Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 9 March 2012

[font size=3]STOCK MARKET WATCH, Friday, 9 March 2012[font color=black][/font]

SMW for 8 March 2012

AT THE CLOSING BELL ON 8 March 2012

[center][font color=green]

Dow Jones 12,907.94 +70.61 (0.55%)

S&P 500 1,365.91 +13.28 (0.98%)

Nasdaq 2,970.42 +34.73 (1.18%)

[font color=red]10 Year 2.01% +0.02 (1.01%)

30 Year 3.17% +0.02 (0.63%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

Financial Sector Officials Convicted since 1/20/09 = [/font][font color=red]12[/font]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)I do so like this new schedule...it works so much better for me.

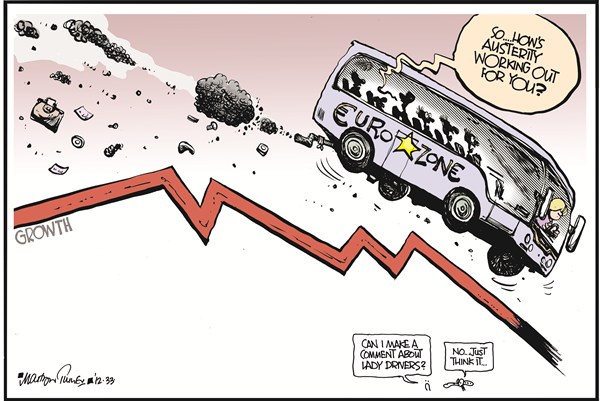

It only LOOKS like Merkel is driving the Eurobus.

She's more like the heroine in King Kong's fist.

Demeter

(85,373 posts)Deutsche Bank took as much as €10bn of European Central Bank emergency funding last week, despite deep reservations over the programme voiced by outgoing chief executive Josef Ackermann

Read more >>

http://link.ft.com/r/UXDMSS/8ZFHFH/YGZ3O/HYNTEY/U14OHV/ID/t?a1=2012&a2=3&a3=8

I THINK WE HAVE IDENTIFIED KING KONG NOW...

Demeter

(85,373 posts)The Justice Department has warned Apple Inc. and five of the biggest U.S. publishers that it plans to sue them for allegedly colluding to raise the price of electronic books, according to people familiar with the matter. Several of the parties have held talks to settle the antitrust case and head off a potentially damaging court battle, these people said. If successful, such a settlement could have wide-ranging repercussions for the industry, potentially leading to cheaper e-books for consumers. However, not every publisher is in settlement discussions.

The five publishers facing a potential suit are CBS Corp.'s Simon & Schuster Inc.; Lagardere SCA's Hachette Book Group; Pearson PLC's Penguin Group (USA); Macmillan, a unit of Verlagsgruppe Georg von Holtzbrinck GmbH; and HarperCollins Publishers Inc., a unit of News Corp. , which also owns The Wall Street Journal. Spokespeople for the five publishers and the Justice Department declined to comment. Apple, which introduced a new version of its iPad tablet Wednesday, declined to comment.

The case centers on Apple's move to change the way that publishers charged for e-books as it prepared to introduce its first iPad in early 2010. Traditionally, publishers sold books to retailers for roughly half of the recommended cover price. Under that "wholesale model," booksellers were then free to offer those books to customers for less than the cover price if they wished. Most physical books are sold using this model. To build its early lead in e-books, Amazon Inc. sold many new best sellers at $9.99 to encourage consumers to buy its Kindle electronic readers. But publishers deeply disliked the strategy, fearing consumers would grow accustomed to inexpensive e-books and limit publishers' ability to sell pricier titles.

(YVES SMITH COMMENTS: This case strikes me as backwards. Amazon is selling below cost. That’s generally called predatory pricing, since the only way it makes sense is if you kill enough of your competitors that you attain monopoly power. But instead it is going after the parties that tried to find a response. And before you tell me you want your cheaper e-books, authors need to be paid, and the pay for writing books sucked even before this race to the bottom.)

Publishers also worried that retailers such as Barnes & Noble Inc. would be unable to compete with Amazon's steep discounting, leaving just one big buyer able to dictate prices in the industry. In essence, they feared suffering the same fate as record companies at Apple's hands, when the computer maker's iTunes service became the dominant player by selling songs for 99 cents.

I THOUGHT TANSY GOLD MIGHT FIND THIS USEFUL...THERE'S A LOT MORE WHERE THAT CAME FROM...

Demeter

(85,373 posts)THIS IS WHY I KEEP WORKING INDEPENDENTLY...AT ARM'S LENGTH, IF NOT FARTHER FROM ANY "EMPLOYER"...

http://www.washingtonpost.com/national/on-leadership/how-to-completely-utterly-destroy-an-employees-work-life/2012/03/05/gIQAxU3iuR_story.html?hpid=z5

...Over the past 15 years, we have studied what makes people happy and engaged at work. In discovering the answer, we also learned a lot about misery at work. Our research method was pretty straightforward. We collected confidential electronic diaries from 238 professionals in seven companies, each day for several months. All told, those diaries described nearly 12,000 days – how people felt, and the events that stood out in their minds. Systematically analyzing those diaries, we compared the events occurring on the best days with those on the worst. What we discovered is that the key factor you can use to make employees miserable on the job is to simply keep them from making progress in meaningful work.

People want to make a valuable contribution, and feel great when they make progress toward doing so. Knowing this progress principle is the first step to knowing how to destroy an employee’s work life. Many leaders, from team managers to CEOs, are already surprisingly expert at smothering employee engagement. In fact, on one-third of those 12,000 days, the person writing the diary was either unhappy at work, demotivated by the work, or both.

That’s pretty efficient work-life demolition, but it leaves room for improvement....(DETAILS AT LINK)

Step 1: Never allow pride of accomplishment.

Step 2: Miss no opportunity to block progress on employees’ projects.

