2016 Postmortem

Related: About this forumWhat would Sanders do? Estimating the economic impact of Sanders programs

BY GERALD FRIEDMAN | NOVEMBER/DECEMBER 2015 | PDF VERSION

No one should be surprised by the popular support that Sen. Bernie Sanders (I-Vt.) has attracted in his run for president as a democratic socialist. Nor should we be surprised that he has drawn attacks charging that his policies will bankrupt the United States. Sanders’ proposals for infrastructure, early-childhood education, higher education, youth employment, family leave, private pensions, and Social Security would total over $3.8 trillion over 10 years. While this is a large number, it would be barely 6% of federal spending for 2017-2026.

Apart from any benefits these programs would bring directly, their cost would be reduced in four ways: Two operate by offsetting current spending and tax policies—either replacing existing federal spending or reducing tax breaks currently subsidizing private spending. The other two, which account for over 70% of the cost reduction, are the “dynamic effects” of increased economic growth—boosting tax revenues and reducing federal safety-net spending when the economy expands.

A quarter of new spending would be offset by savings and by faster economic growth. (See Figure 1.) The ongoing effects of the Great Recession that began in 2007 have left many resources underutilized. By putting unemployed workers and discouraged workers (who have stopped looking for jobs) back to work, the Sanders program would increase economic activity and government revenues while reducing spending on safety-net programs like Supplemental Nutrition.

Taking these dynamic effects into account, the net cost to the public treasury would be about $2.7 trillion, instead of $3.8 trillion, over 10 years. That is, over a quarter of the total tab would be offset by reductions in other forms of government spending and by increased tax revenue derived from faster economic growth.

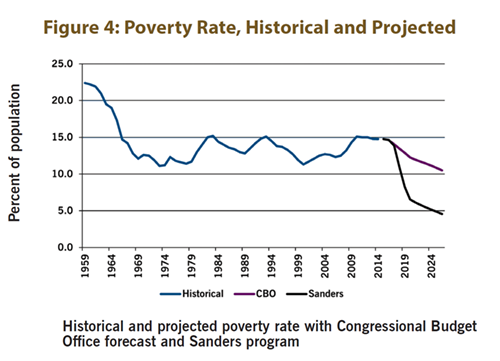

The Sanders program would add six million new jobs. (See Figure 4.) The Congressional Budget Office (CBO) projects that, due to sluggish economic growth, the percentage of the working-age population employed will fall between now and 2026, from 59% to 57%. The Sanders program would directly create jobs in infrastructure, in child-care services, in higher education, and for young people. It would also create additional jobs indirectly, as the newly employed and others spend their additional income. All told, I calculate that the program would raise employment by six million jobs by 2026.

Government spending would decline relative to GDP within the decade. (See Figure 5.) Federal spending would initially increase faster than GDP under the Sanders program. After 2021, however, federal spending would be lower as a percentage of GDP than it would be under Congressional Budget Office (CBO) projections, because of the strength of the economic recovery engendered by the Sanders stimulus. This is actually a conservative estimate of the boost to GDP because it does not include the productivity-raising effects of infrastructure spending and increased education.

http://dollarsandsense.org/archives/2015/1115friedman.html

Uncle Joe

(58,366 posts)Gerald Friedman, What Would Sanders Do. We have posted the research report by Friedman that is the basis of his two columns for us, What Would Sanders Do?, Part 1: The Dynamic Effects of Seven Sanders Initiatives, and What Would Sanders Do?, Part 2: Wages, Poverty, and Inequality. Soon we will post Friedman’s column for our March/April issue, “Bernie Sanders’s Health Care Revolution,” with the numbers behind Sanders’s “Improved Medicare for All.” We have already posted the research report behind that: Friedman Response to Thorpe. (Meanwhile, the Times mentioned Jerry Friedman in Left-Leaning Economists Question Cost of Bernie Sanders’s Plans, but didn’t bother to interview him. They seem to have scoured the universe for left critics of Sanders; as Lambert Strether of Naked Capitalism says, “When Jared Bernstein is at the far left, you know you’re looking at establishment stenography.” And I loved Matt Taibbi’s tweets about this article: “The hysterical concern over how to pay for Bernie’s plans is hilarious. Nobody worries about how we afford the F-35. Nor do we ask how we afford non-negotiated Medicare drugs, the Littoral Combat Ship, the carried interest tax break, or other idiocies.”) And a reminder: the whole point is that single-payer would cost less than the current system, and provide health care to many more people.

