Economy

Related: About this forumWeekend Economists Remember Wars that Didn't Have to Be November 6-8, 2015

The date was declared a national holiday in many allied nations, to commemorate those members of the armed forces who were killed during war. An exception is Italy, where the end of the war is commemorated on 4 November, the day of the Armistice of Villa Giusti. In the Netherlands, Denmark and Norway World War I is not commemorated as the three countries all remained neutral.

https://en.wikipedia.org/wiki/Armistice_Day

It was hyped as "the war to end all wars", but the conflict triggered by the assassination of Archduke Francis Ferdinand actually ended all political Empires (but not the empires of Wealth). The Austro-Hungarian Empire, the Romanov Empire, the Victorian Empire, the Prussian Empire, the Ottoman Empire, all were destroyed by the destruction of Europe that transfigured the Old World.

But out of all the convulsions and turmoil, a singularly unusual story developed in the Hundred Acre Wood....

Demeter

(85,373 posts)It’s easy for Progressives to get excited about the idea of postal banking: a public option for banking! What’s not to love? ... But I think it’s necessary to recognize some of the limits to postal banking. In particular, it's not at all clear to me why we would want to involve the Post Office in the public provision of financial services. What the Post Office offers is a way to recreate a brick-and-mortar branch bank network. This really doesn't make a lot of sense for 21st century banking. Additionally, postal banking is often pitched as an alternative to payday and title lenders. Before we go running down that path, we should think about what it means to have the government in the payday lending business. Postal banking proposals are a subset of public option banking proposals that aim to solve one of two problems: lack of access to financial services and inadequate competition in financial services. It’s worth exploring each of these issues a little more to understand what postal banking can and cannot deliver.

The access problem is actually two separate problems: the problem of the unbanked and the problem of the underbanked.

The idea behind contemporary postal banking proposals is that a postal bank could offer lower-cost and more physically accessible deposit, payment, and credit services than private non-bank financial services firms because it wouldn’t have to either (1) pay for overhead or (2) generate a profit. Basically a Postal Bank would have a lower cost of operating than private competitors and also wouldn’t have to compete for capital. (Note that this is a totally different rationale than the original basis for postal banking in the United States, which was as an alternative to deposit insurance as a solution to the bank run problem.) It isn’t clear to me that the rationale for postal banking really holds up either for the unbanked problem or the underbanked problem. For the unbanked, it would seem simple enough for the Post Office to offer deposit account and payment services. It historically did offer passbook savings accounts, and it already does payments of a sort with money order. Moreover, the Post Office has an unparalleled physical distribution network—it’s in every ZIP code.

But that’s not quite enough, I think. Not all Post Office locations are where you’d want them to be for providing financial services. Moreover, Post Offices aren’t open the right hours for serving the unbanked. If you’re working a 9-5 job, you need a financial service provider that’s open in the evening or early in the morning. Extended Post Office hours starts to cut into the overhead savings advantage. Likewise having to retrain Post Office personnel or change staffing levels starts to cut into the savings advantage.

More importantly, though, it isn’t clear to me why we would want to set up a 20th century brick-and-mortar banking operation in the 21st century. Banks have been shedding branches for a while for a reason. There’s a better way to bank the unbanked. Why not just provide deposit and payment services through government-issued prepaid cards? Treasury already does this successfully with food stamps (SNAP) and Social Security benefits. One could imagine a public option that expands Treasury’s current offerings to allow limited-size deposit accounts (probably $2,000 for AML compliance purposes) that come with a no-fee ATM/debit cards, remote deposit capture, direct deposit, automatic bill payment options, and can be accessed on-line (there are very high rates of smart phone usage among lower-income households). These accounts could be integrated with tax credit provision, etc.

A non-postal public option seems a lot simpler to avoid dealing with the problems of the Post Office and its politics and it also avoids the expense of having to retrofit the Post Office for banking. It’s definitely worth pursuing a public option, but there’s no need to go postal. (I’ll flag here that there’s a big set of data privacy issues involved with a public option bank, but that’s for another day.)

As for the underbanked, I think there’s a separate set of problems...

IT IS AGAIN A QUESTION OF EMPIRE--SHALL THE PUBLIC BANKING OPTION BE EMPLOYED TO BRING DOWN THE PRIVATE BANKING EMPIRES?

SHALL A PUBLIC BANK HELP PROTECT THE US POSTAL SERVICE FROM THE GOP WHO WOULD DESTROY AND PRIVATIZE IT?

THE EMPIRES ARE FINANCIAL, THIS TIME. IT REMAINS TO BE SEEN WHETHER THEY SURVIVE.

MattSh

(3,714 posts)Russia’s government approved the establishment of a massive new bank based on the country’s postal service, a move that will eventually create an institution with more retail branches than all other Russian banks combined. The new entity, called Post Bank, is a joint venture between Russian Post and one of the country’s largest lenders, state-owned VTB Bank.

Post Bank is being established in part to provide banking services across Russia’s far-flung, near-empty regions, and to target pensioners. VTB will fuse one of its subsidiaries, Leto Bank, into the new institution. The partners say the new institution will begin giving out loans as early as January 2016, with a pilot project to be launched in Moscow this fall.

Over the next three years, the bank will open outlets in no less than 15,000 Russian Post offices. After this initial rollout, the bank should start operating in all the 42,000 offices of the national operator. The current leader, Sberbank, has more than 17,000 outlets. Once it is completed, Post Bank will have more retail locations than all other Russian banks combined, according to the Russian banking portal Banki.ru.

Post Bank’s Board of Directors will be headed by Russian Communications Minister Nikolai Nikiforov. “The question of the creation of Post Bank has been discussed for 15 years; eventually we came to the conclusion that it would be created in partnership with the VTB Group,” Mr. Nikiforov told reporters at a conference in September.

-----> http://rbth.com/business/2015/11/04/moscow-creates-vast-new-bank-from-post-office_535635

Demeter

(85,373 posts)NIH (Not Invented Here) strikes again!

Although, if we end up with a Socialist Democratic White House, all bets are off!

Demeter

(85,373 posts)How many passwords do you have? Two? Ten? The same one you've been using since you first opened a MySpace account? Despite our best efforts ("Passw0rd" isn't one of them), it turns out we've been making 'unbreakable' passwords all wrong. Forget character replacement and unique dates, the key is simple: poetry.

Marjan Ghazvininejad (which sounds like a pretty good password) and Kevin Knight from the University of Southern California's department of computer sciences have come up with a method of creating a memorable password that would take five million years to crack.

"User-generated passwords tend to be memorable, but not secure," explains their paper. "A random, computer-generated 60-bit string is much more secure. However, users cannot memorize random 60-bit strings."

Ghazvininejad and Knight create memorable 60-bit strings by assigning numbers to words - using a whopping 32,7868-word dictionary. A computer program then creates a very long random number, breaks that long number into shorter numbers that correspond to the codes assigned to the dictionary words. It then translates those words into two short phrases that rhyme, as so:

Sophisticated potentates

misrepresenting Emirates

Or how about...

The supervisor notified

the transportation nationwide

The point of this generator is that it's based on unrelated words, with no links or patterns that a computer could guess at, but that are easy for us humans to remember by virtue of their rhymes. You can try out Ghazvininejad and Knight's system with this online generator SEE LINK- but it should be emphasized that this web demo isn't secure, and the resulting passwords could be hacked and stolen. For a more secure version, add your email to this system, which will create a unique poem password that will be subsequently deleted.

Sure they're a bit long - but they're far more secure than 'the name of your first pet plus the year United won the treble'.

Demeter

(85,373 posts)Still hurting from the yard work.

MattSh

(3,714 posts)I've thought for a while that this whole adventure in Syria had a larger goal of destabilizing the world far beyond that, especially into Russia's traditionally Muslim regions. This writer takes it a bit beyond that.

The greater Middle East is on fire with one failing state after another overrun by Salafi jihadists—Libya, Iraq, Syria, Yemen—and rapidly reigniting Afghanistan, inflaming Central Asia, Russia’s Chechnya, China’s Xinjiang, southeast Asia and even South Korea.

