Economy

Related: About this forumWeekend Economists Wonder: College. Is it worth it? August 15-16

Well, there's been a lot of talk lately about college loan debt. Plus, it's an issue that our family has had to deal with recently.

It's been a given for many decades that college opens doors to future opportunity, that college grads earn on average a million dollars more over their lifetime than non-college grads. And this makes a lot of sense in an economy that's growing and vibrant. If you can graduate into a job with a yearly salary equal to one year's total cost of attendance, college makes a whole lot of sense. And it used to be (somewhat) easy to do that. But now? What about now?

Right now, it seems college is about to strike out.

Strike One. Over the last few decades, the cost of attending college has rapidly outpaced inflation in general.

Strike Two. A whole slew of well paying jobs that used to be available to USA grads are now being done overseas for 75% less.

Strike Three. Next to nothing has been done to fix the problems that caused the financial meltdown in 2008, guaranteeing that it will happen again, with even more devastating effects this time around.

And the cost benefit analysis used to be: little cost, big benefit. Now it seems to be quite the opposite.

Plus, there are a number of alternatives to college these days, if you have the motivation and the stick-to-it-nives to do it on your own. You can learn to things on Youtube that most colleges don't even teach, and you don't have to jump over some of the artificial barriers that colleges put in your way. Even now, colleges often want a strong math background to go into programming, though a whole lot of programming, even now I suppose, is the ability to get numbers to add and subtract correctly. I couldn't be accepted into a university programming curriculum because I didn't have the pre-requisites, but I managed to get around that and learn programming anyway.

And I'm very leary about the advice that one should attend college only to learn career skills. What, just being educated for education's sake doesn't cut it any more? Having worked alongside a good number of university programming grads, I am very thankful for my liberal arts education (Political Science), thank you very much. It seems that many STEM (Science, Technology, Engineering, Mathematics) grads are highly proficient and what they do, and rather clueless at a great many other things. I've met a good number of STEM grads that are rather conservative in their political leanings, and anyone who believes that ain't a problem isn't in touch with America 2015.

Now, learning things via the internet isn't for everybody, obviously. Many majors require access to rather expensive equipment, the types of things not found in your local neighborhood. And some people need to be lead by the hand through a learning process, not being able to focus and follow-through on a personalized learning curriculum without someone guiding them.

So... what has our family decided about college? Our son is going. He'll be living at home, and his tuition expenses for this year are slightly under $500. (This is Kiev Ukraine, after all). He's the type that needs someone to hold his hand throughout the learning process, and he's not likely to stick with a Youtube University curriculum, unless someone really holds his feet to the fire, so to say.

This video puts it a lot better than I could, though I don't agree with everything they state here... They don't even cover the insanity that is big time college athletics!

MattSh

(3,714 posts)A comparison of Rutgers University, New Brunswick NJ, the State University of New Jersey (My Alma Mater) and Princeton University, Princeton NJ, Ivy League.

Physically, they're 15 miles apart. In other ways, they are worlds away. Notice especially the average debt of graduates and the total cost of attendance.

Data from http://ticas.org/posd/map-state-data#

MattSh

(3,714 posts)(Sometimes it doesn't).

During my time at dear old Rutgers U., the in-state tuition and fees were in the 3 figures the whole time.

In 2012-2013, it was $13,073?

MattSh

(3,714 posts)“@ Hillary Clinton: How does your student loan debt make you feel? Tell us in 3 emojis or less.” | naked capitalism

The above tweet is real and is from Hillary Clinton’s official twitter account. It is very difficult to express how appalling this sentiment is. It represents much of whats wrong with American politics in our current moment. It is

a) an infantilization of your audience. Presumably college students are capable of forming words, let alone sentences, explaining their feelings.

b) asking about students feelings towards their student debt. What does this matter? Is policy based around people’s feelings? If people felt good about their student debt would it not be a policy problem? Feeling can be altered by drugs and other stimulants of all kinds. The obsession with subjective mental states in public policy is pernicious

c) What matters concretely is who is getting blocked from obtaining an education because student loans are used to finance education and the depressive economic effects (as well as social effects) of a large load of student debts nonadjustable by bankruptcy.

Of course the request for people’s “feelings” through “emojis” wasn’t about getting genuine feedback-obviously. It was about clumsily attempting to manipulate people’s feelings by presenting Clinton’s “New College Compact” as something to make students feel better. The “content” of her proposals are similar. The overarching theme is expressed in this quote she (or her staff) offers to finish a sketchy overview of her proposals:

I want every young person in America to have their shot at that moment. I want every hard-working parent out there to get the chance to see his or her child cross a stage — or to cross it themselves. America should be a place where those achievements are possible for anyone who’s willing to work hard to do their part.

In other words, what matters is the emotions you or your children feel being educated, not concretely what they do for you. Notice that she says “. America should be a place where those achievements are possible” not that everyone should be guaranteed an education. In our current neoliberal order i guess it is hopelessly idealistic to think everyone should have a good education, it shouldn’t merely be “possible”.

Complete story at - http://www.nakedcapitalism.com/2015/08/hillary-clinton-how-does-your-student-loan-debt-make-you-feel-tell-us-in-3-emojis-or-less.html

What other DUers have said on prior DU posts. It's a mixed bag of responses, no surprise there...

http://www.democraticunderground.com/1251515855

http://www.democraticunderground.com/1251516147

http://www.democraticunderground.com/10027072152

http://www.democraticunderground.com/1251518955

Demeter

(85,373 posts)but with a different husband....

hamerfan

(1,404 posts)Another Brick In The Wall, Part Two by Pink Floyd:

MattSh

(3,714 posts)Don’t rely on the declining value of credentialing signals: demonstrate you have the skills.

My recent conversation with Max Keiser on Summer Solutions (25:45) included three bits of advice:

Stop financializing the human experience

Acquire skills, not credentials

Vote with your feet

Today’s topic is acquire skills, not credentials.

VIDEO ADDED:

I have written two books on this topic:

Get a Job, Build a Real Career and Defy a Bewildering Economy and The Nearly Free University and the Emerging Economy: The Revolution in Higher Education.

There is a place for credentials that act as an entry key to a profession: a dental hygiene credential, passing the bar exam, etc.

But outside these licensed professions, credentials such as four-year college degrees are fundamentally signals: they don’t actually authenticate real-world skills, they simply signal that the holder of the credential completed the coursework.

It is remarkably easy to exit a university with a degree and essentially no practical real-world skills of the sort employers want and need.

That’s the problem with the signaling value of credentials: in a competitive economy, employers don’t want to gamble that the signal in a credential has value, they want evidence of real-world skills, i.e. the ability to profitably solve problems.

Complete story at - http://dailyreckoning.com/rely-on-skills-not-the-declining-value-of-credentials/

Demeter

(85,373 posts)A sign of things to come?

Or a road map of how to move events locally and beyond.

MattSh

(3,714 posts)What else can one call it? It's Fluffy and Nutty, both at the same time!

Kiev’s hipster revolution – POLITICO

With Russia breathing down their necks, the young seek refuge in ramen burgers and beards.

By VIJAI MAHESHWARI 8/13/15, 5:30 AM CET Updated 8/13/15, 8:32 AM CET

KIEV — A disc jockey spins a remix of Daft Punk’s “Get Lucky” on a stage by the river, while scores of young fashion brands that have sprung up in Ukraine’s capital since the revolution hawk their wares in a carnival atmosphere. T-shirts decorated with slogans like “Putin is a Dick,” “Pray for Ukraine” and “Separatist Buyer’s Club,” flap in the cool summer breeze, alongside harem pants in folk patterns, hoodies emblazoned with the Ukrainian trident, and tons of other creative knick-knacks. A vivacious girl in lensless granny glasses hands us a free cupcake for our “good vibrations” while a bearded barber from the “Tommy Gun Barbershop” offers free shaves. It’s just past noon on a summer Sunday, but Kiev Market is pumping, hipsters jostling against each other to sample the wares.

The flea market was launched just over a year ago, but has already become a fixture of the city’s booming hipster scene that has emerged since the country’s Euro Revolution.

“This European youth movement started with the Maidan. Young people realized that they needed to do something for themselves, and not depend on the government,” says Kiev Market founder Miriam Dragina, a former journalist who launched the market last year to raise funds for the Ukrainian army. She had the idea for the market while visiting Amsterdam last year, and modeled it on street markets in Europe.

“We were inspired by Moscow in the past, but now we’re moving closer to Berlin style,” she adds.

