would go a long way toward remedying this inequity. With only a small contribution from employers and employees, the FAMILY Act would create a national insurance program to provide partial wage replacement for workers for up to 12 weeks due to for pregnancy, child birth or their own serious health problem; to care for a new child; to cope with the serious health problem of a family member; or for specific military caregiving. Because the costs are spread out over the entire workforce, the program would require only a small contribution from employers and employees.

The FAMILY Act would be a boon for businesses as well, including those that employ low-wage workers. In our study of California’s paid family leave program, Professor Ruth Milkman and I found that paid family leave reduced turnover of workers in lower paid jobs. And, as we found in that study, worker turnover in those jobs is far more costly than most employers realize. There are problems with the way in which many employers calculate turnover costs. In one particularly memorable case, the top corporate human resource manager of a national retail chain with high turnover reported very low costs to replace sales staff that quit. It turned out, however, that the HR manager had failed to include a major expense: the salaries paid to the company’s staff of college-educated recruiters employed to replace workers that quit. We also found that employers often fail to account for the time it takes newly hired workers to get up-to-speed. Workers are paid full salary, but may be functioning at less than top performance while they learn the ropes.

**********************************************

A federal paid family and medical leave program that guarantees paid maternity leave and paid time to bond with a newborn or adopted child would be a great Mother’s Day present to America’s working families—and a gift to employers as well.

Demeter

(85,373 posts)SUPPORTING ARTICLES:

http://www.vanityfair.com/news/2013/09/michael-lewis-goldman-sachs-programmer

http://www.nytimes.com/2015/05/05/business/dealbook/ex-goldman-sachs-programmers-twisting-case-has-a-few-turns-left.html?_r=0

http://www.reuters.com/article/2015/05/01/us-goldman-sachs-aleynikov-verdict-idUSKBN0NM43V20150501

The US court convicted a talented programmer from Saint Petersburg of stealing the software algorithm code that he himself wrote and developed. All this is done in order for Goldman Sachs to appropriate Aleynikov’s intellectual property and avoid paying the copyright royalty to the author, and to prevent him from working anywhere else.

It’s all started in 2010, a month after ace programmer Sergey Aleynikov left Goldman Sachs, he was arrested. Loyal to his sentiment that “every American could benefit from some time in jail”, Sergey has been in and out of jail for the past 5 years.

To understand the situation, keep in mind that Aleynikov is the author of the trading algorithm that Goldman Sachs uses. The irony is that no one before could invent such a simple and infinitely complex algorithm for the High Frequency Trading like Sergey has done. Only an engineer with the good old Soviet school mathematical training has enough brain power to accomplish this. Only 1-2% of all programmers at any given time are cable of inventing new algorithms and languages.

You don’t see the EU screaming like banshees demanding the release of an honest, talented, good man, like they do about the Ukrainian Nazi female pilot, a murderess of two Russian journalists. You don’t see Israel demanding an extradition to Israel of Sergey Aleynikov, who is Jewish. No, of course not.

For years now I am following this harrowing, vicious, unstoppable, baseless attacks of the Wall Street on this genius engineer.

Sergey’s story should serve as a caveat emptor for all those young, talented engineers from Russia, China, India and elsewhere who dream of coming to the U.S. to work here and to make it rich. It’s sooo 90s. In 21st century the only ones who gets rich are your American masters. They will use you, and abuse you, and nothing else.

Let Sergey’s story become your warning.

Demeter

(85,373 posts)U.S. troops are now operating openly in Ukraine. The "paper of record's" "coverage" is an embarrassment, per usual ... As of mid-April, when a Pentagon flack announced it in Kiev, and as barely reported in American media, U.S. troops are now operating openly in Ukraine.

Now there is a lead I have long dreaded writing but suspected from the first that one day I would. Do not take a moment to think about this. Take many moments. We all need to. We find ourselves in grave circumstances this spring.

At first I thought I had written what newspaper people call a double-barreled lead: American soldiers in Ukraine, American media not saying much about it. Two facts.

Wrong. There is one fact now, and it is this: Americans are being led blindfolded very near the brink of war with Russia.

MORE

Demeter

(85,373 posts)- Why are stocks still flying-high when the smart money has fled overseas and the US economy has ground to a halt?

According to Marketwatch:

Those figures, however, don’t count exchange-traded funds. In April alone, mutual funds and ETFs that focus on international stocks saw $31.8 billion in net inflows, while U.S.-focused funds and ETFs shed $15.4 billion, according to TrimTabs Investment Research.” (“Why U.S. stocks are near highs even as fund investors flee“, Marketwatch)

So if retail investors are moving their cash to Europe and Japan (to take advantage of QE), and the US economy is dead-in-the-water, (First Quarter GDP checked in at an abysmal 0.1 percent) then why are stocks still just two percent off their peak?

Answer: Stock buybacks.

