Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 14 January 2016

[font size=3]STOCK MARKET WATCH, Thursday, 14 January 2016[font color=black][/font]

SMW for 13 January 2016

AT THE CLOSING BELL ON 13 January 2016

[center][font color=red]

Dow Jones 16,151.41 -364.81 (-2.21%)

S&P 500 1,890.28 -48.40 (-2.50%)

Nasdaq 4,526.06 -159.85 (-3.41%)

[font color=green]10 Year 2.08% -0.04 (-1.89%)

30 Year 2.87% -0.02 (-0.69%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

12/17/15 Martin Shkreli, former CEO Turing Pharmaceuticals and notorious price gouger, arrested on securities fraud charges. Posted $5M bail, resigned as CEO.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Proserpina

(2,352 posts)Since Clinton and her operatives have become aggressive in trying to discredit Bernie Sanders on issues where he both has a better track record and better proposals, it’s time for a wee reality check, in this case, on Sanders’ financial reform package. There’s a lot to like, for instance his insistence that executives be prosecuted for serious misconduct and for backing a Post Office Bank. There are also some things that need to be reworked, like his usury ceiling proposal. Classical economists like Adam Smith were keen supporters of usury ceilings because they could see the consequences of letting lenders charge whatever interest rate they could get. Creditors targeted wealthy gamblers first and foremost, and the rates they were willing to pay was punitively high compared to what productive enterprises could support. Thus Smith and his colleagues saw usury limits as key to forcing lenders to find the best targets at a reasonable rate of interest, rather than search out the most reckless, who tended also not to be socially beneficial users of funds either. The failing with the Sanders proposal is that he sets as fixed limit of 15.9%; it should be set in relationship to prevailing interest rates, as well as the length of the loan.

Larry Summers, acting as a proxy for Team Clinton, took a swipe at the Sanders’ views in a Washington Post op-ed at year end. Admittedly this was a case of dueling op-eds; Summers was responding to a Sanders article in the New York Times which outlined his reform priorities. However, one of Summers arguments, and one that Clinton has taken up now that Sanders has set forth his plan in more detail, is that Sanders’ “Glass Steagall” reform idea is all wet.

Clinton has brazenly mischaracterized Sanders’ proposal. She makes it sound as if it is a straight-up revival of the 1933 law, and asserts that it misses “shadow banking” and her reform proposals are much better on that front. We’ll discuss this issue in greater detail in a later post. The short version is that Sanders did not propose restoring the original Glass Steagall. He intends to implement the bill devised by former FDIC chairman Tom Hoenig and Elizabeth Warren which is informally described as the 21st century Glass Steagall Act. And yes, sports fans, it includes provisions to curb shadow banking.

Summers made the same mis-characterization, but took another angle of attack: Glass Steagall had nothing to do with the crisis, ergo restoring it wouldn’t stop future crises. This line of argument is also bogus, but because most members of the public don’t understand how Glass Steagall contributed to the crisis, they make arguments that can easily be swatted down. So let’s give a little history so that you can better appreciate how Summers distorts the record, and then we’ll turn to his argument, such as it is.

How Glass Steagall Was Dismantled

Too many commentators focus on the formal repeal of Glass Steagall in 1999, as if that were a meaningful event. In fact, by then Glass Steagall was a dead letter. The only reason for dismantling it was to allow for the merger of Citigroup and Travelers...By then, US banks were allowed to do a great deal of investment banking business through subsidiaries, which were subject to revenues as a percent of total revenue limits that were seen as a nuisance rather than a constraint (as in a bank could book high revenue, low profit trading activities that had always been permissible to engage in, like foreign exchange and Treasuries, so that the non-investment banking operations would show high enough revenues as to not be a hindrance). It took well over a decade to get to this point. The then-Citibank had been pushing to get into investment banking since the early 1980s, and JP Morgan soon joined them. One could argue that Mike Milken did an Uber-like end run of Glass Steagall, since he famously, and illegally, controlled the investing of the captive, um cooperative savings and loans in his network. Milken cronies would all be directed to raise more money than they needed through Drexel, typically 15% more. They were then expected to invest the excess funds in new Milken deals. In the case of the savings and loans, they were faxed a sheet at the end of the day telling them what they owned. Milken was effectively trading on their behalf.

But Glass Steagall was undeniably breached by 1990...

Summers’ Disingenuous Arguments

Even though this is the warm-up to Summers’ Glass Steagall section, it merits comment:

Now we get to the Glass Steagall part:

I wonder where the Washington Post copy editors were on the spelling of Glass Steagall; was that a wee bit of sabotage? To the substance: let’s first consider that Sanders is not making a very strong claim. He is merely saying the slow motion death of Glass Steagall contributed to the crisis, not caused it. Now go back to the strategic picture I painted above, that the erosion of Glass Steagall led major financial firms, namely universal banks, big US commercial banks, and traditional investment banks, all to pursue the same capital markets strategy. Given that they all traded with each other, it had the bad side effect of making them what Richard Bookstaber called “tightly coupled” or overly connected, so that if Something Bad happened, the domino effect could move through the system before anyone could stop it. Now Glass Steagall’s fall wasn’t the sole cause of the over-connectedness, but it led to far more firms being tied up in what amounted to a single electrical grid.

We pointed out the danger of being a sub-scale player. You were already under pressure to increase your infrastructure (products depth and range, as well as geographic footprint) when you didn’t have the revenue of the top players. If you were sub-scale and had any pockets of strength, you were in constant danger of having those teams raided by firms that had a bigger platform. Odds were high they’d do no worse and would probably be more productive if they jumped ship. And once you had teams being picked off, you were on your way to losing your independence. The businesses were tightly integrated enough that losing a team would damage your standing in related businesses, making those professionals less productive (as in lowering their bonus prospects) and increasing the odds they’d leave or be recruited away.

