Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 29 June 2015

[font size=3]STOCK MARKET WATCH, Monday, 29 June 2015[font color=black][/font]

SMW for 26 June 2015

AT THE CLOSING BELL ON 26 June 2015

[center][font color=green]

Dow Jones 17,946.68 +56.32 (0.31%)

[font color=red]S&P 500 2,101.49 -0.82 (-0.04%)

Nasdaq 5,080.50 -31.69 (-0.62%)

[font color=red]10 Year 2.47% +0.03 (1.23%)

30 Year 3.24% +0.04 (1.25%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)That's a cute cartoon, Tansy. I like your source. Now may we live long enough to reap the benefits...without some catastrophe to put it off into the waiting list.

Demeter

(85,373 posts)REALLY? WHICH AMERICANS MIGHT THEY BE?

http://www.bloomberg.com/news/articles/2015-06-26/americans-say-they-re-just-fine-with-a-mediocre-economy

Americans are placing bigger bets that incomes will outpace inflation

H. L. Mencken

WELL, THAT COULD BE BECAUSE THEY ARE LIED TO ALL THE TIME BY THE PEOPLE THEY TURN TO FOR INFORMATION....

For the past six years, Americans have been hearing that this economic expansion is lackluster. They're now OK with it, and moving on.

That's how Richard Curtin, director of the University of Michigan Survey of Consumers, characterized the disconnect between weaker economic growth and improving household confidence. A report Friday showed the group's consumer sentiment gauge rose to 96.1 in June, the second-highest reading in eight years.

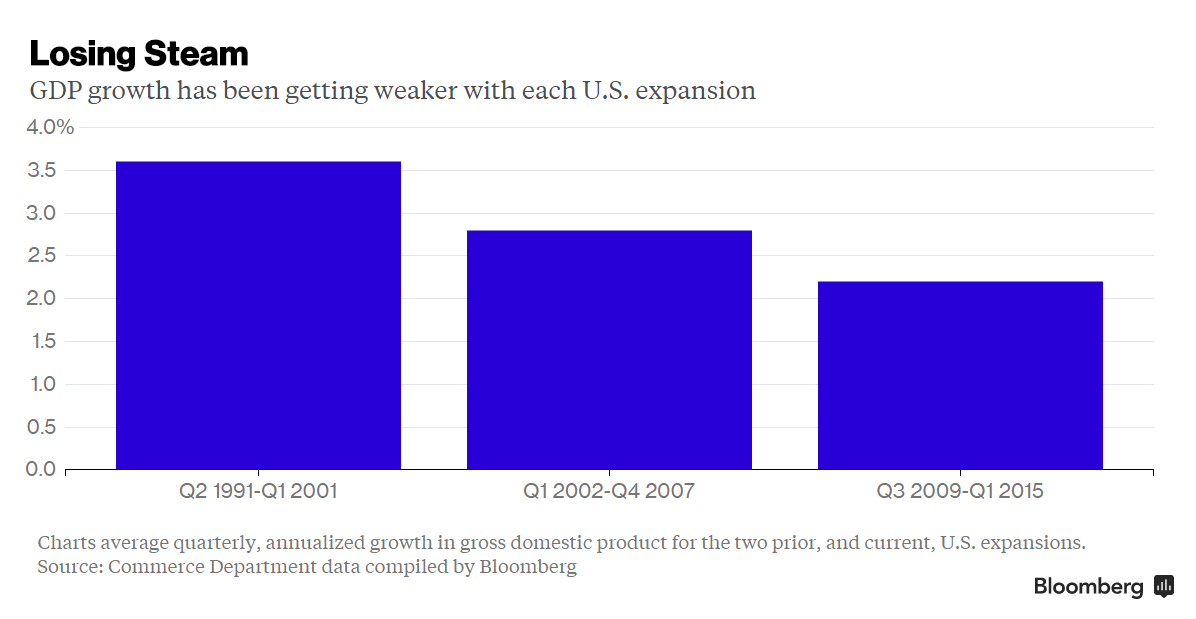

The chart below shows that each successive expansion since the 1990s has been weaker. The world's largest economy contracted in the first three months of 2015, forcing economists to rein in forecasts for the year as a whole.

The gain in confidence "is due to both an improving economy from the consumer perspective, but it also may reflect the acceptance of the diminished economic prospects in the years ahead," Curtin said. "They rate what we would have considered in a bygone era to be rather modest or mediocre growth more positively."

Families are even shrugging their shoulders at moderate income expectations, primarily because they believe low inflation is here to stay. The next chart shows what households say are the odds that their incomes will beat inflation over the next five years.

"The divergence between declining economic forecasts by policy makers and economists and the surge in optimism among consumers has rarely been greater during the past half-century," Curtin said.