* * *

Ukraine’s capital — once known for its glamorous nightclubs and high-heeled, overdressed women — is indeed fast turning into an “Eastern Berlin.” I remember being one of the brave few to ride a bicycle down the city’s busy streets when moving here six years ago. Now biking is the new “cool” and many bars and restaurants have bike stands; hundreds gather for midnight bike rides through the city on the weekends. Bars, which were once a foreign concept, have sprung up like mushrooms in the past year. I tried keeping track of the new bars last fall, but there are now so many Brooklyn-style watering-holes and artist hangouts that it’s impossible to keep up.

Complete story at - http://www.politico.eu/article/kievs-hipster-revolution-russia-ukraine-culture/

Bars were a foreign concept here? Oy vey!

MattSh

(3,714 posts)There's a water park at Texas Tech, a campus steakhouse at North Carolina's High Point University and a 293,000-square-foot indoor beach club on the main campus of the University of Missouri, replete with lazy river, whirlpools, waterfalls and waiters. All of which raises the question: college or country club?

For the last decade, colleges across the U.S. have been tricking out campuses to compete in an amenities arms race aimed at attracting prospective freshmen. Free tanning, bouldering caves, gourmet dining and luxury fitness centers are not uncommon. At MIT, students housed in Simmons Hall enjoy PS3 gaming stations and Roku access in every lounge, a ball pit and private bathrooms.

Closer to home, residence halls at Pomona College offer smart-home technology, solar heating and a rooftop garden with a movie screen. Nearby, the romantic Spanish Colonial dorms at Scripps College are consistently voted "most beautiful" in the nation. Chapman University boasts the tallest university-owned rock wall in Southern California (51 feet), and UCLA just opened Bruin Plate, one of the country's first health-themed dining halls.

It's not home away from home. It's better.

"I think we can go through a list of amenities that 20 years ago would have seemed shocking on a college campus," says Robert Franek, the Princeton Review's senior vice president of publishing and lead author of "Best 379 Colleges." "You can call it an amenities arms race, but it solidly fits into the idea of campus culture and what we expect there."

Bottom line? More than 3 million students are expected to apply to an average of seven to nine colleges each, starting this fall. "Schools are competing for those students, and they're competing hard," Franek says. "If all things are created equal academically, what are the other campus-culture type of things that are going to affect lifestyle? I doubt it comes down to a 25-seat spa at a particular residence hall, but if there are many amenities at a particular campus, it could sway a student."

Complete story at - http://www.latimes.com/home/la-hm-college-amenities-20150718-story.html

MattSh

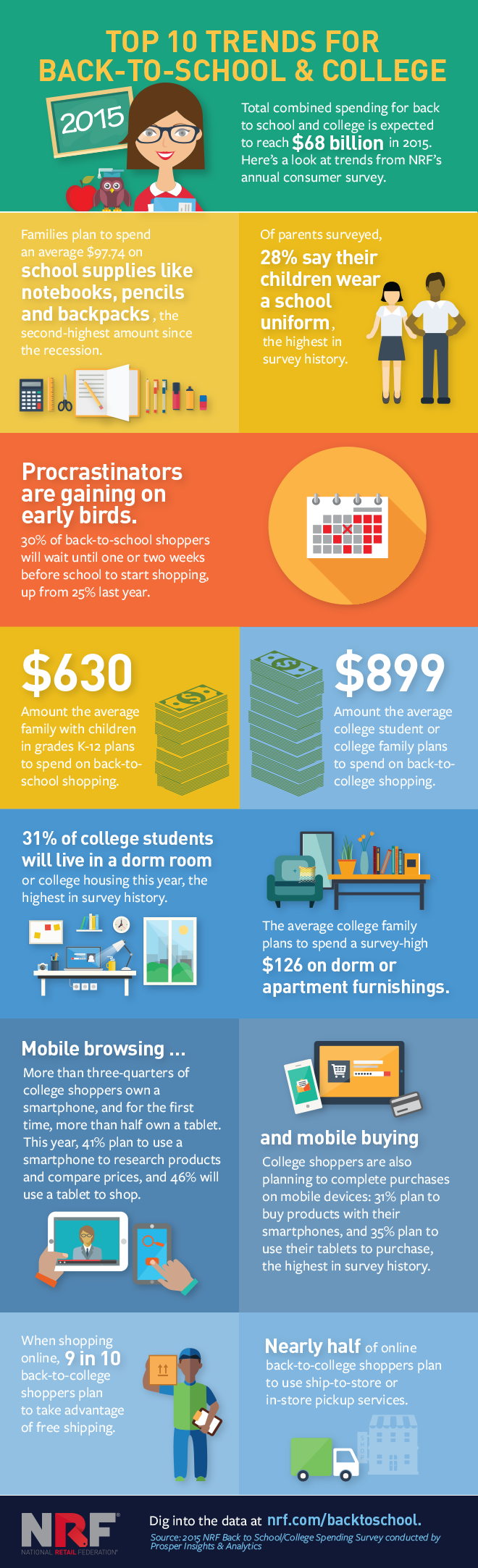

(3,714 posts)Back-to-school and college shopping is a big deal for retailers, with total combined spending second only to the winter holiday shopping season. NRF’s annual survey, conducted by Prosper Insights & Analytics, is among our most anticipated consumer research releases each year.

For the first time, we asked online shoppers if they plan to use retailers’ omnichannel delivery options, including free shipping, same-day delivery, ship-to-store and reserve online. The topics we ask about each year — from school uniforms to living in a dorm — also yielded interesting insights. Here’s a look at some of the data points that have captured our attention this year.

Complete story at - https://nrf.com/news/infographic-top-10-trends-back-school-and-college-2015

Please include attribution to National Retail Federation with this graphic.

MattSh

(3,714 posts)Today is the biggest day of the calendar year for many college presidents: the annual release of the US News and World Report rankings of “America’s Best Colleges.” For better or worse, the rankings have become the most important measuring stick for elite institutions and the semi-elite colleges that wish to join them. They’ve also functioned as a playbook of sorts for institutions that are dissatisfied with their station and want to rise in the eyes of American families. Improve on the measures that US News uses to define “best,” and you’ll move from coach to first class.

The widely acknowledged problem is that those measures often have everything to do with who colleges admit and less to do with what colleges actually teach them while they’re there. The algorithm has changed somewhat over the years, but above all, these rankings are about prestige and selectivity. The magazine measures academic reputation (via a survey of faculty), admissions selectivity (what percentage of applicants get in, and how high are their SAT’s), financial resources, as well as outcome measures like retention and graduation rates. The fastest and most surefire way to climb the ranks is to attract better students, typically by raising SAT benchmarks, rejecting more applicants, and ensuring that admitted students choose to go (yield). Raising tuition doesn’t hurt either.

Recent history is full of high-risers who played the numbers game. George Washington University jacked its tuition, built nicer dorms, and lowered its admission rates from 49 percent to 33 percent over the course of the 2000’s. It went from being unranked in US News to #54 on the tally of national universities this year. (It was also unceremoniously dumped from the rankings for a time after “misreporting” data on the achievement of its students). University of Richmond increased the sticker price of tuition by 31 percent between 2004 and 2005 alone, and lowered its admit rate from 48 percent to 31 percent over the past decade. It went from being unranked on the national liberal arts ranking to #30 in those released today.

Contrast this competition with what goes on in the rest of the economy. In most sectors, competition tends to benefit consumers, as firms work to attract customers by selling a quality product at a competitive price. Competition here implies trying to serve as many paying customers as possible in order to maximize market-share.

US News flips this kind of competition on its head. Colleges try to attract students by building more amenities, which leads them to charge more in tuition; then they strictly ration access to a chosen few. As they rise in the rankings and demand increases, it allows them to be even more selective. Prices rise and the good gets scarcer, making it even more appealing to consumers who want “the best.” The incessant pressure to climb the US News rankings may pay off for colleges (and their alumni), but it actually hurts students and families in the long run.

Complete story at - http://www.forbes.com/sites/akelly/2014/09/09/new-college-rankings-remind-us-of-whats-wrong-with-american-higher-education/

MattSh

(3,714 posts)Earlier this month, we learned that the average employee at 10 legendary "Unicorn startups" is valued at somewhere around $8 million. These startups include Uber, Airbnb, Snapchat, Palantir, SpaceX, Pinterest, Dropbox, Wework, Theranos, and Square.

These "businesses" are valued at a combined $165 billion courtesy of the largely arbitrary and completely ridiculous methodologies employed by founders and their enthusiastic VC backers. Nevermind the fact that between them, they generate but $4 billion in revenue.

Meanwhile, employees at real businesses are worth far less. Take McDonald’s for instance (which, even in its diminished state, still brings in more revenue in three months than all of the Unicorns listed above pull in over the course of a year - combined) where the enterprise value per employee is a paltry (by comparison) $200,000.

.....

Now, Bloomberg is out with a new study based on their own calculations and while it seems that their computation methods are predisposed to understating the case compared to the Economic Policy Institute's figures (shown above), the data still suggests that for at least three American CEOs, the gap between their compensation and that of their employees is even wider than the 303:1 ratio from the preceding chart.