Step 3: Give yourself some credit.(AS BOSS, THAT IS, FOR MAKING PEOPLE MISERABLE)

Step 4: Kill the messengers. Finally, if you do get wind of problems in the trenches, deny, deny, deny. And if possible, strike back. Here’s a great example from our research. In an open Q&A with one company’s chief operating officer, an employee asked about the morale problem and got this answer: “There is no morale problem in this company. And, for anybody who thinks there is, we have a nice big bus waiting outside to take you wherever you want to look for work.”

And I just found out today I've been screwed over as a result of a business deal I entered into over 25 years ago.

Have I ever mentioned to you folks here that I hate publishers? Hate as in with a purple passion?

Demeter

(85,373 posts)Any recourse available?

Tansy_Gold

(17,868 posts)no recourse.

It's a very long story which no one wants to read, but the short version being the publisher of one of my print books is preparing to go into bankruptcy, which means I have virtually no chance to get my rights (aka ownership) of the book back. Yes, the book is copyrighted in my name, so technically I own it, but the original contract remains in force to grant them the equivalent of a permanent lease on it which becomes an "asset" in any BK filing. As a fellow author who also happens to be a lawyer (which I am not) stated some time ago in a similar discussion, suing to get rights reverted is one thing because that's in state court, which would be NY and for most authors -- including yours truly -- that's still prohibitively expensive and in most cases not ultimately worth it. Once the publisher has gone into bankruptcy, which this one may or may not be forced to do, everything moves into federal court.

I don't know how many of my fellow SMWers have personal experience with copyright -- or worse, with copyright infringement -- but the whole Righthaven/DU thing has been an interesting examination of this, and I for one am just jumping up and down to see Righthaven demolished. You're probably wondering why, since they appeared to have been champions against the illegal copying of copyrighted work. But they never were that at all. They were greedy fucks who were trying to stifle fair use. They were a tool, albeit a cheap plastic worthless kind of tool, of PUBLISHERS, and folks, PUBLISHERS are part of that horrible media corporate anaconda that's killing democracy.

I've been pretty much absent from SMW lately, though I get in here and read every single day several times a day. There are several publishing- and media-related issues I've been following as they pertain to my own personal situation, and one of those issues is the case now moving slowly through the system regarding price-fixing BY THE BIG MEGA CONGLOMERATE PUBLISHERS AND APPLE COMPUTERS. This case has the potential to break digital publishing wide open. The media corporations have held onto "traditional" technologies, much in the way the automakers have protected the internal combustion engine, to the detriment of the environment and to the cause of true revolution. That may be coming to an end.

We'll see.

Info at

http://dearauthor.com/features/industry-news/thursday-news-a-bit-about-da-agency-pricing-appears-doomed-tamara-allen-leaves-dsp Scroll down to get info regarding "agency pricing" and price fixing, then down to comment #10 for info and links (which go to more links) on the impending collapse of Dorchester Publishing, aka Leisure Books.

I overslept and now am two hours behind schedule on the day job. I'll check in later.

FarCenter

(19,429 posts)Most copyrights and patents are either created as works for hire or they are transferred to a publisher or business under terms that are very unfavorable to the creator.

Hopefully, the low costs of self-publishing on the web will eventually drive publishers out of business.

Tansy_Gold

(17,868 posts)It's not the copyright on this that protects the publisher -- it's the contract.

Copyrights and patents DO protect the creators' rights, but copyrights and patents don't guarantee profits. The recording industry is a good example -- where the creative artists were able to take at least some control and ownership of their works away from the broadcasters, while sharing some of that ownership and control with the "publishers." Unfortunately, print publishing had a much longer history than copyright and too many traditions were bound into the business, leaving the creative folks with far too little leverage. Digital publishing offers the hope indeed of destroying traditional print publishing, and while I understand there are those who cling defiantly to their dead tree books and brick and mortar book stores, the industry behind all that is antithetical to creative freedom.

Off my soap box and into the shower.

FarCenter

(19,429 posts)If the journal accepts the article for publication, then X usually grants an exclusive right to the copyrighted work to the journal, although some journals would allow X to retain some rights.

If you author an article unrelated to your employment (but read the fine print of your employment contract), then you would be the author and can negotiate copyright transfers with the publisher on your own.

Tansy_Gold

(17,868 posts)Work for hire is an entirely different animal, and doesn't even necessarily cover the situation you're posing, and has absolutely zip to do with my situation.

As in

Not.

Even.

Close.

I'm talking about a 150,000 word novel that I wrote and hold the registered copyright to in my name. No employer was involved. No work for hire. I own the fucking copyright.

Demeter

(85,373 posts)..Washington, D.C.-based Fannie said it lost roughly $2.4 billion in the October-December quarter, stung by declining home prices. Revenue was about $4.5 billion.

The government rescued Fannie and sibling company Freddie Mac in September 2008 to cover their losses on soured mortgage loans. Since then, a federal regulator — the Federal Housing Finance Agency — has controlled their financial decisions. Taxpayers have spent more than $150 billion to prop up Fannie and Freddie, the most expensive bailout of the 2008 financial crisis. The government estimates that figure could top $259 billion to support the companies through 2014 after subtracting dividend payments. Fannie has received more than $116 billion so far from the Treasury Department, the most expensive bailout of a single company.

Fannie's bailout money totaled roughly $16.4 billion in 2011 after accounting for dividend payments. That's up from about $7.3 billion in 2010 but down from about $32.5 billion in 2009.

Fannie officials say losses have increased in recent quarters for two reasons: Some homeowners are paying less interest after refinancing at historically low mortgage rates; others are defaulting on their mortgages....

Demeter

(85,373 posts)Harris County Texas, which includes the city of Houston, won a bid to join a group lawsuit seeking damages from the Mortgage Electronic Registration Systems Inc., Bank of America Corp. and Stewart Title Co.