Demeter

(85,373 posts)Not the people of Greece, not the Greek economy....just how they are going to deal with the Greekness of it all as the Eurozone, the Economic Hitmen and the global economy come crashing down upon the 1% because they had to make an example...to keep the rest of the Eurozone in line and in terror.

The hysteria is not terribly useful, unless you need Schadenfreude. If I find anything factual I will post it...but meanwhile, enjoy the week!

Demeter

(85,373 posts)The international game of chicken, being played out for the last five years, is reaching its climax. Alexis Tsipras has played a very bad hand extremely well, despite what doomsayers suggest

Greek Prime Minister, Alexis Tsipras, seemed to take the world by surprise last night when he announced that he would move to give a referendum to the Greek people on the debt deal currently on offer by the EU/IMF, so that they could have their say. He made it clear that he was unhappy with the offer, which he described as "unbearable" and "humiliating", and minded to reject it.

Opposition parties in Greece have moved swiftly to condemn the move. These are largely the same people who have been, for weeks, criticising Tsipras for making too many concessions during negotiations and moving towards a deal that they said was terrible.

Some international commentators have, however, noted that Eurogroup discussions are in fact continuing today and that the "team Greece" has suddenly found itself in a position of pulling a rather large ace from its sleeve which nobody thought it had.

What is the truth?

As always, it is somewhere between those two positions...

I'D SAY THAT FEAR WAS IN ASCENDANCE OVER GREED, AT THE MOMENT, IN CORNER OFFICES AROUND THE WESTERN WORLD

Demeter

(85,373 posts)THAT'S WHAT THIS IS! Götterdämmerung! AND IT'S SOOOOO GERMAN, THAT MAN WAGNER!

Greece's slow-motion economic train wreck is not just eroding the eurozone's flawed monetary union. Regardless of the outcome of this week's crisis meetings between European leaders in Brussels, permanent damage has already been done to the prestige of two entities that are key elements of the post-World War II settlement: the International Monetary Fund and the European Union itself.

Put that together with American wavering that very nearly derailed its own proposed Trans-Pacific Partnership scheme. Now add China's growing assertiveness in the South China Sea, its successful launch of the Asian Infrastructure Investment Bank and Western mishandling of the Ukrainian crisis that has driven Russia into China's arms, and you can almost hear the rumbling of the tectonic plates of global power.

On life support

The Greek philosopher Heraclitus said that "character is destiny" -- and the Greeks are far from blameless in the making of their own disaster. That much was true not just for Greece, but also for many other European countries, including the U.K., which overspent and overindulged in the heady mid-2000s.

By contrast, the Asian crisis of 1997-98 was less severe and much shorter-lived. Even Iceland, the recent poster child for financial excess, is almost back to peak economic activity and boasts an unemployment rate of just 4.5%. In all these cases, substantial currency depreciation and default or debt forgiveness were crucial factors in the healing process. In contrast, the distressed countries of the eurozone were locked in the lethal embrace of "an ever closer union" that robbed them of control over the main economic levers: monetary policy, the exchange rate and, ultimately, fiscal policy.

The hubris of the creators of the euro was to assume that they could graft northern European economic cultures onto southern European countries without any such compensating mechanisms. Their insouciance about the consequent economic mess has made euro-skepticism a vote-winner in the U.K., France and, most recently, Denmark.

Even now, the overriding priority among the Euro-elite -- the German-led "old Europe" club -- appears to be to maintain the euro currency in its present form, no matter what the cost in terms of unemployment and social collapse in southern Europe. The common-sense alternative, allowing a country to make a managed exit from the euro and restructure its debts while remaining a member of the EU, is too taboo to be even discussed.

MORE AT LINK

Peter Tasker is an analyst with Tokyo-based Arcus Research.

http://asia.nikkei.com/Viewpoints/Perspectives/Twilight-of-the-technocrats-settles-on-eurozone

Demeter

(85,373 posts)HSBC Holdings Plc said it was “monitoring the developments” in Greece after the country imposed capital controls and shut banks to avert financial collapse. HSBC’s $6 billion of Greek assets is the most among European banks.

“Like all banks, HSBC has been working to prepare for such events and to take the necessary steps to meet relevant requirements,” the London-based company said in a statement on Monday. “We are monitoring the developments closely and will keep customers up to date via our websites when further material information becomes available to us.”

Europe’s biggest lender has cut its Greek assets from $7.3 billion since the end of 2013 and they account for 3.7 percent of HSBC’s total net asset value, mainly comprised of loans to banks and the shipping industry, Sanford C. Bernstein & Co. estimates. Royal Bank of Scotland Group Plc has $376 million of Greek exposure, also primarily to banks and shipping.

