Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 21 August 2015

(Happy 15,000 to me. Happy 15,000 to me.)

[font size=3]STOCK MARKET WATCH, Friday, 21 August 2015[font color=black][/font]

SMW for 20 August 2015

AT THE CLOSING BELL ON 20 August 2015

[center][font color=red]

Dow Jones 16,990.69 -358.04 (-2.06%)

S&P 500 2,035.73 -43.88 (-2.11%)

Nasdaq 4,877.49 -141.56 (-2.82%)

[font color=green]10 year 2.07% -0.04 (-1.90%)

30 Year 2.74% -0.04 (-1.44%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

CaliforniaPeggy

(149,719 posts)That is a wonderful milestone!

Here's to many, many more!

And I love the 'toon! Even though it hurts at the same time.

![]()

mother earth

(6,002 posts)Fuddnik

(8,846 posts)Give us an encore with 15,001!

I remember back in a previous lifetime when I had 20,000.

DemReadingDU

(16,000 posts)I totally missed my 15,000 celebration. lol!

snot

(10,538 posts)Demeter

(85,373 posts)Fast work.

I have a secret weapon, though...vitamin C and zinc..which she refuses to take. I don't have time for a cold.

The weather did indeed break with a thunderstorm Thursday 12:01 AM, and the nights are going below 60F again. The plants got a decent amount of rain, too.

My little peach tree, in its 3 year here, has fruit that's swelling to a good size and turning gold and a bit red...but still hard as rocks. I'm in such a state of anticipation!

The rhubarb is barely alive...I guess it needs some attention paid to it. I'm trying to diversify. Maybe I can only pay attention to one thing?

Demeter

(85,373 posts)Whether it’s the rise of the extreme right in Europe, Donald Trump’s ascent in the US, Canada’s stunning plunge into fringe politics, the world is awash in a new political phenomenon: a tsunami of vocal, angry extremism, where once placid waters calmly shimmered. Not extreme enough for you? In one of the world’s most advanced societies, unemployed kids, of which there are too many, are going to have to go…not to school, college, or even community service…but to boot camp.

WTF?

In this short essay, I want to offer a lens through which to see this phenomenon. A few years ago, there was a huge leadership deficit in the world. No one, it seemed, was steering the ship. And perhaps you thought things couldn’t get worse. But today things are different: there’s not a deficit of leadership anymore. There is a surplus of bad leadership. Too many angry, blind pilots pointing ships…straight into the icebergs. Leadership, it appears, has fallen into a deep abyss. From which it must climb out, if it is to regain its place in the world again.

And before I begin let me note. This isn’t an essay I particularly want to write. But the truth is that there are too few voices speaking too few simple truths about this unsettling — and profoundly self-destructive — phenomenon.

Let us, then, put our prejudices aside, and examine these new leaders. So we may see what they stand for — and whether it is worth believing in. What is striking — and immediately obvious — is that they share four positions in common; and that is what distinguishes them as a phenomenon, a class, a category, a larger movement.

- Fatalism

- Scapegoating

- Timidity

- Dehumanization

DEVELOPS HIS ARGUMENT AT LINK.

I THINK HE'S OVERLOOKING THE BIGGEST FACTOR IN BAD LEADERSHIP: FRAUD! FRAUD PERVADES THE 1% LIKE MOLD IN AN EMPTY HOUSE.

“Oh - You're a very bad man!"

Oh, no my dear. I'm a very good man. I'm just a very bad Wizard.”

― L. Frank Baum, The Wonderful Wizard of Oz

TROUBLE IS, TOO MANY OF THESE WOULD-BE LEADERS ARE VERY BAD MEN AND WOMEN, AS WELL AS SNAKE-OIL PUSHING FRAUDS.

Demeter

(85,373 posts)I can’t remember if I have ever written this up, or maybe just explained it in a interview at some point, but I have had several people ask, so I’ll explain it. This is how Hillary Clinton “made” $100,000 off of an initial “investment” of $1000 in cattle futures back in the early 80’s. It was textbook money laundering. I know you’re shocked – SHOCKED to think that a Clinton could be involved in anything untoward, but I’m afraid it is true.

Back in the 80’s in Arkansas, Bill and Hillary were the power couple ascending first to the position of Attorney General and then to the governor’s mansion. Being the psychopathic whores that they both are, they were all about cashing in on their power and accepting de facto bribes and payola. In Arkansas the Tyson family (as in Tyson chicken) were the big players at the time. Wal-Mart was still getting off the ground. Old Man Tyson wanted to buy off the Clintons, and so a money laundering scheme was hatched. A futures account would be opened with a broker named Red Bone (no joke) in HILLARY’S NAME. Red Bone cleared through a company called Refco, which would later become MF Global. That company through its entire history and iterations has always been a hive of villainy.

Anyway, the account was opened in Hillary’s name and Hillary made an opening deposit of $1000. Every day at the opening bell Red Bone, per Old Man Tyson’s instructions, would put in two orders: Buy 50 contracts of live cattle futures AND sell 50 contracts of live cattle futures. (I’m just using 50 as a round number, I don’t know exactly what the quantites were.) At the close the same thing would be done – buy 50 and sell 50.