The Fed’s uber-accommodative monetary policy has created an environment in which corporate bosses can borrow boatloads of money at historic low rates in the bond market which they then use to purchase their own company’s shares. When a company reduces the number of outstanding shares on the market, stock prices move higher which provides lavish rewards for both management and shareholders. Of course, goosing prices adds nothing to the company’s overall productivity or growth prospects, in fact, it undermines future earnings by adding more red ink to the balance sheet. But these “negatives” are never factored into the decision-making which focuses exclusively on short-term profits. Now get a load of this from Morgan Stanley via Zero Hedge:

So corporations are borrowing hundreds of billions of dollars from investors through the bond market. They’re using this cheap capital to repurchase shares in order to boost skyrocketing executive compensation and to line the pockets of their shareholders. At the same time, they are weakening the capital structure of the company by loading on more debt. (It’s worth noting that “highly rated U.S. nonfinancial companies” are now more leveraged than they were in 2007 just before the crash.) This madcap buyback binge has gotten so crazy, that buybacks actually exceeded profits in two quarters in 2014. Here’s the story from Bloomberg:

Buybacks have helped fuel one of the strongest rallies of the past 50 years as stocks with the most repurchases gained more than 300 percent since March 2009.” (Bloomberg)

But maybe we’re being too pessimistic here. Maybe stocks would have risen anyway due to record high earnings and improvements in the economy. That’s possible, isn’t it?

Nope. Not according to Morgan Stanley at least. Check it out:

“More than 50% “! There’s your market summary in one damning sentence. No buybacks means no 5-year stock market rally. Period. If it wasn’t for financial engineering and the Fed’s easy money, stocks would be in the same general location as the real economy, circling the plughole, that is. What’s so frustrating about the present phenom is that the Fed knows exactly what’s going on, but just looks the other way. So while the stock bubble gets bigger and bigger, CAPEX –which is investment in future productivity and growth– continues to deteriorate, GDP drops to zero, and demand gets progressively weaker. Shouldn’t that warrant a rethinking of the policy? Heck, no. The Fed is determined to stick with the same lame policy until hell freezes over. Whether it works or not is entirely irrelevant.

Now take a look at this eye-popper from Wolf Street:

I can’t tell you how many times I’ve read similar stories in the last couple years. The company’s revenues are shrinking, they’re losing money hand over fist, and what do they do? They announce they’re going to buy back $50 billion of their own shares. What a joke. And it doesn’t stop there. The Fed’s policies have also ignited a flurry of activity in margin borrowing. This is from CNBC:

Margin debt is created when investors borrow money in order to buy stocks. If an investor buys $100 worth of stocks with $50 in capital, that individual has $50 of margin debt outstanding. Since margin debt provides leverage, it amplifies gains, but also increases the risk to an investor.” (“What record-high margin debt means for stocks”, CNBC)

More borrowing, more risk taking, more financial instability. And it’s all the Fed’s doing. If rates were neutral, then prices would normalize and CEOs would not be engaged in this reckless game of Russian roulette. Instead, it’s caution to the wind; just keep piling on the debt until the whole market comes crashing down in a heap like it did six years ago. And that’s the trajectory we’re on today, in fact, according to TrimTabs Investment Research, February saw buybacks in the amount of $104 billion, ” the largest monthly figure since these flows were first tracked 20 years ago. ” So things are getting worse not better. Bottom line: The Fed has led the country to the cliff-edge once again where the slightest uptick in interest rates is going to send the economy into freefall. But why? Why does the Fed keep steering the country from one financial catastrophe to the next? That’s a question that economists Atif Mian and Amir Sufi answer persuasively with one small chart. Check it out:

“Here is the distribution of financial asset holdings across the wealth distribution. This is from the 2010 Survey of Consumer Finances:

The top 20% of the wealth distribution holds over 85% of the financial assets in the economy. So it is clear that the direct income from capital goes to the wealthiest American households.” (Capital Ownership and Inequality, House of Debt)

Why does the Fed create one bubble after the other? Now you know.

Mike Whitney lives in Washington state. He is a contributor to Hopeless: Barack Obama and the Politics of Illusion (AK Press). Hopeless is also available in a Kindle edition. He can be reached at fergiewhitney@msn.com.

bread_and_roses

(6,335 posts)As you know, I don't really understand all of this .... the intricacy of international money and the mechanisms of "The Market" are simply beyond me. But I know we are getting screwed.

As for O'Bomber and his shilling for the TPP .... no words suffice.

Happy Mother's Day to Demeter and any other mother's here. I rather detest all these Hallmark Holidays, but I do sincerely wish every mother peace and plenty for herself and her children.

Demeter

(85,373 posts)The weather's been hot and wet....and with my nerve-twanging tooth, I can't tell if it's humidity or an infection making the sweat roll down my face....I'm still gulping Motrin...and it does work, and the twanging is less....I'm hoping to forgo the root canal.

It's always something.

Hotler

(11,424 posts)Happy Mothers Day. I miss my mom very, very much.![]()

Demeter

(85,373 posts)PODCAST ON CO-OPS, TURKEY, AND MORE

Demeter

(85,373 posts)

“Free at last, Free at last, Thank God almighty we are free at last.”

― Martin Luther King Jr., I Have a Dream: Writings and Speeches That Changed the World