Financial stocks declined the most since 2011 on Monday, losing more than $40 billion in market value. The seven-biggest banks on the U.K.’s FTSE 350 index fell 1.7 percent at 10:53 a.m. in London, with HSBC posting a 1.8 percent loss. Earlier in Asia the bank fell the most in eight weeks. The Stoxx 600 Banks Index dropped as much as 4.4 percent, lead by declines for financial firms in Italy, Portugal and Spain...

COULDN'T HAPPEN TO A BANK MORE DESERVING OF DISMANTLING....WE SHALL SEE IF IT HAPPENS

“HSBC is the only one with a material exposure because the bank has a 12-branch retail and commercial network in the country and cites a $2 billion exposure to shipping companies in Greece,” said Chirantan Barua, an London-based analyst at Bernstein. “Other than direct credit risk, the banks are also likely to suffer from second-order and third-order impacts if an exit actually materializes.”

Bank of America Corp. estimates HSBC’s exposure at $5.5 billion, followed by Credit Agricole SA with $3.2 billion, Deutsche Bank AG with $2.3 billion and Barclays Plc at $1.8 billion, according to a report dated June 19. European banks have a total exposure of $45 billion, the analysts said.

RBS updated an internal memo to employees at its commercial bank on Sunday that was first drawn up amid the previous Greek debt crisis detailing how to respond to client questions, said a person with knowledge of the matter.

Lloyds Banking Group Plc had about 3 million pounds ($4.7 million) of Greek assets at the end of December, according to company filings. The bank had about 8.5 billion pounds of assets in Ireland, Spain, Portugal and Italy.

Demeter

(85,373 posts)The water sloshing in the bathtub effect...people still believe we are the safe refuge....don't ask me why, unless it was that $13T the US poured into the global economy last time everything went blooey.

Demeter

(85,373 posts)https://theconversation.com/path-to-grexit-tragedy-paved-by-political-incompetence-43988

...Many of us doubted that it would come to this. In particular, I doubted that it would come to this. Nearly a decade ago, I analyzed scenarios for a country leaving the eurozone. I concluded that this was exceedingly unlikely to happen. The probability of a Grexit, or any Otherexit, I confidently asserted, was vanishingly small... I stand by the economic argument. Where I need to mark my views to market, however, is for underestimating the role of politics. In particular, I underestimated the extent of political incompetence – not just of the Greek government but even more so of its creditors.

...(Greek politicians') incompetence pales in comparison with that of the European Commission, the ECB and the IMF. The three institutions opposed debt restructuring in 2010 when the crisis still could have been resolved at low cost. They continued to resist it in 2015, when a debt write-down was the obvious concession to Mr Tsipras & Company. The cost would have been small. Pretending instead that Greece’s debts could be repaid hardly enhanced their credibility.Instead, the creditors first calculated the size of the primary budget surpluses that Greece would have to run in order to hypothetically repay its debt. They then required the government to raise taxes and cut spending sufficiently to produce those surpluses.

They ignored the fact that, in so doing, they consigned the country to an even deeper depression. By privileging their own balance sheets, they got the Greek government and the outcome they deserved.

The implication is clear. Never underestimate the ability of politicians to do the wrong thing. I will try to remember next time.

Opinion: Here’s why any Greek debt deal will amount to nothing By Satyajit Das

http://www.marketwatch.com/story/heres-why-a-greek-debt-deal-will-amount-to-nothing-2015-06-27?siteid=yhoof2

...Now, the Greek government has called a snap referendum on the new proposals.

In its current form, the terms will represent a few concessions by the creditors, but almost total capitulation by the Greek government. Consider:

First, the agreement is likely to cover five months, necessitating a more comprehensive further program, which will inevitably require creditors to provide new financing to Greece (in effect a third bailout) if default is to be avoided.

Second, the focus originally has been on the release of 7.2 billion euro EURUSD, -0.5105% from the existing second bailout program. If the amounts that Greece has run down from reserves, pensions and also its account at the IMF are replaced, then there is little additional new funding to Greece. It seems the European have found a little more money, by shuffling funds, whereby the amount would be a more “generous” 17 or so billion euro. But it is far from clear what Greece needs in any case.

Third, the issue of debt repayments or relief is not addressed, other than in vague terms. Greece has commitments of around 5-10 billion euro each year plus the continuing need to roll over around 15 billion euro in short-term Treasury bills. Greece may not have the ability to meet these obligations on an ongoing basis. This does not take into account additional funding needs of the State that may arise from budget shortfalls or the need of Greek banks....MORE

http://www.moonofalabama.org/2015/06/the-greek-tragedy-curtain-closes-on-most-absurd-act.html

...Greece took up a lot of debt when banks were giving away money without caring for the ability of the debtor to pay back. When that game ran out, some six years ago, Greece could not no longer take up new credit to pay back its old debts. That is the point where it should have defaulted.