On days in which the market was higher from the open to the close, Hillary’s account would be assigned the lower buy from the open and the higher sell from the close. If the close was $0.25 per pound higher than the open, the math would look like this:

$0.25 X 400 = $100 per contract

$100 per contract X 50 contracts = $5000

A live cattle contract is 40,000 pounds, so the coefficient is 400. Trust me on that. The price is actually quoted in “hundredweights”, hence the dropping of two zeroes.

Now here’s the money laundering bit. The “losing” trades, namely the sell executed at the open and the buy executed at the close at the same prices would be assigned to Old Man Tyson’s account. On days when the market moved lower from the open to the close, Hillary was given the sell from the open and the buy from the close. Sell high, buy back low. Tyson got the opposite side. Do that every day for a month or so and you can move $100k from Tyson to the Clintons very quickly. I think Red Bone also threw a few “losers” into Hillary’s account just to attempt to cover their tracks – and yes, he made commission on all of it. I didn’t back the commissions out of the calculation above, but of course Red Bone charged a hefty commission on every contract. Giving the “good” trades to Hillary and the “bad” trades to Tyson is simply a way to move money from Tyson to the Clintons without Tyson writing the Clintons a check. This is called “money laundering”.

This case was actually the reason why the law was changed and brokers HAD to attach an account number to every order UPON ENTERING THE ORDER. I started in the business in 1997, and that change predated me by 15 years. I can’t imagine how it is that they let people assign account numbers at the end of the day – ever. That is just begging for unfair practices with regards to assigning of prices to customers. Favoritism, frontrunning, etc.

Oh, and Hillary claimed complete ignorance about all of this, which is, of course, a complete lie. She and Bill knew exactly what they were doing and why. Too bad no one cared about the Clintons being psychopathic liars and con artists, because maybe then Hillary wouldn’t have been able to murder Ambassador Chris Stevens and run all of those guns and MANPADS to the Muslim Brotherhood/AlQaeda, amongst all of their many other crimes. Things like this matter. Give a money laundering psychopath enough power and they will move on to murder, genocide and tyranny. Ignore these indicators at your own peril.

This entry was posted in Uncategorized on August 9, ARSH 2013.

Demeter

(85,373 posts)If she had taught me how to launder money, think how much farther I would have gone.

DemReadingDU

(16,000 posts)and laundered money, lol!

Demeter

(85,373 posts)or the Koch Bros.

Fuddnik

(8,846 posts)Launder enough, and you'll clog the system.

A couple of months ago, my washing machine wouldn't drain or spin, so I took to the internets to find a fix. A Youtube video, showed a bladder-like hose that runs into the pump. Following the directions, I took it apart, and found almost $6.00 in change clogging the damned thing. Instead of paying $200.00 for a service call, I turned a profit!

It worked until a week ago, when something else went, and I had to wind up buying a new one anyway.

I wish I could get a job as Donald Trumps laundry boy.

InkAddict

(3,387 posts)Any change and dollars I find turn into an eventual trip to the DQ, LOL.

Hotler

(11,445 posts)Evil grin required twice.

First thing I thought when I read it last night. Guaranteed trip to the pizza parlor.

Which is pretty amazing in itself. I've noticed a few members of the thought police trolling other threads in the Economy Group.

Demeter

(85,373 posts)It's the first sensible explanation for that mysterious event I've ever seen---and I was looking (in the usual not-looking way).

Punx

(446 posts)It's who you know that determines success. Oh sorry, just pulling herself up by "Old Man Tyson's" boot straps.

I'm going to assume this is the Tyson from "Tyson" pork and chicken.

Fuddnik

(8,846 posts)Demeter

(85,373 posts)The Federal Reserve suffered further embarrassment Wednesday when eagerly anticipated minutes from its July meeting were released about fifteen minutes early. Markets had been waiting for the Fed July meeting minutes, scheduled for release at 2 p.m., for clues to when the Fed might raise interest rates. Information about the meeting was scarce because the Fed had only released a brief statement and Fed Chairwoman Janet Yellen did not hold a press conference to discuss the closed-door deliberations. The Fed holds meetings eight times per year and Yellen holds a press conference only at every other meeting.

At 1:47 p.m., the Fed put out a statement saying that the embargo on the minutes had been broken. A Fed official had no immediate comment on how the embargo was broken.

News organizations are given early access to the information under agreement not to release any description of the material until 2 p.m. In a statement released to CNBC, Bloomberg L.P. took responsibility for the embargo break, saying that it inadvertently sent out a headline based on the minutes.

Even before this incident, Republicans in the House of Representatives have been sharply critical of how the U.S. central bank handles sensitive market-moving information. The Justice Department is probing an apparent leak of Fed deliberations from late 2012. Last month, the Fed inadvertently posted on its website its staff’s own economic forecast, which otherwise wouldn’t have been disclosed for 5 years.

The last snafu with the minutes occurred in April 2013 when the Fed discovered it had accidentally emailed the minutes from its March policy meeting to lobbyists and private banks a day early.

Demeter

(85,373 posts)The media runneth over with scandals on prime time child molestation, online adultery, lies about Planned Parenthood, and the primary madness....

I will be digging into my (still substantial) email newsletter backlogs this weekend...unless something blows up.