Here's Bloomberg's list:

Complete story at - http://www.zerohedge.com/news/2015-08-13/these-11-ceos-are-most-overpaid-relative-their-employees

MattSh

(3,714 posts)Fortunately for anyone looking to get a read on the going rate for the various goods and services which comprise the world’s black markets (and in some countries serve as a much needed boon for GDP), Havocscope has a price list for everything you’ve ever wanted to buy (and everything you wouldn’t touch even with Mario Draghi’s hands) from someone in a dark and smoky back alley.

First, a bit on Havocscope’s methodology:

Data listed within Havocscope’s website is collected from credible open-source documents such as newspapers, government reports and academic journals. The source for the figure is clearly listed on each data post. This allows users to see where the information has come from, judge the credibility of the source, and pursue further research if necessary.

That seems fair enough, and so, without further ado, we present current price lists for a veritable smorgasbord of illegal goods and services.

AK-47 and Other Guns on the Black Market

Average price of AK-47 worldwide$534

Europe$400 to $900 for Rocket Launchers and AK-47s

Iraq$800, with Osama Bin Laden’s favorite model for $2,000

Mexico-AK-47$1,400 on US border/$3,000 in South

Profit in the U.S.$500 for selling AK-47 to Drug Cartels

Somalia$400 for Russian AK-47, $600 for North Korean AK-47

United States$400 in California’s black market

United States-Small Pistol$20 to $100 in Dallas, TX

United States – Straw PurchaserUp to $500 per gun

Bribes

Afghanistan – Election Bribes$1 to $18 per vote

Afghanistan – Police Bribe$100,000 to be Police Chief

Afghanistan Average Bribe Amount$214 in 2012

Africa – Bribe Payments of Govt Officials$20 to $40 Billion

Amount of Bribes Paid Worldwide$1 Trillion per year

Bangladesh – Bribes Paid per Household$86

Businesses – Rise in Market Value from Bribes$11 for $1 in bribe

Cambodia – Bribes for Fishing Permit$50

Cambodia – Bribes to Operate Fake License Shop$2.50 per day

Cambodia – Citizens Paying Bribes to Receive Services72%

China – Bribe to become a City Assemblyman$44,000

China – Bribes to Education Officials$10,000 for School Admission

China – Bribes to Rail Ministry$14,897 for job as Train Attendant

China – Impact of Bribes on Drug Prices20%

Companies Asked to Pay Bribes Worldwide28%

Croatia – Average Bribe Payment$300

Czech Republic Average Bribe Amount$248 to $497

Education Corruption1 in 6 students pay bribes

Greece- Bribes Paid by Families$2,500 to Public Officials

Guatemala – Bribes from Drug Traffickers$2,500 to Public Officials

Haiti – Bribe to Border Official for Human Trafficker$400 per immigrant

Illegal Loggers$25,000 to $50,000 in bribes for permits

India – Bribe to Sell DVDs$0.18 to Police

India – Bribes to Police to Sell Water$0.18 to Police

India – Families Paying Bribes4 million families

Indonesia – Bribe to Chief Justice$250,000

Indonesia – Bribe to Oil Regulator$600,000

Indonesia – Bribes to Prison Guard$500 to use cell phone

Indonesia – Businesses Paying Bribes60%

Iraq – Bribes to Prison Guards$100 to Take a Single Shower

Ivory Coast – Bribes at Traffic Checkpoints$300 Million

Kenya – Bribes to Customs and Port Officials$5,797 per shipment

Kenya -Average Bribes Paid Per Month16

Mexico – Amount of Bribes Paid$2.75 Billion in 2010

Mexico – Average Bribe Paid$14

Mexico – Bribes Collected by Police65% less than $6,000

Mexico – Bribes Paid by Drug Cartel to Police$1.2 Billion Per Year

Mexico – Sinaloa Cartel Boss to Escape Prison$2.5 Million

Nigeria – Bribes Accepted by Government Workers$3.2 Billion

Nigeria – Bribes Paid by Shell$2 Million in bribes, $14 Million in profit

North Korea – Bribes to Border Guard by Defector$6,000

North Korea – Bribes to Inspectors$2,000 per visit

Pakistan – Bribe to Police from Artifact Smuggler$10.62 per day of digging

Pakistan – Bribes Paid by Smugglers$1,200 to Police Chiefs

Peru – Bribe to Stop Logging Investigation$5,000

Romania – Bribe to Receive Brain Surgery$6,500

Romania – Bribes Paid Per Day$1 Million

Romania – Bribes to Hospital For Employment$40,000

Russia – Average Bribe Paid$189

Russia – Bribes to Forest OfficialsCases of Vodka

Russia – Business Bribe$10,000

Russia – Education Admission Bribes$1 Billion

Russian -Amount of Bribes Paid$5.9 Billion in 2010

South AfricaTraffic Police Ask for Most Bribes

Thailand – Bribes to Police to Allow Human Smuggling$160 per migrant

Thailand – Kickback and Bribes to Officials25-35% of project value

Thailand -Impact of Bribes on Economy$3.3 Billion

Ukraine – Bribes to Police$1,000 from brothel owners

United Kingdom – People who Paid Bribes1 in 20

United States – Bribe to Border Agent$15,000

United States – Bribes to Prison Guard$5,000 to pass meth

United States – Bribes to TSA Screener$2,400 for each suitcase

United States – Corruption At Workplace60% believe common

Vietnam – Bribes to Forest Official$2,300

Profits from the Business of Crime and Illegal Jobs

Afghanistan – Taliban$200 Million a year from Opium

Antique Looter1 percent of final sale price

Asian Massage Parlor – New Jersey, United States$108,000 per year

Asian Massage Parlor – Washington DC, United States$1.2 Million per year

Assassin – Colombia$600 monthly retainer, $3,000 per hit

Assassin – Mexico$3,000 to teenagers

Bootlegger – Pakistan$4,000 per year

Bride Trafficker Broker – Cambodia$1,500 per bride

Child Beggar – Pakistan$1.88 to $2.36 per day

Child Beggar – Thailand$20 per day

Child Begging Ring – China$40,000 per year

Child Begging Ring – Saudi Arabia$15,000 per month

Cigarette Smuggler – Mali$200 per trip, $2,000 if cocaine

Cigarette Smuggling – USA$500,000 from One Run

Cigarette Truck Unloader – Indian Reservation, USA$200 per truck

Coal Mining – Mexico$25 Million by Los Zetas

Coca Farmer – Peru$9,860 per year, $1,554 growing coffee

Cockfighting – Management of Matches$2,000 a day

Cockfighting – Prize Money for Winning Rooster$15,000

Counterfeit Dollars – Peru$20,000 for every $100,000 in fakes

Counterfeit Drug Seller$450,000 based on $1,000 investment

Crystal Meth Smuggler – Indonesia$311 per trip

Custom Officials – Mexico$1 Million per shipment passed through

Driver License Broker – Afghanistan$10,000 per year

Drug Dealer – Rio de Janeiro$15 Million in Favelas

Drug Mule – Indonesia$15,000 to swallow 76 capsules of heroin

Drug Mule – Panama$5,000 per trip

Drug Mule – Paraguay Local$200 per trip

Drug Mule – Paraguay Tourist$3,970 per trip

Drug Mule – Teen in Mexico$50 to $100 per trip across border

Drug Smugglers – Guatemala$600 Million to $800 Million per year

Extortionist – Guatemalan Prison $6,000 a week

Extortionist Gang – Colombia$100,000 per month

Fake Degrees – Europe$50 Million per year to 15,000 customers

Fake Degrees Online Website$5 Million in 9 years

Fake Viagra Seller- South Korea$0.84 per tablet

Football Match Fixing Syndicate$15 Billion per year

Gambling Runners – Singapore$1,957 per day handling bets

Gold Smuggler – India$33.50 for 10 grams

Gun Straw Purchasers – United States$500 per gun for Mexican Drug Cartel

Heroin Dealer – Ireland$694 per week

High Class Escort – Florida, United States$80,000 a month

Human Smugglers – Indonesia$1 Million per boat to Australia

Human Smugglers – South Korea$2,500

Human Trafficker – Canada$79,380 per year

Human Trafficker – New York City$100,000 per year

Human Trafficker – United Kingdom$77,000 per year

Human Trafficker – Vietnam$470 to move victim to China

Kidnappers – Virtual Kidnappers$1,000 to $3,000 per ransom

Legal Brothel Owner40 to 50 percent of sex workers earnings

Logger – Madagascar$1.33 per kilo for illegal timber

Marijuana Plant – United States$2,200

Meth Trafficking – Thailand$168 per trip

Money Launderer – Mexico15 cents to each dollar laundered

Money Mule – United Kingdom8 percent of cash laundered

Oil Thieves – Nigeria$6,098 per day

Online Dating Scammers – Ivory Coast$13,000 a month

Online Drug Dealer$3 Million for Top Seller on Silk Road

Online Extortion$500 to $15,000 in “sextortion”