But the Greece government was pressed on to pay back the debt to the commercial banks even when it had no money and not enough income to ever do so. Bank lobbyists pressed other EU governments to raid their taxpayers to indirectly cover the banks' losses. These other governments then pushed Greece to take on "emergency loans" from their states to pay the foreign commercial banks.

Nothing of that money ever reached the people in need in Greece. Here is a gif that explains what happened to all those foreign taxpayer loans treats "given to the Greek".

To get these new loans Greece had to agree to lunatic economic measures, an austerity program and neoliberal "reforms", to fix its balance of payments. But austerity has never worked, does not work and will never work. It crashes economies, lowers tax incomes and thereby further hinders a government to pay back it debts. It creates a vicious cycle that ends in an economic catastrophe.

After six years of austerity nonsense the Greece voted for a new party that promised to end the cycle and stop the austerity measures. But the new Syriza government misjudge the situation and the nastiness and criminal energy of the other governments and organizations it was negotiating with. It early on said it would not default and thereby took away its own best negotiation argument. The negotiations failed. The creditors still demand more and more austerity. Now it will have to default but under circumstances that will make it much more difficult for Greece to get back on its feet....

The law of Grexit: What does EU law say about leaving economic and monetary union?

http://eulawanalysis.blogspot.be/2015/06/the-law-of-grexit-what-does-eu-law-say.html

... Solutions to the tragedy

Classical Greek tragedies often ended with a ‘deus ex machina’ (‘god out of the box’). The playwright had manoeuvred the characters into an impossible situation, and the only way to resolve the plot was by the introduction of a radically new plot element – a god or goddess who could use his or her divine powers to resolve all of the problems which the characters faced. The normal rules of narrative are suspended. In my view, this is where we stand with Greek participation in the EU’s single currency. Whether or not Greece stays in EMU, a new approach to the legal framework is necessary to try and address the Greek position.

I see four main possibilities.

But in either case, a crucial exception to the ‘legal certainty’ rule can justify debt relief for Greece. It’s arguable that due to the essential illegality of the legal framework in which Greek debts were incurred, the no bail-out rule did not fully apply, leaving the creditors and Greece free to negotiate a realistic amount of debt relief. (True, the no bail-out rule does apply to non-Eurozone States too; but Greece borrowed far more than it would have done due to its illegal participation in the euro). If Greece has left the euro already, it could in future benefit from the slightly different regime for financial assistance to non-Eurozone States.

Although Greece would still be formally required to try to join the single currency in future, the EU tends not to pressure countries (like Sweden) which have no real intention of joining. Realistically, no one would pressure it to join for a very long time.

All of these solutions provide, in one way or another, that ‘it was all a dream’: either the debt or the euro participation never existed in the first place, or the Treaty or EU legislation retroactively apply to address the issues, or the Treaty means something quite different from what it was generally thought to mean. It is always preferable to avoid such an approach to the law, but it’s hard to see how any other type of solution could work in this case. Legally, simply put: Greece allegedly should not have joined the euro; it should not have been allowed to run up huge debts; it cannot leave EMU; and it cannot be forced to leave the EU. Economically and politically: Greeks have suffered more than enough; Greece can never pay its accumulated debts while taking austerity measures which depress its economy; but taxpayers of other Eurozone States understandably would like to see their money back.

These illegalities and economic and political conflicts cannot be resolved within the current framework, so we need to revise it radically....

BEST ARTICLE I'VE SEEN...WORTHY READ

BUT FOR THE RECORD, I'D PUT MY MONEY ON PUTIN BEING THE ‘deus ex machina’.

HE'S THE ONLY ACTOR WITH THE ABILITY, INTELLIGENCE, RESOURCES AND WILL TO ACT, AND THE ONLY ONE WHO WOULD OFFER A FAIR DEAL WITH QUID PRO QUO. HE CAN'T STABILIZE THE GREEK CURRENCY; ONLY GREECE CAN DO THAT. BUT HE CAN PROVIDE THE SPACE AND BREATHING ROOM FOR GREEKS TO GET BACK UP ON THEIR GAME, AND PROTECT THEM FROM THE WEST. HE CAN OFFER THE KIND OF STRATEGIC ADVICE THAT SELF-SERVING GOLDMAN SACHS NEVER DOES, TO ANYONE.

mother earth

(6,002 posts)Demeter

(85,373 posts)Almost lost by the wave of responses to the Supreme Court’s decisions last week upholding the Affordable Care Act and allowing gays and lesbians to marry was the significance of the Court’s decision on housing discrimination. In a 5-4 ruling, the Court found that the Fair Housing Act of 1968 requires plaintiffs to show only that the effect of a policy is discriminatory, not that defendants intended to discriminate. The decision is important to the fight against economic apartheid in America – racial segregation on a much larger geographic scale than ever before.