Demeter

(85,373 posts)The U.S. stock market endured its worst performance in 18 months on Thursday, driven lower by another slump in Chinese shares and heavy selling by technical traders. The global rout started in China, where sharp declines in energy and property stocks pushed the Shanghai Composite down more than 3 percent. That selling soon spread to European and U.S. markets, where the Standard & Poor's 500 index moved further below a closely watched trading level. Investors, facing screens full of red, retreated to their usual places of safety: bonds, gold and cash.

"The emerging markets really got slammed overnight and that quickly spread to the rest of the world," said J.J. Kinahan, chief strategist at TD Ameritrade.

The Dow Jones industrial average plunged 358.04 points, or 2.1 percent, to 16,990.69. The S&P 500 dropped 43.88 points, or 2.1 percent, to 2,035.73 and the Nasdaq composite lost 141.56 points, or 2.8 percent, to 4,877.49. It was the biggest percentage decline for the Dow and S&P 500 since February 2014. The blue chip index is now at its lowest level since October 2014.

Buyers of stocks were few and far between. Selling outweighed buying by a ratio of more than eight to one in heavy trading. Still, even with the sell-off, the S&P 500 was down just 4.5 percent from its record close of 2,130.82 on May 21. As the selling picked up Thursday, investors moved money to traditional havens in times of uncertainty.

Gold rose $25.30, or 2.2 percent, to $1,153.20 an ounce, the metal's best day since April. Demand for ultra-safe U.S. government bonds rose, pulling down the yield on the benchmark 10-year Treasury note to 2.07 percent from 2.13 late Wednesday. The 10-year's yield stood at 2.19 percent only two days before, and its decline since then represents a major decline.

MORE

GOODBYE, 17000! REMEMBER US TO 18K+

Warpy

(111,359 posts)and until the latter is fixed, the economy is going nowhere but worse.

Many things need to be fixed, but without a substantial rise in wages, none of them will work.

ETA: What really had them dumping stocks this week was the sheer terror over the Fed increasing interest rates, probably by a whopping 1/4%.

Demeter

(85,373 posts)Doesn't even look like the Plunge Protection Team tried to stand in the way.

"Après moi, le déluge" will be Obama's parting words.

DemReadingDU

(16,000 posts)The deluge could occur before he is out of office?

Demeter

(85,373 posts)That way Bernie would have a clear path to FDR's legacy and continuation.

And Hillary would be swept away...along with all her support.

Punx

(446 posts)A market crash could strengthen the Republican's hands in the 2016 election. The thought of Trump or one of those other psychopaths in control of the White House with a Republican congress and possible senates scares the hell out of me.

Of course with Hillary in charge it will only be a slower / gentler road to perdition.

Fuddnik

(8,846 posts)And the American public is about dumb enough to vote for him. Here's a spectacle of a guy who's unafraid to say the stupid things other Republicans (and a lot of voters) think, but are smart enough not to say in public.

Demeter

(85,373 posts)I Feel the Bern!

Ooops, sorry, that's sunburn from 2 hours of weeding...

Demeter

(85,373 posts)A one-time small community bank president who became the first person convicted of trying to rip off the federal bailout program was sentenced on Thursday to 2 1/2 years in prison by a judge who said time behind bars was necessary because his crimes were too serious for his cooperation with the government to win his freedom. U.S. District Judge Naomi Reice Buchwald sentenced Charles Antonucci Sr. in Manhattan, where he was president of The Park Avenue Bank before his arrest in a fraud prosecutors said included bank bribery, self-dealing, embezzlement of bank funds and a failed effort to fraudulently get more than $11 million worth of taxpayer rescue funds from the Troubled Asset Relief Program, or TARP. The government said the 64-year-old Fishkill and Woodside resident also participated in a $37.5 million fraud that left an Oklahoma insurance company in receivership during a crime spree between 2006 and 2009.

"Even though he's cooperated, he committed enormous crimes," the judge said. "It isn't enough to say, 'I've been caught, I'll cooperate and everything will be right with the world and I'll just go home.'"

She ordered him to pay $54 million in restitution. He also must forfeit $11 million. If he had not cooperated, he would have faced at least 20 years in prison if federal sentencing guidelines were followed after his guilty plea.

Before Antonucci's sentence was announced, he apologized "for my actions and to those I've harmed...This is not the legacy I want to leave my children," he said.

The judge said she had not heard an excuse or explanation for his crimes. "The only one that comes to mind is greed," she said.

Antonucci resigned in 2009 as president of the bank.

On Wednesday, the judge sentenced Matthew L. Morris, a former senior vice president of the bank who pleaded guilty and cooperated, to a year and a day in prison.

The government said Antonucci was the first defendant convicted of fraud in the federal bailout program, which was put in place to rescue financial institutions and strengthen the nation's financial system when the economy collapsed in 2008. The federally insured bank Antonucci had led primarily catered to small businesses. At the end of 2009, it had about $500 million on deposit and more than $520 million in assets.

Prosecutors said Antonucci carried out some of his crimes through a corrupt relationship with Wilber Anthony Huff, a Kentucky-based businessman. Huff, who pleaded guilty last year, was sentenced in June to 12 years in prison.