http://dollarsandsense.org/blog/2016/02/notes-links-on-the-democratic-primaries.html

Uncle Joe

(58,366 posts)A distinguished professor and Chair of the Department of Health Policy & Management, in the Rollins

School of Public Health of Emory University, Kenneth Thorpe has been one of the leading figures in the

analysis of health care finance in the United States. From 1993-95, he was Deputy Assistant Secretary for

Health Policy in the U.S. Department of Health and Human Services in charge of coordinating financial

estimates and program impacts of President Clinton’s health care reform proposal. Since leaving the

Clinton White House, he has written widely about the economic advantages of a single payer system to

finance health care.1

Thorpe’s expertise and reputation have added weight and authority to his attack on Senator Sanders’

program for Medicare-for-All.2 This makes it all the more important that his analysis receive the type of

scrutiny due a serious policy proposal. Unfortunately, Kenneth Thorpe does not provide enough

documentation to make an explicit comparison between his estimates and those provided in detail by the

Sanders campaign. He lists his projected Federal spending per year, he fails to explain how he calculated

these numbers. While this failure makes it impossible to consider his claims on a point by point basis, it

is possible to extract enough from his statement to conclude that his analysis is so deeply flawed that it

implies some clearly unrealistic assumptions.

Subject to the caveat that Professor Thorpe fails to provide adequate documentation, there are several

clear differences between the approach he follows and that followed by the Sanders campaign

(summarized in Table 1 below):

1. Thorpe assumes much fewer administrative savings. He assumes savings of 4.7% of national

health expenditures from reduced administrative waste while Sanders has assumed 13% including

saving 6% of total national health expenditures from reducing administrative expense in the

private insurance industry (and in administering Medicaid) and savings of 7% from reducing

administrative expenses in provider offices. Thus, Thorpe’s total savings projection is less than

the savings that would be captured simply by eliminating the excess administrative overhead of

the private insurance industry without considering the vast savings in provider offices. The

savings from national single-payer are well documented.3 For his part, Thorpe refers to a study

(snip)

http://www.dollarsandsense.org/Friedman-response-to-Thorpe-paper-020516.pdf

Uncle Joe

(58,366 posts)Senator Bernie Sanders has proposed an ambitious program of social reform, including regulatory changes to raise wages and protect workers’ rights, progressive tax reforms, and universal health insurance (Improved Medicare for All). Taken together, these policies would not only dramatically increase employment and national income, but would also raise wages, reduce poverty, and narrow the gap between rich and poor Americans.

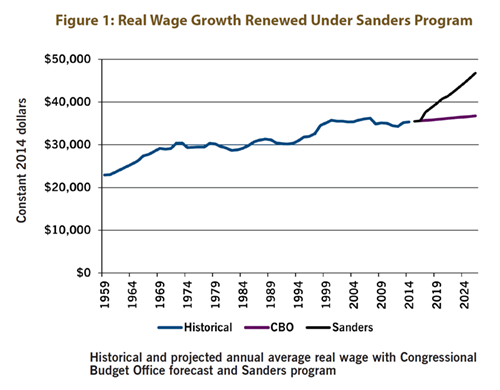

The Sanders program will end wage stagnation. (See Figure 1.) I project that, under the Sanders program, real wages would grow by 2.5% a year, returning to the growth rates of the late 1990s. Faster wage growth would result from 1) faster economic growth, which would raise wages by improving the bargaining position of workers, and 2) government regulations restoring the real value of the minimum wage and protecting workers’ rights to overtime pay, equal pay for women, and workers’ right to organize unions. In addition, universal health insurance financed through progressive taxation would lift the burden of health insurance premiums off workers and employers, freeing up employers’ expenses on labor to be paid in higher money wages.