The decision is likely to affect everything from bank lending practices whose effect is to harm low-income non-white borrowers, to zoning laws that favor higher-income white homebuyers.

First, some background. Americans are segregating ever more by income in terms of where we live. Thirty years ago, most cities contained a broad spectrum of residents from wealthy to poor. Today, entire cities are mostly rich (San Francisco, San Diego, Seattle) or mostly impoverished (Detroit, Baltimore, Philadelphia).

Because a disproportionate number of the nation’s poor are black or Latino, we’re experiencing far more segregation geographically. Which is why, for example, black students are more isolated today than they were 40 years ago. More than 2 million black students now attend schools where 90 percent of the student body is minority. According to a new study by Stanford researchers, even many middle-income black families remain in poor neighborhoods with low-quality schools, fewer parks and playgrounds, more crime, and inadequate public transportation. Blacks and Hispanics typically need higher incomes than whites in order to live in affluent neighborhoods. To some extent, this is a matter of choice. Many people prefer to live among others who resemble them racially and ethnically.

But some of this is due to housing discrimination. For example, a 2013 study by the Department of Housing and Urban Development found that realtors often show black families fewer properties than white families possessing nearly the same income and wealth...

WE CALLED IT REDLINING, IN DETROIT. ANCIENT AND VERY AMERICAN PRACTICES.

MORE AT LINK

Demeter

(85,373 posts)SO, I WAS BORN AND RAISED IN THE MOTOR CITY===SUE ME!

http://www.newsandlists.net/abandoned-luxury-cars-from-dubai/

Some cities have a litter problem, some suffer from high crime rates and others might have a lack of affordable housing. And then you have Dubai, which for the last several years has been facing the unusual problem of high end sports cars being abandoned and left to gather thick layers of dust at airport car parks and on the roadside across the city.

If you’ve ever been to Dubai or anywhere in the United Arab Emirates, you will have noticed they have a serious car culture out there, with a particular preference for the latest and greatest in high-end super cars. But like the rest of the world, Dubai has fallen on hard times. Once the hub of the oil economy and the centre of a booming property market, foreigners, mostly British, invested in the red hot market. Newly wealthy ex-pats bought the lastest Italian and German sports cars to compliment their millionaire lifestyles– and then the global economic crisis came along and burst everybody’s bubble.

Thousands of the finest automobiles ever made are now being abandoned every year since Dubai’s financial meltdown, left by expatriates and locals alike who flee in a hurry because they face crippling debts. With big loans to repay to the banks (unpaid debt or even bouncing a cheque is a criminal offence in Dubai), the panicked car owners make their way to the airport at top speeds and leave their vehicles in the car park, hopping on the next flight out of there, never to return. Ferraris, Porsches, BMWs, Mercedes are regularly abandoned at the car park of Dubai International Airport, some with loan documents and apology notes simply left on the windscreen and in some cases with the keys still in the ignition.

Last year, a Ferrari Enzo, one of only four hundred manufactured, was seized by police having spent several months in a car park collecting dust. The million dollar motor went on sale at auction alongside other Ferraris, Porsches, Range Rovers and Mercedes plucked from the roadside. Residents complain about the unsightly vehicles hogging parking spaces at the airport and sitting slumped outside their fancy yacht clubs– it’s like, so not a good look. On the plus side, discount Ferraris for everyone!

Sigh.

BET THEY DON'T HAVE ANY RUST FROM SALT, EITHER.

Demeter

(85,373 posts)The first auto safety device probably was the padded dashboard, unless you count such basics as roofs and windshields. Whatever the case, such features have proliferated to seat belts, air bags, rear cameras and the like.

Now researchers at the University of Alabama, Birmingham (UAB), are studying what may be the ultimate in safety features, one that's also counter-intuitive: The self-driving car that would allow its own occupants to die if its computer determines that their number would be fewer than the people whose lives are threatened in a looming auto accident...

THEY PROBABLY HAVE TO FIGURE YOUR NET WORTH AND POLITICAL CONNECTEDNESS, FIRST....

Demeter

(85,373 posts)The Post had a good piece noting the large number of people dropping out of the workforce, presumably because they can't find jobs in the weak economy. However the problem is likely worse than the piece indicates.

There are a large number of people who do not respond to the Bureau of Labor Statistics' Current Population Survey (CPS), the standard survey used to measure labor force participation. In recent years the non-response rate overall has been close to 12 percent, as opposed to just 5 percent three decades ago. The non-response rate varies hugely by demographic group. For older white men and women it is 1-2 percent. By contrast, for young African American men it is close to one-third.