Antonucci, during his 2010 guilty plea, admitted accepting gifts from customers, including $250,000 in cash and the use of private planes and luxury cars. In 2008 and 2009, he used a private plane more than 10 times to fly to Florida, Panama, Arizona and Georgia, including trips to the Super Bowl and the Masters Golf Tournament, the government said.

NOT SO LITTLE A FISH...LIKE MADOFF!

STILL, THERE'S AN OCEAN OF OTHERS TO CATCH....

Tansy_Gold

(17,873 posts)to the wall

Demeter

(85,373 posts)Analyses and discussions of Greece’s economic situation usually begin—and often end—with its fiscal policy. The policies mandated by the “troika” of the European Commission, the European Central Bank and the International Monetary Fund have undoubtedly resulted in a severe contraction that will continue for at least this year. But little has been said about the private sectors of the economy, and why they have not offset at least part of the fiscal “austerity.” Consumption spending is linked to income, so there is no relief there. But what about the other sources of spending, investment and net exports?

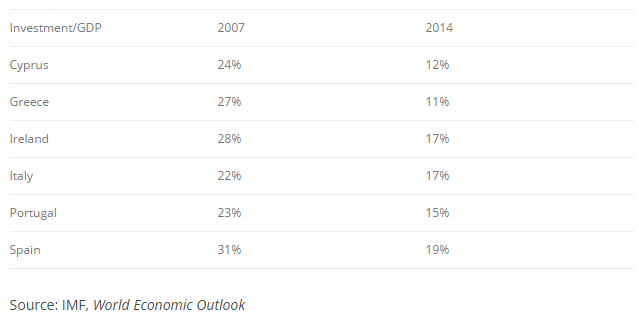

Investment expenditures provide no counterweight, as they have plunged in the years since the global financial crisis. The same phenomenon took place in other countries in the southern periphery of the European Union, but the change in Greece’s investment/GDP ratio between its pre-crisis 2007 level and that of 2014 was an extraordinary decline of 16 percentage points at a time when GDP itself was falling:

In view of the scale of the crisis, it is not surprising that investment fell as much as it did in these countries. The parlous state of the banks only reinforced the decline. The particularly severe decrease in Greece reflects the political uncertainty there as well as the calamitous economic conditions.

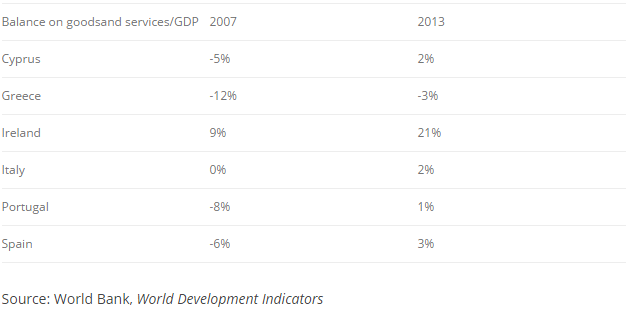

Net exports of goods and services have continued to record a deficit in Greece while the other periphery countries by 2013 showed small (or in the case of Ireland large) surpluses:

AND STILL NO RECOVERY--EXPERTS ARE PUZZLED. MORE AT LINK

Demeter

(85,373 posts)FOR WHAT IT DOES, QUITE WELL. FOR WHAT WE NEED? NOT SO GREAT.

http://www.bradford-delong.com/2015/08/how-well-structured-is-our-federal-reserve-anyway.html

Let me step back and try to think through the issues from the very beginning:

When we think about what the Federal Reserve is doing right now, we need to consider four questions, only one of which which Tim Duy addresses here:

- Is the Federal Reserve properly implementing the monetary policy strategy the FOMC has decided upon?

- Is the monetary policy strategy the FOMC has decided upon the right strategy given the beliefs and values of the committee and the baton the Congress has given to it?

- Has the Congress given the Federal Reserve the right baton--that is, is the mandate calling for price stability, maximum feasible employment, moderate long-term interest rates, and financial stability the right mandate?

- Has Congress created the right institutional structure--that is, given the FOMC the proper membership and orientation?

I would argue that the answers to all four of these questions are: "No."

It is true that over the past three decades the U.S. Federal Reserve has been the best-performing central bank of any in the North Atlantic. And it is likely that the U.S. Federal Reserve is the best-structured central bank in the North Atlantic. But, may I say: "that is a low bar"? I believe we ought to be doing considerably better.

Take my four questions in reverse order, briefly:

- The Federal Reserve was supposed to be a people's central bank--controlled not, like other central banks, by New York money-center bankers and financiers, but by a combination of president-appointed and senate-confirmed regulators in Washington, and with some banker voice but outnumbered by representatives of "agriculture, commerce, industry, services, labor, and consumers" in the twelve regional Federal Reserve Bank cities, only one of which was New York. Its Rube Goldbergian institutional structure is a Progressive-Era and New-Deal attempt to keep it from being the victim of regulatory capture by money-center banking and financial interests. But success has been, at best, very partial.