U.S. District Judge Reed C. O’Connor allowed Harris and nearby Brazoria County (66583MF) to enter the case that could result in payouts of a much as $10 billion for all Texas counties, according to court papers filed by the plaintiffs.

The counties accuse MERS, which runs an electronic registry of mortgages, and members of the mortgage banking industry including Bank of America of filing false lien claims in the real property records of Texas counties. The suit also alleges the defendants failed “to record subsequent assignments of mortgage loans and pay the attendant filing fees.”

MERS, a unit of Reston, Virginia-based Merscorp Inc., has said it complies with Texas’s recording statutes and regulations. Dallas sued in state court in September and the defendants won a change of the case to federal court in October. The U.S. Judicial Panel on Multidistrict Litigation in February denied an attempt by the defendants to join the case with a lawsuit brought against Merscorp by homeowners in Arizona. The case is Dallas County, Texas v. Merscorp Inc., 3:11-cv- 02733-O, U.S. District Court (1100L), Northern District of Texas (Dallas).

Demeter

(85,373 posts)AFTER BANCO AMBROSIANO WHICH COLLAPSED IN 1982, AND THE MAFIA WHICH STARTED IN THE 1850'S, AND ALL THE OTHER STUFF WHICH HAS GONE DOWN IN ITALY SINCE BRUTUS KNIFED CAESAR, THEY FINALLY CAUGHT A CLUE!

http://www.rawstory.com/rs/2012/03/07/u-s-sees-vatican-as-potential-money-laundering-hub/?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+TheRawStory+%28The+Raw+Story%29

Demeter

(85,373 posts)The national minimum wage for workers aged 20 and under is set to be frozen at less than £5 an hour in an attempt to create more jobs for them, the Government will announce soon...

Warpy

(111,339 posts)around until they brush his butt into Club Fed for the rest of his rotten life, which is what 20 years in the pen will be.

I just hope the fines strip his family of all his ill gotten gains. While I don't want to see people flung into poverty if they did no wrong, no one should be able to profit from innocent people the way Stanford did. All his money needs to be gone.

After all, his shenanigans threw enough of his non relatives into poverty.

Enjoy prison, you bastard!

Demeter

(85,373 posts)So either there's some major security threat of which we know nothing — or the Powers That Be are simply terrified of being mic-checked. I'm gonna have to go with the second one:

Administration officials and associates, speaking only on the condition of anonymity, said the president in recent weeks began discussing the idea of a more intimate setting for the world leaders — both to ease their communications and to cut down on the security concerns and traffic tie-ups of a big-city summit. Also, several noted, Vladimir V. Putin, a harsh critic of the United States who returns to the presidency of Russia after his election on Sunday, will be among the attendees.

“To facilitate a free-flowing discussion with our close G-8 partners, the president is inviting his fellow G-8 leaders to Camp David on May 18 to 19 for the G-8 Summit, which will address a broad range of economic, political and security issues,” the brief White House statement said.

Still, the change of location was unusual given the months-long lead time that such events require for preparation.

I think the reporter just said the White House was lying. Not in so many words, but close. You can draw your own conclusions.

Huh. So if protests weren't even a factor, considering the sorts of things that have been going on in protests around the globe, they'd have to be pretty dumb to not be worried about them. Which indicates to me that someone is blowing smoke, but that's okay. It's always better to have them scared of the people than it is to have the people scared of the Powers That Be.

Demeter

(85,373 posts)The people at NECSI sent me the following interesting blurb on the relationship between the rise in food prices and social unrest:

These videos illustrate the correlation between increasing costs of food and worldwide food riots, especially from 2000 until the present day. Both prices and riots peaked in 2008 and 2011 after a brief drop in 2009. This month, NECSI is publishing the results of its food prices update, in which the institute extends its food price model to January 2012, entering no modifications to the model and continuing to use its dynamics.

“The food price bubble of 2011 caused widespread hunger and helped trigger the Arab spring. In 2013 we expect prices to be even higher and may lead to major social disruptions.” said Professor Yaneer Bar-Yam President of NECSI, who has just returned from the World Economic Forum in Davos, Switzerland where he presented his findings on speculation in global commodity markets. His paper “The Food Crises: A Quantitative Model of Food Prices Including Speculators and Ethanol Conversion” was called one of the top 10 discoveries in science of 2011 by Wired magazine.

According to the new study, the next food price peak will take place in about a year. The results will be dramatically higher prices than we have encountered thus far. The study warns that should ethanol production continue to grow according to multiyear trends, even this underlying trend will reach social-crisis levels in just one year.

NECSI’s latest findings reveal that the model from their 2011 paper still fits food price price trends. Their update reveals one important shift, however, in price trends, which might add to, not reduce, global instability. “The current trend of prices suggests that in the immediate future market prices may become lower than equilibrium,” says the study, “consistent with bubble and crash market oscillations.” The next bubble is expected by the end of 2012.

NECSI’s researchers said the model they have used to examine food prices has proven to be robust and consistent with ongoing behavior of food prices. Bar-Yam, who co-authored last year’s food-price study as well as the latest study update, said that the fit with the FAO Food Price Index is still “strikingly quantitatively accurate, validating both the descriptive and predictive abilities of the model.

”To extend NECSI’s earlier model ten months out and still witness a fit is important,” he added. “This means we have validated it for data that was not around when we first made the model. It predicted the burst of the 2011 food bubble at the exact time it happened, when many were saying that high food prices were there to stay. Success in predictive validation is remarkable. The conclusions are reinforced greatly that high food prices are due to ethanol and speculators–with all the relevant policy implications.”

“The current equilibrium value is about 50% higher than the prices prior to the impact of the ethanol shock. And the projected time until the next food price bubble is about a year.” The results will be dramatically higher prices than encountered thus far.