Faster growth, pro-worker regulation, and universal health insurance would all help push wages up. (See Figure 2.) CBO economic forecasts imply that annual real wages for the average American worker will grow by about $1,300, or about 3%, for the next decade as a whole. Faster growth under the Sanders program would add about another $2,200 in average wages. Regulatory programs, notably a higher minimum wage, would add nearly another $3,000—still more for women who would benefit from new pay-equity regulations. Finally, universal health insurance would add nearly another $5,000 for workers who would no longer have to pay private health insurance premiums. Only a small increase is expected in average wages from the Workplace Democracy Act—which would establish card-check unionization and first-contract arbitration—because these policies would likely do little to increase union membership.

(snip)

Sanders’s regulatory and tax programs would sharply reduce inequality. (See Figure 5.)The ratio of the average income of the richest 5% to that of the poorest 20% has increased from less than 11:1 in the early 1970s to about 23:1 today. Economic policy and growth rates forecast by the CBO would allow this ratio to widen further—to over 27:1 by 2026. While faster economic growth due to the Sanders program would narrow differentials slightly, this effect is limited because faster growth also increases corporate profits. By raising wages at the bottom, the Sanders regulatory program—especially the higher minimum wage—would do much more to reduce inequality. By ensuring that the rich pay their fair share of taxes, meanwhile, Sanders’s progressive-taxation program will also dramatically bring down inequality.

http://dollarsandsense.org/archives/2016/0116friedman.html

Uncle Joe

(58,366 posts)Uncle Joe

(58,366 posts)kristopher

(29,798 posts)Enough is enough!

![]()

Uncle Joe

(58,366 posts)cast aspersions on Bernie's economic proposals as if they had no validity.

This morning I noticed repeated articles stating how Bernie's economic proposals would be "pie in the sky" or that he was just pulling it out of thin air, so I felt they needed answering

Mr. Mook told the donors that the outcome in Nevada, a state he ran for Mrs. Clinton in the 2008 campaign, was hard to predict and that, depending on turnout, Mrs. Clinton could win by a lot or win or lose by a tiny margin, according to several donors who requested anonymity to discuss the private meeting. But Mr. Mook stressed that the map leaned in Mrs. Clinton’s favor as the race moved to South Carolina, where he was confident she would win, and that she would do well on March 1, when more states voted.

The collected fundraisers, who for years have bundled checks for Mrs. Clinton’s campaign, listened approvingly as Ms. White, who seemed especially frustrated, expressed bewilderment that the campaign’s mobilization of grassroots support had been eclipsed in the news media by Bernie Sanders’s criticism of Mrs. Clinton as the establishment candidate representing big money.

Mr. Mook, who had furnished the donors with a Washington Post clip about the campaign’s “small donor boom,” told the steering committee that he repeatedly told reporters about Mrs. Clinton’s small donors, but “they don’t listen.”

(snip)

Donors also voiced some frustration with the lack of media scrutiny of Mr. Sanders, who they said was essentially getting a pass. They pressed Mr. Mook to demonstrate that the Vermont senator’s policy proposals were entirely implausible promises and that his responses to essentially all substantive questions drew on excerpts of his stump speech and rants about the “millionaires and billionaires.”

One donor also asked Mr. Mook to go after the youth vote. With a straight face, attendees said, the operative took the suggestion under advisement.

http://www.democraticunderground.com/12511263284

http://www.nytimes.com/politics/first-draft/2016/02/17/hillary-clinton-donors-hear-concerns-about-nevada-outcome/

Thanks and peace to you, kristopher.

geek tragedy

(68,868 posts)Uncle Joe

(58,366 posts)and what does it mean that inflation doesn't appear?

geek tragedy

(68,868 posts)if wages go up 10% but inflation goes up 11%, real wages go down.