This week, South Korea received bomb threats from an Islamic State (IS)-linked group to blow up a shop near COEX, a large shopping complex in the wealthy district of Gangnam in Seoul.[1] In April, IS attacked the South Korean embassy in Libya and killed at least two people.[2]

It appears the negative contagion of US –sponsored regime changes in the Mideast, that empowered the rise of Salafi jihadism, is pivoting east and destabilizing Asia. After one year of US-led anti-IS campaign, the Islamic caliphate is getting stronger and on the march, destroying the old world order and establishing a new one with the implicit backing of Saudi Arabia, Qatar, and especially Turkey’s Erdogan.

As Turkey held election on November 1, a pro-AKP columnist even claimed that under a new presidential system, Erdogan would be “caliph” of the Sunni Muslims in the world, with the 1,005-room new presidential palace hosting “representatives from nations under the caliphate.”[3]

Distracted by an alphabet soup of various salafist jihadi groups such as Al Qaeda in Iraq (IS), Al Qaeda in Syria (Al Nusra), Al Qaeda in the Arabian Peninsula (AQAP), Al Qaeda in North Africa (AQIM), Al Qaeda in the Philippines (Abu Sayyaf), Al Qaeda in China (Turkistan Islamic Party), [4] Boko Haram, Taiban, Haqqani Network and so on, and trying to separate “good terrorists” from “bad terrorists”, Washington is blindsided by the fact that ultimately they share the same end of establishing a global caliphate under Sharia, only differing in the means and speed of that goal.

Writing in the Wall Street Journal, Henry Kissinger warned that IS “seeks to replace the international system’s multiplicity of states with a caliphate, a single Islamic empire governed by Shariah law.”[5]

As such, he argued “the destruction of IS is more urgent than the overthrow of Bashar Assad, who has already lost over half of the area he once controlled. Making sure that this territory does not become a permanent terrorist haven must have precedence.”

However, his warnings seem to fall on deaf ears in the Obama administration, with Secretary Kerry continuing to toe the Saudi/Qatar/Turkey line of a regime change mandate that “Assad must go”(and replaced by their Islamist extremists), rather than a counterterrorism mandate of prioritizing combating IS and other Salafi jihadists to restore regional stability.

-----> http://atimes.com/2015/11/obamas-regime-change-in-syria-effort-to-destabilize-china-russia/

Hey, what a plan! Destabilize the whole of Europe and Asia. Only by doing that can we have a new "American Century!"

MattSh

(3,714 posts)What, the British Prime Minister wants to know, will the Russians do?

The United States has engaged in Syria — and is pushing for regime change. Moscow is bristling, and has responded with a display of Russian air power outside Damascus and warships in the Mediterranean Sea. A shadowy cabal of Russian "volunteers" has arrived in Syria and Turkey has sent a flood of troops to the border. Saudi Arabia is on edge. Iran and Egypt have been dragged in. And NATO officials are speaking of an all-out war.

And so it may have unraveled — in 1957.

The above is not a play-by-play of Syria's ongoing and seemingly intractable civil war, though may read as such. Rather, it is an eerily prescient scenario dreamed up more than half a century ago by British intelligence officials in a "TOP SECRET" report that was made public for the first time this week.

Back in 1957, things were heating up in Damascus. The Syrian government — ostensibly non-aligned, in a Cold War-divided world — seemed to be moving further into the Soviet camp. Washington and London feared that Syria would become a Soviet client state, and began secretly plotting to overthrow the Syrian government and assassinate Syrian officials. Turkey moved troops to the border and the Soviets threatened to launch missiles at Istanbul.

-----> https://news.vice.com/article/the-west-worried-about-russian-escalation-and-proxy-war-in-syria-in-1957

MattSh

(3,714 posts)A prominent Turkish journalist has compiled a list of 41 “moderate” rebel leaders who have been killed in the last 30 days. (It's closer to 40 days now). No wonder Washington is flipping out:

-----> https://twitter.com/ornekali/status/659500402078019584

Wars that didn't have to be. Wow, there's so many of them!

Demeter

(85,373 posts)The US Empire is tottering as I type. Rotten to the core, as appendage after appendage is hacked off by the Caliphate, the US will either retreat and rebuild upon a self-sufficient and populist framework, or be occupied by people who don't have any reason to show US any mercy. It's not as if the US is going to nuke itself (one would hope, at least) to stave off a takeover. The oceans are our only sure protection, and they won't stop Chinese-powered Latinos.

The Eurozone, that Potemkin shell pretending to be a "democracy", is overrun already, with no sign of a stoppage, nor even a means to stop the flood of refugees out of Asia and Africa. I could see some idiot nuking the ME or the Continent of Human Origin, but to what point? Jihad is not a one-state-sponsored invasion...unless the House of Saud falls. That MIGHT put a crimp in things, especially if the Emirates go down with it. Cut off the money, and see what happens.

Russia has refused to rebuild the Soviet Empire at least twice. Putin is nobody's fool, and a lot of fools who htink they know what he thinks or wants are just projecting their own greed upon him. Russia is intent on keeping the Islamic Jihadist hordes out of Russia. Russia and its neighbors could build a true federation of nation-states seeking the same goal and finding protection and efficiencies of scale, rather like what the US colonies did, when they wrote the Constitution. A lot of old injuries would have to be forgiven, though, and a lot of US propaganda washed out of nonsense-stuffed brains.

Either Asia will deal separately with its jihadists, or it will go under. The Asians had best not look to Uncle Sam for protection.

And as for Ergodan, trying to rebuild the Ottoman Empire, I sure hope he gets what's coming to him, and soon. He's the most dangerous loose cannon (aside from the House of Saud) out there.

The Israelis are so dependent on the US, that they will soon regret pissing off every neighbor around them. I'd recommend another Jewish Diaspora, stat!

MattSh

(3,714 posts)“I, Jacob Arend, invented this cabinet in my own mind and have drafted it all and marked it out. I have cut it [the marquetry] with a fret-saw and shaded it. This was done in the Sander quarter, near Korn Gasse by the river Main. But neither of us will be staying here much longer. This cabinet has been completed in the winter month[s], and we would like to go elsewhere, for little meat and a great deal of cabbage and turnips have driven us out of Würzburg. We ask him who finds this note to drink our health and if we are no longer living then, may God grant us eternal rest and salvation. This 22nd day of October in the year 1716.”

Jacob’s letter gives us a window into a workshop capable of producing a writing cabinet using materials from at least three continents while the craftsmen were living in very straightened circumstances. The contrast between the rich details and opulence of the cabinet and the makers’ steady diet of cabbage and peas is startling. Jacob was working in his brother’s court-appointed workshop, which probably gave him some level of security, but had reached a point of desperation. How had living conditions deteriorated to the extent he and Johannes decided they had to leave? Life traveling from town to town seeking work was not only dangerous there was also no guarantee they would find enough work and wages to survive.

In describing their diet and lack of bread and meat Jacob gives us a key to what had happened to their food supply. In the V&A analysis the harsh winter of 1714-15 was noted as having a dire impact on the following year’s harvest. I did my own investigation to learn more about the weather conditions.

Europe at that time was in a weather pattern called the Late Maunder Minimum (LMM) also known as “The Little Ice Age.” The winter of 1714-15 was very cold and dry and the beginning of a drought that would cause crop failures. There were also more instances of forest fires. With a shortage of grains, prices were raised, farmers could afford to feed fewer livestock and grains for bread and other foodstuffs became more scarce. Drought conditions caused water levels to drop and transport of goods, including lumber, became more difficult and costly. Jacob mentions the poor grape harvest the last four years (and increased price of wine) indicating an extended period of poor crop yields. Jacob writes in a joking manner, “…we have grown so fat that we can hardly climb the stairs any more.” The V&A analysis indicated the term fat may mean bloating from the diet of cabbage and peas or could be the much more serious symptom of prolonged starvation. In the German text there is some ambiguity on whether Jacob had written about the lack of ‘broden’ (bread) or ‘braden’ (roast meat). If they were at the point of a scarcity of bread their level of hunger was more severe.

-----> http://blog.lostartpress.com/2015/11/05/when-cabbage-and-peas-were-often-our-best-meal-a-letter-from-an-18th-century-journeyman-cabinetmaker/

MattSh

(3,714 posts)Well, there's some less than pleasant images in this one.

Demeter

(85,373 posts)America’s jobs market roared into top gear last month as hiring far surpassed Wall Street forecasts, further heightening expectations that the Federal Reserve will raise interest rates next month for the first time in nine years. The Bureau of Labor Statistics reported the strongest rate of job creation thus far this year, as payrolls expanded by 271,000. The unemployment rate dropped to half the level it reached during the worst days of the recession.