Online Game Hacker$16,000 a month in China

Online Streaming Website$4.4 Million for largest sites

Opium Farmer – Afghanistan$4,900 vs $770 for wheat farmer

Opium Farmer – Myanmar$6 per day vs. $1.20 for rice

Opium Farmer – Students$15 to $20 per day during season

Organ Trafficker – Turkey$10,000 profit

Passport Seller – Thailand$200 to sell own passport

Pickpockets – Barcelona, Spain$6,132 per week

Pimp$67,200 per year

Pirate – Somalia$30,000 to $75,000 per hijacking

Pirated Book Seller – Mumbai, India$2 per book

Pirated DVD Seller – Los Angeles$50,000 a month

Pirated DVD Seller – Mexico$2 Million per day

Pirated Movie Uploader$1 to $2 per 1,000 views

Poppy Farmer – Afghanistan$10,000 per year, $120 if wheat

Prison Guard – United States$3,000 to $5,000 Smuggling Contraband

Prostitute – Brazil$100,000 (High-End Prostitute)

Prostitute – Calcutta, India$1.85 a day

Prostitute – Cannes, France$40,000 a night

Prostitute – Jamaica$470 per day

Prostitute – Java, Indonesia$952 per month

Prostitute – Kuwait$570 per month

Prostitute – Male Prostitute in LondonHigh of $49,000

Prostitute – Orange Country, California$700 a day

Prostitute – Pennsylvania, United States$20,000 a week

Prostitute – South Korea$70 per session

Prostitute – UgandaUp to $500 a night

Prostitute – Washington, DC$500 per day

Prostitutes – Filipino Women in Japan$150 Million a year

Ransomware$5 Million a year

Roma Thief$7,000 a month

Spam Sellers – Russia$60 Million a year

United States Workers$2 Trillion Not Reported to IRS

Much MUCH more at the link!

Complete story at - http://www.zerohedge.com/news/2015-08-13/1300-tiger-penis-800k-snipers-complete-black-market-price-guide

MattSh

(3,714 posts)

Hotler

(11,425 posts)get fighting mad and take to the streets by the hundreds of thousands and stay there in a strike. We may have to get mean, may have to throw some rocks and when the cops push we push back harder. The days of voting every two and four years to get change are over for now.

The American people are too lazy to take to the street and mass protest will not happen until more people feel the pain. Too many (even liberials) have the attitude "I have mine fuck the rest of you.". That is why a part of me says let the republicans have the next election and let them drive this country into the ground. That is when the pain will comeand the people will finally get mad to do something.

One of the ways we the people can get the attention of the PTB is with a consumer spending strike. One of our biggest weapon is the power of our wallets and pocketbooks. Shut the spending down. No new cars, appliances, shoes, computers, stop going out to eat except to mom and pop shops. Get rid of cable and satilite. Stop supporting pro and collage sports, stop going to NASCAR races and on and on.

Sure it will hurt the economy and many low wage workers, but we have already taken a hit from this depression and already know how to survive. When the rich and Wall St. don't have any consumer dollars rolling in they will start to squirm. Their creditors will go after them before they come after us because we are already without money to collect.

Hotler

(11,425 posts)Great topic and well done. I always enjoy your contirbutions to SMW and WEE.

Thank you again and take care.

Hotler

(11,425 posts)Sick of Windows spying on you? Go Linux

More at the link.

http://www.zdnet.com/article/sick-of-windows-spying-on-you-go-linux/#ftag=YHFb1d24ec

Demeter

(85,373 posts)I have "reserved" a copy of Windows 10, but not downloaded it. I figure let others debug it...

Given this article, I may not download it at all...

Reminds me of The Twilight Zone episode: "To Serve Man".

http://www.imdb.com/video/hulu/vi2866521881

https://en.wikipedia.org/wiki/To_Serve_Man_%28The_Twilight_Zone%29

Hotler

(11,425 posts)Boycott Amazon. They treat their employees like shit and the owner is an ass.

Demeter

(85,373 posts)You sure pulled it together fast!

In contrast, I doubt I will ever be pulled together in this year, or maybe even this decade....I'm no longer sure it's possible. But that's no reason to stop trying, is it?

It's hot--87F, feels like 93F, and tomorrow is supposed to be worse.

Demeter

(85,373 posts)of a whopping $200/year. The books and fees cost more. Massachusetts supported public education in those days.

Was it worth it? Well, yes. It's just that events cut off the path I was on, and I've been wandering in the wilderness since 1983...

Fuddnik

(8,846 posts)I enrolled several times, but always had to drop out because I couldn't stay on a shift long enough to attend. So, I always had a book in my hand anyways...

And I was making more money than the professors.

Demeter

(85,373 posts)It’s unfortunate that we have to be spending so much time on the Federal Reserve. It’s the place to start if you want to understand a lot of what’s going on in the markets. In fact, nothing is more important — but I wish that weren’t true. I wish the central banks could go back to just being boring, opaque, marginal institutions that took care of money supply and acted as a lender of last resort instead of monstrosities that seem to manipulate and invade every corner of every market in the world. But unfortunately, that is what we have today.

When the Fed manipulates the dollar and dollar interest rates, they are directly and indirectly affecting every market in the world — equities, gold, real estate, other commodities, junk bonds, corporate debt, etc. So even though I wish it wasn’t the case, understanding what the Fed will do next is the big question.

Let’s take two scenarios: What if they raise rates? And what if they don’t?

I’ll address both of those directly but first, I’d like to give you some background to help you understand what’s behind the debate. The Fed has certainly signaled that they intend to raise rates and it’s what the markets expect. Securities around the world are priced as if the Fed were going to raise rates. I’ve never seen anything more trumpeted and more advertised in my career. There’s good reason for that. The last time the Fed raised rates was 2006. In terms of cutting rates, they hit bottom in late 2008 when they got to zero — and they’ve been at zero ever since. It’s been six and a half years at zero. But you have to go back two years before that to find the last time they raised rates, so it’s going on nine years at this point. That’s a long time without a rate increase and people may forget how nasty they can be.

I was in the markets in 1994 when the Fed raised rates, and it was a wipe out. That’s when we had the bankruptcy of Orange County, California, and other dealers went out of business. There was a bond market massacre. The same thing happened in 1987. A lot of people recall the crash of October 1987 when the stock market dropped 22% in a single day. In today’s market, that would be the equivalent of over 3,000 Dow points. Imagine the market dropping not 300 points, which would get everyone’s attention, but 3,000 points. That’s what happened in October 1987. But before that, in March of 1987, there was a bond market crash. The bond market crash preceded the stock market crash by about six months.

These things can get nasty and I could say it’s been a long time since the last one. That’s why the Fed is talking so much about it. You have to go all the way back to May 2013 when the Fed was still printing money and buying bonds (long-term asset purchases as they call it) when Ben Bernanke first started talking about maybe beginning the taper...

MORE

Demeter

(85,373 posts)"So when the Fed says, well, we think the economy is healthy enough for a rate increase, that’s the first sign that it’s not. Now besides that, there’s a lot of data. We’re seeing auto loan defaults go up, real wages are stagnant to down, labor force participation continues to be very low, our trade deficit is getting worse partly because of the strong dollar, emerging markets are slowing down, and China and Europe are slowing down.

I think it’s nonsense to believe that we would be closely coupled on the way up but somehow the rest of the world is going to go down and the U.S. won’t be affected by that. "

Demeter

(85,373 posts)TALKS ABOUT COLLEGE, AMONG OTHER THINGS

MattSh

(3,714 posts)Actually quite well said and kept my interest. Well worth the time.

Often when I see something over 10 minutes, I figure I don't have time for that. Short attention span I guess you could say...