He's also not accounting for increased employer taxes factoring into inflation (companies will not be eating that extra cost--they'll raise prices to cover at least part of it) or for the Federal Reserve taking action to slow down the economy if there's 5.3% growth--because you can't have 5.3% growth without inflation happening. If there's 5.3% growth, the Fed will raise interest rates, which will slow down economic growth and job creation.

This doesn't even get into the fact that 5.3% is a number too good to be true. Also, this is a GIANT RED FLAG--note his sourcing:

"Dynamic scoring" is what the Republicans use to claim tax cuts will lower the deficit.

Danger, Will Robinson, danger.

Uncle Joe

(58,366 posts)Government spending would decline relative to GDP within the decade. (See Figure 5.) Federal spending would initially increase faster than GDP under the Sanders program. After 2021, however, federal spending would be lower as a percentage of GDP than it would be under Congressional Budget Office (CBO) projections, because of the strength of the economic recovery engendered by the Sanders stimulus. This is actually a conservative estimate of the boost to GDP because it does not include the productivity-raising effects of infrastructure spending and increased education.

geek tragedy

(68,868 posts)spending will decrease as a percentage of the economy.

Uncle Joe

(58,366 posts)

President Barack Obama signed the American Recovery and Reinvestment Act of 2009 in February 2009; the bill provides $787 billion in stimulus through a combination of spending and tax cuts. The plan is largely based on the Keynesian theory that government spending should offset the fall in private spending during an economic downturn; otherwise the fall in private spending may perpetuate itself and productive resources, such as the labor hours of the unemployed, will be wasted. Critics claim that government spending cannot offset a fall in private spending because government must borrow money from the private sector in order to add money to it. However, most economists do not think such "crowding out" is an issue when interest rates are near zero and the economy is stagnant. Opponents of the stimulus also point to problems of possible future inflation and government debt caused by such a large expenditure.[247][248]

In the U.S., jobs paying between $14 and $21 per hour made up about 60% those lost during the recession, but such mid-wage jobs have comprised only about 27% of jobs gained during the recovery through mid-2012. In contrast, lower-paying jobs constituted about 58% of the jobs regained.[249]

https://en.wikipedia.org/wiki/Economic_history_of_the_United_States

geek tragedy

(68,868 posts)but it's only a stimulus if it's deficit spending.

Uncle Joe

(58,366 posts)increasing drag or "deficit" on our national economy?

We get a D+ in infrastructure.

Every four years, the American Society of Civil Engineers’ Report Card for America’s Infrastructure depicts the condition and performance of the nation’s infrastructure in the familiar form of a school report card—assigning letter grades based on the physical condition and needed investments for improvement.

The 2013 Report Card grades show we have a significant backlog of overdue maintenance across our infrastructure systems, a pressing need for modernization, and an immense opportunity to create reliable, long-term funding, but they also show that we can improve the current condition of our nation’s infrastructure — when investments are made and projects move forward, the grades rise.

(snip)

We know that investing in infrastructure is essential to support healthy, vibrant communities. Infrastructure is also critical for long-term economic growth, increasing GDP, employment, household income, and exports. The reverse is also true – without prioritizing our nation’s infrastructure needs, deteriorating conditions can become a drag on the economy.