It was thus imperative for a sub-scale player to work like mad to climb his way up the food chain. He had to to have any realistic chance of long-term survival. Since these firms couldn’t match the raw revenue generation power of their bigger peers, they had to focus their resources on higher potential profit businesses. They’d wind up making bigger bets on what they thought were the best opportunities. And since the profit model in the late 1990s and early 2000s, thanks to falling and ultimately negative real interest rates, shifted the business model away from lower-risk fee businesses to higher risk trading businesses, it also entailed taking more balance sheet risk.

Who were the most sub-scale players? Bear Stearns and Lehman. And what was their big strategic bet? Real estate, particularly the seemingly high profit subprime sector. And for Bear, that also meant becoming a big player in credit default swaps (recall that Bear was one of the few players that John Paulson approached early on to create CDOs that were designed to fail).

So Summers is dead wrong in his simple-minded version of “Glass Steagall had nothing to do with Bear and Lehman.”

AIG, Fannie and Freddie were among the biggest customers of the Wall Street subprime bonds and CDO factory. AIG had accidentally created a firm within a firm and had gotten rid of its real risk managers, leaving Joe Cassanno, a bully who didn’t understand the downside until way too late, in charge. Fannie and Freddie both talked themselves into the foolish practice of using the fees they got for insuring mortgage bonds and investing that dough in subprime bonds and loans. Freddie and Fannie (as we discussed in 2007) were already thinly capitalized; they could not afford a bone-headed bet like that. So AIG, Fannie and Freddie were all insurers that made terrible investment decisions by virtue of falling for Wall Street’s latest apparent high return opportunity. AIG was systemically important by virtue of its CDS serving effectively as synthetic equity to the banks, since it allowed them to greatly understate the capital needed to support their CDS and/or credit default swaps. Again, had banks been separated from investment banks, AIG would have been the counterparty to far fewer institutions with much smaller balance sheets (ie, under a traditional banking regime, it would be less likely that US and UK banks would have been allowed to play in the CDS casino, but you would have seen similar casualty levels among the Eurobanks).

so much more at link

I think you could produce a daily newspaper with the headline ‘why Larry Summers is Wrong’ on every page for every day for a year and still not cover everything he says.

But it does still amaze me that someone so prominent can get away with saying so many transparently false things and still hold his reputation. Its one thing to accept a politician evading the truth, its another for someone who is supposedly an independent expert to do it. And he is of course, far too smart not to know exactly what he is doing.

It shows, among other things I think, the poor quality of so much journalism that there are limited numbers of journalists with the ability and desire to actually challenge him on his evasions and falsehoods. But it seems that half the economics writers in the US are hustling to get on Team Hilary, so who cares about proper analysis.

Tansy_Gold

(17,864 posts)Back to November 2008, when (ahem) Someone got into all kinds of trouble on DU2 for daring to suggest that putting Larry Summers on the transition team was not a good idea?

Sheesh.

Proserpina

(2,352 posts)Fuddnik

(8,846 posts)Summers is a certifiable asshole.

And just when you think he's hit bottom, he pulls out another jack hammer to go deeper.

Proserpina

(2,352 posts)Proserpina

(2,352 posts)By Michael T. Klare, a TomDispatch regular, professor of peace and world security studies at Hampshire College and the author, most recently, of The Race for What’s Left.

As 2015 drew to a close, many in the global energy industry were praying that the price of oil would bounce back from the abyss, restoring the petroleum-centric world of the past half-century. All evidence, however, points to a continuing depression in oil prices in 2016 — one that may, in fact, stretch into the 2020s and beyond. Given the centrality of oil (and oil revenues) in the global power equation, this is bound to translate into a profound shakeup in the political order, with petroleum-producing states from Saudi Arabia to Russia losing both prominence and geopolitical clout.

To put things in perspective, it was not so long ago — in June 2014, to be exact — that Brent crude, the global benchmark for oil, was selling at $115 per barrel. Energy analysts then generally assumed that the price of oil would remain well over $100 deep into the future, and might gradually rise to even more stratospheric levels. Such predictions inspired the giant energy companies to invest hundreds of billions of dollars in what were then termed “unconventional” reserves: Arctic oil, Canadian tar sands, deep offshore reserves, and dense shale formations. It seemed obvious then that whatever the problems with, and the cost of extracting, such energy reserves, sooner or later handsome profits would be made. It mattered little that the cost of exploiting such reserves might reach $50 or more a barrel...As of this moment, however, Brent crude is selling at $33 per barrel, one-third of its price 18 months ago and way below the break-even price for most unconventional “tough oil” endeavors. Worse yet, in one scenario recently offered by the International Energy Agency (IEA), prices might not again reach the $50 to $60 range until the 2020s, or make it back to $85 until 2040. Think of this as the energy equivalent of a monster earthquake — a pricequake — that will doom not just many “tough oil” projects now underway but some of the over-extended companies (and governments) that own them.

The current rout in oil prices has obvious implications for the giant oil firms and all the ancillary businesses — equipment suppliers, drill-rig operators, shipping companies, caterers, and so on — that depend on them for their existence. It also threatens a profound shift in the geopolitical fortunes of the major energy-producing countries. Many of them, including Nigeria, Saudi Arabia, Russia, and Venezuela, are already experiencing economic and political turmoil as a result. (Think of this, for instance, as a boon for the terrorist group Boko Haram as Nigeria shudders under the weight of those falling prices.) The longer such price levels persist, the more devastating the consequences are likely to be.

A Perfect Storm

Generally speaking, oil prices go up when the global economy is robust, world demand is rising, suppliers are pumping at maximum levels, and little stored or surplus capacity is on hand. They tend to fall when, as now, the global economy is stagnant or slipping, energy demand is tepid, key suppliers fail to rein in production in consonance with falling demand, surplus oil builds up, and future supplies appear assured.