OH, I AM SO IMPRESSED!

“If the FOMC were meeting today they would be tightening,” said Jim O’Sullivan, an economist at High Frequency Economics, referring to the Fed’s rate-setting committee. “This is an unambiguously strong report.”

The jobless rate fell to 5 per cent, as the number of unemployed people fell by 1.1m compared with this time last year. Wages rose at their strongest clip since 2009, with average hourly earnings rising 2.5 per cent over the year.

The figures triggered a sharp rise in bond yields, with the two-year Treasury yield jumping to a five-and-a-half year high as traders priced in a Fed increase next month. The dollar also shot up, with the euro 1.4% lower against the buck at $1.0736 and sterling down 0.9% at $1.5076. The DXY dollar index — which measures the currency against a basket of its peers — was up 1.2%. Gold fell 1.6% to $1,086.78 an ounce.

October’s numbers were far above economists’ expectations of a 180,000 reading and are easily strong enough to reassure Fed policymakers that the US is approaching full employment. Job gains in August and September combined were revised up by 12,000...

Demeter

(85,373 posts)The number of Americans filing for unemployment benefits climbed to the highest level in five weeks, representing a pause in the recent progress that left claims at their lowest level since 1973.

Applications increased by 16,000 to 276,000 in the week ended Oct. 31, a Labor Department report showed Thursday. It marked the biggest advance since the end of February, while the level exceeded the Bloomberg survey median estimate of 262,000. The four-week average of claims climbed from the lowest in four decades.

Employers intent on ensuring skilled workers remain on their payrolls have been holding the line on dismissals, making adjustments to hiring plans instead in response to the slowdown in overseas economies. A report Friday is projected to show job growth that’s a step down from the average so far this year.

“We’re still at very healthy levels,” said Thomas Costerg, senior U.S. economist at Standard Chartered Bank in New York, whose forecast for 275,000 claims was among the closest in the Bloomberg survey. “Jobless claims suggest the labor market is quite close to full employment.”

YEAH, RIGHT

VIDEO INTERVIEW IS LAUGHABLE, TOO

Demeter

(85,373 posts)Don't think a robot could take your job? A study in the latest issue of McKinsey Quarterly says as many as 45 percent of the tasks that Americans get paid to do could be automated. The share rises to 58 percent if computers get as good as the median human being at speech recognition and understanding.

The study's most depressing finding is that a lot of what people do at work is rote. Just 4 percent of Americans' work activities require creativity at the level a normal person has, and just 29 percent require sensing emotion, the authors conclude. (Though it isn't clear the humans are sensing emotion like crazy, either.)

The study differs from earlier ones on automation by focusing on activities, not occupations. Any given occupation, from landscaper to chief executive officer, involves a set of activities, some of which can be automated and some of which can't, the authors say. "Very few occupations will be automated in their entirety in the near or medium term," they write. "Rather, certain activities are more likely to be automated."

Automation, in other words, will transform occupations, with machines taking over what they do best and people doing more of what they do best, the study says. That sounds like an opportunity for McKinsey & Co., whose consultants presumably would be happy to help companies restructure jobs. The report was written by Michael Chui, a principal at the McKinsey Global Institute, the consulting firm's think tank; James Manyika, a director of the institute; and Mehdi Miremadi, a principal in McKinsey's Chicago office...

YOU MAY SCOFF AT WILL

Demeter

(85,373 posts)The commonly held notion that it was started out of outrage over the assassination of Archduke Franz Ferdinand of Austria and his wife Sophie at the hands of Serbian nationalist secret society known as the “Black Hand” isn’t entirely correct. In fact, the Emperor Franz Josef himself expressed relief over the assassination because it rid him of an heir whom he deeply disliked. The Emperor commented that “God will not be mocked. A higher power had put back the order I couldn’t maintain.”

Indeed, it wasn’t just the Emperor who was relieved; it was reported by an Austrian newspaper that the general consensus among the various political circles was that the assassination, though a tragedy, was for the best. As far as the Austrian people were concerned, it was noted “The event almost failed to make any impression whatever. On Sunday and Monday, the crowds in Vienna listened to music and drank wine as if nothing had happened.” Indeed, it took the government itself a full three weeks to react.

As you’ll see shortly, the “treaty alliance system” that was prevalent in Europe with numerous treaties interconnecting the various states was really at the heart of why what would have been a small conflict, not noteworthy in any way in history, escalated into one of the bloodiest wars in human history with over 15 million people dead. Somewhat ironically, the spark that set it all off was the assassination that nobody really cared about.

So why go to war over an assassination, if nobody cared? Because, while nobody seemed to much care about the assassination itself, Austria-Hungary had been looking for an excuse to wage a “preventative war” against Serbia as a state in order to weaken or destroy them so as to take back territory in the Balkans, which had been taken during the Balkan Wars. They had not taken it back up to this point because they lacked Germany’s support; without that support, they feared Russia too much, because of the treaty Russia had with Serbia...

...So in the end, a small quick war over a minor land dispute got turned into a lengthy war that was joined by powers all over the globe due to a variety of existing treaties dating back as much as 75 years before the war started.

Demeter

(85,373 posts)The 'crapification' of jobs is the direct result of the 'crapification' of the economy.

Two recent articles shed light on the 'crapification' of jobs and the rise of income inequality:

Martin Wolf on the Low Labor Participation as the Result of the Crapification of Jobs (Naked Capitalism)

The Measured Worker: The technology that illuminates worker productivity and value also contributes to wage inequality. (Technology Review, via John S.P.)

While both articles offer valuable insights into the secular trend of stagnating employment and wages, I think both miss a couple of key dynamics. As a general starting point: if you want to understand the 'crapification' of jobs and wages, we have to look at the 'crapification' of the economy from the perspective of those who are doing the hiring: the employers. From the perspective of employees, the 'crapification' of jobs boils down to 1) low/stagnant wages for 2) highly structured, boring, repetitive and often difficult work. The decline in the quality, pay and upward mobility of jobs is directly related to the dynamics of globalization, financialization, and the surplus of ordinary labor and capital:

1. Increased competition suppresses wages as employers seek to cut expenses. Rents, taxes, healthcare, government fees, etc. all rise like clockwork; that leaves labor as the largest component that can be trimmed.

2. Cheap capital incentivizes replacing labor with new software/technology. With the cost of capital at all-time lows, the pressure to replace costly labor with new software, robotics, etc. is intense. Software, robotics and related technologies are dropping in price even as their productivity increases.

- The reality is that humans can only be pushed to produce more if the tools they're using become more productive.

The second reality is that for many enterprises, these global pressures boil down to automate or die, with the purpose of automating being to reduce labor costs and boost productivity, as both are required to survive competition and stagnating sales.

3. The total compensation costs of employees is rising even if wages are flat. Employees (and the vast majority of pundits, most of whom have never hired a single employee with their own money) tend to overlook the overhead costs paid by employers: workers compensation insurance (soaring), healthcare insurance (soaring), disability insurance, unemployment insurance, 401K or pension contributions, etc.

- Total compensation costs = wages + labor overhead. If labor overhead costs are climbing, the employer is paying more per employee even though the employees aren't getting a dime more in wages.

4. As system costs rise, those with stagnant incomes have less to spend. We can't say no to higher taxes, higher healthcare costs, higher junk fees, higher fees imposed by monopolies, etc. and so the share of income that is truly disposable is declining as the big-ticket expenses continue rising.

This means stretched consumers are foregoing expenses that they once paid for without thinking: the $350 blood test for the ailing pet, the broken air conditioner in the car ($500+ to repair), the after-school enrichment class, the Friday dinner out, etc., etc., etc.

The net result of stagnating income for 90% of the households is stagnant sales. The cheerleaders on propaganda-TV never mention that the rising corporate profits they are trumpeting are typically accompanied by declining sales and declining same-store sales. In other words, the "profits" are accounting gimmicks, not true profits earned on rising sales.

5. It is increasingly difficult to generate a profit in this environment unless you own/operate a monopoly or quasi-monopoly. Those focusing on the 'crapification' of jobs tend to look at global corporations--those with thousands of low-paying jobs or those doing extremely well (Google, Facebook, Apple, etc.)-- while everyone from Mom and Pop small businesses to mid-sized corporations are generally being squeezed by slumping sales and higher total compensation costs.

