Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Economy

Related: About this forumSTOCK MARKET WATCH -- Tuesday, 22 December 2015

[font size=3]STOCK MARKET WATCH, Tuesday, 22 December 2015[font color=black][/font]

SMW for 21 December 2015

AT THE CLOSING BELL ON 21 December 2015

[center][font color=green]

Dow Jones 17,251.62 +123.07 (0.72%)

S&P 500 2,021.15 +15.60 (0.78%)

Nasdaq 4,968.92 +45.84 (0.93%)

[font color=black]10 Year 2.19% 0.00 (0.00%)

[font color=red]30 Year 2.92% +0.01 (0.34%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

12/17/15 Martin Shkreli, former CEO Turing Pharmaceuticals and notorious price gouger, arrested on securities fraud charges. Posted $5M bail, resigned as CEO.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

14 replies, 1387 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (9)

ReplyReply to this post

14 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

STOCK MARKET WATCH -- Tuesday, 22 December 2015 (Original Post)

Tansy_Gold

Dec 2015

OP

Drone owners get Christmas surprise from FAA: you will have to register to fly

Proserpina

Dec 2015

#7

I think they hate the thought of localized aerial bombardment (and snooping) worse

Proserpina

Dec 2015

#10

Proserpina

(2,352 posts)1. 8 Terrible Things About the Trans-Pacific Partnership

Only 8? It’s no wonder the Obama administration tried to keep this secret—the corporate-friendly trade agreement, decoded.

http://inthesetimes.com/article/18695/TPP_Free-Trade_Globalization_Obama

In October, President Obama hailed the proposed Trans-Pacific Partnership (TPP) as “the most progressive trade deal in history.”

But progressive public-interest organizations say that the final text, the fruit of seven years of secretive trade talks between the United States and 11 other Pacific Rim countries, dashed even their low expectations. The deal not only continues most of the troubling features of trade agreements since NAFTA but also breaks worrisome new ground.

Like most recent international economic agreements, the TPP only glancingly resembles a classic trade deal, concerned mainly with tariffs and quotas. Rather, like the WTO agreements or NAFTA, it is an attempt to set the rules of the global economy to favor multinational corporations over everything else, trampling on democracy, national sovereignty and the public good. The more than 600 corporate lobbyists who had access to the draft texts used their insider status to shape the deal, while labor unions, environmentalists and others offered testimony from outside, with little impact.

Like most post-World War II trade deals, the TPP also has a strategic political goal: tying as many countries as possible to the United States as trade partners—often under terms unfavorable to the average American worker—in order to win political support against anyone seen as a rival to the American economic model. When Obama defends the TPP, he often casts it as a challenge to China’s growing role in defining the Asian economy...

#1 IT GIVES 9,200 FOREIGN FIRMS THE RIGHT TO CIRCUMVENT OUR COURTS AND ATTACK THE LAWS WE RELY ON FOR A CLEAN ENVIRONMENT, SAFE FOOD AND DECENT JOBS.

#2 ITS ENVIRONMENTAL PROTECTIONS ARE MOSTLY TOOTHLESS, AND IT WOULD DIRECTLY ENCOURAGE FRACKING.

#3 WE’D LOSE MILLIONS OF MANUFACTURING JOBS.

#4 IT DOES NOTHING TO FIX OUR ENORMOUS TRADE DEFICIT.

#5 IT WOULD MAKE MEDICINES MORE EXPENSIVE, AND COMPROMISE ACCESS FOR MANY PEOPLE IN THE PACIFIC RIM.

#6 IT WOULD COMPROMISE THE SAFETY OF OUR FOOD.

#7 IT WOULD DESTABILIZE GLOBAL FINANCE.

#8 IT WOULD STRENGTHEN ALREADY-FLAWED INTELLECTUAL PROPERTY REGULATIONS IN AWFUL WAYS, PARTICULARLY ON THE INTERNET.

details at link

http://inthesetimes.com/article/18695/TPP_Free-Trade_Globalization_Obama

In October, President Obama hailed the proposed Trans-Pacific Partnership (TPP) as “the most progressive trade deal in history.”