Demeter

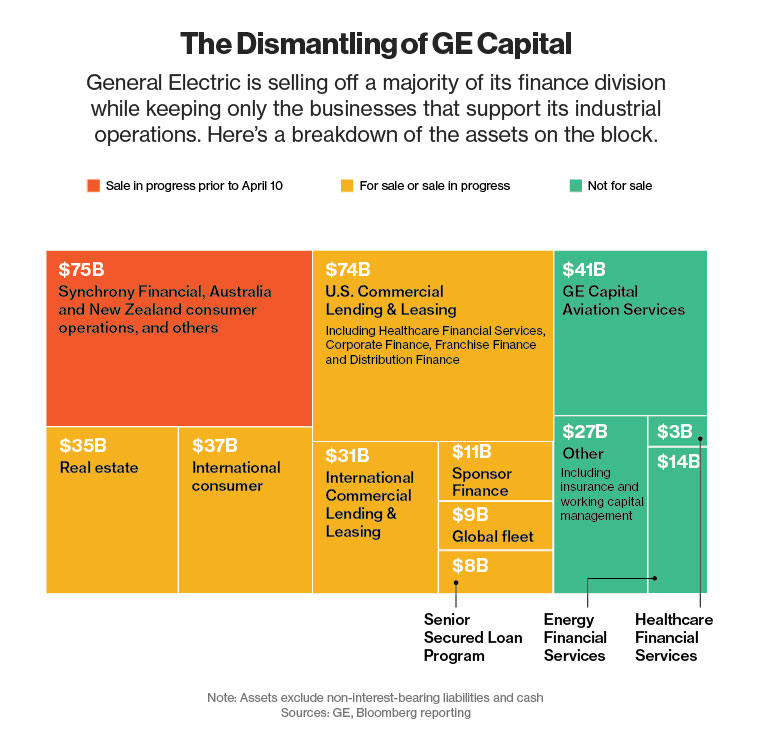

(85,373 posts)Goldman Sachs Group Inc. agreed to acquire an online banking unit from General Electric Co. that has about $16 billion of deposits, giving the Wall Street firm access to a cheap source of funding. Goldman Sachs’s banking subsidiary said Thursday it will take on $8 billion in online deposits and $8 billion of brokered certificates of deposit in the agreement with GE Capital Bank. Terms weren’t disclosed for the purchase, which is subject to regulatory approval.

The securities firm has boosted its reliance on deposit funding since converting to a bank during the financial crisis. Its deposits more than tripled from 2008 to $89 billion at the end of June, cushioning a drop in secured funding and helping to finance an increase in loans.

“This transaction achieves greater funding diversification and strengthens the liquidity profile of GS Bank by providing an additional deposit-gathering channel,” Liz Beshel Robinson, Goldman Sachs’s treasurer, said in a statement.

The acquisition won’t include any physical assets, and the only financial assets are cash associated with the deposits, Goldman Sachs said. Scott Roberts, president of GE Capital Bank, will join GS Bank, which is offering jobs to “substantially all” of the unit’s employees.

Regulatory Burden

GE plans to wind down the remaining operations of GE Capital Bank after the deal. Along with its pending disposal of Synchrony Financial, Thursday’s deal will “facilitate our complete exit from U.S. banking operations, eliminate the exposure of the U.S. deposit-insurance safety net to GE Capital and thereby significantly reduce our regulatory footprint in the U.S.,” Keith Sherin, GE Capital’s CEO, said in a statement. GE plans to dispose of about $200 billion of banking assets and focus on industrial operations after GE Capital’s struggles during the financial crisis imperiled the parent company. GE also wants to shed its status as a systemically important financial institution, which brings heightened regulation.

That’s a turnaround from just two years ago, when GE had acquired about $6.4 billion in deposits from MetLife Inc., the largest U.S. life insurer. MetLife was itself retreating from banking to limit regulatory oversight...

********************************************

Goldman Sachs has taken some steps to operate more like a bank, even as it still derives a much smaller portion of its funding from deposits than commercial banks. The firm’s loans have more than doubled in the past two years to $56.4 billion at the end of June.

HOT POTATO, ANYONE?

Demeter

(85,373 posts)WHY IT'S NOT A GOOD IDEA

Demeter

(85,373 posts)Billionaire George Soros’s family office sold almost all of its stake in Alibaba Group Holding Ltd. in the second quarter, as Asia’s largest Internet company saw its stock decline further because of a slowing Chinese economy.

Soros Fund Management owned about $370 million of Alibaba’s American depositary receipts at the end of the first quarter. As of June 30, it held a stake worth $4.9 million, according to a regulatory filing Friday. Alibaba has lost about $100 billion of its value since November’s record high.

Soros’s firm trimmed its energy holdings during the quarter. Crude oil reached highs for the year in June, peaking at about $60 a barrel, before plummeting to current levels of about $42. The family office sold off its stakes in Cenovus Energy Inc. and Suncor Energy Inc. and reduced its holdings in EQT Corp. and Noble Energy Inc.

The family office, which overseas about $30 billion, bought a new stake in Time Warner Cable Inc., making the company it’s second-largest U.S. stock holding. The company is awaiting regulatory clearance to merge with Charter Communications Inc. The position was worth $259 million at the end of the quarter.

Demeter

(85,373 posts)As crude tumbles in its worst summer ever, experts are lining up to forecast exactly how low it will go.

Among the lowest so far is $10 to $20 a barrel, which came from Gary Shilling, president of A. Gary Shilling Co., who spoke in a Bloomberg Television interview on Friday. Because fixed costs are already spent, drillers in a “price war” will keep pumping as long as prices are above the cash costs of production, which are below today’s levels of around $49 a barrel in London.

MEANWHILE, BACK AT THE REFINERY....

http://www.the-review.com/local%20news/2015/08/14/indiana-refinery-breakdown-results-in-soaring-gas-prices

Area drivers experienced sticker shock Thursday morning, as gas pump prices jumped significantly overnight.

Prices that were in the $2.30 range on Wednesday night surged to as high as $2.989 at many stations around the area. Blair's Gas & Go in Beloit was as low as $2.489 and stations on the north side of Alliance were in the $2.58-$2.60 range.

Blame it on Indiana. More specifically, a refinery in Whiting, Indiana, that has experienced a breakdown of its largest crude distillation unit, according to an article in The Detroit Free Press.

That story, citing Patrick DeHaan of the website GasBuddy.com, claims the Whiting unit, owned by petroleum giant BP, is the seventh-largest refinery in the United States and biggest in the Midwest. According to the U.S. Energy Information Administration, it can process more than 400,000 barrels of crude oil daily.

The increase at the pump is expected to continue. Earlier this summer, industry analysts speculated prices would fall to around $2 by Christmas, but this week's developments have forced them to revise their estimates.

Now, some analysts fear prices will drive back up to more than $3 per gallon in the short term, with little expectation it will fall back.

IT'S ALREADY AS HIGH AS $3.22 TODAY HERE IN ANN ARBOR---AND REPAIRS WILL TAKE 6 MONTHS OR MAYBE MORE, THEY SAY...HOW CONVENIENT! FOR BP, THAT IS. AND ALL THE PUMP PRICES ARE UP, EVEN THOSE THAT DON'T BUY FROM BP.

IS THIS RETALIATION FOR THE DEEPWATER HORIZON LAWSUIT THAT BP LOST?

Demeter

(85,373 posts)The U.S. agreed to allow some crude to flow to Mexico in the latest step toward easing a 40-year ban on most domestic oil exports.

Up to 100,000 barrels a day of light oil and condensate will be exchanged for heavy Mexican crude, according to Petroleos Mexicanos, the state-owned oil company. Canada is the only other nation that is exempt from the prohibition on exports. Requests from less than a dozen other unidentified countries to import U.S. crude were denied, said a senior administration official who asked not to be named according to U.S. policy.

Energy producers including Exxon Mobil Corp. and ConocoPhillips have called for an end to the export restrictions after a drilling boom boosted U.S. oil production to the highest level in more than 40 years. Some members of Congress have also called for an end to the policy, as prices dropped by more than half since last June. Approval from the U.S. Commerce Department comes after the same agency allowed for exports of lightly processed oil last year.

“It shows the administration is going to be flexible within existing law to find homes for domestic production,” said John Auers, executive vice president of energy consultant Turner Mason & Co. “With crude prices being low, export restrictions are arguably causing an even greater impediment to domestic production.”

Under the permits due to be issued by the end of the month, Mexico can receive the oil in return for shipping similar quantities to U.S. refineries. The U.S. crude that goes to Mexico must be refined there.

MORE

MattSh

(3,714 posts)Here are my favorite ideas...

Travel the world. Here’s a basic assignment. Take $10,000 and get yourself to India. Check out a world completely different from our own. Do it for a year. You will meet other foreigners traveling. You will learn what poverty is. You will learn the value of how to stretch a dollar. You will often be in situations where you need to learn how to survive despite the odds being against you. If you’re going to throw up you might as well do it from dysentery than from drinking too much at a frat party. You will learn a little bit more about eastern religions compared with the western religions you grew up with. You will learn you aren’t the center of the universe. Knock yourself out.

Create art. Spend a year learning how to paint. Or how to play a musical instrument. Or write 5 novels. Learn to discipline yourself to create. Creation doesn’t happen from inspiration. It happens from perspiration, discipline, and passion. Creativity doesn’t come from from God. Its a muscle that you need to learn to build. Why not build it while your brain is still creating new neurons at a breathtaking rate than learning it when you are older (and for many people, too late).

