Economy

Related: About this forumTop 20 per cent pay 61 per cent of Canada's income taxes, 'more than their share': study

Canada’s top income earners pay more than half of the total taxes collected by all levels of government, according to a new report from the Fraser Institute.

The report notes that increasing taxes on the wealthy is often pitched as a populist measure, with progressive politicians claiming the rich don’t pay their fair share, and that fiscal problems can be solved by boosting taxes on the wealthy.

In the last federal election, for example, Jagmeet Singh’s New Democrats proposed a special tax for those earning more than $10 million per year.

However, the report, which uses a tax simulation the Fraser Institute developed, says that the 20 per cent of Canadian families with an income of more than $227,486 actually pay 61.4 per cent of income taxes and 53 per cent of the country’s total taxes. That would include taxes such as payroll tax, sales tax and property tax.

https://montrealgazette.com/news/politics/income-taxes-canada

------------------------

Fraser Institute is a right-wing think tank, so take it with a grain of salt. Still, over 50% of all taxes is less than I expected for the top 20%. Normally you hear top 1% or top 10% being cited.

The Magistrate

(96,043 posts)What share of the nation's income falls to the upper fifth?

What proportion of the nation's wealth adheres to upper fifth?

OnlinePoker

(6,031 posts)According to Stats Canada, they hold 67.5% of wealth, which isn't surprising since they control much of the economy through full ownership or stock ownership in most companies. Their housing properties are likely valued quite high as well, mostly because they live in tonier neighbourhoods. Here in Victoria, for instance, my 3000 sq ft home would be worth over $1 million more if it was located just 1 block away beside the ocean.

https://www150.statcan.gc.ca/n1/daily-quotidien/210907/cg-b002-eng.htm

Hiawatha Pete

(2,053 posts)And the Montreal Gazette is owned by PostMedia, a RW rag 66% owned by US media conglomerate Chatham Asset Management-the $4.3 billion hedge fund that owns the National Enquirer & whose lawyers include none other than Michael Cohen - who handled Stormy Daniels' hush money for Donald Trump

References:

https://en.wikipedia.org/wiki/Postmedia_Network

https://www.bnnbloomberg.ca/at-hedge-fund-that-owns-trump-secre

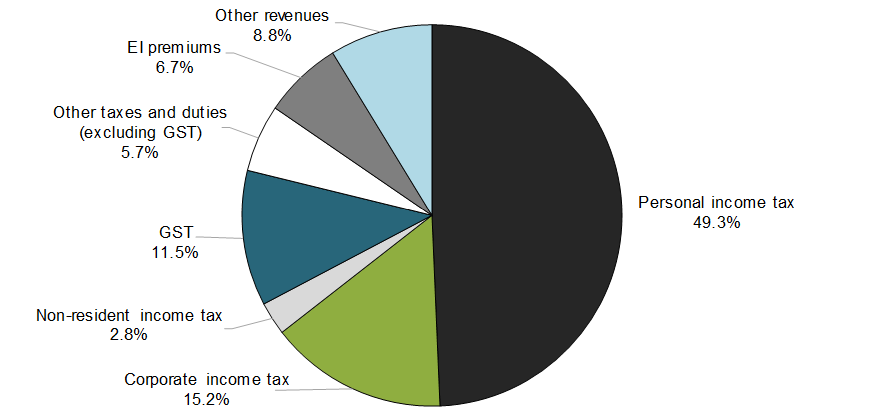

Here is the actual breakdown from Revenue Canada, with half of all tax revenue coming from personal income tax (ie the 99%):

TheRealNorth

(9,629 posts)How can we buy the political system if we are taxed higher?

James48

(4,985 posts)In the USA, the top 10% pay 70% of federal taxes. But gets because that same top 10% earns 70% of the USA earned income.

If they make more, they pay more. That’s ok.

Fiendish Thingy

(20,962 posts)That top 20% group wasn’t pulled out of a hat…it was almost certainly selected because it crossed the 50% threshold. In BC, lots of two income professional households cross the $227,000 income mark (remember that’s in Canadian dollars)

Not mentioned is the concentration of wealth within the income groups, such as the total wealth held by the top 5%, 1%, etc. Wealth inequality isn’t as dramatic in Canada as it is in the US, but it’s still there.

The Fraser institute is just looking for a rationale to cut the top tax rates, and raise taxes on the middle class.

Midnight Writer

(24,858 posts)I make a very small income, but I pay more in real tax dollars than Donald Trump. Is that the fairness they are looking for?

bucolic_frolic

(52,734 posts)VAT is a solution? I'm no tax expert, but taxing consumption might be considered.