During the go-go years of the housing boom, in the early part of this century, the world economy was thriving, demand was indeed soaring, and many analysts were predicting an imminent “peak” in world production followed by significant scarcities. Not surprisingly, Brent prices rose to stratospheric levels, reaching a record $143 per barrel in July 2008. With the failure of Lehman Brothers on September 15th of that year and the ensuing global economic meltdown, demand for oil evaporated, driving prices down to $34 that December. With factories idle and millions unemployed, most analysts assumed that prices would remain low for some time to come. So imagine the surprise in the oil business when, in October 2009, Brent crude rose to $77 per barrel. Barely more than two years later, in February 2011, it again crossed the $100 threshold, where it generally remained until June 2014...Several factors account for this price recovery, none more important than what was happening in China, where the authorities decided to stimulate the economy by investing heavily in infrastructure, especially roads, bridges, and highways. Add in soaring automobile ownership among that country’s urban middle class and the result was a sharp increase in energy demand. According to oil giant BP, between 2008 and 2013, petroleum consumption in China leaped 35%, from 8.0 million to 10.8 million barrels per day. And China was just leading the way. Rapidly developing countries like Brazil and India followed suit in a period when output at many existing, conventional oil fields had begun to decline; hence, that rush into those “unconventional” reserves. This is more or less where things stood in early 2014, when the price pendulum suddenly began swinging in the other direction, as production from unconventional fields in the U.S. and Canada began to make its presence felt in a big way. Domestic U.S. crude production, which had dropped from 7.5 million barrels per day in January 1990 to a mere 5.5 million barrels in January 2010, suddenly headed upwards, reaching a stunning 9.6 million barrels in July 2015. Virtually all the added oil came from newly exploited shale formations in North Dakota and Texas. Canada experienced a similar sharp uptick in production, as heavy investment in tar sands began to pay off. According to BP, Canadian output jumped from 3.2 million barrels per day in 2008 to 4.3 million barrels in 2014. And don’t forget that production was also ramping up in, among other places, deep-offshore fields in the Atlantic Ocean off both Brazil and West Africa, which were just then coming on line. At that very moment, to the surprise of many, war-torn Iraq succeeded in lifting its output by nearly one million barrels per day.

Add it all up and the numbers were staggering, but demand was no longer keeping pace... even at $33 a barrel, production continues to outpace global demand and there seems little likelihood of prices rising soon, especially since, among other things, both Iraq and Iran continue to increase their output. With the Islamic State slowly losing ground in Iraq and most major oil fields still in government hands, that country’s production is expected to continue its stellar growth. In fact, some analysts project that its output could triple during the coming decade from the present three million barrels per day level to as much as nine million barrels...And keep in mind that the tremors from the oil pricequake have undoubtedly yet to reach their full magnitude. Prices will, of course, rise someday. That’s inevitable, given the way investors are pulling the plug on energy projects globally. Still, on a planet heading for a green energy revolution, there’s no assurance that they will ever reach the $100-plus levels that were once taken for granted. Whatever happens to oil and the countries that produce it, the global political order that once rested on oil’s soaring price is doomed. While this may mean hardship for some, especially the citizens of export-dependent states like Russia and Venezuela, it could help smooth the transition to a world powered by renewable forms of energy.

so much more at link

Proserpina

(2,352 posts)Not only that, but probably 3x as big as the projected increase.

When has that ever happened, without a sudden declaration of war?

I hope to have more to post in the morning...everything is Bernie, all the time, even on Bloomberg!

Bedtime! It's snowing, 13F and feels like 3F. Tomorrow is forecast to be much warmer...we'll see how that prediction pans out.

Warpy

(111,285 posts)"Sell everything."

That harrowing advice is from The Royal Bank of Scotland, which has warned of a "cataclysmic year" ahead for markets and advised clients to head for the exit. Do not wait. Do not pass go.

"Sell everything except high quality bonds," warned Andrew Roberts in a note this week.

He said the bank's red flags for 2016 -- falling oil, volatility in China, shrinking world trade, rising debt, weak corporate loans and deflation -- had all been seen in just the first week of trading.

http://money.cnn.com/2016/01/12/investing/markets-sell-everything-cataclysmic-year-rbs/

Personally, I find that overstated. I expect a very large correction, possibly an overcorrection, but it's not going to be the end of civilization as we know it. That won't happen until the collapse of the derivatives casino.

Proserpina

(2,352 posts)U.S. stocks rang up sharp losses Wednesday in a tough day of trading marked by investors unloading consumer-discretionary and health-care shares.

A renewed slump in crude-oil prices added to the selling pressure, driving the S&P 500 and the Dow Industrials to their lowest levels since Sept. 29, 2015.

Health care issues...I wonder if Hillary's faux pas is behind that?

Proserpina

(2,352 posts)1. "There really isn't a retirement crisis."

You know about Holocaust-deniers, right? Well now we have retirement crisis-deniers. For years, pretty much all the studies and surveys have predicted a tsunami of trouble for baby boomers when they retire. We've been told that the combination of our increased longevity, the loss of our jobs in the Great Recession, and the fact that we've been spenders -- and not savers -- for most of our lives was going to unleash the greatest financial crisis since the bankers did or did not jump from the skyscrapers in 1929. Even among Americans aged 55 to 64 who do save, Motley Fool says the median value of their retirement accounts is a mere $103,000. And that doesn't factor in the millions who have not saved a nickel. But now, along come the deniers. Andrew G. Biggs -- an American Enterprise Institute scholar who served as deputy commissioner of the Social Security Administration under President George W. Bush -- recently wrote an Alfred E. Neuman "What, me worry?" column in the Wall Street Journal in which he decries any such justification for public panic. He talks about stuff like what percentage of your paycheck Social Security needs to replace, how that formula should be calculated, and other things that will make your eyes glaze over.