The Bureau of Labor Statistics effectively assumes that the people who don't get picked up in the CPS are just like the people who do. This assumption may not be plausible. The people who don't respond may be more transient or may have legal issues that make them less willing to speak to a government survey taker. For these reasons they may be less likely to be employed than the people who do respond to the survey.

My colleague, John Schmitt, examined this issue by looking at the 2000 Census (which has a 99 percent response rate) and comparing the employment rates overall and for different demographic groups in the CPS and the Census for the months when the Census was conducted. He found that the overall employment rate was 1.0 percentage point higher in the CPS. For groups with high non-response rates the gap was larger, with a gap of 8 percentage points for young African American men.

These results imply that the problem of people dropping out of the labor force is likely much worse than is generally recognized. The problem is that many of those who are dropping out are not responding to the surveys we use to measure the problem.

Addendum:

I forget to mention, the reason that so many people are just dropping out of the workforce now is the shortening of the period of extended unemployment benefits. As long as people are receiving unemployment insurance they have to be looking for work. When their period of eligibility ends, most people just drop out of the labor force. The period of extended benefits was shortened in most states at the end of 2012. As a result, many people went from being classified as unemployed (no job, but looking for work) to being out of the labor force (no job and not looking for work). This was reflected in a sharp drop in January in both the average and median duration of unemployment spells, since many of the people who had been out of work longest were no longer counted as unemployed.

ORIGINAL SOURCE: http://www.washingtonpost.com/business/economy/vanishing-workforce-weighs-on-growth/2013/04/06/2bc46116-9e20-11e2-9a79-eb5280c81c63_story.html

Demeter

(85,373 posts)Among the many unpleasant discoveries made by those who stashed their cash in Cypriot banks is that the island's government could stop them moving their money elsewhere. Capital controls are supposed to be a thing of the past, a figment of the pre-globalised world. But it turns out that when banks are threatened, the gloves come off.

One of the side-effects of this rude awakening seems to have been a surge of interest in a virtual currency called Bitcoin...The basic idea behind Bitcoin is to use a combination of public-key cryptography and peer-to-peer networking to create a virtual analogy of gold, that is to say, a substance that is scarce (if not absolutely finite) and fungible. Nakamoto devised a software system that enabled people with access to powerful computers to "mine" Bitcoins (effectively by solving very complex mathematical puzzles) and then securely use the resulting "coins" for online trading. He also arranged things such that the number of Bitcoins can never exceed 21m and that they will become progressively harder to "mine" as the years go by.

To the average punter, who knows nothing of cryptography, this sounds like a scam. Ditto the average reporter, though Reuters's Felix Salmon has recently written a terrific account of the phenomenon. A better way of viewing it would be as a radical experiment triggered by the catastrophic failure of our banking system. This system was, you will recall, supposed to be based on trust. And then we discovered that that trust had been systematically abused and flouted by all of the institutions involved – not just the commercial banks, but also the central banks, regulators and governments that were supposed to ensure that public trust in the system was warranted.

"The root problem with conventional currency," wrote Nakamoto in 2009, "is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts." In contrast, everything in Nakamoto's system "is based on crypto proof rather than trust".

MORE

Demeter

(85,373 posts)Wikileaks has published more than 1.7 million US diplomatic and intelligence reports from the 1970s. They include allegations that former Indian PM Rajiv Gandhi was a middleman in an arms deal and the first impressions of eventual British PM Margaret Thatcher. The documents have not been leaked and are available to view at the US national archives.

Wikileaks says it is releasing the documents in searchable form. Much of the work has been carried out by the website's founder Julian Assange while he has been holed up at the Ecuadorean embassy in London...Wikileaks made headlines around the world in 2010 after it released more than 250,000 leaked US cables...Mr Assange told Britain's Press Association that the latest collection, entitled the Public Library of US Diplomacy (PlusD), reveal the "vast range and scope" of US diplomatic activity around the world.

The data comprises diplomatic cables, intelligence reports and congressional correspondence running from the beginning of 1973 to the end of 1976. Much of the correspondence is either written by or sent to Henry Kissinger, who was US Secretary of State and National Security Adviser during that period.

It includes claims, being widely reported by the Indian media, that Rajiv Gandhi - of India's most famous political family - was employed by the Swedish firm Saab-Scandia as it tried to sell its Viggen fighter jet to India. Mr Gandhi was working as a commercial pilot and not in politics himself at the time. A US diplomat is quoted in a February 1976 cable as saying: "We would have thought a transport pilot is not the best expert to rely upon in evaluating a fighter plane, but then we are speaking of a transport pilot who has another and perhaps more relevant qualification." Rajiv Gandhi became prime minister in 1984 and was assassinated in 1991. Saab-Scandia did not win its bid to sell Viggen fighter jets to India; the contract went to Britain's Jaguar planes.