But progressive public-interest organizations say that the final text, the fruit of seven years of secretive trade talks between the United States and 11 other Pacific Rim countries, dashed even their low expectations. The deal not only continues most of the troubling features of trade agreements since NAFTA but also breaks worrisome new ground.

Like most recent international economic agreements, the TPP only glancingly resembles a classic trade deal, concerned mainly with tariffs and quotas. Rather, like the WTO agreements or NAFTA, it is an attempt to set the rules of the global economy to favor multinational corporations over everything else, trampling on democracy, national sovereignty and the public good. The more than 600 corporate lobbyists who had access to the draft texts used their insider status to shape the deal, while labor unions, environmentalists and others offered testimony from outside, with little impact.

Like most post-World War II trade deals, the TPP also has a strategic political goal: tying as many countries as possible to the United States as trade partners—often under terms unfavorable to the average American worker—in order to win political support against anyone seen as a rival to the American economic model. When Obama defends the TPP, he often casts it as a challenge to China’s growing role in defining the Asian economy...

#1 IT GIVES 9,200 FOREIGN FIRMS THE RIGHT TO CIRCUMVENT OUR COURTS AND ATTACK THE LAWS WE RELY ON FOR A CLEAN ENVIRONMENT, SAFE FOOD AND DECENT JOBS.

#2 ITS ENVIRONMENTAL PROTECTIONS ARE MOSTLY TOOTHLESS, AND IT WOULD DIRECTLY ENCOURAGE FRACKING.

#3 WE’D LOSE MILLIONS OF MANUFACTURING JOBS.

#4 IT DOES NOTHING TO FIX OUR ENORMOUS TRADE DEFICIT.

#5 IT WOULD MAKE MEDICINES MORE EXPENSIVE, AND COMPROMISE ACCESS FOR MANY PEOPLE IN THE PACIFIC RIM.

#6 IT WOULD COMPROMISE THE SAFETY OF OUR FOOD.

#7 IT WOULD DESTABILIZE GLOBAL FINANCE.

#8 IT WOULD STRENGTHEN ALREADY-FLAWED INTELLECTUAL PROPERTY REGULATIONS IN AWFUL WAYS, PARTICULARLY ON THE INTERNET.

details at link

Proserpina

(2,352 posts)2. Fed to raise rates again in March, follow up with fewer hikes: Reuters poll

http://www.reuters.com/article/us-usa-fed-poll-idUSKBN0U11J520151218

The U.S. Federal Reserve will raise interest rates again in the next three months, according to two-thirds of economists polled by Reuters, although many say rates won't rise as quickly next year as policymakers have suggested...

The U.S. Federal Reserve will raise interest rates again in the next three months, according to two-thirds of economists polled by Reuters, although many say rates won't rise as quickly next year as policymakers have suggested...

Proserpina

(2,352 posts)3. IMF’s Lagarde to Face Trial for ‘Negligence’ in Tapie Case

http://www.bloomberg.com/news/articles/2015-12-17/imf-s-lagarde-to-face-trial-for-tapie-case-mediapart-reports

International Monetary Fund Managing Director Christine Lagarde will be tried for “negligence” in relation to a settlement the French government reached with businessman Bernard Tapie during her time as finance minister, a French court said Thursday.

Lagarde, 59, has repeatedly denied wrongdoing and will appeal the decision to put her on trial, her lawyer said. The decision was made by a special commission of the court against the advice of the prosecutor, a court official said.

The trial concerns Lagarde’s 2008 decision to allow an arbitration process to end a dispute between Tapie, a supporter of then-French President Nicolas Sarkozy, and former state-owned bank Credit Lyonnais. The court has been looking into whether she erred in agreeing to the arbitration, which resulted in the tycoon being awarded about 403 million euros ($438 million.)

Having to face trial in France could have serious implications for Lagarde’s future at the helm of the IMF, though her job may not be in any immediate danger. Her five-year term as managing director expires in July. At the fund’s annual meeting in Lima in October, Lagarde said she’d be open to serving another term...

International Monetary Fund Managing Director Christine Lagarde will be tried for “negligence” in relation to a settlement the French government reached with businessman Bernard Tapie during her time as finance minister, a French court said Thursday.