But this line, everyone will understand: "Add in 401(k) and other plans, and it should not be difficult for a typical worker to achieve a total replacement rate of 70 percent or even 80 percent through individual savings and Social Security benefits." Right, except for the millions who aren't covered by a 401(k) or any other plan. A recent report by the Employee Benefit Research Institute put the median amount of a 401(k) plan at $18,433 and noted that almost 40 percent of employees have less than $10,000 invested. Older workers, who have been trying to save for longer, have more. At Vanguard, for example, the median for savers aged 55 to 64 in 2013 was $76,381. That's it. And, no offense intended, that will hardly be enough. Me? I prefer to just look at the dollar amounts and ask where it is exactly that an elderly person in America can afford to live on $1,335 a month, which is the average amount of a Social Security retirement check.

2. "You should have saved more instead of expecting Social Security to bail you out."

This is a big "No shit, Sherlock" moment. OK, we should have saved more. Right. Got it. Point taken. But some of us didn't, and now what? Are we really prepared to mandate death squads for the elderly to avoid the unpleasantness of watching them go hungry or having them gobble up too much of Medicare? Seriously, what's the solution going to be? Wagging a finger at people who worked their whole lives and lived paycheck-to-paycheck doesn't seem to further the discussion much, does it? Let's make the assumption that most people did the best they could and it clearly wasn't good enough. Now what? For many, Social Security is what stands between them and the curb. And besides, they paid into it, so give them back their money.

3. "Why don't you find a part-time job if you need more money?"

Happy to, right after we address the problem of age discrimination that runs rampant in the job market. People in their 60s can't get hired. Most say they would be happy to keep working to feather the nest a bit more, but first they need to be able to find a job. And they can't. The EEOC twiddles its thumbs while companies advertise with blatantly biased language like "seeking someone young" or "digital native" or "a recent college graduate." Forty-four percent of unemployed workers 55 or older had been unemployed for more than a year in 2012, a Pew study reported. And while older workers have a lower unemployment rate overall because they tend to leave the workplace when they lose their job, the ones who are job-hunting find the process an uphill struggle. Maybe what we need is a jobs corps program for those 60+. Wouldn't it be great to flood our overcrowded classrooms with teacher's aides?

4. "Ageism isn't a real thing. It's just that your skills are genuinely out-of-date."

What skills would those be? The ones that cause us to be dependable, bring decades of experience and knowledge to the job and actually have fewer "bad days in the office" than our younger colleagues? Oh yeah, and technology isn't really all that scary.

5. "Well, at least you get free health care!"

There isn't much free about Medicare. Part A, which is the part that covers in-patient hospital care, indeed in most cases does not charge a premium. But it does have a lot of tricky rules. For example: If you don't spend two midnights as an admitted patient, you get handed the full bill. And even when you make the two-midnight clause, you still get to pay a $1,288 deductible. The rest of Medicare -- parts B and onward -- all have premiums, copays and deductibles. Plus Medicare covers you and you alone. If you have a younger spouse, he or she will not be covered just because you are. They too must be 65. Same issue for your dependent children. Most employers' plan have options to cover the whole family.

Warpy

(111,285 posts)because they invariably intone like it's the wisdom of the ages, handed down on stone tablets, "you should have put $2,000 a year in savings since you turned 20!" What they don't realize is that when we turned 20, $2,000 was our yearly pay before taxes. Young folks seem particularly incapable of understanding inflation and why indexing everything from wages to progressive taxes to benefits is so vitally necessary.

Proserpina

(2,352 posts)Three possible explanations for robust hiring, weak GDP

The U.S. economy just witnessed the two best years of job growth — 2014 and 2015, in that order — since 1999. Yet real economic growth has been bumping along at a 2.1% rate since the Great Recession ended.

The 79-month expansion included two quarterly contractions in gross domestic product, which is already unusual. The economy never exhibited any real thrust coming out of the long and deep recession. Even economists have begun to despair, abandoning their perennial 3%-growth-next-year forecast for something with a 2% handle.

Yet the mystery of consistently strong job growth in the face of consistently weak economic growth remains. The possible answers to the conundrum can be divided into three categories:

1. Productivity growth is lousy.

2. GDP growth is being understated.

3. Job growth is being overstated.

None of these answers is totally satisfying. After much research, I would rank the viability of each theory in the order in which they are presented...

Proserpina

(2,352 posts)Last year was a memorable one for the global economy. Not only was overall performance disappointing, but profound changes – both for better and for worse – occurred in the global economic system. Most notable was the Paris climate agreement reached last month. By itself, the agreement is far from enough to limit the increase in global warming to the target of 2ºC above the pre-industrial level. But it did put everyone on notice: the world is moving, inexorably, toward a green economy. One day not too far off, fossil fuels will be largely a thing of the past. So anyone who invests in coal now does so at his or her peril. With more green investments coming to the fore, those financing them will, we should hope, counterbalance powerful lobbying by the coal industry, which is willing to put the world at risk to advance its shortsighted interests. Indeed, the move away from a high-carbon economy, where coal, gas, and oil interests often dominate, is just one of several major changes in the global geo-economic order.

Many others are inevitable, given China’s soaring share of global output and demand. The New Development Bank, established by the Brics (Brazil, Russia, India, China, and South Africa), was launched during the year, becoming the first major international financial institution led by emerging countries. And, despite Barack Obama’s resistance, the China-led Asian Infrastructure Investment Bank was established as well, and is to start operation this month. The US did act with greater wisdom where China’s currency was concerned. It did not obstruct the renminbi’s admission to the basket of currencies that constitute the International Monetary Fund’s reserve asset, Special Drawing Rights (SDRs). In addition, a half-decade after the Obama administration agreed to modest changes in the voting rights of China and other emerging markets at the IMF – a small nod to the new economic realities – the US Congress finally approved the reforms.