Demeter

(85,373 posts)The most virulent obit came out of Australia: TODAY'S SCHADENFREUDE

'Ding Dong!': Margaret Thatcher's foes celebrate death of former PM

http://www.smh.com.au/world/ding-dong-margaret-thatchers-foes-celebrate-death-of-former-pm-20130408-2hhs7

Demeter

(85,373 posts)Yves here. This post is elegant in the way it challenges the standard (sloppy) definitions of money. Even if you don’t agree, it will force you to think and articulate why you don’t agree (hopefully in a rigorous manner).

Many people try to attribute a solidity to money (I suspect German has better words that correspond to “thing-ness” for this sort of ideation) that it lacks. The desire to have money be concrete seems to be linked in many cases to the enthusiasm for gold or gold-currencies. But gold’s value isn’t enduring or fixed in any way; it’s value depends on the structure of social relations. For instance, in Vietnam, women typically get a necklace of gold beads in their youth. It’s a dowry of sorts. When conditions became desperate during the war, some women would try trading these beads for food or medicine, or as a way to buy off a possible rapist. The beads, when they were accepted, went for much less than the metal value.

Originally published at Another Amateur Economist

The standard definition of money is in error.

The standard definition of money is given in terms of its three functions:

1: Money is a medium of exchange.

2: Money is a measure of value.

3: Money is a store of value.

Number 1 is at best misleading. Numbers 2 and 3 are simply wrong, and these things are easy to show. It is also easy to show that this is important.

First, the actual definition of money:

1: Money is a token, or instrument, of demand, which is exchanged for goods or services. Or simply: Money is demand.

2: Money is a measure of demand.

3: Money is a store of demand.

In the standard definition, Number 3 cannot possibly be true. Were Number 3 true, money would have value of itself. The value of money would be independent of what ever else an economy produced. But consider, the best monies are those instruments which have no intrinsic value whatever. How can any amount of something which has no value, be a store of value? Even where commodities have been used for money, (and this may be the origin of the error,) they have tended to be those commodities, precious metals, for instance, which, because of their properties, were of only limited economic use. The reason for this is known and simple: These commodities had to be more valuable as money than they were valuable as commodities. If they were more valuable as commodities, they would be consumed, and so their use as money would disappear. But this implies that the value of these commodities, as money, over their value as a commodity, is not intrinsic, but as with plain fiat money, purely a matter of other factors. That is, the value of the commodity as money is not based on any intrinsic value of the commodity to the economy.

So fiat money has no intrinsic value, and therefore cannot be a store of value. If the economy produced only money, that money would have no value. It does not have value as, say, a refrigerator full of food has value, or a tank filled with gasoline. But, what the third function of money actually is is as a store of demand. If you have $100 in the bank, or in your pocket, you have a store of demand, which you can keep as long as you want, and when you choose to, you can spend it. You can demand something which is offered for sale, to the amount of $100.

Then you can take your $100 of tokens of demand and you can go to the grocery store and with it buy $100 worth of food. This shows that money is also a measure of demand: You have as much demand for food, or anything else, as $100 will purchase. If you have more money, you have more demand. If you have less money, you have less demand. If you have no money, you have no demand.

Money is not a store of value. Can it reliably be a measure of value? Economically worthless things may be in much demand, and therefore command a price beyond their value. Yachts, for instance. Economically valuable things may be in little demand, or supplied at prices below their value. Water, for instance. With money, you have demand for these things, at the prices they are offered. But their prices do not reflect their economic value, only the amount of demand, the amount of money, which must be exchanged for them.

This counters the claim that the only value a thing has is that set and measured by the market: The toys of the wealthy are much in demand, but of little value. The goods needed by the poor are to them of great value, but it may be that those poor are only able to demand a meager portion of them. Markets only measure demand. They need not measure value. This is the primary inadequacy of markets.

So because money is demand, or more exactly a token or instrument of demand, it serves as a ‘medium’ of exchange: Because money is not demand for any particular good or service, but is demand for any offered good or service, it may be exchanged for any offered good or service. Money is a medium not in the sense of being an environment for exchange, but in the sense of being a generalized instrument. It is an abstract good, which is offered in exchange for other goods and services. The individual who exchanges his good or service for money then himself has equal demand on others for different goods or services. Money thus flows opposite to the flow of goods and services, not to the degree of the value of these goods and services, but according to the demand for these goods and services that are offered.