- The Congress has handed the Federal Reserve a mandate that overweights the importance of price stability. The Fed recognizes this--it was Republican Mandate Alan Greenspan who declared and made stick that the general welfare calls not for price stability but for an average inflation rate of 2%/year. But as Larry Summers and I argued upstairs back in 1992, the balance of evidence is that the economy works better for America with a 4%/year than with a 0%/year average inflation rate. And as IMF chief economist Olivier Blanchard has noted, history since is pretty clear that at least 4%/year is better than 2%/year.

- The Federal Reserve is not living up to even Alan Greenspan's redefinition of its mandate. As former Obama Chief Economist Christina Romer said to me as I left Berkeley for here: "Tell them that even Greenspan said 2%/year thinking it was the right inflation rate on average, but the current Federal Reserve is treating it as a ceiling".

- It is more likely than not that the current Federal Reserve policy path will not even get the inflation rate up to 2%/year. In the past year inflation was 0.2%. It is true that we expect it to climb up toward the 1.8%/year current core inflation rate--but not all the way, only about 3/4 of the way. And both the prime-age employment rate and manufacturing capacity utilization have been drifting down since last fall. Add on economic turmoil in Europe and approaching economic turmoil in China, and this does not seem to be a good time to start raising interest rates. Or, rather, it seems like a good time only if you think the official unemployment rate is the only reliable source of information about the real state of the economy.

Remember: the last four times the Federal Reserve has started raising interest rates, it has had no clue where the economic vulnerabilities lie:

Demeter

(85,373 posts)Will flagging productivity growth trigger a hawkish response from the Fed? That is a question I have been asking myself since Federal Reserve Chair Janet Yellen discounted the cyclical influences of low wage growth in her July 10 speech:

The most important factor determining continued advances in living standards is productivity growth, defined as the rate of increase in how much a worker can produce in an hour of work. Over time, sustained increases in productivity are necessary to support rising household incomes…Here the recent data have been disappointing. The growth rate of output per hour worked in the business sector has averaged about 1‑1/4 percent per year since the recession began in late 2007 and has been essentially flat over the past year. In contrast, annual productivity gains averaged 2-3/4 percent over the decade preceding the Great Recession. I mentioned earlier the sluggish pace of wage gains in recent years, and while I do think that this is evidence of some persisting labor market slack, it also may reflect, at least in part, fairly weak productivity growth.

Goldman Sachs economists led by Jan Hatzius hypothesize that productivity growth is low only because growth is mis-measured, undercounting the value of free or improved software and digital content made possible by information technology (although see Greg Ip’s opposing view). It seems that Yellen is leaning in the direction of taking the productivity numbers at face value and seeing low wage growth as consistent with the view that the productivity slowdown is real.

Indeed, the productivity trends may be even grimmer than 1-1/4 percent that Yellen cited in her speech. Consider for example two measures of underlying productivity growth trends, a moving average measure and the result from a simple unobserved components model:

The downtrend since 2000 is more easily discerned by focusing only on the trends:

....MORE...

Bottom Line: Fed policy increasingly reflects the view that the productivity growth slowdown is real. We see it in falling estimates of potential GDP growth, falling expectations for the terminal federal funds rate, and now we see it as a reason to anticipate low wage growth. The first and third reactions seem to have had a hawkish impact on policy - not only is low wage growth not an impediment to raising rates, but San Francisco Federal Reserve President John Williams argued the Fed needs to engineer a substantial slowdown in growth next year. But the FOMC has yet to act on that relative hawkishness; to date they have moved in the direction of market participants. Indeed, while I suspect the odds favor a September hike, we don’t even know they will raise rates this year at all! The question is whether they would be quick to act on that hawkishness in the face of any unexpectedly high inflation or wage growth numbers. I am thinking low-productivity growth coupled with memories of the 1970s may prime FOMC members in that direction.

NOW, IF ANYONE CARES, THIS IS WHAT I THINK:

BY STRANGLING THE WORKERS AND THE ECONOMY, THE FINANCIAL WIZARDS HAVE STOPPED PRODUCTIVITY IN ITS TRACKS. YOU WANT TO GAIN, YOU HAVE TO GIVE. AND YOU CAN'T STARVE AND BEAT THE WORKERS WHO ARE THE ECONOMY, AND EXPECT MASSIVE PROFITS TO SKIM OFF...

Demeter

(85,373 posts)IT'S HARDLY THEIR FAULT THAT ED HAS A CONSCIENCE AND READ THE CONSTITUTION, NOW, IS IT? ARE THEY GOING TO BE TESTING FOR THAT, NOW?

http://www.theguardian.com/us-news/2015/aug/20/firm-vetted-edward-snowden-settles-us-justice-department-30m

United States Investigations Services strikes deal with justice department after claims it took shortcuts when vetting federal employees... The US justice department said on Wednesday that the settlement with USIS and its parent company, Altegrity Inc, will resolve claims that the firm failed to perform quality control reviews in connection with its background investigations. The justice department said the settlement is part of a broader deal struck as part of the bankruptcy proceedings for Altegrity, which filed for Chapter 11 in February. The deal resolves claims first asserted in a whistleblower lawsuit filed in 2011 that the justice department later joined.

The case was separate from USIS’s review of Snowden, who lives as a fugitive in Russia after leaking documents about the NSA’s surveillance programs, or Aaron Alexis, the technology contractor who killed 12 people at the Washington Navy Yard in 2014.