The most controversial geo-economic decisions last year concerned trade. Almost unnoticed after years of desultory talks, the World Trade Organization’s Doha Development Round – initiated to redress imbalances in previous trade agreements that favored developed countries – was given a quiet burial. America’s hypocrisy – advocating free trade but refusing to abandon subsidies on cotton and other agricultural commodities – had posed an insurmountable obstacle to the Doha negotiations. In place of global trade talks, the US and Europe have mounted a divide-and-conquer strategy, based on overlapping trade blocs and agreements. As a result, what was intended to be a global free trade regime has given way to a discordant managed trade regime. Trade for much of the Pacific and Atlantic regions will be governed by agreements, thousands of pages in length and replete with complex rules of origin that contradict basic principles of efficiency and the free flow of goods. The US concluded secret negotiations on what may turn out to be the worst trade agreement in decades, the so-called Trans-Pacific Partnership (TPP), and now faces an uphill battle for ratification, as all the leading Democratic presidential candidates and many of the Republicans have weighed in against it. The problem is not so much with the agreement’s trade provisions, but with the “investment” chapter, which severely constrains environmental, health, and safety regulation, and even financial regulations with significant macroeconomic impacts.

In particular, the chapter gives foreign investors the right to sue governments in private international tribunals when they believe government regulations contravene the TPP’s terms (inscribed on more than 6,000 pages). In the past, such tribunals have interpreted the requirement that foreign investors receive “fair and equitable treatment” as grounds for striking down new government regulations – even if they are non-discriminatory and are adopted simply to protect citizens from newly discovered egregious harms. While the language is complex – inviting costly lawsuits pitting powerful corporations against poorly financed governments – even regulations protecting the planet from greenhouse gas emissions are vulnerable. The only regulations that appear safe are those involving cigarettes (lawsuits filed against Uruguay and Australia for requiring modest labeling about health hazards had drawn too much negative attention). But there remain a host of questions about the possibility of lawsuits in myriad other areas. Furthermore, a “most favoured nation” provision ensures that corporations can claim the best treatment offered in any of a host country’s treaties. That sets up a race to the bottom – exactly the opposite of what US President Barack Obama promised.

Even the way Obama argued for the new trade agreement showed how out of touch with the emerging global economy his administration is. He repeatedly said that the TPP would determine who – America or China – would write the twenty-first century’s trade rules. The correct approach is to arrive at such rules collectively, with all voices heard, and in a transparent way. Obama has sought to perpetuate business as usual, whereby the rules governing global trade and investment are written by US corporations for US corporations. This should be unacceptable to anyone committed to democratic principles....

One would think so

Proserpina

(2,352 posts)Iraqi and American officials leading the military campaign against the Islamic State now have to wrestle with a challenge that has the potential to change battlefield fortunes: the slumping price of oil.

The semi-autonomous Kurdistan Regional Government in northern Iraq, an oil-producing region, has racked up $18 billion in debt, which has imperiled its ability to pay state workers and security forces. This is especially worrisome since Kurdish security forces have been instrumental in rolling back the Islamic State’s advances.

The government in Baghdad, meanwhile, is scrambling to avoid a budget shortfall this year. Iraqi officials last year obtained a $1.7 billion loan from the World Bank and reached an agreement with the International Monetary Fund that will allow it to obtain additional loans.

Baghdad is seeking to renegotiate with international energy companies new terms for oil contracts, which have become less advantageous for Iraq as the price of oil has crashed. And it is seeking a $2.7 billion loan from the United States to acquire military equipment. Iraq’s budget problems have rightly alarmed officials in Washington. While there is little appetite to bankroll a country where so much American money has been wasted and pilfered since the ill-conceived 2003 invasion, Iraq’s economic problems must be addressed. If they are to worsen, more Iraqis will almost certainly join the tide of refugees leaving the Middle East and the government will have a harder time rebuilding areas that Iraqi security forces have wrested back from Islamic State control...

Proserpina

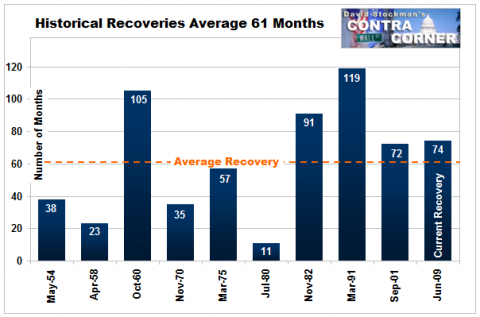

(2,352 posts)Here’s a newsflash that CNBC didn’t mention. According to the BLS, the US economy generated a minuscule 11,000 jobs in the month of December. Yet notwithstanding the fact that almost nobody works outdoors any more, the BLS fiction writers added 281,000 to their headline number to cover the “seasonal adjustment.” This is done on the apparent truism that December is generally colder than November and that workers get holiday vacations. Of course, this December was much warmer, not colder, than average. And that’s not the only deviation from normal seasonal trends. The Christmas selling season this year, for example, was absolutely not comparable to the ghosts of Christmas past. Bricks and mortar retail is in turmoil and in secular decline due to Amazon and its e-commerce ilk, and this trend is accelerating by the year. So too, energy and export based sectors have been thrown for a loop in the last few months by a surging dollar and collapsing commodity prices. Likewise, construction activity has been so weak in this cycle—-and for the good reason that both commercial and residential stock is vastly overbuilt owing to two decades of cheap credit—–that its not remotely comparable to historic patterns. Never mind. The BLS always adds the same big dollop of jobs to the December establishment survey come hell or high water. In fact, the seasonal adjustment has averaged 320,000 for the last 12 years! ...the bureaucrats at the BLS have chosen to invent the same guesstimate year after year; its not science, its political fiction. The fact is, the seasonal adjustment factors are about the closest thing there is to pure noise among all the dubious “incoming” data that the Fed and Wall Street obsess over. Here’s a better take on the matter. We are now in the 78th month since the June 2009 recession bottom, and are reaching the point where this so-called business cycle expansion is getting very long in the tooth by all historical standards.