Make people laugh. This is the hardest of all. Spend a year learning how to do standup-comedy in front of people. This will teach you how to write. How to communicate. How to sell yourself. How to deal with people who hate you. How to deal with the psychology of failure on a daily basis. And, of course, how to make people laugh. All of these items will help you later in life much more than Philosophy 101 will. And, by the way, you might even get paid along the way.

Write a book. Believe me, whatever book you write at the age of 18 is probably going to be no good. But do it anyway. Write a novel about what you are doing instead of going to college. You’ll learn how to observe people. Writing is a meditation on life. You’ll live each day, interpret it, write it. What a great education!

Work in a charity. Plenty of charities do not require you to have a college degree. What is going to serve you better in life: taking French LIterature 101 or spending a year delivering meals to senior citizens with Alzheimers, or curing malaria in Africa.

Complete story at - http://www.jamesaltucher.com/2011/01/8-alternatives-to-college/

Attend community college.

While community college doesn’t carry the prestige of the 4-year university, there are numerous benefits to this alternate path:

Saves boatloads of money – the average credit hour at a community college costs $60, while the average credit hour at a 4-year college costs around $300. While community college costs are rising right along with 4-year colleges, it’s not nearly at the same pace. There are even schools like Tulsa Community College that will cover 100% of the tuition costs for all high school seniors with at least a 2.0 GPA who enroll the fall after they graduate. Check to see what kinds of programs and incentives are available in your area.

• Makes the transition to college easier – if you attend community college, you’re more than likely either living at home, or else living very close to home. Instead of feeling like you’ve been kicked off a cliff into the deep waters of college, you can wade in at a pace that is right for you, and slowly take on responsibilities of your own.

• Gives you time to define and refine your interests – at 4-year colleges, the majority of your first two years are going to be general ed classes, even if they’re related to your major. You can do the same thing at a community college, for a fraction of the cost. This gives you time to explore your interests, without the stress of knowing you may be racking up massive debt on courses that don’t end up counting towards your degree or major.

Get into a trade.

Trade schools offer specific vocational training for a wide variety of skilled careers. Sometimes this means getting an associate’s degree at a community college, but many times it’s simply a year or so at a technical school. These careers are often associated with “blue collar” jobs, and unfortunately often carry some negative stereotypes in today’s culture.

The reality is that there are literally millions of people who work in skilled labor jobs, and they’re paid well, especially compared to college graduates. The average starting salary for a college graduate is $45,000, while the average salary of someone who went through trade school is $42,000. Not much of a difference, and the trade school graduate is entering the workforce at least two years sooner.

In addition, you’re almost guaranteed a job coming out of school. There are numerous stories of large energy and construction projects that had to be canceled not due to money shortages, but due to labor shortages. Companies simply can’t find the skills to complete the work needed.

Yet another benefit of skilled labor is that your skills are not as exportable as people who sit at a computer in a cubicle all day. Even work that was formerly done by lawyers and doctors is being outsourced. You can’t outsource electrical or plumbing or welding jobs. These careers are truly what makes our nation run on a daily basis.

Take online classes.

Online college-level courses have boomed in the last couple years, with Coursera and EdX leading the way. While YouTube and a variety of websites freely offer lectures for the public to consume, Coursera and EdX offer certificates of completion, and with a small fee, those certificates can be university-verified.

While you won’t get college credit for taking these courses, they are absolutely college-level (trust me, they’re difficult), and will teach you some very valuable and practical skills that can be applied to a number of professions. A selection of class titles includes New Models of Business in Society, Competitive Strategy, Physics 1, Beginning Game Programming, and many more. If you don’t have a degree on your resume, being able to show a handful of certificates for specific skills is much better than nothing at all.

One institution making waves in the education world is the University of the People (UoPeople). Founded in 2009, it offers tuition-free education to anyone and everyone. Students can receive an associate’s or a bachelor’s degree in business administration or computer science. It’s hard to believe, but UoPeople is no gimmick and there’s really no catch for students – you get a real degree. Curriculum is put together by volunteers, and the school was recently accredited by the Distance Education and Training Council. Bill Gates has given money, as have many large corporate entities. It has applied for accreditation from the Department of Education, and it’s believed that they’ll meet the requirements.

One drawback is that in attending this university, you really have no skin in the game. While there are over 1,500 students, only about half are active. I’ve noticed this phenomena myself when taking courses on Coursera or EdX; when it’s free, it’s harder to stay motivated to continue when life gets busy or if you simply become disinterested.

http://www.artofmanliness.com/2014/04/17/is-college-for-everyone-10-alternatives-to-the-traditional-4-year-college/

MattSh

(3,714 posts)MattSh

(3,714 posts)MattSh

(3,714 posts)The song's inspiration stems from a trip when the band (P.O.D.) was on their way to record for Satellite on March 5, 2001. They were held up in traffic and discovered that the reason was a shooting at Santana High School where a fifteen-year-old student named Charles Andrew Williams killed two and wounded thirteen. The album was consequently delayed, and the band was inspired to write "Youth of the Nation."

MattSh

(3,714 posts)OK, yeah a couple of dark ones there. Guess that sums up my school experience though...

MattSh

(3,714 posts)Ye gads, I'm on a roll now. Maybe I need to take a break and step away from the computer...

What did you learn in school today,

Dear little boy of mine?

What did you learn in school today,

Dear little boy of mine?

I learned that Washington never told a lie.

I learned that soldiers seldom die.

I learned that everybody's free,

And that's what the teacher said to me.

Chorus

That's what I learned in school today,

That's what I learned in school.

What did you learn in school today,

Dear little boy of mine?

What did you learn in school today,

Dear little boy of mine?

I learned that policemen are my friends.

I learned that justice never ends.

I learned that murderers die for their crimes

Even if we make a mistake sometimes.

Chorus

What did you learn in school today,

Dear little boy of mine?

What did you learn in school today,

Dear little boy of mine?

I learned our Government must be strong;

It's always right and never wrong;

Our leaders are the finest men

And we elect them again and again.

Chorus

What did you learn in school today,

Dear little boy of mine?

What did you learn in school today,

Dear little boy of mine?

I learned that war is not so bad;

I learned about the great ones we have had;

We fought in Germany and in France

And someday I might get my chance.

Chorus

Complete story at - http://lyrics.wikia.com/wiki/Pete_Seeger:What_Did_You_Learn_In_School_Today%3F

Demeter

(85,373 posts)Some of the earliest adopters of the digital currency Bitcoin were criminals, who have found it invaluable in online marketplaces for contraband and as payment extorted through lucrative “ransomware” that holds personal data hostage. A new Bitcoin-inspired technology that some investors believe will be much more useful and powerful may be set to unlock a new wave of criminal innovation. That technology is known as smart contracts—small computer programs that can do things like execute financial trades or notarize documents in a legal agreement. Intended to take the place of third-party human administrators such as lawyers, which are required in many deals and agreements, they can verify information and hold or use funds using similar cryptography to that which underpins Bitcoin.

TAKE THE PLACE OF LAWYERS! WHAT AN INNOVATION!

Some companies think smart contracts could make financial markets more efficient, or simplify complex transactions such as property deals (see “The Startup Meant to Reinvent What Bitcoin Can Do”). Ari Juels, a cryptographer and professor at the Jacobs Technion-Cornell Institute at Cornell Tech, believes they will also be useful for illegal activity–and, with two collaborators, he has demonstrated how. “In some ways this is the perfect vehicle for criminal acts, because it’s meant to create trust in situations where otherwise it’s difficult to achieve,” says Juels. In a paper to be released today, Juels, fellow Cornell professor Elaine Shi, and University of Maryland researcher Ahmed Kosba present several examples of what they call “criminal contracts.” They wrote them to work on the recently launched smart-contract platform Ethereum.

One example is a contract offering a cryptocurrency reward for hacking a particular website. Ethereum’s programming language makes it possible for the contract to control the promised funds. It will release them only to someone who provides proof of having carried out the job, in the form of a cryptographically verifiable string added to the defaced site. Contracts with a similar design could be used to commission many kinds of crime, say the researchers. Most provocatively, they outline a version designed to arrange the assassination of a public figure. A person wishing to claim the bounty would have to send information such as the time and place of the killing in advance. The contract would pay out after verifying that those details had appeared in several trusted news sources, such as news wires. A similar approach could be used for lesser physical crimes, such as high-profile vandalism.

“It was a bit of a surprise to me that these types of crimes in the physical world could be enabled by a digital system,” says Juels. He and his coauthors say they are trying to publicize the potential for such activity to get technologists and policy makers thinking about how to make sure the positives of smart contracts outweigh the negatives. “We are optimistic about their beneficial applications, but crime is something that is going to have to be dealt with in an effective way if those benefits are to bear fruit,” says Shi.