As I commented before the Arab Spring:

-On Food Price Inflation, Nov 2010

I don’t think things are any different now. I should add that emerging markets central banks were pushed to tighten in 2010 because of rising food prices and this has created a negative growth dynamic in countries like Brazil and India as high interest rates have combined with inflation to suppress demand growth. In Brazil’s case, the currency has also created even more problems.

If the NECSI’s models have any predictive value, policy makers in the developed economies addicted to easy money to cure the indebtedness in the private sector should take note because their policies can have unintended consequences as negative real yields bite and private portfolio preferences shift and drive up commodity prices.

As NECSI puts it in:

Source: UPDATE 2012 — The Food Crisis: Predictive Validation of a Quantitative Model of Food Prices Including Speculation and Ethanol Conversion

*********************************************************************

Edward Harrison is the founder of Credit Writedowns and a former career diplomat, investment banker and technology executive with over twenty years of business experience. He is also a regular economic and financial commentator on BBC World News, CNBC Television, Business News Network, CBC, Fox Television and RT Television. He speaks six languages, a skill he uses to provide a more global perspective. Edward holds an MBA in Finance from Columbia University and a BA in Economics from Dartmouth College.

Demeter

(85,373 posts)CONTRAST BETWEEN HOW BLUE AND WHITE COLLAR CRIMES ARE HANDLED...MUST READ

Demeter

(85,373 posts)I'm leaving at 7AM going East into the sunrise and rush hour traffic....the things I do for this board! And it's going to be cold tomorrow--it might get up to freezing (Saturday up to 48F, Sunday, 58F).

You will of course be bored with a blow-by-blow account...

Demeter

(85,373 posts)Billions in taxpayer dollars were improperly paid out in the form of unemployment insurance benefits last year and, as ABC News has learned, many states have been slow in trying to get that money back. In 2011 alone, the government paid out $11 billion to people who either were intentionally cheating the system or accidentally violated the rules, according to the U.S. Department of Labor.

In other words, some people who no longer qualify for benefits are still collecting.

The Labor Department said there is a program to help states recoup the funds but ABC News has learned that only a few state governments are actually using it. So far only New York, Wisconsin, Pennsylvania and Michigan are actively working with the Treasury Department to collect improperly distributed payments through resources like the Treasury Offset Program (TOP). Under the TOP program, the IRS allows states to withhold the tax refunds of people who have received improper compensation to recoup the lost funds. More than 20 other states planning to join in the future to help regain billions in wrongly disbursed unemployment funds including states like Texas and California.

Over the last three years, Texas has paid out more than $1 billion improperly, according to the Labor Department. In California, unemployment recipients were paid more than $1.7 billion in error or under fraudulent circumstances. More than 40 percent of unemployment payments paid out in Louisiana and Indiana were improper funds.

Assistant Secretary of Labor Jane Oates told ABC News that outdated computer software at the state level is a major reason why so few states have been taking part in the program since it was started in January 2011. "Our states have really let their infrastructure systems become obsolete," Oates said. "So therefore, when new programs become available, their systems aren't able to handle them. So it does require an investment on the range of millions of dollars." At a time when cash-strapped states are slashing budgets because of deficits, it's an investment few states have been willing to make.

I EXPECT, WITHOUT THESE "ERRORS", THERE WOULD BE NO SIGNS OF "RECOVERY" AT ALL...

wobblie

(61 posts)The overwhelming majority of "improper payments" are NOT the result of the actions of the unemployed claimant. Rather they are the result of the various adjudicators (claims examiners, administrative law judges, state review boards and civil judges) not agreeing on what constitutes "unemployed through no fault of their own". On the one hand, as the economic debacle called the "great recession" got going, states made the decision to pay as many claimants as possible to keep the economy chugging along. Every decision to pay a claimant can be appealed by the employer who's State Unemployment Tax Assessment (SUTA) is ultimately charged for the benefits. On appeal many of the initial decisions to pay claimants are being reversed resulting in the "improper" and "overpayment". Employer negligence is in fact a major reason why improper payments occurred, (no mention of that in the article--can't say anything bad about the "job' creators.) The war on those who received a UI benefit is just getting going. In Michigan 10's or thousands of "Fraud" adjudications have been issued to claimants on the basis of nothing more than a non-response by the claimant (as if unemployed people are not forced to move) . These "fraud" findings impose HUGE penalties plus interest on the claimant (some will owe over a 100 thousand in improper payments, penalties and interest) some will become debt slaves to the state.The draconian measures implemented by Michigan will soon be followed in other states where the Republicans control.

Demeter

(85,373 posts)TRAUMA SHOWS UP BEFORE MOST RADIATION CONSEQUENCES....

http://www.npr.org/2012/03/09/148227596/trauma-not-radiation-is-key-concern-in-japan?ft=1&f=1001

..."Surprisingly, there have been no health effects that have been demonstrated among the Japanese people or among the workers," says John Boice, a cancer epidemiologist at Vanderbilt University. To be sure, "there was radiation released. It was about a tenth of what was released from Chernobyl," he says. "But most of the releases were blown off to the Pacific Ocean. The winds were blowing to the sea and not to populated areas."

One big cloud did blow inland, up toward the northwest. But most of the 170,000 residents in the area were quickly evacuated. Boice says that helped limit dangerous doses. So did other quick actions by the Japanese government. "They prohibited the release of any food that had had increased levels of radiation in them," he says. "So there wasn't milk out there in the public supply. There wasn't any fish that had levels that were increased."

And that's a huge difference from the aftermath of Chernobyl. In 1986, the Soviets let people eat contaminated food and drink contaminated milk, activity that led to many cancers. In Japan, Boice says the only people with significantly elevated doses are the nuclear workers. And as a result, a few workers are at slightly higher risk for cancer...