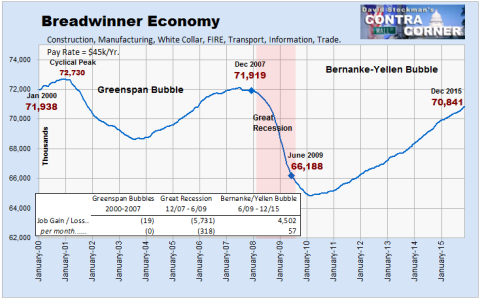

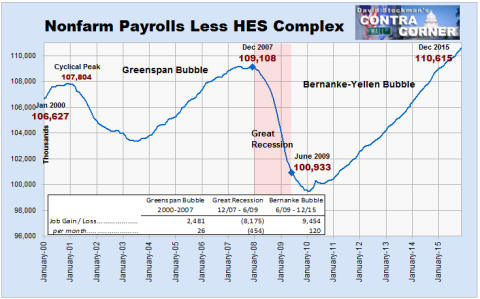

So what happened to the non-seasonally adjusted (NSA) job count in December at similar points late in the course of prior cycles? Well, in December 1999 about 140,000 jobs were added and in December 2007 there was a NSA gain of 212,000. This time we got the magnificent sum of 11,000, and by the way, last year was only 6,000. The real news flash in the December “jobs” report, therefore, is that even by the lights of the BLS’ rickety, archaic and virtually worthless establishment survey, the domestic economy is dead in the water. We are not on the verge of “escape velocity”, as our foolish monetary politburo keeps insisting; the US economy is actually knocking on the door of recession. And that’s why the retail sheep have been led to the slaughter once again in the Wall Street casino. The cats who run it have embraced the nonfarm payroll report as the primo macroeconomic indicator because they know that it drastically lags the real drivers of main street activity and has an abysmal record of forecasting turns in the macroeconomic cycle. Stated differently, these fictional monthly SA jobs numbers are extremely useful to the Wall Street sell side. They keep the rubes hitting the “buy” button until the fast money can slowly dump its holdings and get out of Dodge; or even pivot and reload to the short side. That’s right. We are not talking tin foil hats here. It is plain as day that the BLS’ seasonal adjustments are a completely stupid waste of time...So here’s the real truth. Construction jobs are breadwinner jobs. The average annualized pay rate for the category is $57,000, but the US economy is not actually generating new construction jobs any longer. What’s happening is that the BLS is simply reporting “born again” jobs and thereby enabling the Keynesian chorus to claim “progress” and “strength”, and for its Wall Street section to blather about “blow-out numbers”... the December 2015 number of breadwinner jobs was still 1.1 million jobs below that posted for the first month of this century!

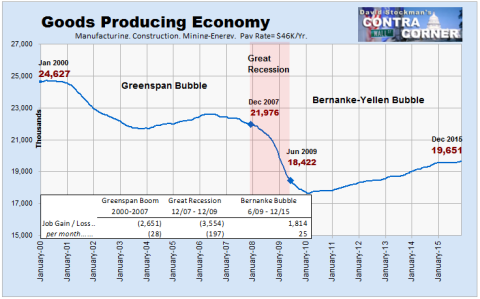

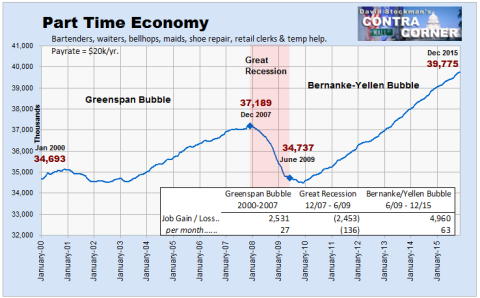

Needless to say, that’s not “strength”. It’s actually a profound indictment of the archaic convention embedded in the monthly employment report that counts job slots, not the variable gigs and hours on which employment in the contemporary US economy is actually based. Indeed, all the Jobs Friday hoopla is based on your grandfather’s BLS survey, which arose at a time when everyone punched the clock at the Ford factory 40-50 hours per week, including overtime. By contrast, now the greeters and cash register operators at Wal-Mart are computer-scheduled in 15 minute increments. Since average pay for the bartenders and waiters category is less than $20,000 on an annualized basis owing to an average of 26 hours per week and $13/hour pay rates, you need 2.5 of these gigs to get the equivalent of one breadwinner job. Yet on Jobs Friday its all one job, one vote...In fact, not withstanding the “blow-out” December numbers, the US economy still has 11% fewer jobs in goods production—-mining, energy, manufacturing and construction—–than it did at the December 2007 cyclical peak, and 21% fewer than at the turn of the century.

By contrast, what is being swapped in are what we have called Part-Time Economy jobs, where there have been modest cyclically comparable gains in job levels during the past 15 years. Needless to say, however, the average annualized pay rate in this category is less than $20,000.