Goods or services are thus exchanged for an equal demand on other goods or services. Money, then, is an instrument for comparing the demand for dissimilar objects. However, we have shown it is not reliable for comparing the value of dissimilar objects.

By mistaking demand for value, the standard definition of money thus implicitly fails to distinguish between the value of an object, and the demand for that object. In an informal sense, this results in the failure to distinguish between the needs of an economy, and its wants.To provide another example, the economy ‘needs’ streetlights in Highland Park, Mi. It ‘wants’ yachts in Newport, RI.

If we regard the economy as like a tree, money cannot distinguish between the fruits of a tree, and its roots.

There is a larger issue. The standard definition of money goes back, essentially unchanged, to 1875. See eg. Wikipedia. It is, implicitly, a key part of the foundations of the entire field of economics. That it is in error calls into question the soundness of the entire economics project.

Demeter

(85,373 posts)magical thyme

(14,881 posts)With all eyes focused on Greek ATM lines, collapsing Chinese ponzi schemes, and European bank implosions, one could be forgiven for forgetting about another crisis occurring closer to home. As we detailed here, Puerto Rico is now "in a death spiral" and PR bonds are collapsing this morning...

What happens next is unclear: "Puerto Rico, as a commonwealth, does not have the option of bankruptcy. A default on its debts would most likely leave the island, its creditors and its residents in a legal and financial limbo that, like the debt crisis in Greece, could take years to sort out."

García Padilla said that his government could not continue to borrow money to address budget deficits while asking its residents, already struggling with high rates of poverty and crime, to shoulder most of the burden through tax increases and pension cuts. Where have we heard that before...

And this one: any deal with hedge funds, who are desperate to inject more capital in PR so they can avoid writing down their bond exposure in case of a default, "would only postpone Puerto Rico’s inevitable reckoning. “It will kick the can,” Mr. García Padilla said. “I am not kicking the can.”

antigop

(12,778 posts)Demeter

(85,373 posts)Take the wind out of their sails.

Puerto Rico is the Rich Man's tax haven....so tax the Rich, the Obscenely Wealthy, and tell them to go soak their heads in the Caribbean.

Demeter

(85,373 posts)DJIA at 1:52 PM 17,709.83 Price decrease 236.85

Warpy

(111,267 posts)and the slide is likely to continue.

The worst reason to make any financial decision is panic. Yet the market as a whole is getting very panicky over Greece, over Puerto Rico, over China's stall, and over all the wrong things.

So they'll continue to dump stocks that are supplying them with dividends and put the money into gold, which supplies nothing, and interest generating investments, which generate next to nothing.

Sigh.

Demeter

(85,373 posts)In response to the market breaks in October 1987 and October 1989, the New York Stock Exchange instituted circuit breakers to reduce volatility and promote investor confidence. By implementing a pause in trading, investors are given time to assimilate incoming information and the ability to make informed choices during periods of high market volatility. In 2012, in connection with its approval of the Regulation NMS Plan to Address Extraordinary Market Volatility, commonly referred to as the Limit Up – Limit Down Plan, the SEC approved amendments to Rule 80B (Trading Halts Due to Extraordinary Market Volatility) that revise the halt provisions and circuit-breaker levels. Amended Rule 80B is operative during the pilot period of the Limit Up – Limit Down Plan.

Rule 80B

Effective April 8, 2013, amended Rule 80B will be in effect. Amended Rule 80B replaces:

the DJIA with the S&P 500 as the benchmark index for measuring a market decline;

the quarterly calendar recalculation of Rule 80B triggers with daily recalculations; and

the 10%, 20%, and 30% market decline percentages with 7%, 13%, and 20% market decline percentages.

Amended Rule 80B also modifies:

the length of the trading halts associated with each market decline level; and

the times when a trading halt may be triggered.

Specifically, the circuit-breaker halt for a Level 1 (7%) or Level 2 (13%) decline occurring after 9:30 a.m. Eastern and up to and including 3:25 p.m. Eastern, or in the case of an early scheduled close, 12:25 p.m. Eastern, would result in a trading halt in all stocks for 15 minutes. If the market declined by 20%, triggering a Level 3 circuit-breaker, at any time, trading would be halted for the remainder of the day.

A Level 1 or Level 2 halt can only occur once per trading day. For example, if a Level 1 Market Decline was to occur and trading was halted, following the reopening of trading, the NYSE would not halt the market again unless a Level 2 Market Decline was to occur. Likewise, following the reopening of trading after a Level 2 Market Decline, the NYSE would not halt trading again unless a Level 3 Market Decline were to occur, at which point, trading in all stocks would be halted until the primary market opens the next trading day.

NOW THAT WE HAVE THAT CLEAR...I SHOULD BE TRACKING THE S&P 500!