NOT COUNTING THE SUICIDE WORKERS, ONE MUST ADD...They work until they reach the occupational radiation limit of 50 millisieverts in a year, then they go home. But they don't know what their risk really entails...

wobblie

(61 posts)Demeter

(85,373 posts)Commitment by German group to ‘encourage global companies to invest in Greece’s economic revival’

Read more >>

http://link.ft.com/r/IOCBMM/DW10C3/MJTKN/62K46I/3095JJ/N9/t?a1=2012&a2=3&a3=9

LOOK MAUD, THE VULTURES ARE RETURNING TO CAPISTRANO! A CLEAR SIGN OF SPRING!

Demeter

(85,373 posts)The emergency funding was tapped despite the concerns of the outgoing chief executive that the move would be seen as a sign of weakness

Read more >>

http://link.ft.com/r/IOCBMM/DW10C3/MJTKN/62K46I/973YUB/N9/t?a1=2012&a2=3&a3=9

MUST BE WHY HE'S "OUTGOING"

Demeter

(85,373 posts)Allen Stanford, the bank executive convicted of stealing $7bn in a Ponzi scheme, must forfeit $330m held in offshore accounts, a jury ruled

Read more >>

http://link.ft.com/r/IOCBMM/DW10C3/MJTKN/62K46I/4CS4RG/N9/t?a1=2012&a2=3&a3=9

Demeter

(85,373 posts)The US Treasury has sold 206m AIG shares at $29 apiece, lowering its stake from 77 to 70 per cent and touting the recovery of taxpayer money

Read more >>

http://link.ft.com/r/IOCBMM/DW10C3/MJTKN/62K46I/R37G5W/N9/t?a1=2012&a2=3&a3=9

Demeter

(85,373 posts)It is deja vu all over again. To little media fanfare the dire financial situation in Ireland is nothing less than a repeat of the Lehman collapse in those dark days of September 2008. With the recent nationalization of half of the country's six big banks, and the blanket guarantee over the rest of them, the Irish government has effectively made sure that bondholders in all banks, even those which such as long insolvent Anglo Irish bank will be made whole by the long-suffering Irish taxpayers. And despite rumors of haircuts for at least sub debtholders, actual facts validating this possibility remain unseen. Which begs the question why is everyone in the world so terrified of taking mark to market losses on even a few billion in debt? Simple: as all of the world's banks, but Europe more so than anyone else, are now caught in the biggest circle jerk ever imaginable, with one entity's liabilities making up another's assets, which in turn are someone else's liabilities, and so forth in a MC Escher (or is that HR Giger?)-esque flow chart of the surreal (as can be seen here), even one dollar of write downs can spiral and affect tens if not hundreds of billions of downstream assets (and thus liabilities). Which explains why the ECB and everyone else in Europe is so intent on preventing a failed auction in Ireland (we previously disclosed that virtually every September auction of Irish bonds was purchased by the ECB, either directly and indirectly): should the banks that are on the hook actually validate their impairment, Europe is one step away from activating its own $1 trillion TARP package. Yet what is amusing is that inbetween the cracks of exclusively European-bank based senior and subordinated bondholders in such bankrupt banks as Anglo-Irish, a familiar name emerges: Goldman Sachs.

Yes, nested quietly inbetween the €4,034,756,880 in face value of Anglo Irish bondholders is the name that managed to pull the strings (via its puppet Hank Paulson) and get bailed out when AIG threatened to make Goldman management and investors insolvent. Is Goldman, via its UK-based Goldman Sachs Asset Management Intl. subsidiary, currently petitioning Brian Lenihan to be the only US-based bank to receive a direct bailout on its Anglo bond position? Or is it, as always behind the scenes, negotiating on behalf of 80 other European banks, among which Lombard Odier, Rothschild, and Deutsche, and achieve what it always succeeds in: escaping scott free, and stuffing taxpayers with the bill? We are confident Irish taxpayers, and drivers of cement trucks, would be fascinated in getting the correct answer.

Guido Fawkes, who managed to obtain the Anglo Irish bondholder list, shares the following commentary:

Every child in Ireland is being bequeathed a huge debt at birth to protect the interests of foreign, mainly German, bondholders – why? Guido was once a bond trader, it was always understood that sometimes the bond issuer defaults. That is the risk investors take.

So why is Dublin’s political establishment so keen to protect foreign investors at the expense of future generations? Guido has obtained the list of foreign Anglo-Irish bondholders as at the close of business tonight. These are the people whom Dublin’s politicians really seem to care about.

Between them they hold Anglo-Irish bonds with a face-value of €4,034,756,880. Shouldn’t they take the hit rather than future generations of Irish taxpayers? Capitalism is a system of profit and loss, they took the risk of investing in Anglo-Irish Bank. Is the Irish government under pressure from the European Central Bank in Frankfurt to protect German investors?

Spot on question. And as the highlighted area in the chart below demonstrates, we would like to add Goldman Sachs to the list of bailoutees. Surely, few firms in the world deserve to be redeemed as much as god's little helpers.

Demeter

(85,373 posts)Eurozone finance ministers have approved a 130bn euro ($170bn) second bailout package for Greece to resolve the debt-ridden nation's immediate repayment needs. The deal reached after 13 hours of tortuous talks in Brussels, however, is unlikely to revive Greece's ailing economy...Papademos, a former European Central Bank No. 2 backed by European Union partners to lead an emergency coalition government in Athens, acknowledged that full delivery of the deal depends on Greece delivering on a string of conditions in "a timely and effective manner". Analysts say the deal may only delay a deeper default by a few months. Greece has been in recession for the last five years and it is unlikely to do well in the next one decade with huge spending cuts.

The accord will enable Greece to launch a bond swap with private investors to help reduce and restructure Athens' vast debts, put it on a more stable financial footing and keep it inside the 17-country eurozone. Greece will have around 100 billion euros of debt written off as banks and insurers will swap bonds they hold for longer-dated securities that pay a lower coupon. Private sector holders of Greek debt are expected to take losses of 53.5 per cent or more on the nominal value of their bonds as part of a debt exchange. Previously they had agreed to take a 50 per cent nominal writedown, which equated to around a 70 per cent loss on the net present value of the bonds.