If the management of public companies don't meet Wall Street's grandiose profit expectations, they'll be fired. If small businesses lose money, the owners are forced to either close the business or go bankrupt. So everyone in the managerial food chain hoping to avoid the crapified employment market below their current job (i.e. those trying not to get fired) must crapify every job they manage to wring enough productivity and profit out of stagnant sales to keep their job.

The 'crapification' of jobs is the direct result of the 'crapification' of the economy.

Demeter

(85,373 posts)Now that virtually every nation is entering the bust phase, all are being tested.

Booms powered by credit, new markets and speculation are followed by busts as night follows day. This creates a very difficult test for every nation-state facing the inevitable bust: how does the leadership deal with the end of the boom? As the world is about to learn once again, the "fix" may make the next bust even more destructive.

Let's start by reviewing what conditions generate booms.

1. An undeveloped nation gains access to new credit, markets and resources and goes through a "boost phase" much like a rocket lifting off when suddenly abundant finance capital ignites the country's latent growth potential. When a country with little to no public or private debt suddenly gains access to essentially unlimited capital, growth explodes.

- One variant of this is the discovery of vast new resources that quickly attract capital (for example, oil) or that generate new wealth (for example, gold).

The modern example of a developing nation gaining access to new credit, markets and resources is of course China, but this model also describes America in the 1790s and early 1800s, and many other nations in various phases of their development.

2. A new sector opens up in a developed nation's economy. A recent example is the Internet, which exploded in a boost phase from 1995 to 2000. In these cases, the new sector simply didn't exist, and the boost phase is as spectacular as the ones in newly developing economies. Examples from American history include the railroad-fueled boom of the 1870s and 1880s and the advent of electric light and later, radio.

3. A previously "safe" sector is financialized as the assets are collateralized into vast mountains of debt and leverage, both of which fuel runaway speculation.

- The mortgage-backed-securities and subprime-fueled housing boom of 2002-2008 is a recent example of this: a safe, conservative sector (mortgages and housing) was rapidly financialized into a speculative frenzy.

Eventually this boost phase burns thru all the productive investments and moves into mal-investment, rampant speculation and outright fraud as insiders take advantage of new entrants. In the U.S., this occurred in the early 1890s once the construction of railroads had moved to the over-indebted, speculative mal-investment phase.

The same post-boost phase bust occurred in 2000 after the dot-com frenzy had run its course.

The difference between the three booms is that busts that are limited to one sector are easier to manage than busts in the entire economy. The problem with the subprime housing bust was that it wasn't limited to housing or mortgages--the speculative boost phase had infected the entire financial system. When entire economies enter the bust phase, the nation's political, social and economic foundations are tested. If they aren't rock-solid, the country enters a crisis that is often marked by war, economic collapse and political destabilization.

The political and financial leadership that won plaudits during the boost phase for wise management is loathe to accept the bust phase as necessary medicine for over-indebtedness, speculation and mal-investment. Instead, the leadership attempts a series of hastily assembled financialization "fixes" aimed at returning the economy to the boost phase of rapid growth: fiscal and monetary stimulus, lowering interest rates, etc. These have the same effect as tossing gasoline on a fire. Debt, leverage and speculation are ignited, but since the productive investments have long been made, all that's left is unproductive mal-investment and speculative bets.

Exhibit A is the global economy's soaring debt, with China's vast expansion since 2007 as the prime example of "fixing" Degrowth with vast mountains of new debt that flow mostly into speculative wormholes and mal-investments such as empty malls, airports, sports facilities and cities.

Now that virtually every nation is entering the bust phase, all are being tested. So far, virtually all are in denial and still trying to 'solve" the Degrowth/speculative bust reality with the same old financialization tools.

That these will fail is as predictable as night following day.

Demeter

(85,373 posts)outside my window as I type. It looks rather like:

which is the design of the flag of Pakistan, where one could argue the entire mess we are in started, back with the division of India into two nations...

Not a good portent for the times, but a startling coincidence...most Islamic nations feature the Star and Crescent, by the way...

Demeter

(85,373 posts)https://hereandnow.wbur.org/2015/11/04/true-story-of-pooh

PODCAST AT LINK

CAN YOU SEE THE BEAR CUB, IN THE LAP OF THE GUY IN THE MIDDLE? THAT'S WINNIPEG, OR WINNIE, FOR SHORT

In 1914, a Canadian veterinarian on his way to treat World War I battlefield horses got off his train on a platform in White River, Ontario, and saw a bear cub. Actually, it was a bear cub tied to a string, held by a trapper. Against his better judgement, the vet bought the bear for $20 and re-boarded the train.

He named the bear Winnie, after his native Winnipeg, and continued to the east coast of Canada, where he boarded a ship — with Winnie and his new regiment — to England.

The bear stayed with him, becoming a regiment mascot, through months of battlefield training in miserable weather. But when the time came to deploy to France, he realized that Winnie would not be safe. He brought her to the London Zoo, which agreed to care for Winnie for the duration of the war.

That real-life bear, represented in statues in London and Winnipeg, as well as in historical photos and documents, is the one now known as Winnie the Pooh. And as readers find out in Canadian author Lindsay Mattick‘s new picture book “Finding Winnie: The True Story of the World’s Most Famous Bear,” there really was a Christopher Robin too! Mattick, it turns out, is the great grand-daughter of that Canadian veterinarian and knew her family’s story needed to be told.

“At some point, I knew I was going to have a child and I thought, there was no better way to explain to them this amazing family story than to do it as a picture book,” Mattick tells Here & Now’s Robin Young. “And so when I found out I was pregnant a few years ago, I basically had this nine month kind of deadline to take my first crack at writing a picture book.”

MORE AT LINK

SO EVEN OUT OF THE MOST HORRIBLE CONFLICT MAN HAS INFLICTED UPON FELLOW MAN, A STORY OF GENTLENESS, HOPE, AND NEW LIFE WAS BORN...

Demeter

(85,373 posts)In fact, she was so tame that children were allowed into her cage to play with her! As Christopher did....

He named his teddy bear after his real-life bear playmate.

The Pooh came from the sound of Christopher blowing swan's down off his bear....

and so, Winnie the Pooh was born, to live forever. As was Christopher Robin Milne.

Demeter

(85,373 posts)Demeter

(85,373 posts)Demeter

(85,373 posts)Demeter

(85,373 posts)The first Armistice Day was held at Buckingham Palace, commencing with King George V hosting a "Banquet in Honour of The President of the French Republic" during the evening hours of 10 November 1919. The first official Armistice Day events were subsequently held in the grounds of Buckingham Palace on the morning of 11 November 1919. This would set the trend for a day of Remembrance for decades to come.

Most countries changed the name of the holiday just prior to or after World War II, to honor veterans of that and subsequent conflicts. Most member states of the Commonwealth of Nations, like United Kingdom and (as Canada in 1931), adopted the name Remembrance Day, while the United States chose All Veterans Day (later shortened to 'Veterans Day') to explicitly honor military veterans, including those participating in other conflicts. "Armistice Day" remains the name of the holiday in France and Belgium, and it has been a statutory holiday in Serbia since 2012. In New Zealand, observance ceremonies take place but the day is not a public holiday.

In many parts of the world, people observe a one or more commonly a two-minute moment of silence at 11:00 a.m. local time as a sign of respect in the first minute for the roughly 20 million people who died in the war, and in the second minute dedicated to the living left behind, generally understood to be wives, children and families left behind but deeply affected by the conflict. The two minute silence was proposed to Lord Milner by South African Sir Percy Fitzpatrick in 1919. This had been the practice in Cape Town from May 1918, although it had quickly spread through the Empire after a Reuters correspondent cabled a description of this daily ritual.

From the outset, many veterans in many countries have also used silence to pay homage to departed comrades. The toast of "Fallen" or "Absent Comrades" has always been honoured in silence at New Zealand veteran functions, while the news of a member’s death has similarly been observed in silence at meetings.