Lagarde, 59, has repeatedly denied wrongdoing and will appeal the decision to put her on trial, her lawyer said. The decision was made by a special commission of the court against the advice of the prosecutor, a court official said.

The trial concerns Lagarde’s 2008 decision to allow an arbitration process to end a dispute between Tapie, a supporter of then-French President Nicolas Sarkozy, and former state-owned bank Credit Lyonnais. The court has been looking into whether she erred in agreeing to the arbitration, which resulted in the tycoon being awarded about 403 million euros ($438 million.)

Having to face trial in France could have serious implications for Lagarde’s future at the helm of the IMF, though her job may not be in any immediate danger. Her five-year term as managing director expires in July. At the fund’s annual meeting in Lima in October, Lagarde said she’d be open to serving another term...

Proserpina

(2,352 posts)4. Congress Approves IMF Change in Favor of Emerging Markets

http://www.bloomberg.com/news/articles/2015-12-18/congress-approves-imf-changes-giving-emerging-markets-more-sway

U.S. lawmakers approved changes to International Monetary Fund governance that will give more of a voice to emerging markets such as China and India in exchange for greater congressional oversight of the fund.

The House and Senate on Friday passed a $1.1-trillion spending plan that includes language implementing the IMF reforms, which have been awaiting congressional ratification since 2010, a delay that spurred global criticism of the U.S. President Barack Obama, who supported the change, signed the bill on Friday.

Ratification also clears the way for the Washington-based fund to begin reviewing another round of changes that could give China and other emerging markets an even bigger voting share. The IMF’s executive board is expected to consider a timetable as early as January for the next review of the institution’s share system...

more

U.S. lawmakers approved changes to International Monetary Fund governance that will give more of a voice to emerging markets such as China and India in exchange for greater congressional oversight of the fund.

The House and Senate on Friday passed a $1.1-trillion spending plan that includes language implementing the IMF reforms, which have been awaiting congressional ratification since 2010, a delay that spurred global criticism of the U.S. President Barack Obama, who supported the change, signed the bill on Friday.

Ratification also clears the way for the Washington-based fund to begin reviewing another round of changes that could give China and other emerging markets an even bigger voting share. The IMF’s executive board is expected to consider a timetable as early as January for the next review of the institution’s share system...