The euro jumped almost half a cent, reversing earlier losses, after the deal was struck. The private creditor bond exchange is expected to be launched on March 8 and completed three days later. That means a 14.5-billion-euro bond repayment due on March 20 would be restructured, allowing Greece to avoid default. The vast majority of the funds in the 130-billion-euro programme will be used to finance the bond swap and ensure Greece's banking system remains stable: 30 billion euros will go to "sweeteners" to get the private sector to sign up to the swap, 23 billion will go to recapitalise Greek banks. A further 35 billion will allow Greece to finance the buying back of the bonds, and 5.7 billion will go to paying off the interest accrued on the bonds being traded in. Next to nothing will go directly to help the Greek economy.

Jan Kees de Jager, the Dutch finance minister who is the most outspoken of Greece's northern creditors, insisted in Brussels on Monday that the Netherlands could not approve the rescue package until Greece had met all its obligations. Finland, another stern creditor, signed a side deal with Greece for Greek banks to provide collateral in cash and highly rated assets in return for Finnish loan guarantees, removing one long-running obstacle. Massive austerity cuts demanded by Greece's international creditors have failed to restore growth and have provoked clashes between protesters and police. Measures passed by the Greek parliament last week set out 3.3bn euros' worth of cuts to salaries and pensions, and health and defence spending - sparking a fresh series of protests.

Demeter

(85,373 posts)Actually I was down there before the quake. The money never gets to the poor Haitians.

xchrom

(108,903 posts)

what a fabulous photo!

xchrom

(108,903 posts)xchrom

(108,903 posts)The nation’s banks and credit unions had their best year since 2006, as a slowly recovering economy led to modest loan growth and lower levels of nonperforming loans.

Commercial banks made $119.5 billion in net income in 2011, the most since 2006, when they earned $145.2 billion. Credit unions earned $6.4 billion, the most ever.

According to an American University Investigative Reporting Workshop analysis of quarterly federal reports, total troubled assets (nonperforming loans plus repossessed real estate) tumbled to $251 billion as of Dec. 31, down from $322.6 billion a year earlier. As a result, the number of banks with more troubled assets than capital and reserves fell to 321, from 389 a year ago.

That meant banks had to set aside much less money for potential loan losses.

Despite their growing profits, banks are not lending much more. For the full year, bank lending increased by a mere 1.8 percent to about $7.27 trillion. Lending remains well below the $7.8 trillion level of December 2007.

xchrom

(108,903 posts)The U.S. used to be a powerhouse in manufacturing. In the past quarter of a century we have relinquished this leadership position, in large part because we made a decision—consciously or unconsciously—that the service and financial sectors are sufficient to sustain our economy. But they are not. Service jobs pay little. The financial industry makes nothing of value and therefore cannot maintain, let alone raise, the nation’s standard of living.

The fate of manufacturing is in some ways linked to our prowess in the physical sciences. In the 1960s and 1970s high-performance computing (HPC) developed at the national labs made its way to the manufacturing sector, where it now powers much of the innovation behind our most successful commercial firms. Yet we are ceding leadership in the physical sciences, too. Canceling the Superconducting Super Collider in the 1990s ended U.S. dominance in particle physics. NASA’s decision to delay, and possibly eventually abandon, the Wide-Field Infrared Survey Telescope could do the same for cosmology.

Fortunately, the nation’s lead in high-performance computing still stands. HPC is the advanced computing physicists use to model the dynamics of black holes, meteorologists use to model weather and engineers use to simulate combustion. This expertise may also be our best chance to rescue U.S. manufacturing. If we can successfully deliver it to engineers at small firms, it might give the sector enough of a boost to compete with lower labor costs overseas.

We already know how useful HPC is for big firms. When Boeing made the 767 in the 1980s, it tested 77 wing prototypes in the wind tunnel. When it made the 787 in 2005, it tested only 11. In the future, Boeing plans to bring that number down to three. Instead of physical wind tunnels, it uses virtual ones—simulations run on supercomputers—saving much time and money and quickening the pace of new products development. HPC modeling and simulation has become an equally powerful tool in designing assembly lines and manufacturing processes in a broad range of fields—big manufacturers such as Caterpillar, General Electric, Goodyear and Procter & Gamble use it routinely. Small manufacturers could get similar benefits from these tools, if only they had access to them.

xchrom

(108,903 posts)

Spanx founder Sara Blakely at the Spanx Fall 2012 Fashion Week Presentation in New York in February. (Skip Bolen, Getty Images for Spanx / February 13, 2012)

Spanx inventor Sara Blakely is a billionaire at 41 years old, according to the annual Forbes magazine list of billionaires.

Blakely, the creator and owner of the line of women's and men's slimming, smoothing undergarments, is the youngest woman ever to make the list as a self-made billionaire, meaning she didn't inherit or marry into the money.

She's one of several billionaires who appear on the cover of the latest Forbes issue.

According to Forbes, Blakely was 29 when she was looking for something flattering to wear under her white slacks. She ended up inventing a new line of shaping underwear. She invested $5,000 — her entire life savings — to start the company.

DemReadingDU

(16,000 posts)xchrom

(108,903 posts)there's a great doc on -- i wanna say the sundance channel about womens underwear -- who made what and sometimes how much money was made.

quite the lucrative business for some -- and more women than i realized involved at highest levels -- i had always thought all that stuff was designed by men.