While the modest progress is encouraging, it is clear that we have a significant backlog of overdue maintenance across our infrastructure systems, a pressing need for modernization, and an immense opportunity to create reliable, long-term funding sources to avoid wiping out our recent gains. Overall, most grades fell below a C, and our cumulative GPA inched up just slightly to a D+ from a D four years ago.

http://www.infrastructurereportcard.org/

Infrastructure-based economic development also called infrastructure-driven development combines key policy characteristics inherited from the Rooseveltian progressivist tradition and Neo-Keynesian economics in the United States, France's Gaullist and Neo-Colbertist centralized economic planning, Scandinavian social democracy as well as Singaporean and Chinese state capitalism : it holds that a substantial proportion of a nation’s resources must be systematically directed towards long term assets such as transportation, energy and social infrastructure (schools, universities, hospitals…) in the name of long term economic efficiency (stimulating growth in economically lagging regions and fostering technological innovation) and social equity (providing free education and affordable healthcare).[1][2] While the benefits of infrastructure-based development can be debated, the analysis of US economic history shows that at least under some scenarios infrastructure-based investment contributes to economic growth, both nationally and locally, and can be profitable, as measured by a high rate of return. The benefits of infrastructure investment are shown both for old-style economies (ports, highways, railroads) as well as for the new age (airports, telecommunications, internet...).

(snip)

In the wake of the Great Recession that started after 2007, liberal and Neo-Keynesian economists in the United States have developed renewed arguments in favor of “Rooseveltian” economic policies removed from the ‘Neoclassical’ orthodoxy of the past 30 years- notably a degree of federal stimulus spending across public infrastructures and social services that would “benefit the nation as a whole and put America back on the path to long term growth”.[11]

Similar ideas have gained traction amongst IMF, World Bank and European Commission policy makers in recent years notably in the last months of 2014/early 2015: Annual Meetings of the International Monetary Fund and the World Bank Group (October 2014) and adoption of the €315 bn European Commission Investment Plan for Europe (December 2014).[/]b

https://en.wikipedia.org/wiki/Infrastructure-based_development

geek tragedy

(68,868 posts)Certainly to get to decent/good growth we need to address those problems.

I would say, however, that tackling those doesn't mean we'll enjoy spectacular, unprecedented growth.

Uncle Joe

(58,366 posts)Now to be sure there are major differences between war torn Europe and modern day U.S. but at 200 billion a year pumped into updating our decrepit infrastructure exceeding the total in today's dollars of the Marshall Plan would have a profound impact on growing our economy both in the short and long term.

Of course this doesn't take into account Bernie's other economy growing proposals both short and long term, ie; minimum wage increase to $15, universal health care, free tuition to public universities, taking marijuana off schedule 1, breaking up the mega-banks, credit card and payday interest reform etc. etc.

The Marshall Plan (officially the European Recovery Program, ERP) was an American initiative to aid Western Europe, in which the United States gave $13 billion (approximately $130 billion in current dollar value as of August 2015) in economic support to help rebuild Western European economies after the end of World War II. The plan was in operation for four years beginning in April 1948. The goals of the United States were to rebuild war-devastated regions, remove trade barriers, modernize industry, make Europe prosperous again, and prevent the spread of communism.[1] The Marshall Plan required a lessening of interstate barriers, a dropping of many regulations, and encouraged an increase in productivity, labour union membership, as well as the adoption of modern business procedures.[2]

(snip)

The years 1948 to 1952 saw the fastest period of growth in European history. Industrial production increased by 35%.Agricultural production substantially surpassed pre-war levels.[61] The poverty and starvation of the immediate postwar years disappeared, and Western Europe embarked upon an unprecedented two decades of growth that saw standards of living increase dramatically. There is some debate among historians over how much this should be credited to the Marshall Plan. Most reject the idea that it alone miraculously revived Europe, as evidence shows that a general recovery was already underway. Most believe that the Marshall Plan sped this recovery, but did not initiate it. Many argue that the structural adjustments that it forced were of great importance. Economic historians J. Bradford DeLong and Barry Eichengreen call it "history's most successful structural adjustment program."[89] One effect of the plan was that it subtly "Americanized" countries, especially Austria, who embraced United States' assistance, through popular culture, such as Hollywood movies and rock n' roll.[90]

(snip)

While some historians today feel some of the praise for the Marshall Plan is exaggerated, it is still viewed favorably and many thus feel that a similar project would help other areas of the world. After the fall of communism several proposed a "Marshall Plan for Eastern Europe" that would help revive that region. Others have proposed a Marshall Plan for Africa to help that continent, and U.S. vice president Al Gore suggested a Global Marshall Plan.[91] "Marshall Plan" has become a metaphor for any very large scale government program that is designed to solve a specific social problem. It is usually used when calling for federal spending to correct a perceived failure of the private sector.

https://en.wikipedia.org/wiki/Marshall_Plan

Furthermore a President Bernie Sanders Administration would be more focused on just redirecting our financial assets here at home versus wasting it on destructive foreign military misadventures abroad.