more

Proserpina

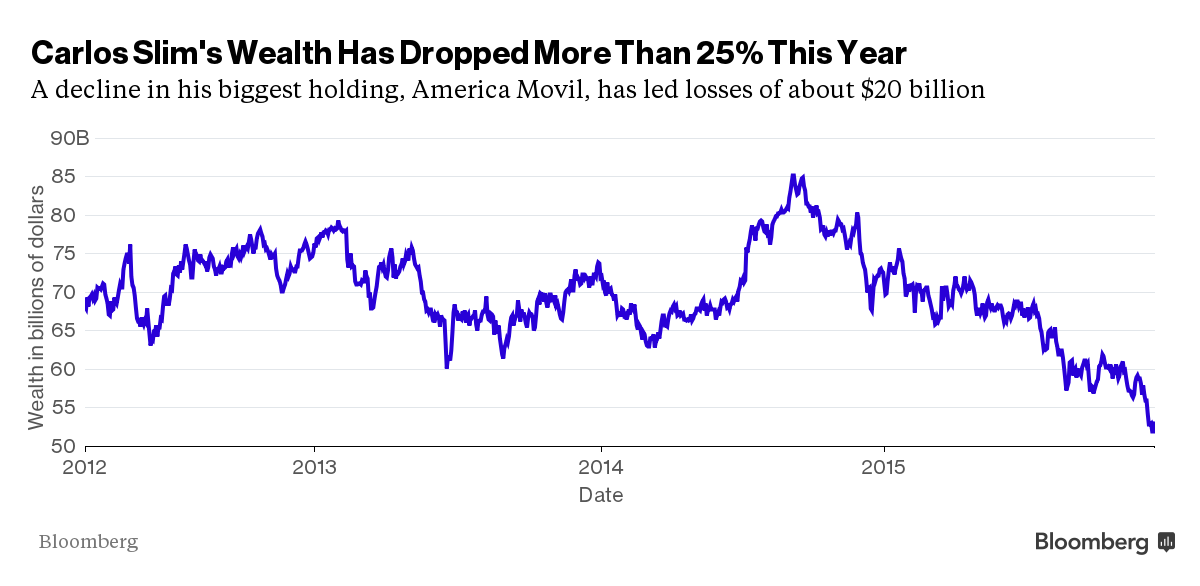

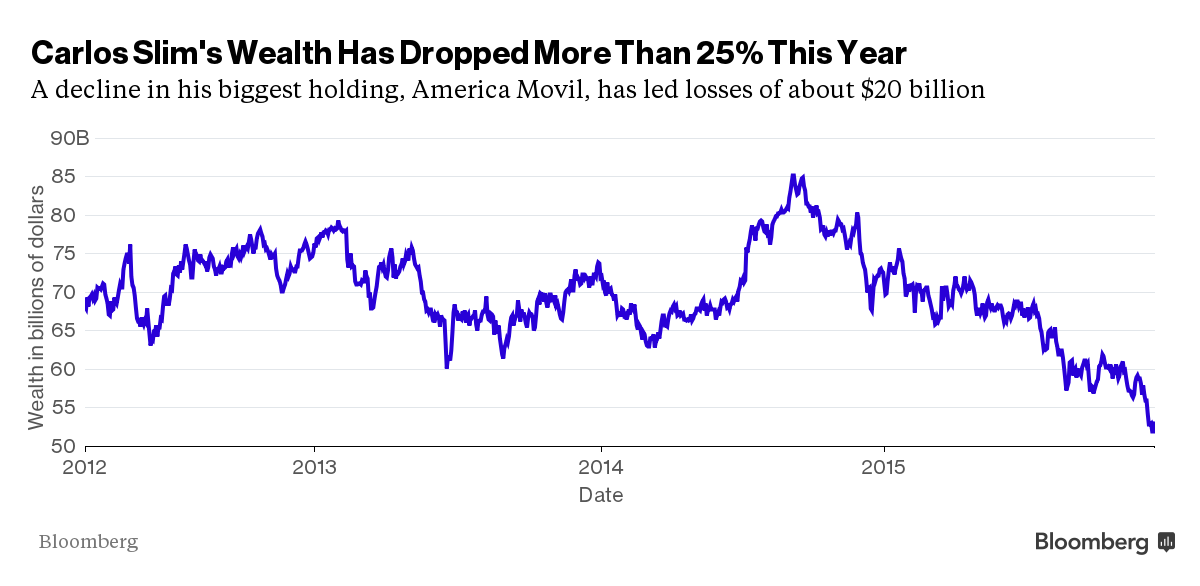

(2,352 posts)5. Carlos Slim Is Biggest Loser in World's Top 400 Richest People

http://www.bloomberg.com/news/articles/2015-12-22/carlos-slim-is-biggest-loser-in-world-s-top-400-richest-people

Carlos Slim had a tough year, the worst among the wealthiest people of the world.

Since the start of 2015, the Mexican executive lost almost $20 billion, or about the size of Honduras’s economy, according to the Bloomberg Billionaires Index. The shares of his America Movil SAB telecommunications giant are heading for their biggest decline since 2008. The company has suffered under regulatory pressures in Mexico, where it’s now forced to share the infrastructure that allowed it to dominate the mobile and fixed-line market for more than a decade.

Among conditions working against Mexico City-based America Movil are: a dismal outlook for Brazil’s economy, its second-biggest market; stronger competitors at home; and limited opportunities to expand in Europe. Slim, now the fifth-richest person in the world -- down from third earlier this year -- owns 57 percent of the company. The stock, down 18 percent this year, lost its long-held position as the most-weighted stock on Mexico’s benchmark index, making Slim the biggest loser among the world’s 400 wealthiest individuals...

more

Carlos Slim had a tough year, the worst among the wealthiest people of the world.