AnneD

(15,774 posts)before there was panty hose. So I got to experience at a young age girdles/garters. Trust me, Spankx are not girdles and this woman deserves her fortune. To those of us in maintenance mode....Spankx are your best friend. No more laying on the bed to zip up those jeans, no more last minute wardrobe surprise when you have a pair of spanks handy. Men designed girdles, a woman designed Spankx.

girl gone mad

(20,634 posts)but she doesn't look like she needs slimming undergarments.

xchrom

(108,903 posts)TalkingDog

(9,001 posts)Something "flesh-colored" that has no seams or creates no panty-line however....

xchrom

(108,903 posts)

Analysts expect Chinese policymakers to implement modest loosening measures such as lowering bank reserve ratios. Above, shoppers outside a mall in the city of Datong, Shanxi province. (Mark Ralston, AFP/Getty Images / March 9, 2012)

Reporting from Beijing—

China’s annual inflation rate fell to a 20-month low in February, giving policymakers room to ease lending at a time of tapering economic growth.

“The inflation story is over, leaving [China’s central bank] with fewer excuses not to step up its easing efforts, especially given a sharp slowdown in exports so far this year,” said Qu Hongbin, co-head of Asian Economics Research for HSBC, in a note to clients Friday. “Get ready for more steps toward policy easing.”

Consumer prices rose 3.2% from a year earlier, down from 4.5% annual growth in January, China’s National Bureau of Statistics said Friday.

The slowdown was led by food prices, which rose 6.2% in February compared to 10.5% in January.

xchrom

(108,903 posts)The rising stock market is making Americans richer.

A powerful surge in stock prices that began in early October helped boost Americans’ net worth 2.1% in the fourth quarter, according to data released Thursday by the Federal Reserve.

Investor stock portfolios jumped nearly 10% in the final three months of the year, as the Standard & Poor’s 500 index rose 11%.

Overall net worth rose to $58.5 trillion, up nearly 20% from the early-2009 low that followed the global financial crisis. But Americans’ total wealth is still less than the $63.5-trillion level in mid-2007.

In a sign that Americans are feeling more comfortable about their finances and job security, household debt levels rose 0.25%, the first increase since mid-2008, according to the Fed.

One sour note: the continued decline in home values, which dipped 1.3% during the fourth quarter.

*** that's really the whole article -- so there's a lot of info missing -- like -- are we talking about small investors? where and who are these americans? etc

AnneD

(15,774 posts)until you sell it.

I learned years ago, never confuse your value on paper with your worth...real or imagined. YMMV

xchrom

(108,903 posts)this is always the problem for regular people -- especially since it's all boom and bust these days.

xchrom

(108,903 posts) ?t=1331239434&s=4

?t=1331239434&s=4

The entrance to the Museum of the Olympic Games in Olympia, Greece, is cordoned off last month, after two hooded thieves broke into the museum and made away with more than 70 ancient objects. The stolen loot included chariots, horses and a gold ring that was more than 3,000 years old. Greeks say such sites are vulnerable because of cutbacks that have reduced the number of guards. (Dimitris Papaioannoy / EPA/Landov)

At the Museum of the Olympic Games in Olympia, Greece, lush pine trees and olive groves are filled with chirping birds. The one guard at the site looks nervously at the few visitors.

There is still a sense of shock in Olympia following the theft last month at the museum, when armed robbers broke into the building and tied up the single guard on duty.

Archaeologist Kostantinos Antonopoulos says they ran off with 77 priceless objects, including votive figurines, chariots and horses.

"But the most precious and valuable exhibit that they took was a golden ring of the Mycenaean times. And it had a picture on it, very important from the early times of the games," he says, adding that the ring was more than 3,000 years old.

Roland99

(53,342 posts)U.S. gains 227,000 jobs in February

Best stretch of job growth since 2006; jobless rate remains at 8.3%

http://www.marketwatch.com/story/us-gains-227000-jobs-in-february-2012-03-09?dist=beforebell

Roland99

(53,342 posts)U.S. trade gap widens sharply in January

Month’s deficit of $52.6 billion hits highest since October 2008

http://www.marketwatch.com/story/us-trade-gap-widens-sharply-in-january-2012-03-09?link=MW_home_latest_news

Roland99

(53,342 posts)DOW 12,870 +98.00 0.77%

NASDAQ 2,637 +34.00 1.31%

xchrom

(108,903 posts)Citigroup Inc. (C), the third-biggest bank, said it gave Chief Executive Officer Vikram Pandit $14.9 million in total compensation for 2011, including his first bonus since the lender almost collapsed in 2008.

The package included $1.67 million of salary and a $5.33 million cash bonus, the New York-based lender said yesterday in a regulatory filing.

The award reflects Citigroup’s return to profitability under Pandit, who became CEO in December 2007, the bank’s personnel and compensation committee said in the filing. The payout also rewards his performance last year, which he spent grappling with a revenue slump as the European sovereign-debt crisis roiled markets. The stock tumbled 44 percent, second- worst among the 24-company KBW Bank Index.

“Although Citi’s reported financial performance was mixed, underlying client trends point to continued progress on our operating goals,” the bank said. “The committee awarded annual incentive compensation, in addition to salary, to Mr. Pandit for the first time in four years in a manner commensurate with his responsibilities and the success of his implementation of Citi’s long-term strategies.”

xchrom

(108,903 posts)Oil at $110 a barrel is taking only half as big a bite out of Americans’ pocketbooks as it did in 1981, the last time Iranian shipments were disrupted.

The cost of a barrel of crude in the U.S., adjusted for total disposable income, was $107.92 in January of this year, compared with a peak of $213.44 in the same month in 1981, according to data compiled by Bloomberg (.OILINCM) and the Energy and Commerce Departments. Oil consumption was 4.8 percent of income in 2010, compared with 9.7 percent in 1981, the data showed.

For all the concern over the fallout from sanctions against Iran and the prospect of gasoline topping $4 a gallon in a U.S. election year, the distress caused by rising oil prices is being mitigated by improved household purchasing power, a strengthening economy and America’s growing energy independence.

“The threshold to withstand the run-up in energy prices is higher than most people think,” said Carl Riccadonna, a senior U.S. economist at Deutsche Bank Securities Inc. in New York, in a phone interview March 6. “We can tolerate fuel at $4. Job growth is stronger and incomes are looking very decent. The economy is on firmer footing.”