Nevertheless, the lawsuit came amid heightened attention to the firm, which had been the US government’s largest private provider of security checks.

“Shortcuts taken by any company that we have entrusted to conduct background investigations of future and current federal employees are unacceptable,” Benjamin Mizer, head of the justice department’s civil division, said in a statement....

The justice department said that from March 2008 through at least September 2012, USIS deliberately circumvented quality reviews of completed background investigations in order to increase its revenues and profits. The justice department said USIS engaged in practice internally called “dumping” or “flushing” in which cases were released to the US office of personnel management and represented as complete when in fact they were not. The justice department contended that as a result, the government made payments to USIS it otherwise would not have. Under the settlement, the justice department said Altegrity and USIS have agreed to forgo their right to collect payments they claimed they were owed by the office of personnel management valued at least at $30m. The justice department’s claims originated from a lawsuit filed in 2011 by a former USIS executive, Blake Percival, under the False Claims Act, the law that lets people collect rewards for blowing the whistle on fraud against the government. Percival’s share of the settlement has not been determined.

A TALE OF TWO WHISTLEBLOWERS...

Demeter

(85,373 posts)Demeter

(85,373 posts)Fears of a Russian-Chinese-Iranian internet takeover have subsided as Congress and the web’s governing body begin to see eye to eye...What would the internet look like if countries like Russia, China, and Iran claimed influence over the web’s domain name system? American policymakers don’t want to find out. Since 1988, internet domain oversight power has rested in the hands of the U.S. Commerce Department. Through contracts with the Internet Corporation for Assigned Names and Numbers (ICANN) — the nonprofit group that manages the technical infrastructure of the internet — the department has acted as a network steward, maintaining authority over the management of domain names and internet addresses. But since the early days of ICANN, the internet was envisioned as a space free from the inclinations and interventions of nation-states, including the United States. That vision included plans for the Commerce Department’s stewardship role to be transferred to an international, multi-stakeholder group this fall. But now those plans have been delayed.

Lawrence Strickling, a top official with the Commerce Department, announced on Monday that the agency’s contract with ICANN would be renewed for one year, pushing back the transfer of power to a privatized, non-governmental group under the corporation. “It has become increasingly apparent over the last few months that the community needs time to complete its work, have the plan reviewed by the U.S. government and then implement it if it is approved,” Strickling said in a blog post. Last spring, when Strickling first announced the outline of a transition plan, he insisted that ICANN maintain the security and stability of the domain name system and preserve the openness of the internet. But critics in Congress feared that antagonistic foreign governments might interfere. In June, the House of Representatives passed legislation that would give Congress a review period in which to evaluate any approved transition proposal. Even with the past criticisms of Congress, the delay does not come as a surprise. Both Strickling and Fadi Chehade, ICANN’s president, indicated this summer that completing and executing the transition plans would not be done in time. But the delay has been described as a matter of process, a reasoned review to iron out the kinks, and not a reactionary maneuver to avoid an internet swayed by nefarious governments. “After factoring in time for public comment, U.S. government evaluation and implementation of the proposals, the community estimated it could take until at least September 2016 to complete this process,” Strickling said in explaining the delay.

Christopher Mondini, ICANN’s vice president of stakeholder engagement, told BuzzFeed News that much of the talk about a loss of internet sovereignty, of a grand geopolitical struggle being played out through ICANN, is headline-grabbing rhetoric. While things like government filtering, blocking and traffic monitoring occur in many parts of the world, these practices operate on a more surface-layer part of the web, not the naming system ICANN manages, Mondiri said. The same applies to criminal activity on the web, from spam to cyber attacks to human trafficking. ICANN’s role concerns operations that allow global networks to communicate with each other, not actual content, he added. “Whenever you see a headline that talks about giving up control of the internet or countries taking over the internet, it doesn’t really compute,” he said.

However, according to Daniel Castro, vice president of the Information Technology and Innovation Foundation, holding oversight power of the domain name system grants the U.S. useful leverage in negotiating global internet policies. That power can also be used to pressure ICANN to abide by its stated principles of being unfettered by corrupt state and corporate interests, he said. “Some countries want to see more censorship online,” Castro told BuzzFeed News. “They want to see more control over who can be online, what they can say. And they see the United States stepping down as an opportunity for them have the internet more to their vision of what it should be.”

For Mondiri, ICANN’s multi-stakeholder system of governance, as well as its focus on transparency and deliberation, has won over a skeptical Capitol Hill. And for critics abroad who view America’s stewardship as an unfair arrangement, the eventual transfer of power will signal to the world that the U.S. is committed to an internet unchecked by government control, he said. “Letting go of this contract is a very easy way for the U.S. government to really let go of nothing tangible, and yet convince the world that it really stands by what it said all along, which is that the internet belongs to everyone, it’s a shared global platform,” he said.

Over the course of several hearings, lawmakers have seen ICANN address many of their concerns stemming from a lack of accountability and the possible undue influence of foreign governments. “This is an important step,” Rep. Fred Upton, chairman of the House Energy and Commerce Committee, said in a joint statement with Reps. Greg Walden and John Shimkus on Monday. “The administration is recognizing, as it should, that it is more important to get this issue right than it is to simply get it done.” The trio of Republican lawmakers have come to view the Commerce Department and ICANN as willing partners on internet governance. “We appreciate the administration’s efforts and look forward to working with them, and the global internet community, to get this done right,” they said in the statement.