Similar ceremonies developed in other countries during the inter-war period. In South Africa, for example, the Memorable Order of Tin Hats had by the late 1920s developed a ceremony whereby the toast of "Fallen Comrades" was observed not only in silence but darkness, all except for the "Light of Remembrance", with the ceremony ending with the Order’s anthem "Old Soldiers Never Die". In Australia, meanwhile, the South Australian State Branch of the Returned Sailors & Soldiers' Imperial League of Australia similarly developed during the interwar period a simple ceremony of silence for departed comrades at 9 p.m., presumably to coincide with the traditional 11:00 a.m. time for Armistice ceremonies taking place in Europe (due to the ten-hour time difference between Eastern Australia and Europe).

In Britain, beginning in 1939, the two-minute silence was moved to the Sunday nearest to 11 November in order not to interfere with wartime production should 11 November fall on a weekday. After the end of World War II, most Armistice Day events were moved to the nearest Sunday and began to commemorate both World Wars. The change was made in many Commonwealth countries, as well as Britain, and the new commemoration was named Remembrance Sunday or Remembrance Day. Both Armistice Day and Remembrance Sunday are now commemorated formally in Britain. In recent years Armistice Day has become increasingly recognised, and many people now attend the 11:00 a.m. ceremony at the Cenotaph in London - an event organised by The Western Front Association, a British charity dedicated to perpetuating the memory of those who served in the First World War.

In the U.S., the function of Veterans Day is subtly different from that of other 11 November holidays. Instead of specifically honoring war dead, Veterans Day honors all American veterans living and dead. The official national remembrance of those killed in action is Memorial Day, originally called 'Decoration Day', from the practice of decorating the graves of soldiers, which originated in the years immediately following the American Civil War.

Demeter

(85,373 posts)REALLY? WE'LL SEE AT CHRISTMAS SALES TIME, WON'T WE? GOING BY THE AMAZING SALES IN GROCERY STORES, I AM GOING TO SCOFF.

http://fortune.com/2015/11/06/average-pay/?xid=yahoo_fortune

Janet Yellen and the Fed are thrilled.

Friday’s jobs report was an upside surprise, with job growth surging, the unemployment rate falling, and most important, average hourly earnings rising at twice as fast as economists had expected they would.

Average per-hour pay increased rose 9 cents to to $25.20, which brought the year-over-year increase in hourly pay to 2.5%. A year ago, average hourly pay was rising just 2%, and so this dynamic gives evidence to Janet Yellen and Federal Reserve’s theory that as the unemployment rate falls, wage growth will start to pick up more quickly.

As Jim O’Sullivan, Chief Economist with High Frequency Economics, wrote in a note to clients, these wage increases are one of the more salient bits of data in the report. Referring to Janet Yellen and the Federal Reserve’s desire to raise interest rates starting in December, O’Sullivan writes, “The case for tightening in December–and a lot more in 2016–looks increasingly strong.”

MORE RAH-RAH, SIS-BOOM-BAH AT LINK

I THINK SHE WILL, AND I THINK WE CRASH COMPLETELY, SHORTLY AFTER. IT'S GOING TO BE A HELL OF AN ELECTION!

Demeter

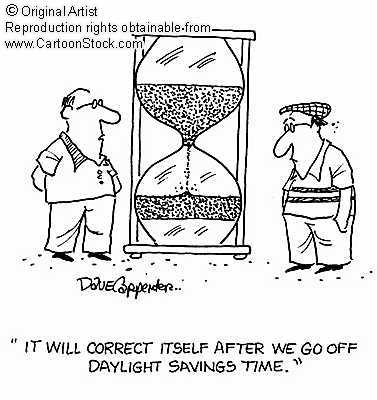

(85,373 posts)...remember what a hassle daylight saving time actually is. When clocks leap forward in the spring, researchers have found, rates of heart attacks,traffic accidents, and workplace injuries tend to increase slightly — likely the effect of millions of people's bodies being forced to adjust to the missing hour of sleep. Workplace productivity, meanwhile, tends to decrease. Then there's the hassle of adjusting again in the fall.

These problems have led some people, sick of changing their clocks twice a year, to call for the end of daylight saving. They point out that the practice doesn't even appear to save any energy — one of its original purposes.

But the real solution here isn't abolishing daylight saving. It's making it a year-round affair. In an ideal world, we'd leave our clocks exactly as they are on Sunday — and then keep them that way forever.

Why we shift our clocks back and forth

The simplest way of thinking of daylight saving time (DST) is that it's a coordinated, official way of getting us to all wake up an hour earlier than we would otherwise — "saving" daylight, rather than sleeping through it. It means one hour less light in the mornings (before most of us go to work or school) and one extra hour of light in the evenings (after most of us are done and heading home).

Daylight saving time was first formally proposed way back in 1895 by a New Zealand entomologist named George Vernon Hudson, who realized that shifting clocks forward an hour would give him more time to collect insects in the evenings.

In the United States, the idea was formally adopted during World War I as part of an effort to save fuel, which was especially scarce. But it was only done during the summer — otherwise, farmers would have to wake up and begin farming in the dark to be on the same schedule as everyone else...

AND I SAY...SCREW IT! MICHIGAN IS ON DAYLIGHT SAVINGS TIME ALL THE TIME, THANKS TO FOLLOWING THE EASTERN TIMEZONE. THE LEGISLATURE HAS A BILL TO CUT IT OUT. I'M ALL FOR LEAVING THE DAMN CLOCKS ALONE. WE CAN STAY ON EASTERN, BUT THE FOOLISHNESS HAS GOT TO STOP.

WHAT CAN I SAY...PEOPLE WERE IGNORANT, 100 YEARS AGO, EVEN MORE THAN THEY ARE NOW, HARD AS IT MAY BE TO BELIEVE.

Demeter

(85,373 posts)MyRA, the Obama administration's free, guaranteed-return starter retirement account, launched nationwide on Wednesday...plan will be available for those earning a single income below $131,000 a year or $193,000 for married couples

The government-backed plan is an option for the tens of millions of U.S. workers whose employers don't offer a retirement savings plan. MyRA accounts are open to anyone earning an annual salary of less than $131,000, or $193,000 if they are married and file taxes jointly. There is no minimum to open an account, as with an IRA, and no fee to open one. Payments can go into the plan automatically, directly from a checking or savings account, or from an employer's payroll system, via direct deposit. Any or all of a federal tax refund can be directed into a MyRA account, which is portable from employer to employer.

(More: Comerica picked to help manage Obama's retirement savings program)

RISK FREE

A myRA (My Retirement Account) won't return nearly what a stock fund is likely to return over time, but workers face no risk of losing their nest egg. MyRAs will invest only in a Treasury security guaranteed never to lose value. Users can access the money for emergencies. In short, it operates a lot like a 401(k) — albeit without that crucial match that companies may make on employee contributions — but is effectively a Roth IRA with contributions of after-tax money that can be withdrawn, tax-free, in retirement.

The myRA.gov website notes that "interest earned is the same rate as investments in the Government Securities Fund, which earned an average annual return of 3.19% over the 10-year period ending December 2014." Over the past five years, that rate has dropped to a little over 2%, said Treasury officials, noting that "the rate is dramatically higher than what people are able to earn on savings accounts."

Savers can put away up to $5,500 a year, and those who are at least 50 by year-end can contribute as much as $6,500. The guaranteed return lasts until they accumulate $15,000 in the plan or have been in myRA for 30 years, when they will need to move the money into a private sector product such as a Roth. They're also free to move the money out of myRA and into an outside retirement product at any prior time.

'LONG TIME COMING'

"This has been a long time in coming," said Olivia Mitchell, professor of business economics and public policy at the Wharton School and director of the Pension Research Council. "Yet it's just a first step, and more needs to be done to enhance retirement security for an ever longer-lived population."

David John, a senior strategic policy adviser at retirement organization AARP's Public Policy Institute, said myRA is a good tool but not the solution to a “desperate need for additional ways to save for retirement.” MyRA will help many people get started in saving, he said, “but people also need to be able to roll over money into a regular retirement plan, whether it's a state-sponsored plan or that of an employer." And only about half of U.S. employers, especially in the small business area, offer such a plan.

Treasury Secretary Jack Lew noted in a news conference that "we have been very clear that this is a start, not a finish. People will never build up the retirement savings they need if they don't start."

Treasury officials also noted that "the goal of the program is continuous improvement" and that additional features are planned.

The plan to start MyRA (My Retirement Account) was announced by the administration in the president's State of the Union Address in 2014 and has been in a pilot program with a small group of employers since late last year.

