Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Economy

Related: About this forumwith ACA repeal, tax cuts worth more than premiums for 800,000 people in 20 states - CBPP

http://www.cbpp.org/research/federal-tax/aca-repeal-trump-tax-plan-and-ryans-better-way-tax-plan-all-fail-mnuchin-testRepublican lawmakers’ planned bill to repeal the ACA is expected to resemble the repeal bill that President Obama vetoed in January 2016. This approach would cut taxes for the richest people in the country while eliminating premium tax credits for low- and moderate-income people that help them buy health coverage in the health insurance marketplace and thereby afford to go to the doctor.

Households with incomes above $1 million would receive tax cuts averaging $57,000 apiece in 2025, reaping 53 percent of the net tax cuts.[6] The bulk of the tax cuts for high-income filers would come from eliminating two ACA Medicare taxes that fall only on high-income filers: the additional Medicare Hospital Insurance tax of 0.9 percent on earnings over $250,000 a year ($200,000 for single filers) and the Medicare tax of 3.8 percent on the unearned income of households above the $250,000 and $200,000 thresholds.

* Households with incomes above $1 million would receive 80 percent of the windfall from eliminating these two taxes, TPC estimates. [7]

* The top 400 households, who had average incomes of $318 million in 2014, would receive about $7 million apiece, on average, CBPP estimates based on IRS data.[8]

Not only would the highest-income households receive large tax cuts, in clear violation of the Mnuchin test, but people making between $40,000 and $50,000 would face an average tax increase of $100, in large part from the elimination of the premium tax credit.[9] Seven million low- and moderate-income families would lose premium tax credits worth an average of $5,700 in 2025.[10]

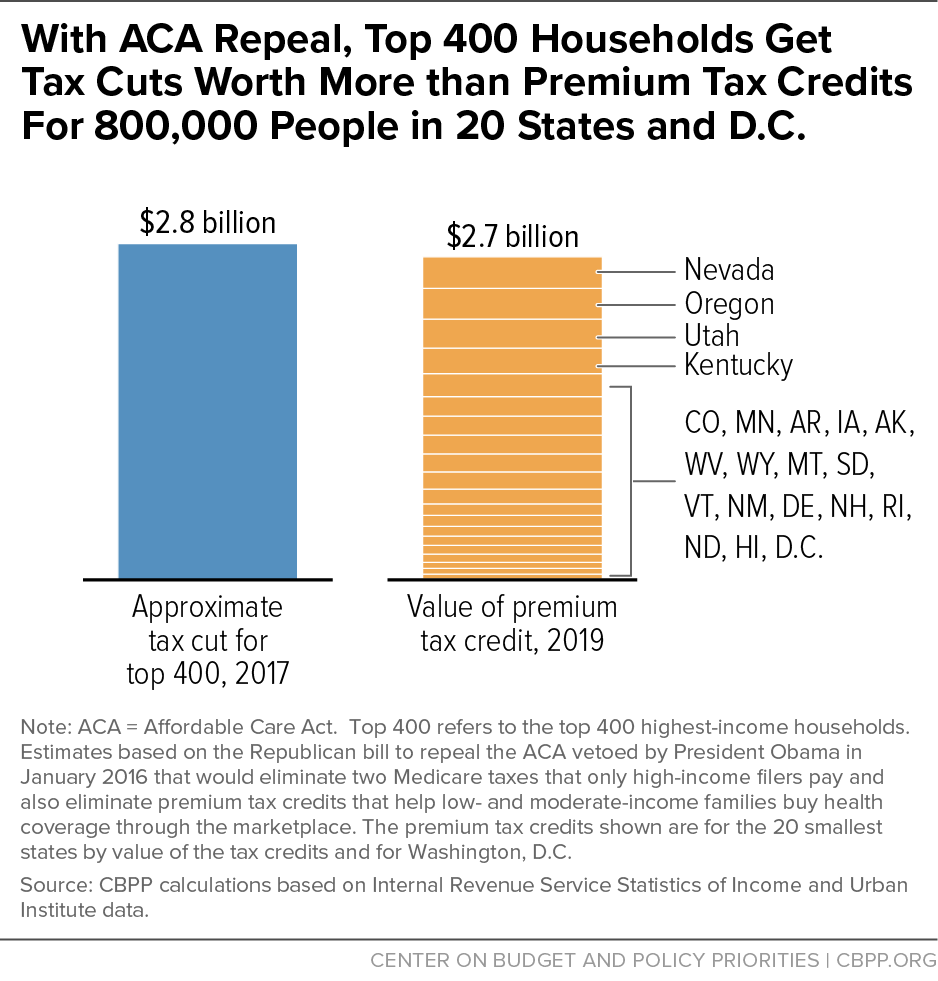

The total tax cuts for the Top 400 as a group just from repealing the ACA’s two Medicare tax provisions would exceed all of the premium tax credits for 813,000 low- and moderate-income people in the 20 smallest states and Washington, D.C. (see Figure 1).

(much more)

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

2 replies, 1501 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (1)

ReplyReply to this post

2 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

with ACA repeal, tax cuts worth more than premiums for 800,000 people in 20 states - CBPP (Original Post)

Bill USA

Jan 2017

OP

Wellstone ruled

(34,661 posts)1. There you go folks,

here is the hard numbers as many of us have been talking about since July.

Kittycow

(2,396 posts)2. Thank goodness the rich fucks can relax now.