2016 Postmortem

Related: About this forumHillary has taken millions from 7 of 14 banks in a lawsuit for rigging interest rates

She was paid MILLIONS of dollars collectively from these too big to fail banks for speeches at a going rate over $200k for each speech:

Goldman Sachs

Citigroup

JP Morgan

Morgan Stanley

UBS

Bank of America

Deutsche Bank AG

(Another bank on the list HSBC has paid Bill Clinton to speak as well. Many of these banks have also given millions more to her foundation.)

This is epitome of Wall Street corruption and Hillary is willing to take millions in cash from these corrupt banks. This isn't the only criminal investigations or lawsuits that these banks have been involved with either. They have a long and sordid history of such things.

Hillary has already said she doesn't support bringing back a new Glass Steagall bill to break these too big to fail banks up. Banks that are obviously doing things that ALREADY violate US laws and the public trust.

And the American people are suppose to just trust her that all this income won't effect her decisions in regards to regulating and policing these corrupt banks?

A federal judge in Manhattan on Monday rejected an effort by 14 of the world's biggest banks to throw out a private lawsuit accusing them of rigging an interest rate benchmark used in the $553 trillion derivatives market.

U.S. District Judge Jesse Furman said investors led by several pension funds and municipalities could pursue federal antitrust claims over an alleged conspiracy to rig "ISDAfix" from 2009 to 2012, and breach of contract and unjust enrichment claims against most defendants. Other claims were dismissed.

The defendants include Bank of America Corp, Barclays Plc, BNP Paribas SA, Citigroup Inc, Credit Suisse Group AG, Deutsche Bank AG, Goldman Sachs Group Inc, HSBC Holdings Plc, JPMorgan Chase & Co, Morgan Stanley, Nomura Holdings Inc, Royal Bank of Scotland Group Plc, UBS AG and Wells Fargo & Co.

~Snip~

Banks were accused of rigging ISDAfix for their own gain by executing rapid trades just before the rate was set each day, called "banging the close"; and causing ICAP to delay trades until they moved ISDAfix where they wanted, and post rates that did not reflect market activity....

Read more:

http://www.reuters.com/article/us-banks-rigging-lawsuit-idUSKCN0WU1E8

rhett o rick

(55,981 posts)The culture that has made the Clintons hundreds of millions of dollars in 15 years.

think

(11,641 posts)corporations and politicians aren't allowed to collude like this.

If we need to pay our politicians more to work for us so they don't feel the need to take more from corporations so be it.

I want to pay politicians to work for us not the corporations that they associate with...

BernieforPres2016

(3,017 posts)Their business model is fraud.

Octafish

(55,745 posts)

Their Profit is Our Loss

The Dark Heart of the Libor Scandal

by MARK VORPAHL

CounterPunch, August 07, 2012

Though, for most, the London Inter-Bank Offer Rate (Libor) interest rate fixing scandal appears to be distant and far too complex to understand, its potential consequences may be as economically devastating as a world war.

The Libor is used to set payments on $800 trillion worth of financial instruments. It sets the prices that people and corporations pay for loans and receive for savings. Given that the fraud impacted $10 trillion in consumer loans, the Libor scandal will likely leave a long list of previous financial scandals that contributed to the Great Recession look like child’s play.

It also pulls back the curtain on the mechanisms behind the world economy, its anti-social priorities, its willingness to gamble away the future of billions of people, and the government’s collusion in these operations. The Libor scandal reveals that the “invisible hand” Adam Smith spoke of in explaining how a capitalist economy regulates itself has been transformed into the trained hand of a swindler.

SNIP...

Barclays Bank is just the tip of the iceberg. In several countries, 20 big banks are under investigation, including such behemoths as Citigroup, Deutsche Bank, HSBC, JPMorgan Chase, RBS and UBS.

Current Treasury Secretary Timothy Geithner and former president of the Federal Reserve Bank of New York, and Chairman Ben Bernanke have had to defend the Fed’s response when it first became aware of the fraud in 2008. While Geithner said he was “aggressive” in expressing his concerns, this on-going scandal did not come to light until four years later.

CONTINUED...

http://www.counterpunch.org/2012/08/07/the-dark-heart-of-the-libor-scandal/

Here in Detroit, since 2008, many of my friends have lost their homes. Almost always, their jobs went first. Then the town's businesses left and then the town's economy left. Then Democracy itself left. Ask the Emergency Manager in Flint.

Feudalism. You Gotta Luv It. Like Fascism. CREEPed RIGHT in with the money trumps peace crowd after Dallas.

think

(11,641 posts)probably haven't heard of either one of these scandals.

Frustrating...

Octafish

(55,745 posts)Why no one knows is the work of the media and lackademia.

Here's a bit of Lost History of Wall Street:

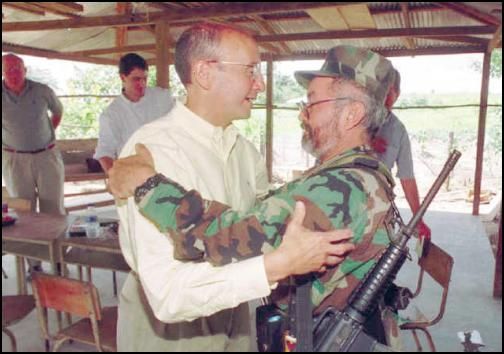

In late June 1999, numerous news services, including Associated Press, reported that Richard Grasso, Chairman of the New York Stock Exchange flew to Colombia to meet with a spokesperson for Raul Reyes of the Revolutionary Armed Forces of Columbia (FARC), the supposed "narco terrorists" with whom we are now at war. -- Catherine Austin Fitts

http://www.democraticunderground.com/discuss/duboard.php?az=show_mesg&forum=389&topic_id=4649515&mesg_id=4649742

When was the last time you went outside and didn't see someone looking at their phone?

think

(11,641 posts)I sure appreciate the wealth of information you bring to discussions. You always manage to share things that I've never heard about that are truly astounding. Much appreciated!

As to what those two were collaborating on I'm not sure I want to know! It can't be anything kosher from the looks of it...