WOW-WHEE! $15,000! THAT MIGHT PAY ONE YEAR'S MEDICARE PREMIUMS....

COMMENTS FROM PAGE:

HAHAHAHAHAHAHA....Prediction: one year from now "myRA falls flat....fails to attract investors".

BillyBob concernedcitizen01 • 19 hours ago

Yes, it will fail, and as they say, it's the just first step. Next step is they'll add the bonds to 401ks, next step is the bonds are your 401k.

How absolutely embarrassed I am that I renewed my FPA membership. I just saw the president say this is a great tool for retirement. Clueless.

Goodguy6410 concernedcitizen01 • 3 days ago

It WILL fail to attract investors because 1) no one is getting paid to actively promote it and 2) it pays next to nothing. But here's the REAL purpose: this vehicle will ultimately be forced on everyone. There will be NO private sector IRAs in the future. This is Phase One of the takeover of all retirement assets by the government who, exactly like social security, will spend the money and issue de facto "IOUs" without any backing. Watch.

wkb4447 Goodguy6410 • 2 days ago

Regrettably, you may be right...unless legislation specifically prohibits the government from doing so. California tried to do this with the Pubic Employee Retirement System (PERS) some years back and were ultimately kept from doing so by the State Supreme Court. But, the federal system is an entirely different matter. We've seen what has happened with Social Security...

Showing my age concernedcitizen01 • 3 days ago

Well, the 1-year pilot is over, and it didn't fall flat yet. However, I would love to know the enrollment numbers.

Also, the cost of the program can't be worth it, so I expect it to be defunded in 2017.

BillyBob Showing my age • 19 hours ago

I'm curious what government program ever is allowed to fall flat? You understand they have a printing press, yes? You understand that government egos are more important than retirement security?

If you answered no, you may be interested to know that scientists for years have been able to predict years in advance which drugs the FDA would withdraw after approval. They know because they know how many people are dying on them and they know the egos will eventually crumble after so many thousand deaths.

Great work promoting financial planning over products FPA! Promote retirement insecurity through savings bonds!

wkb4447 Showing my age • 2 days ago

A possible solution promoted at the worst time possible. Although no one wants to admit it, 2008 did irreparable harm to our entire economic system from top to bottom. We are still at dangerous risk from another "correction". The only question is how hard will the "landing" be and how long will it last.

BillyBob wkb4447 • 19 hours ago

Your government did damage to the economic system before, during, and after 2008. There is no damage. There are favored firms, and a government continuously not following the rules.

myRA was a trademark btw. Nice work following your own trademark laws.

disqus_uGEMEQRnet • 3 days ago

A) Can the investor expect protection if something goes wrong?

B) Can anyone expect long term Treasury yields to hedge real inflation?

C) Will the administration of these plans be better than Obamacare?

D) Seeing what has happened to SS does anyone trust the government?

F) Apply this letter if it should be the governments performance grade.

wkb4447 disqus_uGEMEQRnet • 2 days ago

A) Not really, but you can pretend.

B) Yes, on alternating Tuesdays during leap year.

C) What could possibly be better administered than Obamacare?

D) Actually, SSA is no longer administered the way it used to be, so it really is now a matter of faith, not trust.

E) Whoa, now you've gone way to far. The government hasn't had a performance review for years. Performance reviews were deemed statistically irrelevant for government many years ago. John Adams was President.

Demeter

(85,373 posts)U.S. prosecutors and the commodities regulator have asked some banks to provide information in connection with a broad probe into whether their traders rigged auctions on government debt, the Wall Street Journal reported, citing people familiar with the matter.

The prosecutors at the Fraud Section at the Justice Department and investigators at the Commodity Futures Trading Commission (CFTC) sent the requests to many of the banks that serve as primary dealers, which are authorized to deal directly with the government on the sale of Treasury bonds, the newspaper reported. (on.wsj.com/1P8hJAA)

The list of primary dealers includes Goldman Sachs Group Inc , as well as other Wall Street banks and many of their European and Asian counterparts. There are 22 primary dealers, but it is not clear whether all of those firms received the requests, the paper said.

The involvement of the CFTC suggests investigators are examining futures trading that occurs ahead of and around Treasury auctions. However, it is not clear why the DoJ's Fraud Section is taking the lead on the inquiry, but indicates prosecutors are focused on allegations of manipulation, rather than collusion, the newspaper said.

Demeter

(85,373 posts)ALL THE BANKSTERS ARE DUMPING ASSETS--WERE THEY NON-PERFORMING, OR A WAY TO RAISE THE CAPITAL?

http://www.reuters.com/article/2015/11/03/us-bank-of-america-blackrock-funds-idUSKCN0SS1HJ20151103

Bank of America Corp, the No. 2 U.S. bank, has agreed to sell its $87 billion money-market fund business to BlackRock Inc in one of the cash-management industry's largest deals ever. The transaction comes as big banks have faced pressure to simplify their businesses since the global financial crisis and marks the largest in a series of deals reshuffling the cash-management industry before costly regulatory reforms take effect in 2016.

Terms of the transaction were not disclosed. The agreement is expected to lift BlackRock's global cash-management business to $372 billion from about $285 billion, according to the New York-based company. BlackRock, a manager of mutual funds, exchange-traded funds, private equity pools and other investment products, is already the world's largest money manager with $4.5 trillion in assets. YOUR SHADOW BANKING SYSTEM AT WORK

"Combining our business together with the Bank of America assets and distribution puts us in a unique competitive position," said Tom Callahan, co-head of global cash management at BlackRock, in an interview.

"It's a challenge managing cash in a low interest-rate environment, so we have to be highly efficient."

BlackRock's heft is partly the result of similar acquisitions, including Merrill Lynch's investment management business in 2006. Merrill was later acquired by Bank of America and remains a major distributor of BlackRock products to individual investors and institutions.

"This transaction is consistent with Bank of America’s ongoing efforts to simplify its business, in this instance, by outsourcing certain product manufacturing functions to an industry leader," said Bank of America spokeswoman Susan McCabe. She added that the bank will focus on distributing money market funds from BlackRock and other third-party providers.

The profitability of money-market funds, which invest in relatively low-risk corporate and government debt that can be paid back within days or weeks, has been hemmed in by U.S. interest rates hovering near zero. Mergers and acquisitions trimmed the money funds industry from 75 providers in the United States last summer to just 67 this year, according to Crane Data, an industry research service.

Once the deal closes next year, BlackRock will leapfrog JPMorgan Chase & Co to become the second largest money fund family, behind Fidelity Investments, according to Peter Crane of the research service. The $2.7 trillion industry has lost some $30 billion in revenue since 2009, according to trade group Investment Company Institute, after slashing fees to prevent investors from losing money in an era of rock-bottom interest rates. The funds are expected to face increasingly stiff competition for a dwindling supply of the lowest-risk debt. A set of reforms adopted last year by the Securities and Exchange Commission requires money-market funds that serve institutional investors let their asset values stray from the typical $1 per share unless the funds invest primarily in government securities. Some $200 billion in funds have announced plans to invest primarily in government-backed debt.

"Everybody has been talking about consolidation for years, but it really didn't happen until today," said Crane. "So many large players have resisted getting out of the business until now, but it's just a matter of the costs and uncertainty of money fund reforms proving to be overwhelming to some players."

Crane said Bank of America's decision came after an evaluation of which businesses were essential.

"At the same time asset managers are trying to get bigger, banks are trying to get smaller," he said. "This reflects regulatory pressure on both sides."

The deal is subject to regulatory and fund shareholder approvals.

Demeter

(85,373 posts)Fifteen of the biggest players in the $14 trillion market for credit insurance are also the referees.

Firms such as JPMorgan Chase & Co. and Goldman Sachs Group Inc. wrote the rules, are the dominant buyers and sellers and, ultimately, help decide winners and losers.

Has a country such as Argentina paid what it owes? Has a company like Caesars Entertainment Corp. kept up with its bills? When the question comes up, the 15 firms meet on a conference call to decide whether a default has triggered a payout of the bond insurance, called a credit-default swap. Investors use CDS to protect themselves from missed debt payments or profit from them.

Once the 15 firms decide that a default has taken place, they effectively determine how much money will change hands.