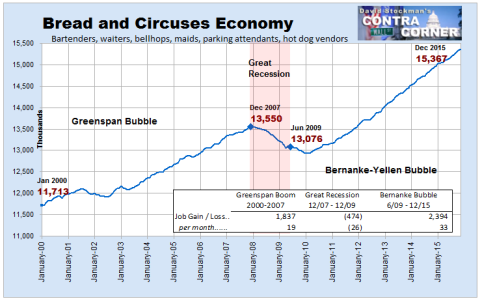

But even these trend level gains are heavily concentrated in the lowest quality quadrant. That is, in what we have called the “Bread and Circuses Economy”—–bartenders, waiters, bellhops, maids, parking attendants, hot dog vendors and the like. The fact is, this category accounts for fully 70%, or 1.8 million, of the 2.59 million gain in Part Time Economy jobs since the pre-recession peak in December 2007.

Another factor obscured by the BLS’ archaic job slot counting convention is the root wealth and productivity contribution of the job count at any point in time. Generally, private sector jobs financed by consumers add to wealth and productivity at varying degrees, depending on the sector.

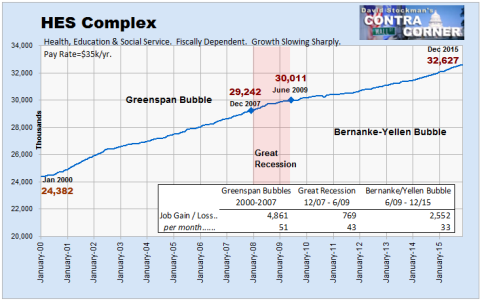

By contrast, taxpayer financed jobs—–directly through government outlays or indirectly through heavy tax subsidies and preferences—–do not add to wealth, and, not to put too fine a point on it, may well subtract from it. And that gets us to the HES Complex (health, education and social services). This is the fastest growing job category since the turn of the century, yet it now depends upon more than $2 trillion per year of Medicare, Medicaid and other government health spending—–plus another $250 billion or so of tax expenditures for employer health plans and tax credits for education.

Yes, it can be argued that a some part of the current 32.6 million jobs in the HES Complex add to long-run productivity via education and health status improvement of the working age population. But that point does not get you too far if you recognize the abject and worsening failure of public education in the US and the gross inefficiency of our third-party payment dominated health care system. Far more relevant is this fact. For the entirety of this century there has been only a 3.7% net gain in even the gross number of job slots in the US economy outside of the HES Complex, and that measurement includes the Part Time Economy and its Bread and Circuses subset. Stated differently, on a trend level basis, the US economy has only generated 21,000 jobs per month over the last 15 years that were not funded by the public fisc, and therefore indirectly by the $10 trillion gain in public sector debts since the turn of the century.

So whatever is embedded in the BLS payroll count, don’t call it recovery, strength or progress. Instead, call it a propaganda cloud that serves the interests of Wall Street and the monetary central planners, alike....(big edit)...Needless to say, the 281,000 seasonal adjustment factor contained in the December jobs “blowout” came just in the nick of time.

and there's still more at link. Stockman is a wordy fellow

Proserpina

(2,352 posts)https://www.creditwritedowns.com/2016/01/is-there-a-us-goldilocks-scenario-possible-for-2016.html

The jobs report today was a strong one, underscoring the ability of the US economy to power through. Am I uneasy about where we are in the economic and credit cycle and the accuracy of the Fed’s forward guidance? Yes – and I tend to think most of the risk is to the downside. Even so, there is a Goldilocks scenario in the data that I think is achievable. Let me outline that scenario here.

What we saw from the jobs report today was +292,000 non-farm payrolls in December and upward revisions to November and October, bringing November to +252,000 and October to +307,000. That’s an average of 283,000 jobs. That’s a pretty good number. To put this in context, we averaged about +221,000 in 2015. So the last three months are well above. An average of +221,000 is a good number. And +283,000 is even better. The unemployment rate was unchanged at 5.0% Bottom line: the US employment market is doing just fine right now. Yes, jobs are a lagging indicator. Nonetheless, upward revisions and the positive delta between the 3-month and the 12-month rolling average are not lagging indicators and they are indicative of economic support.

So, despite my general outlook being one where the risks are to the downside to the point where even recession is possible, I think there is a Goldilocks scenario possible here.

First, the Fed is hiking rates right now. Futures for April Fed Funds are at about 48 bps, suggesting one further rate hike between now and then. That’s supportive of the US dollar. And a strong US dollar is negative for EM, for commodities, for oil and for high yield and leveraged loans. But it is also potentially supportive of credit growth.

In a Goldilocks scenario, consumers try to lock in borrowing at lower rates now, in anticipation of higher rates down the line.This means borrowers would be pulling forward borrowing decisions and pushing up credit growth while the energy sector works through its problems. This also means – with job growth fairly robust – the baton to do the heavy lifting of maintaining economic growth is passed to wage growth and residential construction from capital spending and non-residential construction. I’m not saying this scenario is the one that will result in 2016. I am pointing out that it is a potential outcome to the upside. My baseline right now is 2% growth for 2016 with enough tail risk to make recession a possibility as the Fed hikes interest rates. But the Goldilocks scenario is one in which we see 3% growth and accelerating wage growth as the Fed raises rates.

The biggest risk to the Goldilocks scenario is corporate earnings. Right now we are at the beginning of the third consecutive contractionary quarterly corporate earnings season. You don’t see wages rising when corporate earnings are contracting. And the wage number in this latest jobs report was down slightly. But a 3% wage growth number is still doable in a situation where household credit growth is robust. My view: the economy remains on a track that is consistent enough with the Fed’s overall outlook that we should expect more rate hikes and a strong US dollar. How this impacts the Chinese currency, commodities, energy and high yield will have a meaningful impact on the economic picture. However, at the same time, we need to watch US credit growth to understand how well the US economy can overcome downside risks.