Mondiri emphasized that anybody with any interest in the internet can comment on ICANN’s governance and accountability proposals, which are open to public feedback through mid-September. After forming a consensus document, ICANN will come to a final resolution in October at their next public meeting in Dublin.

Congress is expected to evaluate the final transition plan by the beginning of 2016.

Demeter

(85,373 posts)For 6 ½ long years, we have been bombarded with the mythology known as “the U.S. economic recovery” by the mainstream media. Exposing this fantasy is simple, since the gulf between myth and reality has grown to such absurd proportions. There is no better starting point than the farcical claim by Barack Obama that “10 million new jobs” have been created during this non-existent recovery. In fact, the U.S. government’s own numbers show that the total number of employed Americans has fallen by more than 3 million over that span, in spite of the population growth over those past 6 ½ years.

The chart above is now somewhat dated, as the St Louis Fed has deliberately changed the format of this chart in order to make it harder to reproduce. Updated, the U.S. civilian participation rate has now fallen to a 36-year low, and as the chart clearly shows, it has fallen at a faster rate since the start of this mythical recovery. The lie: “10 million new jobs created”. The fact: more than 3 million jobs lost. This is a reality-gap of 13 million jobs, or exactly 2 million jobs per year. The U.S. economy hasn’t been “creating” 1.5 million new jobs per year. It’s been losing roughly ½ million jobs every year of this fantasy-recovery.

Then we have the “heartbeat” of the U.S. economy, its velocity of money. A chart of this heartbeat shows that it has plummeted far lower than at any other time in the 56-year history of this data series. This doesn’t merely show a dying economy, it shows a dead economy.

As for the supposed “GDP growth” over this 6 ½ year span, falsifying this statistic requires nothing more than lying about the rate of inflation. Here again, the lie is obvious. The U.S. (and other Western governments) pretend that inflation is near-zero, while in the real world, food and housing prices have been soaring at the fastest rate in our lifetime over the past 10 – 15 years.

Then we have U.S. energy consumption. Again the picture is clear. Overall U.S. energy consumption peaked in 2007 and has been falling since then, while official gasoline consumption has been plummeting for several years. Growing economies use more energy. Shrinking economies use less energy. Case closed.

All this is old news to regular readers, however. What has been less easy to document in any sort of definitive way has been the fall in U.S. wages. The problem is that to express wages meaningfully, we must use “real dollars”, i.e. we must adjust these wages for inflation. With the U.S. government only providing nominal data about U.S. wages, and consistently lying about the actual inflation rate; we have lacked the data to make any conclusive statement. A recent boast by the U.S. government/Corporate media (i.e. another false claim) has now provided us with a clearer picture here, going back to the beginning of this imaginary recovery. In trying to downplay the absence of any wage-growth in the U.S. in Q2 of this year; the propaganda machine made this claim:

…That is down from a 2.6 percent increase in the first quarter of 2015, which was the biggest in 6 ½ years.

The claim is that nominal wages in the U.S. rose at the fastest rate “in 6 ½ years” in the first quarter of 2015, i.e. the highest rate during the entire pseudo-recovery. Now let’s discount that number with the (real) rate of inflation, in order to get a real-dollar number for U.S. wages...A recent commentary pegged U.S. inflation at a conservative level of 12% per year. That number is substantially higher for the Working Poor (and poor), who now comprise the majority of nearly all Western societies. Translating that to a quarterly number (i.e. dividing it by four), we get a quarterly inflation-rate in the U.S. of 3% -- significantly higher than the supposed “growth” in wages of 2.6%.

Thus the U.S. government itself has now provided us with a definitive picture on U.S. wages. During Q1 of this year, the high-water mark for U.S. wage “growth” during the entire Recovery; U.S. wages were still falling. Ipso facto, U.S. wages have been falling every quarter of this recovery. Now we begin to see the whole truth in the U.S. labour market, versus the absurd, official claim of lots of “new jobs” and “rising wages”. U.S. employment has been falling, not rising, every quarter, every year. U.S. wages have been falling, not rising, every quarter, every year. But that picture is still incomplete. The total number of hours worked by the Working Poor is also falling, and in 18 out of 20 of the U.S.’s industrial sectors, total number of hours worked is still lower than during the so-called Great Recession. This is also reflected in the fall in the percentage of full-time employees.

To summarize: since the beginning of the imaginary U.S. economic recovery, there are millions fewer Americans who are now employed. Their wages have been falling for every quarter of the “recovery”, and they are also working fewer hours. Growing economies create more jobs; shrinking economies lose jobs. Strong economies have rising (real) wages; weak economies have falling wages. Once again we see the supposed U.S. recovery is pure mythology.