And now, seven years after the financial crisis first brought CDS to widespread attention, pressure is growing inside and outside what’s called the determinations committee to tackle conflicts of interest, according to interviews with three dozen people with direct knowledge of the panel’s functioning who asked that their names not be used. Scandals that exposed how bank traders rigged key interest rates and fixed currency values have given ammunition to those who say CDS may also be susceptible to collusion or, worse, outright manipulation...

CLUTCHES PEARLS---"QUICK, MY FAINTING COUCH!"

SO MUCH MORE AT LINK

Demeter

(85,373 posts)Walt Disney Co., which triggered a selloff in media stocks three months ago with a warning about subscriber losses at ESPN, posted fourth-quarter earnings that beat analysts’ estimates as profit from cable networks and motion pictures rose. Earnings rose to $1.20 a share, excluding items, Burbank, California-based Disney said Thursday in a statement, beating the $1.14 average of 28 analysts’ estimates. The shares rose as much as 3.3 percent Friday in New York.

The results follow reports this week from Time Warner Inc. and 21st Century Fox Inc. that reignited investor fears that the pay-TV industry is losing ground to lower-cost streaming services such as Netflix Inc. Media stocks tumbled, as they did in August when Disney cut the long-term profit growth forecast for cable networks including ESPN. This time, cable networks were a bright spot for Disney.

The company has been cutting costs, most notably at its ESPN sports networks, which eliminated almost 300 jobs last month. Disney also introduced DisneyLife, a $15-a-month online service in the U.K. that shows archived children’s movies and TV shows. The company plans to expand that in Europe.

“We’re very proud of this product,” Chief Executive Officer Bob Iger said on a conference call with analysts. “It definitely speaks to where we’re going as a company and we see opportunities to grow the concept across other markets and perhaps other brands in the future.”

*****

Disney’s parks and resorts division posted a 7 percent increase in profit to $738 million, as revenue advanced 10 percent to $4.36 billion. The domestic parks attracted a higher number of guests and they spent more when they arrived, the company said. Lower attendance at Hong Kong Disneyland, higher costs at Disneyland Paris and pre-opening costs for Shanghai Disney Resort held back profit growth for the division. New attractions in the Disney parks will increase total capital spending by $800 million in fiscal 2016, the company said.

Earnings at the ABC broadcast division gained 1 percent to $164 million, while revenue was up 10 percent to $1.58 billion.

Revenue from film entertainment was flat at $1.78 billion. Profit doubled to $530 million on growth from TV and streaming video, fewer write-offs of films that didn’t do well, stronger theatrical results and a bigger share of consumer product revenue from movie related merchandise.

The consumer products division boosted sales by 11 percent to $1.2 billion, while profit was 10 percent higher at $416 million. The interactive division earned $31 million on 4 percent lower revenue.

The results don’t include merchandise sales from “Star Wars: The Force Awakens,” even though such toys and gadgets went on sale Sept. 4. Accounting rules require the company to wait until the film’s December release before actually booking the results, Christine McCarthy, Disney’s chief financial officer, said on the call.

Net income for the quarter, including a $399 million expense related to the bailout of Disneyland Paris, increased 7.3 percent to $1.61 billion, or 95 cents a share, Disney said.

Demeter

(85,373 posts)SHALL WE TAKE UP A COLLECTION?

http://www.bloomberg.com/news/articles/2015-11-06/a-wal-mart-heir-is-27-billion-poorer-than-everyone-calculated

Ever since Wal-Mart heir John T. Walton died 10 years ago in a plane crash, it’s been widely assumed that he passed the bulk of his vast estate to his widow, Christy.

Turns out that was very wrong.

In what’s been a closely guarded family secret, Walton gave half of his then-$17 billion estimated fortune to charitable trusts and a third to their only child, Lukas Walton, now 29, an analysis of court documents reveals. Christy got the rest.

The filings, unsealed by a Wyoming court at Bloomberg News’s request, mean that Christy’s fortune as previously calculated has taken a big hit -- from $32 billion before the court records were unsealed to about $5 billion now. She’s unlikely to ever again reach her former designation as America’s richest woman, which she held until last month.

But her loss is Lukas’s gain. Though little-known outside of a few scattered social media posts, he becomes the 103rd-richest person in the world, with about $11 billion -- and as much as $25 billion if certain trusts are included, according to the Bloomberg Billionaires Index.

That makes the grandson of Wal-Mart founder Sam Walton $5.5 billion richer than his 66-year-old mother, and the fourth-wealthiest member of the Walton family. His net worth is higher than the likes of Google executive Eric Schmidt and money manager John Paulson...

Demeter

(85,373 posts)New rules proposed by international banking regulators would severely reduce, and possibly eliminate, banks’ profitability in trading bonds that finance everything from home loans and apartment mortgages to auto loans and student debt, according to JPMorgan Chase & Co.

The rules, expected to be finalized in December by the Basel Committee for Banking Supervision, impact nearly all forms of securitized debt, and may force banks to “completely rethink” their market-making activity for asset-backed securities, JPMorgan analysts John Sim, Amy Sze and Meghan Kelleher wrote in a note to clients on Monday.

“There is no sector that escapes unscathed,” the analysts wrote. “Liquidity, which in many of our markets is at best anemic, would become non-existent.”

Banks would have to hold more capital for assets in their trading books, and in some cases, account for potential shocks in credit spreads by up to 34 percent, according to risk weightings outlined in a July 2015 impact study released by the Basel committee...

Demeter

(85,373 posts)Warren Buffett’s Berkshire Hathaway Inc. said third-quarter profit doubled on a one-time investment gain in Kraft Heinz Co.

Net income climbed to a record $9.43 billion, or $5,737 a share, from $4.62 billion, or $2,811, a year earlier, the Omaha, Nebraska-based company said in a statement Friday. Operating earnings, which exclude some investment results, were $2,769 a share, beating the $2,721 average estimate of three analysts surveyed by Bloomberg.

The results show how lucrative Berkshire’s relationship has been with 3G Capital. Buffett, 85, teamed with the investment firm in 2013 to buy ketchup maker H.J. Heinz and embarked on an aggressive cost-cutting drive to boost margins. Then, in March, they engineered Heinz’s purchase of Kraft Foods Group Inc., creating the third-biggest food and beverage company in North America and a $4.4 billion windfall for Berkshire.

“It shows shrewd investing on his part,” James Armstrong, who oversees about $550 million including shares of Berkshire as president of Henry H. Armstrong Associates, said before the earnings announcement. “The old guy still has some smarts upstairs.”

Book value, a measure of assets minus liabilities, rose almost 1 percent from June 30 to $151,083 a share....

Demeter

(85,373 posts)JPMorgan Chase & Co., Bank of America Corp. and Citigroup Inc. are among eight large U.S. banks that may have credit grades cut by Standard & Poor’s on the prospect that the U.S. government is less likely to provide aid in a crisis. The companies -- along with Wells Fargo & Co., Goldman Sachs Group Inc., Morgan Stanley, Bank of New York Mellon Corp. and State Street Corp. -- had senior unsecured and nondeferrable subordinated debt ratings placed on negative credit watch, S&P said Monday in a statement. S&P said it expects to resolve the credit reviews by early December.

The Federal Reserve approved a rule last week that will require large U.S. banks to hold a stockpile of debt that can be converted into equity if they falter. The rule on total loss-absorbing capacity, or TLAC, is a key part of regulators’ efforts to avoid another financial crisis.

“The action reflects our belief that U.S. regulators have made further progress and provided more clarity in enhancing their plans for resolving systemically important institutions,” S&P said in its statement. That lowers “the probability that the U.S. government would provide extraordinary support to these institutions to enable them to remain viable.”

Bond Performance

Bonds of U.S. banks have gained 2.03 percent in 2015, compared with a 4.7 percent return in the corresponding period last year, Bank of America Merrill Lynch index data show. The debt has gained 1.08 percent since the end of August, compared with 0.9 percent for dollar-denominated investment-grade corporates.

Because the bank’s creditors would end up providing support under the Fed’s rule, S&P said it’s taking no negative actions on the eight banks’ operating entities. The ratings firm placed "core and highly strategic operating subsidiaries" of Bank of America, Citigroup, Goldman Sachs, and Morgan Stanley on credit watch positive. That review includes issuer credit ratings and senior unsecured debt ratings...

Demeter

(85,373 posts)WOULD IT HAVE BEEN A BETTER TAX MOVE TO GIFT THEM TO MUSEUMS?