*** i guess we'll see if this holds true...or if we will be in for a 'surprise'.

Demeter

(85,373 posts)As someone who drives for a living, and can't raise prices for it, $4 gas is NOT affordable....

xchrom

(108,903 posts)Greek government bonds due to be issued after the nation’s debt swap is completed were priced at less than 30 percent of face amount, signaling concern the country will struggle to repay its revised obligations.

While the debt swap is “a big step forward, it’s not totally out of the woods yet,” said Mohit Kumar, the head of European fixed-income strategy at Deutsche Bank AG in London. “There is a premium still demanded for Greece.”

Greece’s economy shrank 7.5 percent in the fourth quarter from the same period in 2010, the Athens-based Hellenic Statistical Authority said today. The contraction, based on non- seasonally adjusted data, was wider than a Feb. 14 preliminary estimate of a 7 percent contraction, the authority said.

The 2 percent bonds maturing in February 2023 were bid at 25.75 cents on the euro at 2:06 p.m. London time, BNP Paribas SA data on Bloomberg showed. They were offered at 26 cents, according to Jefferies Group Inc. That left the yield on the securities bid at 19.56 percent and offered at 19.42 percent, the data showed. Portuguese securities maturing in October 2023 yielded less than 14 percent.

“The market will price” Greek bonds “at a premium to Portugal,” said Kumar.

CAPHAVOC

(1,138 posts)What will they have to do to get the next money drop in a few months?

xchrom

(108,903 posts)can have confidence in this or even be able to figure out what is actually happening.

Roland99

(53,342 posts)DemReadingDU

(16,000 posts)3/8/12 MF Global Still Set to Pay Bonuses

Executives Helping Trustee in Wake of Firm's Collapse Could Get Hundreds of Thousands of Dollars

Three top executives of MF Global Holdings Ltd. when it collapsed could get bonuses of as much as several hundred thousand dollars each under a plan by a trustee overseeing the securities firm's bankruptcy case, people familiar with the matter said.

Louis Freeh, the former Federal Bureau of Investigation director now in charge of unwinding what is left of the New York company, is expected to ask a bankruptcy-court judge as soon as this month to approve performance-related payouts for the chief operating officer, finance chief and general counsel at MF Global, these people said. All three executives kept their jobs after the company's Oct. 31 failure in order to help Mr. Freeh untangle the firm's assets and maximize payouts to creditors.

Under the expected pay plan, the three executives and as many as 20 other MF Global employees working for Mr. Freeh would get the bonuses only if they hit specified targets such as increasing the value of MF Global's estate for creditors.

The payments could vary in size depending on progress with the estate and likely would be paid in batches throughout 2012, a person familiar with the matter said. The total payouts are expected to be smaller than bonuses received by the same executives before MF Global sank amid panic over the big bets made on European sovereign debt under Jon S. Corzine, the company's former chairman and chief executive. He resigned in November.

more...

http://online.wsj.com/article/SB10001424052970203961204577269841477216320.html?mod=googlenews_wsj

girl gone mad

(20,634 posts)one of the clients whose money was stolen hasn't gone postal yet.

xchrom

(108,903 posts)The Bureau of Labor Statistics reports that the private sector generated 233,000 jobs in February, with 227,000 total jobs created as the public sector, led by the federal government, lost 6,000 jobs—an improvement over 2011, when an average of 22,000 public sector jobs were lost each month. The unemployment rate was unchanged at 8.3 percent

The number of officially unemployed people is 12.8 million, "essentially unchanged" from January, with 5.4 million having been jobless for six months or longer. The U6, an alternative measure of unemployment that includes those working part-time because they cannot find the full-time work they want and some (but not all) people who have become too discouraged to look for work, dropped below 15 percent for the first time since 2009.

The numbers are seasonally adjusted. December's numbers were revised upward, from 203,000 to 223,000, and January was revised from 243,000 to 284,000. Crucially, the civilian labor force participation rate and the employment-population ratio both grew slightly, to 63.9 percent and 58.6 percent respectively.

Manufacturing employment rose by 31,000, entirely in durable goods manufacturing. Professional and business services employment rose by 82,000 jobs; however, more than half of those jobs, 45,000, were in temporary help services. Health care and social assistance employment rose by 61,000 and leisure and hospitality by 44,000.

Roland99

(53,342 posts)ISDA Finds Greek Credit Event Has Occurred Reports Bloomberg

http://www.zerohedge.com/news/isda-finds-greek-credit-event-has-occurred-reports-bloomberg

ISDA CDS Trigger Decision Is Unanimous

http://www.zerohedge.com/news/isda-cds-trigger-decision-unanimous

In light of today’s EMEA Determinations Committee (the EMEA DC) unanimous decision in respect of the potential Credit Event question relating to The Hellenic Republic (DC Issue 2012030901), the EMEA DC has agreed to publish the following statement:

The EMEA DC resolved that a Restructuring Credit Event has occurred under Section 4.7 of the ISDA 2003 Credit Derivatives Definitions (as amended by the July 2009 Supplement) (the 2003 Definitions) following the exercise by The Hellenic Republic of collective action clauses to amend the terms of Greek law governed bonds issued by The Hellenic Republic (the Affected Bonds) such that the right of all holders of the Affected Bonds to receive payments has been reduced.

The EMEA DC has resolved to hold an auction with respect to the settlement of standard credit default swaps for which The Hellenic Republic is the reference entity. To maximise the range of obligations that market participants may deliver in settlement of any such credit default swaps, the EMEA DC has agreed to run an expedited auction process such that the auction itself will take place on March 19, 2012. In light of this expedited auction process, market participants should submit any obligations that they would like to include on the list of deliverable obligations to ISDA as soon as possible.

Demeter

(85,373 posts)hamerfan

(1,404 posts)Train. Save Me, San Francisco:

just because....