Sanders: $1T infrastructure bill would be cheaper than Iraq War

Sen. Bernie Sanders (I-Vt.) said Monday that his bill to spend $1 trillion over the next five years to boost the nation's transportation infrastructure would cost less than what the U.S. government spent on the Iraq War.

"It has been estimated that the costs of the Bush/Cheney Iraq War, a war we should never have waged, will total $3 trillion by the time the last veteran receives needed care," he said during a speech at the Brookings Institution in Washington.

"A $1 trillion investment in infrastructure could support 13 million decent-paying jobs and make our country more efficient, productive and safer," Sanders continued.

http://thehill.com/policy/transportation/232224-sanders-1t-infrastructure-bill-would-be-cheaper-than-iraq-war

geek tragedy

(68,868 posts)that the study is not realistic in its assumptions about how much good would be done. If the policies lead to 3.4% economic growth and also lead to people leading longer and happier lives, with greater social stability, then they still make sense.

Uncle Joe

(58,366 posts)I believe it does make sense.

geek tragedy

(68,868 posts)But I don't think they will provide such a miraculous benefit to the economy. It is never that easy.

mythology

(9,527 posts)The underlying assumptions such as a sustained 5.3% economic growth aren't just unrealistic, they are dishonest. It's never happened.

Uncle Joe

(58,366 posts)Meet the Man Who Says Bernie Sanders Can Deliver 5.3% Economic Growth

The idea of 5.3% GDP growth seems spectacular.

It is higher than it’s been lately. But I’m afraid we’ve gotten used to poor economic performance as the norm. We’ve been stagnating for eight years, and at this point, seven years into the recovery, we have an employment rate of 59%, which reverses 25 years of employment growth.

We have 10 million fewer jobs than we would have than if we had the employment rate of 2006. We have a lot of underutilized capacity.[/]b

http://fortune.com/2016/02/18/bernie-sanders-economic-growth/

http://www.democraticunderground.com/12511264118

kristopher

(29,798 posts)kristopher

(29,798 posts)The HRC campaign is getting its instructions... the donor class is weighing in big-time now...

http://www.nytimes.com/politics/first-draft/2016/02/17/hillary-clinton-donors-hear-concerns-about-nevada-outcome/?_r=0

Comments from Reddit:

Not surprisingly those are exactly the attacks that the Clinton campaign is now dutifully lobbing.

With no small amount of irony, the mega-donors also asked Mook to highlight the Clinton campaign's support from small donors.

Jeff Weaver, campaign manager for Bernie 2016 said, "One of the biggest differences between our campaigns is that Bernie’s campaign does not take its marching orders from Wall Street and big money donors. It's shameful that the Clinton campaign is parroting attacks at Sen. Sanders that The New York Times has documented come right from her big money backers. Now we are beginning to get a glimpse into what goes on in all those closed door meetings with Wall Street interests."

via http://www.democraticunderground.com/12511265301

Duppers

(28,125 posts)Too busy right now.

Always loved that dance vid. ![]()

Ferd Berfel

(3,687 posts)You have a Troll or two here disguised as Bernie supporter(s)

![]()

![]()

We won't survive any more Status Quo

Uncle Joe

(58,366 posts)believe that's the case, just an honest disagreement

Peace to you, Ferd Berfel. ![]()

Ferd Berfel

(3,687 posts)and offering nothing positive - regarding Bernie.