Since the start of 2015, the Mexican executive lost almost $20 billion, or about the size of Honduras’s economy, according to the Bloomberg Billionaires Index. The shares of his America Movil SAB telecommunications giant are heading for their biggest decline since 2008. The company has suffered under regulatory pressures in Mexico, where it’s now forced to share the infrastructure that allowed it to dominate the mobile and fixed-line market for more than a decade.

Among conditions working against Mexico City-based America Movil are: a dismal outlook for Brazil’s economy, its second-biggest market; stronger competitors at home; and limited opportunities to expand in Europe. Slim, now the fifth-richest person in the world -- down from third earlier this year -- owns 57 percent of the company. The stock, down 18 percent this year, lost its long-held position as the most-weighted stock on Mexico’s benchmark index, making Slim the biggest loser among the world’s 400 wealthiest individuals...

more

Proserpina

(2,352 posts)6. How a Nation Self-destructs By Harvey Lothian

http://dissidentvoice.org/2015/12/how-a-nation-self-destructs/

Nations are made up of people. Nations are only as strong as the bonds between the people. Strong social bonds, strong nation; weak social bonds, weak nation. Social bonds have many elements; the most important element is how much people care about each other. If people do not care about each other, if they have a “screw you, I got mine” attitude and are not willing to help others in need, then a nation is ready to topple at the first sign of significant stress. If people have a strong social bond, they will work together during difficult times and solve all problems.

If a nation’s leaders create enormous amounts of national debt that cannot be paid because good paying jobs have been sent overseas, a weakly bonded nation is doomed to failure when an inevitable bankruptcy and economic collapse occurs.

If just before the national bankruptcy and economic collapse the leaders frighten the people with a real or phony enemy, some people will purchase weapons to protect themselves. Should the financial and economic crash occur, a weakly bonded people might resort to using weapons against each other in an every man for himself situation.

Mission accomplished; nation destroyed.

How to Save a Nation--see link

Nations are made up of people. Nations are only as strong as the bonds between the people. Strong social bonds, strong nation; weak social bonds, weak nation. Social bonds have many elements; the most important element is how much people care about each other. If people do not care about each other, if they have a “screw you, I got mine” attitude and are not willing to help others in need, then a nation is ready to topple at the first sign of significant stress. If people have a strong social bond, they will work together during difficult times and solve all problems.

If a nation’s leaders create enormous amounts of national debt that cannot be paid because good paying jobs have been sent overseas, a weakly bonded nation is doomed to failure when an inevitable bankruptcy and economic collapse occurs.

If just before the national bankruptcy and economic collapse the leaders frighten the people with a real or phony enemy, some people will purchase weapons to protect themselves. Should the financial and economic crash occur, a weakly bonded people might resort to using weapons against each other in an every man for himself situation.

Mission accomplished; nation destroyed.

How to Save a Nation--see link

Proserpina

(2,352 posts)7. Drone owners get Christmas surprise from FAA: you will have to register to fly

http://www.theguardian.com/technology/2015/dec/14/drone-federal-aviation-administration-register-license-uav?utm_source=esp&utm_medium=Email&utm_campaign=GU+Today+USA+-+Version+A&utm_term=143915&subid=9068680&CMP=ema_565a

Buyers beware! If that drone you find under the Christmas tree weighs much more than half a pound, you’re going to have to register it with the Federal Aviation Administration (FAA) before you fly it outside.

The FAA and the Department of Transportation (DoT) announced new rules on Monday that will mean nearly all drone operators will have to register their drones in a national database.

The authorities have been attempting to crack down on unlicensed drones amid their rising popularity – they are expected to be one of this Christmas’s biggest toys. But drones have been seen as a major menace and have disrupted firefighting efforts, been used to snoop on neighbors and to smuggle drugs into prison (not to mention regularly flying too close to manned aircraft).

The new rules cover all drones weighing more than 0.55lb (0.25kg) and take effect on 21 December. A significant number of Christmas toys may be affected – and quite a few children may need to get their parents to register for them, because licensed drone pilots must be over 13 years of age. Drone owners who began flying their quadcopter vehicles before that date will have until 19 February to comply...

more

Buyers beware! If that drone you find under the Christmas tree weighs much more than half a pound, you’re going to have to register it with the Federal Aviation Administration (FAA) before you fly it outside.