Nicolas Christin, an assistant professor at Carnegie Mellon University who has studied criminal uses of Bitcoin, agrees there is potential for smart contracts to be embraced by the underground. “It will not be surprising,” he says. “Fringe businesses tend to be the first adopters of new technologies, because they don’t have anything to lose.” Indeed, some criminals have made significant gains from Bitcoin. The way it can make digital payments more anonymous has aided the rise of malicious “ransomware” (see “Holding Data Hostage: The Perfect Internet Crime?”). And Christin published a paper this week tracing the evolution of online marketplaces for contraband that have been partly enabled by Bitcoin. It shows that although the most notorious, Silk Road, was taken down by U.S. law enforcement in 2013, others rose in its place and together make sales estimated at around $400,000 a day. Still, Christin notes that the scale of criminal activity made possible by Bitcoin today, and perhaps by smart contracts in the future, is tiny compared with more traditional, cash-based physical crimes. Smart contracts are also more complex to use than Bitcoin transactions, he adds. Writing a smart contract or properly understanding the terms of one takes specialized programming skills. WELL, THAT'S A RELIEF, I'M SURE.

Gavin Wood, chief technology officer at Ethereum, notes that legitimate businesses are already planning to make use of his technology—for example, to provide a digitally transferable proof of ownership of gold, and to power a lottery system. However, Wood acknowledges it is likely that Ethereum will be used in ways that break the law—and even says that is part of what makes the technology interesting. Just as file sharing found widespread unauthorized use and forced changes in the entertainment and tech industries, illicit activity enabled by Ethereum could change the world, he says. “The potential for Ethereum to alter aspects of society is of significant magnitude,” says Wood. “This is something that would provide a technical basis for all sorts of social changes and I find that exciting.” TIME TO CUT BACK ON THE DRUGS, GAVIN

For example, Wood says that Ethereum’s software could be used to create a decentralized version of a service such as Uber, connecting people wanting to go somewhere with someone willing to take them, and handling the payments without the need for a company in the middle. Regulators like those harrying Uber in many places around the world would be left with nothing to target. “You can implement any Web service without there being a legal entity behind it,” he says. “The idea of making certain things impossible to legislate against is really interesting.”

SOUNDS AN AWFUL LOT LIKE SKYNET, TO ME--DEMETER

Demeter

(85,373 posts)I have often noted the existence of a primitive tribal taboo shared by virtually all economists against using the “f” word – “fraud.” I have found a new example that sums up many of the pathologies of economics and economists. It is an article entitled “Going for Broke: New Century Financial Corporation, 2004-2006.” Given that New Century was a classic accounting control fraud, the use of the long-discredited gambling metaphor (our “autopsies” of S&L failures refuted it in 1984) demonstrates the crippling power of the taboo. The three economists who authored the September 2010 article are Augustin Landier (Toulouse School of Economics) David Sraer (Princeton University) David Thesmar (HEC & CEPR) (collectively, “LST”).

The Office of the Comptroller of the Currency (OCC) has published a list of the “worst of the worst” – the ten worst lenders in the ten worst markets for nonprime mortgage foreclosures. The absolute worst lender on that list is New Century. That makes it the worst of the worst of the worst. It also makes LST the worst of the worst of the worst economists writing about the fraud epidemics that drove the financial crisis. The LST article is remarkably and inexcusably awful. At the time it was written it was representative of the lack of quality of orthodox economic “scholarship” about elite financial frauds. That has changed. As Mian and Sufi explained in their recent study demonstrating pervasive fraud in liar’s loans:

The most recent studies by very conservative financial scholars that actually study elite financial frauds have confirmed what we have been explaining for decades. While LST did not have access to these two recent studies, one of the studies (Piskorski, Seru, and Witkinl) was done on the basis of a New Century data set that the authors shared with other scholars who requested access, including the Jiang study that LST cite. Piskorski, Seru, and Witkin and Mian and Sufi exemplify how economists can conduct a real “forensic” investigation of fraud. The press picked up both the Piskorski, Seru, and Witkin and the Mian and studies’ findings. Here is the key passage from a story in which Piskorski was interviewed.

They compared loan-level mortgage data with credit reports and used New Century, a now-bankrupt subprime lender, as a case study. By comparing the loans with the credit profiles of their borrowers, they found that the loans New Century sold did not accurately reflect what the bank knew in their credit files.

While the data cannot establish how blatant the fraud was or how it was motivated, other research and insider accounts show that fraud was endemic among mortgage lenders in the years leading up the housing crash. And it wasn’t a case of a single bad company — the authors studied major companies and found similar results for all originators across the board.

“We didn’t find out this is the only the problem of a few bad apples. That would be kind of good news,” Piskorski said. “This is a really pervasive problem, and every single institution in the data misrepresented mortgages.”

This wasn’t a few cases of fraud, either. According to the study, 27 percent of loans obtained by non-owner occupants misreported their true purpose, and 15 percent of loans with second liens incorrectly reported that such loans were not present.

LST got New Century wrong despite an extensive, publicly available record that refuted their claims. LST ignored that record, failed to conduct any forensic examination of New Century, failed to conduct an effective hypothesis testing, and failed to alert their readers to any of these facts. They produced a travesty that exposes many of the pathologies of theoclassical economics. LST have no excuse because their citations include George Akerlof and Paul Romer’s classic 1993 article – “Looting: The Economic Underworld of Bankruptcy for Profit.” LST, however, simply assumed that New Century could not be a control fraud. Here is the sole basis they provide for this assumption (with its accompanying footnote). LST use the acronym “NC” to refer to New Century.

20 Besides, we have checked the insider filings on the SEC’s EDGAR website. Between 2003 and the default of NC, the founder-managers have sold less stocks than they were granted, in particular through stock-option exercise.

“This evidence” (A) is not “evidence” and (B) provides zero logical support for their assumption that it would demonstrate that the NC was not an accounting control fraud. It is not “evidence” because the LST authors assumed their conclusion – they assumed that NC’s “market capitalization” was not the product of accounting fraud. The reality, which LST studiously ignored in order to mislead the reader and policy makers, was that NC’s reported “profits” that drove the “striking increase in market capitalization” were fictional. They were produced by the accounting control fraud “recipe” for a lender. LST know this to be true from a raft of publicly available information from multiple sources. LST, however, provide none of that information to their readers. The information destroys their assumption that bankers who own stock in a company will never loot the company (an assumption also disproved by the relevant literature and history). The LST authors fail to engage Akerlof and Romer, the criminologists, the financial regulators, the secondary market participants, investigative, and judicial findings that had falsified their claim about stock ownership decades earlier. Indeed, Akerlof and Romer, the National Commission on Financial Institution Reform, Recovery and Enforcement, and the criminologists confirmed that we (the financial regulators) were correct that dominant (often 100%) ownership of an S&L by its controlling officers was a factor that greatly increased the risk of looting. LST hide all these findings from the reader. There are many reasons why a fraudulent CEO faces restraints in stock sales or simply waits too long to sell.

The first question is whether NC followed the accounting control fraud “recipe” for a lender. The answer, indisputably, is “yes.” (I provide details below.) The recipe for a fraudulent lender (purchaser) of loans has four “ingredients.”

Grow like crazy by

Making (or buying) really crappy loans at a premium nominal yield while

Employing extreme leverage and

Providing only grossly inadequate allowances for loan and lease losses (ALLL)

In NC’s case, in addition to the (deliberately and pathetically inadequate) ALLL on loans it held in portfolio (allowances that its controlling officers reduced as fraud, defaults, and losses surged in its massively expanding liar’s loans) the most relevant loss allowances were for repurchases of loans that it (A) fraudulently originated and (B) fraudulently sold to the secondary market through fraudulent “reps and warranties.”

Lenders led by honest bankers, of course, would never follow this recipe because it produces the classic three “sure things” – (1) the bank is guaranteed to report record (albeit fictional) profits in the near term, (2) the controlling officers will promptly be made wealthy through modern executive compensation, and (3) the firm will suffer catastrophic losses.

There is a literature on how to distinguish between accounting control fraud, incompetence, and “gambling for resurrection.” The beginning of that literature is cited by Akerlof and Romer.

4. See Merton (1978).

5. Black (1993b) forcefully makes this point.

The research paper I authored in 1993 for the National Commission on Financial Institution Reform, Recovery and Enforcement that Akerlof and Romer cited was not the genesis of this analysis. Our “autopsies” of every S&L failure in 1984 disclosed the fraud “recipe” and the fact that it was essential to gut underwriting in a manner that no honest lender would ever do in order to produce the first two “ingredients” of the recipe. We used that insight beginning in 1984 to identify the accounting control frauds while they were still reporting record (albeit fictional and fraudulent) profits (like NC’s reported “profits” that LST implicitly assume must be real). Indeed, to Charles Keating’s horror, we targeted the S&Ls reporting the highest profits as our examination and enforcement priorities, while economists praised the frauds on the basis of their record reported (albeit fictional and fraudulent) profits. Three decades, and tens of thousands of frauds later, economists shilling for the CEOs leading these frauds still accept reported income and capital as if it were obviously accurate.