Edward Harrison is the founder of Credit Writedowns and a former career diplomat, investment banker and technology executive with over twenty years of business experience. He is also a regular economic and financial commentator on BBC World News, CNBC Television, Business News Network, CBC, Fox Television and RT Television. He speaks six languages and reads another five, skills he uses to provide a more global perspective. Edward holds an MBA in Finance from Columbia University and a BA in Economics from Dartmouth College.

Edward Harrison is talking through his hat.

Proserpina

(2,352 posts)Civilization was pretty great while it lasted, wasn't it? Too bad it's not going to for much longer. According to a new study ... we only have a few decades left before everything we know and hold dear collapses. The report, written by applied mathematician Safa Motesharrei of the National Socio-Environmental Synthesis Center along with a team of natural and social scientists, explains that modern civilization is doomed. And there's not just one particular group to blame, but the entire fundamental structure and nature of our society.

Analyzing five risk factors for societal collapse (population, climate, water, agriculture and energy), the report says that the sudden downfall of complicated societal structures can follow when these factors converge to form two important criteria. Motesharrei's report says that all societal collapses over the past 5,000 years have involved both "the stretching of resources due to the strain placed on the ecological carrying capacity" and "the economic stratification of society into Elites [rich] and Masses (or "Commoners"

Elite power, the report suggests, will buffer "detrimental effects of the environmental collapse until much later than the Commoners," allowing the privileged to "continue 'business as usual' despite the impending catastrophe." Science will surely save us, the nay-sayers may yell. But technology, argues Motesharrei, has only damned us further:

Technological change can raise the efficiency of resource use, but it also tends to raise both per capita resource consumption and the scale of resource extraction, so that, absent policy effects, the increases in consumption often compensate for the increased efficiency of resource use.

In other words, the benefits of technology are outweighed by how much the gains reinforce the existing, over-burdened system — making collapse even more likely...The worst-case scenarios predicted by Motesharrei are pretty dire, involving sudden collapse due to famine or a drawn-out breakdown of society due to the over-consumption of natural resources. The best-case scenario involves recognition of the looming catastrophe by Elites and a more equitable restructuring of society, but who really believes that is going to happen?

more

bread_and_roses

(6,335 posts)Have you read "Collapse" by Jared Diamond? It's pretty dense - at least for me - nothing like as readable as "Guns, Germs, and Steel" for an eclectic generalist like me. But worth plowing through, I thought.

Proserpina

(2,352 posts)I have too much homework for such things.

Proserpina

(2,352 posts)China's two stock exchanges said late on Wednesday that they have stepped up monitoring share selling activities by listed companies' major shareholders.

Separately, the China Securities Regulatory Commission (CSRC) also reiterated that the transition toward a U.S.-style registration system for initial public offerings would be a gradual process and will not lead to a surge in IPOs.

The statements, published via CSRC's official microblog, came after the Shanghai benchmark index .SSEC plunged 2.4 percent on Wednesday to the lowest level in four and a half months, breaching the 3,000-point level seen as a key technical support by many investors.

The Shanghai and Shenzhen stock exchanges said in separate statements that they are closely monitoring share sales by major shareholders to ensure that recent restrictions on such transactions are not breached. The Shanghai Stock Exchange said that it has taken special supervision measures on sales of shares acquired through block trades, and will take action against any activities that impact normal market order. CSRC issued rules on Jan 7 to further restrict share sales by listed companies' major shareholders as a sales ban expired, seeking to arrest the market's free-fall.

Proserpina

(2,352 posts)The U.S. economy expanded across most of the country in the past six weeks as the job market showed strength that’s failing to stoke broad wage pressures, a Federal Reserve survey showed.

The central bank’s Beige Book economic survey, which is based on reports from late November to early January by regional Fed banks, showed that two of the 12 Fed districts posted “moderate” growth and seven described the expansion as “modest.” Boston contacts were described as “upbeat,” while the New York and Kansas City Fed districts reported “essentially flat” economic activity.

The report released Wednesday in Washington underscores the challenge facing Fed policy makers heading into their meeting later this month: The labor market is strengthening without triggering signs of higher wages or inflation more broadly.

Few market participants and economists expect an interest-rate change at the Jan. 26-27 meeting, but the anecdotes could help to color policy makers’ reading of the economy as they move toward a potential increase in March...

when is an expansion not an expansion? Ask Max Keiser, David Stockman, Paul Craig Roberts, etc

Proserpina

(2,352 posts)Major Asian stock markets retraced some of their downward slide but closed mostly in negative territory, following a massive sell-off on Wall Street overnight. China bucked the trend, erasing early losses to close up almost 2 percent.

Japan's Nikkei 225 closed down 474.68 points, or 2.68 percent, at 17,240.95, but that was off lows after the index fell as much as 4.09 percent intraday. Shares were weighed by the commodities and machinery sectors.

South Korea's Kospi ended 16.27 points, or 0.85 percent, lower at 1,900.01.

Down Under, the ASX 200 closed down 78.04 points, or 1.56 percent, at 4,909.40, with energy and financials sectors sharply down. All sectors were in the red except gold producers, which saw an uptick of 3.61 percent.

After a late sell-off Wednesday afternoon, Chinese indexes opened lower. But in afternoon trade, the indexes turned positive, with the Shanghai composite closing up 57.95 points, or 1.96 percent, at 3,007.54, while the Shenzhen composite was up 68.18 points, or 3.80 percent, at 1,859.37.

Hong Kong's Hang Seng index was down 0.62 percent.

Offering some sign of stability in a generally volatile market, the People's Bank of China (PBOC) set Thursday's yuan mid-point rate at 6.5616, compared with Wednesday's fix of 6.5630. The dollar-yuan pair was nearly flat at 6.5777.

http://www.cnbc.com/2016/01/13/asia-stock-markets-set-for-sell-off-on-dow-sp-500-nasdaq-plunge-oil-price-slump.html