However, with respect to the destruction of the U.S. standard of living, to truly appreciate what has been done to the U.S. population (and the populations of nearly all of the Corrupt West), we must look at the picture over a much longer term. In the 40 years before the beginning of this imaginary recovery, the wages of the Average American fell by roughly 50% (in real dollars). Now the descent of the majority of the U.S. population to Third World status becomes crystal clear. From 1970 to the beginning of 2009 (i.e. the current “recovery”), U.S. wages fell roughly 50%. Then came the mythical Recovery, and U.S. wages have continued to fall, quarter after quarter after quarter. The Great Recovery has been worse than the Great Recession which came before it. What do we call it when a nation experiences a “great recession”, and then the economy continues to crumble at an even faster rate after that, year after year? We call it a Greater Depression.

Shrinking economy. Losing jobs. Falling wages. Declining energy consumption. No “heartbeat”. Has anything been left out, in describing this U.S. economic Armageddon? Certainly. The U.S. government is obviously bankrupt. The U.S. dollar is obviously worthless. The U.S. economy has been run completely into the ground. When the current, assorted bubbles are deliberately popped (almost certainly in 2016, or late-2015), and Old-Man Buffett goes on a massive shopping spree with the $60+ billion he is now currently hoarding; there will be nothing left but economic rubble. And Milton Friedman will be smiling, from (way) down in his final, resting place.

Demeter

(85,373 posts)See you tonight on the Weekend!

Demeter

(85,373 posts)I will have to start pruning it, so it stays within reach. Semi-dwarf, my eye! It's already sticking over the first storey and on its way to the second storey windows...picking peaches from the bedroom window SOUNDS like a good idea, but I'm sure the condo association would bitch.

Next up, the back yard wilderness. I did start on the patio two weeks ago. But the far beds by the road are as yet untouched.

I feel calmer, already. Like Antaeus, I need to stay in touch with my mother Earth Gaia to stay sane....still sneezing, though. Time for more zinc.

Antaeus was known to the Berbers as Änti, a distinct figure from the Egyptian god of that name. Greeks of the 6th century BC, who had established colonies along the coast of North Africa, placed Antaeus in the interior desert of Libya.

Antaeus would challenge all passers-by to wrestling matches and remained invincible as long as he remained in contact with his mother, the earth. As Greek wrestling, like its modern equivalent, typically attempted to force opponents to the ground, he always won, killing his opponents. He built a temple to his father using their skulls.

Antaeus fought Hercules as he was on his way to the Garden of Hesperides as his 11th Labor. Hercules realized that he could not beat Antaeus by throwing or pinning him. Instead, he held him aloft and then crushed him to death in a bearhug.

A location for Antaeus somewhere beyond the Maghreb might be quite flexible in longitude: when the Roman commander Quintus Sertorius crossed from Hispania to North Africa, he was told by the residents of Tingis (Tangier), far to the west of Libya, that the gigantic remains of Antaeus would be found within a certain tumulus; digging it open, his men found giant bones; closing the site, Sertorius made propitiatory offerings and "helped to magnify the tomb's reputation".

In Book IV of Marcus Annaeus Lucanus' epic poem Pharsalia (c. AD 65-61), the story of Hercules' victory over Antaeus is told to the Roman Curio by an unnamed Libyan citizen. The learned client king Juba II of Numidia (died 23 BC), husband of the daughter of Antony and Cleopatra, claimed his descent from a liaison of Hercules with Tinga, the consort of Antaeus.

In his Life of Sertorius cited above, Plutarch recounts what he says to be a local myth, according to which Hercules consorted with Tinge after the death of Antaeus and had by her a son Sophax, who named a city in North Africa Tingis after his mother. Sophax in his turn was father of Diodorus who conquered many Libyan peoples with his army of Olbians and Mycenaeans brought to Libya by Hercules. Moreover, some related that Hercules had a son Palaemon by Iphinoe, the daughter of Antaeus and (presumably) Tinge.

Scholiasts on Pindar's Pythian Ode 9 also recorded a story which made Antaeus king of the city Irassa in Libya, and father of a daughter named either Alceis or Barce. Antaeus promised her hand to the winner of a race, just like Danaus did to find new husbands for his daughters.

Alexidamus beat all the other suitors in the race and married the daughter of Antaeus. Three versions of this story, with minor variations, were collected by the scholiasts; one of those versions made Antaeus, king of Irassa, a figure distinct from the Antaeus killed by Hercules, while another one suggested that they were one and the same.

https://en.wikipedia.org/wiki/Antaeus

AND THAT WAS JUST THE IMAGINING OF THE ANCIENTS! THE TALE LIVES ON AND IS REINTERPRETED WITH EVERY GENERATION....EVEN OURS! SEE WIKI

Fuddnik

(8,846 posts)Stocks were clobbered Friday on Wall Street — a brutal finish to the worst week in the market in almost four years. The Dow Jones industrial average closed down 530 points, the ninth-biggest point decline in its history.

Investors were worried about signs of a slowdown in the Chinese economy that could hammer companies and countries around the world. The stock of Apple, which depends heavily on demand from China, fell more than 6 percent.

The Dow finished at 16,459. It has fallen more than 1,200 points in August alone and more than 10 percent decline from its all-time high in May — the definition of a market correction. That has not happened in four years.

The Dow's decline came to 3.1 percent. The Standard & Poor's 500 index, a broader gauge of the stock market, finished down 3.2 percent and closed below 2,000 for the first time since early this year.

(snip)----------------------------------------------------------

Is the party over yet?