In 1995, I supplemented that “point” about how one can distinguish accounting control frauds from (hypothetical) honest “gamblers for resurrection” even more “forcefully” in an article I co-authored with two top white-collar criminologists – Kitty Calavita and Henry Pontell. “The Savings and Loan Debacle of the 1980s: White-Collar Crime or Risky Business” Law and Policy Volume 17, Issue 1, pages 23–55, January 1995. LST ignore the relevant literature. As financial regulators we found, in all the S&L failures, not a single case of “gambling for resurrection” that accorded with the theoclassical economic model on which LST rely. This is not surprising, as Akerlof and Romer explained in the next paragraph of their article.

In the current crisis, the “risk of prosecution” of banksters leading accounting control fraud has become nonexistent.

New Century Was a Classic Accounting Control Fraud

At the time the LST authors wrote the version of the paper I found on the web there was a wealth of information available about NC’s frauds and the fact that it followed the fraud “recipe.” Two of the sources were the bankruptcy examiners massive report on NC and securities litigation against NC.

Warning: I went really wonky on this article because I am so outraged at LSTs’ conduct in not revealing these facts to their readers. I want to give the reader an understanding of how detailed the forensic evidence of NC’s accounting control fraud is and how pervasive, large, and blatant NC’s controlling officers’ frauds were. My secondary purpose in providing such extensive, arcane quotations is to give my readers a real world sample of the kind of understanding of accounting fraud schemes that is essential to be an effective financial regulator, investigator, and prosecutor – or economist or white-collar criminologist. None of these roles is for the faint at heart or those unwilling to make a huge investment of time to understand how fraud schemes actually work.

The first ingredient in the fraud recipe is extreme growth.

That finding establishes the first ingredient and (if you know the industry) the second. The LST authors concede this point, referring to NC’s “amazing growth.” The SEC’s securities fraud complaint against NC’s three controlling officers was also available to the LST authors, but none of its relevant findings from the SEC investigation were disclosed to the reader. The SEC’s investigation confirmed the “phenomenal” growth of NC loans (and the effect on reported earnings).

The fact that NC’s controlling officers bragged about being the largest non-prime wholesale lender in the world also demonstrates the second ingredient. The SEC complaint explains that making poor credit quality loans was NC’s strategic plan.

Even LST concede, albeit in one of history’s great understatements, that “Over the full period, there is some evidence that NC’s lending standards have worsened….” But they ignore the fact that to speak of NC’s “lending standards” is to discuss an oxymoron, for NC’s lending standards were not followed. They were simply a key element in the fraud scheme – the false representation that NC actually (1) had prudent underwriting standards and (2) actually followed them. This deception was essential to NC’s ability to sell tens of billions of dollars in fraudulently originated mortgages through fraudulent “reps and warranties” to secondary market purchasers. The fraudulent “reps and warranties” were that NC actually had, and followed, prudent underwriting standards. One of the publicly available securities law suits alleges the following about NC’s underwriting practices – and backs the allegations up with compelling evidence. (“CW” refers to “confidential witness” – whistleblowers from NC.)

New Century systematically disregarded its own underwriting guidelines and wholly disregarded a borrower’s ability to pay when originating loans….

As reported by the Bankruptcy Examiner, reckless origination and underwriting of New Century loans was rampant. For example:

Certain senior managers at New Century in 2004 were told by a New Century employee that when underwriting stated income loans, “we are unable to actually determine the borrowers’ ability to afford a loan.”

In early 2006, one senior manager at New Century described the performance of a certain loan product as “horrendous.”

In 2004, the number and severity of the exceptions to underwriting standards employed by New Century to originate greater volume was 67 described by one Senior Officer as the “number one issue” facing New Century.

By 2004, New Century Senior Management became aware of spiking increases in Early Payment Default (“EPD”) rates—where a borrower fails to make even the first several payments on a loan—suggesting that the loan should never have been originated in the first place. In every month following March 2006, the EPD rate exceeded 10%, reaching to as high as 14.95% by year end.

Up until 2005 New Century used a DOS-based underwriting system which, according to a New Century manager interviewed by the Bankruptcy Examiner, enabled employees to “finagle anything.”

In December 2009, the SEC filed civil fraud charges against New Century’s former CEO, CFO and controller, alleging that despite New Century’s representations as a prudent lender, it “soon became evident that its lending practices, far from being ‘responsible,’ were the recipe for financial disaster.” The executives settled the SEC’s civil fraud charged in July 2010 for approximately $1.5 million.

Numerous former New Century employees interviewed by TIAA’s counsel confirmed the conclusions of the New Century Bankruptcy Examiner and the SEC’s complaint against New Century’s executives explaining that loans were not originated according to New Century’s stated underwriting guidelines, but were instead originated without regard to a borrower’s ability to repay the loan. For example, according to CW 26, a former New Century fraud investigator and senior loan underwriter who examined numerous New Century mortgage loans from January 1999 until April 2007, New Century “started to abandon prudent underwriting guidelines” at the end of 2003 in order to “push more loans through.” According to 68 CW 26, New Century essentially “stopped underwriting.”12 CW 29, a former New Century Vice President and Regional Manager, employed by New Century from September 1996 until May 2007 explained that New Century made very low quality and extremely risky loans, even for a sub-prime lender, noting that: “If you had a heartbeat, we would give you a loan.”

CW 30, another former New Century underwriter and risk manager employed at New Century from December 2001 until April 2007, explained that exceptions to underwriting guidelines were endemic and it was “more about quantity than quality,” with the attitude being “get the volume on; get the volume on.” Indeed, CW 30 reported that nine out of ten loans that CW 30 recommended denying were nevertheless approved by management.13

Facts such as these led the New Century Bankruptcy Examiner to conclude that statements in New Century’s SEC filings declaring that “regardless of document type, New Century designed its underwriting standards and quality assurance standards to make sure that loan quality was consistent and met its guidelines” were “not supportable.” Rather, the Bankruptcy Examiner concluded that “New Century did not produce ‘high quality’ loans or have ‘high origination standards.’” Moreover, claims asserted against New Century for making false 12 CW 27, a former New Century Vice President, Corporate Finance, agreed that New Century began to lower credit standards beginning in 2003. At that time, New Century changed its practice with respect to stated income loans, which became to be known in the industry as “liar’s loans.” CW 28, a former New Century senior training development manager employed by New Century from March 2003 until March 2006 explained that underwriters often allowed borrowers to resubmit a rejected full-documentation loan (which had been rejected because the borrower’s income was too low) as a “stated loan” with a new and higher income, which was then approved. CW 28 stated that this practice was “taboo” in the mortgage industry but routinely occurred and was a “running joke” at New Century. 13 CW 31, a former New Century Vice President, Regional Manager, employed by New Century from October 1999 until March 2007, stated that starting in 2003 and 2004, roughly half of New Century’s loans contained exceptions. CW 32, a former New Century underwriter employed by New Century from May 2005 to March 2006 in Itasca, Illinois and, previously, from 2000 until 2003 in Cincinnati, Ohio, explained that he could not recall the last loan that he looked at that did not have an exception. 69 or misleading statements of material fact regarding New Century’s purported prudent underwriting guidelines have already been sustained under Section 10(b) and Rule 10b-5 of the Securities Exchange Act of 1934, and Section 11 of the Securities Act of 1933. See In re New Century, No. CV 07-00931 DDP (JTLx), ECF No. 333, at 34 (C.D. Cal. Dec. 3, 2008) (“This Court likewise agrees…that Plaintiffs’ Complaint alleges sufficient facts that the statements were material misrepresentations of New Century’s loan quality and underwriting practices.”).

Statements in the Offering Materials representing that New Century ensured proper appraisals when issuing loans to borrowers were also false and misleading when made. In order to increase loan origination volume, New Century routinely hired biased appraisers and used inflated appraisals as a matter of course to issue loans to borrowers who would not otherwise qualify for the mortgage.

As described in the Bankruptcy Examiner’s Report, in New Century’s wholesale division—which accounted for the vast majority (approximately 85%) of New Century’s loan originations—the regional managers who had lending authority could override the internal appraisers’ decisions. Moreover, the regional managers’ compensation was not tied to loan quality, but was rather based on the volume of loans originated, providing incentive to inflate appraisal values in order to increase origination of New Century loans.