DETROIT AREA BILLIONAIRE...HIS REPUTATION IS RUINED! PICKED A BAD TIME TO DIE, IMO. DEFLATION IS COMING TO THE ART WORLD!

http://www.bloomberg.com/news/articles/2015-11-06/sotheby-s-a-alfred-taubman-sale-top-10-lots-results

On Wednesday and Thursday, 200 art objects from the late billionaire Alfred Taubman's estate sold for a total of $419.7 million. For many (most?) human beings on the planet, a few hundred objects netting close to half a billion dollars would be cause for celebration. Among the art world's dealer/adviser/journalist class, however, the sale occasioned hand-wringing and recrimination.

The problem lay in the fact that Sotheby's had reportedly guaranteed the sale of Taubman's 500-piece collection (more art will be sold later) for an unprecedented $500 million. The guarantee, which was a record in the art world, came about because of a reported bidding war between Sotheby's and its rival auction house, Christie's. Taubman was the onetime chairman of Sotheby's (a price-fixing scandal sent him briefly to jail and put an end to his tenure), and so, from the outside at least, it appeared that the auction house had to do anything—even saddle itself with a $500 million bet—to represent the sale of its ex-chairman. As a result, if the art sold for less than that guaranteed amount, they would actually lose money.

After the first two sales, Sotheby's has yet to break even, prompting Chief Executive Tad Smith to issue a statement that he expects "to cover the Taubman guarantee in its entirety." On Wednesday night, the first sale netted $377 million for 77 lots, barely above the night's aggressive low estimate. The next day, a larger sale of 123 lower-priced lots netted $42.7 million, which came close to the high estimate. (Totals include buyer's premiums, which are an additional fee that auction houses tack on to an object's hammer price; the estimates do not.)

MORE AT LINK

Demeter

(85,373 posts)Earlier this week the ad tech company AppNexus announced what it described as a major innovation: It would allow advertisers to pay only for those digital ads that are actually seen by people. To those uninitiated in the ways of programmatic advertising, this might seem like table stakes. Given all the talk about sophisticated tracking and targeting associated with digital ads, finding out which ones get viewed should be simple. But most industry studies estimate that only about half of digital ads are seen by real people.

AppNexus is not the only company trying to change that. Last month Google said advertisers using the Google Display Network wouldn’t be charged if their ads weren’t seen by people, and this week it began allowing third-party auditors to double-check Google’s own claims about the viewability of ads on YouTube. Facebook recently made a similar move. With the ad tech companies getting in line, it would seem the days of paying for digital ads no one sees are almost over. Brian O’Kelley, the chief executive of AppNexus, doesn't think so. He says that he won't force advertisers to buy only those ads that are seen by people, and he predicts that some will decide against it. According to O'Kelley, it will be several years before the market for nonvisible ads dries up.

Advertisers have always paid to place ads that they know people aren’t seeing. An ad in the back of the New Yorker costs less than that one next to the table of contents because fewer people will look at the page it's on. Online, an ad at the bottom of a page is cheaper than one at the top. The difference with Web ads is that it's technically possible to find out exactly how few people see it. Ads at the bottom of Web pages will survive for a while, O'Kelley says, because advertisers have developed a taste for the cheapest option available. Programmatic advertising auctions have put a downward pressure on ad rates as measured by CPMs, or cost per thousand times an ad is shown, and marketers have got used to the low prices. The problem is that the CPM metric measures page impressions but not always whether someone has actually scrolled down to where the ad is shown.

Buying ads that no one sees can obviously be a huge waste for advertisers. But not all people in the industry see getting rid of waste as their primary incentive. Specifically, says O’Kelley, ad agencies often have to promise advertisers lower ad rates as a way to land competitive deals. “That pushes agencies to do really weird things,” he said. “One really interesting aspect of this is that procurement for marketers may effectively be forcing agencies to buy nonviewable impressions.” Advertisers are preserving the status quo by choosing cheap ads that don't work well, said Ian Schafer, founder and chairman of the ad agency Deep Focus. "As technology improves, there’s no reason to live with that lower quality. You’re talking about a transitional period,” Schafer said.

MORE ANGELS DANCING ON THE HEAD OF A PIN AT LINK

Demeter

(85,373 posts)Mortgage giant Fannie Mae reported net income of $2 billion for the July-September period, down from $3.9 billion a year earlier.

The government-controlled company attributed the third-quarter decline in profit mainly to losses on the investments it uses to hedge against swings in interest rates.

Nonetheless, the results posted Thursday marked the 15th straight profitable quarter for Washington-based Fannie Mae.

Fannie said it will pay a dividend of $2.2 billion to the U.S. Treasury next month. With that payment, Fannie will have paid a total $144.8 billion in dividends...

Demeter

(85,373 posts)The European Central Bank will decide at its next meeting whether its asset-purchase programme can counter a global economic slowdown or needs to be ramped up, its president said on Thursday.

"We need to examine whether, with a weakening of the global economy, it (the programme) is also effective in countering headwinds that could hamper a return to price stability in the medium term," Mario Draghi said at an academic event in Milan.

"If we were to become convinced that this is not the case, we will examine ways in which to intensify it (the programme) to achieve our objective."

WHAT A CROCK!

Demeter

(85,373 posts)A Scottish man has been indicted by a federal grand jury in San Francisco for posing on Twitter as influential short-selling firms and sending bogus tweets that drove down the stock prices of two companies, in an effort to profit from illegal trading. The U.S. Department of Justice said James Alan Craig, 62, of Dunragit, Scotland, was charged with one count of securities fraud. A similar charge was filed by the U.S. Securities and Exchange Commission in a related civil case.

Thursday's charges mark the latest effort by U.S. authorities to crack down on using social media to commit stock market fraud. Craig's whereabouts could not immediately be determined and it is unclear whether he has hired a lawyer. Authorities said Craig in January 2013 created Twitter accounts that appeared to belong to Muddy Waters Research and Citron Research, carrying the handles @Mudd1Waters and @citronresearc and the logos of both firms.

Craig allegedly then falsely tweeted that technology company Audience Inc and biopharmaceutical company Sarepta Therapeutics Inc faced federal investigations, driving down their share prices by a respective 28 percent and 16 percent. Thereafter, Craig used his girlfriend's brokerage account to buy the companies' shares at depressed prices, hoping to sell them later after they rebounded, authorities said.

The Justice Department said the tweets cost shareholders about $1.6 million of losses. Nonetheless, the SEC said Craig's effort to profit from big price swings ultimately proved "largely unsuccessful."

Muddy Waters and Citron, which is run by the investor Andrew Left, said at the time that the suspect tweets were not theirs...

Demeter

(85,373 posts)I'll try to make my escape tonight....have a good day, y'all!

antigop

(12,778 posts)Based on Jaroslav Hašek's satiric novel The Good Soldier Švejk, the musical focuses on a naive and idealistic young man who, despite his pacifist views, leaves his sweetheart Minny Belle Tompkins to fight in Europe in World War I. He first tries to stop the war after meeting a young German sniper of the same name, who believes that the soldiers must unite. However, the commanders of the allied forces intend to use the discontent with the war among the German soldiers as a perfect time to advance in the war. Johnny then manages to bring the skirmish to a temporary halt by incapacitating a meeting of the generals with laughing gas, but once they recover they promptly reinstate the war, resulting in hundreds of thousands of fatalities. Meanwhile Johnny finds himself committed to an asylum for ten years. He returns home to discover Minny Belle has married a capitalist, and he settles down as a toymaker who will create anything except tin soldiers, his personal gesture of peace in an increasingly warlike society.

Its title was inspired by the fact the name appeared on United States casualty rolls more often than any other.[1]

The play was written and composed by Green and Weill during the summer of 1936 in a rented old house located in Nichols, Connecticut near the summer rehearsal headquarters of the Group Theatre at Pine Brook Country Club.[2][3]

Playlist here:

&list=PLg9slclv_IRBukAv9CUDr8ixX3CIO4Uen

antigop

(12,778 posts)From Wildhorn's "Civil War", but gets to me every time.

lyrics: http://musicals.lyricsallsongs.com/civil-war/i-never-knew-his-name.html

MattSh

(3,714 posts)When Moscow puts on a parade, they never fail to entertain, but there's often a message involved too.