The FAA and the Department of Transportation (DoT) announced new rules on Monday that will mean nearly all drone operators will have to register their drones in a national database.

The authorities have been attempting to crack down on unlicensed drones amid their rising popularity – they are expected to be one of this Christmas’s biggest toys. But drones have been seen as a major menace and have disrupted firefighting efforts, been used to snoop on neighbors and to smuggle drugs into prison (not to mention regularly flying too close to manned aircraft).

The new rules cover all drones weighing more than 0.55lb (0.25kg) and take effect on 21 December. A significant number of Christmas toys may be affected – and quite a few children may need to get their parents to register for them, because licensed drone pilots must be over 13 years of age. Drone owners who began flying their quadcopter vehicles before that date will have until 19 February to comply...

more

Hotler

(11,440 posts)9. Register your drone=good. Register your gun=bad.

Thank God the FAA is protecting me against drone violence. I thought that those republican shit stains in Washington hated more big government? ![]()

Proserpina

(2,352 posts)10. I think they hate the thought of localized aerial bombardment (and snooping) worse

not to mention mid-air collisions.

Hotler

(11,440 posts)12. I know...... I was feeling the need to...

talk shit about something. ![]()

Proserpina

(2,352 posts)13. Always willing to oblige! As long as you don't alert on me

Hotler

(11,440 posts)14. I wouldn't even think of it. n/t

Proserpina

(2,352 posts)8. Number of female billionaires increases sevenfold in 20 years

http://www.theguardian.com/business/2015/dec/15/number-of-female-billionaires-increases-sevenfold-in-20-years?utm_source=esp&utm_medium=Email&utm_campaign=GU+Today+USA+-+Version+A&utm_term=143915&subid=9068680&CMP=ema_565a

The number of female billionaires worldwide has increased nearly sevenfold in the past 20 years to 145 – and it is Asian entrepreneurs who are driving this growth, according to a study.

The report found that women have outpaced men when it comes to membership of the billionaires’ club, with their ranks and wealth growing at faster rates. The number compares with only 22 in 1995.

Lists of the world’s wealthiest women have long featured the likes of Liliane Bettencourt, the 93-year-old L’Oréal heiress, and Christy and Alice Walton, members of the Walmart family.

But they are now increasingly featuring self-made billionaires from countries including China, Hong Kong and India. Among them are women such as Zhang Xin, a 50-year-old Chinese real estate mogul, who worked in a garment factory in Hong Kong from the age of 14, saved enough to come to the UK to study at Sussex University, and was said earlier this year to be worth well over $3bn (£2bn).

However, this is a club still very much dominated by men over 60. There are 1,202 male billionaires – but their number has only grown by a factor of 5.2.

In 1995, there were 289 billionaires globally, but by 2014 their number had swelled to 1,347, according to the study published by the Swiss bank UBS and professional services firm PricewaterhouseCoopers...

more

The number of female billionaires worldwide has increased nearly sevenfold in the past 20 years to 145 – and it is Asian entrepreneurs who are driving this growth, according to a study.

The report found that women have outpaced men when it comes to membership of the billionaires’ club, with their ranks and wealth growing at faster rates. The number compares with only 22 in 1995.

Lists of the world’s wealthiest women have long featured the likes of Liliane Bettencourt, the 93-year-old L’Oréal heiress, and Christy and Alice Walton, members of the Walmart family.

But they are now increasingly featuring self-made billionaires from countries including China, Hong Kong and India. Among them are women such as Zhang Xin, a 50-year-old Chinese real estate mogul, who worked in a garment factory in Hong Kong from the age of 14, saved enough to come to the UK to study at Sussex University, and was said earlier this year to be worth well over $3bn (£2bn).

However, this is a club still very much dominated by men over 60. There are 1,202 male billionaires – but their number has only grown by a factor of 5.2.

In 1995, there were 289 billionaires globally, but by 2014 their number had swelled to 1,347, according to the study published by the Swiss bank UBS and professional services firm PricewaterhouseCoopers...

more

Proserpina

(2,352 posts)11. It's 50F and dropping, wet, but no more rain in forecast

I am off to cause trouble somewhere else now...see you later!