Octafish

Octafish's JournalMedia By Design

Why the Big Money goes into the Big Lie: It's not just busting unions. They want to bust Democracy.

The plan spelled out, by a lawyer who helped keep cancer covered-up for Big Tobacco and soon-to-be-rewarded with a sinecure on the Supreme Court:

The Lewis Powell Memo - Corporate Blueprint to Dominate Democracy

Greenpeace has the full text of the Lewis Powell Memo available for review, as well as analyses of how Lewis Powell's suggestions have impacted the realms of politics, judicial law, communications and education.

Blogpost by Charlie Cray - August 23, 2011 at 11:20

Greenpeace.org

Forty years ago today, on August 23, 1971, Justice Lewis F. Powell, Jr., an attorney from Richmond, Virginia, drafted a confidential memorandum for the U.S. Chamber of Commerce that describes a strategy for the corporate takeover of the dominant public institutions of American society.

Powell and his friend Eugene Sydnor, then-chairman of the Chamber’s education committee, believed the Chamber had to transform itself from a passive business group into a powerful political force capable of taking on what Powell described as a major ongoing “attack on the American free enterprise system.”

An astute observer of the business community and broader social trends, Powell was a former president of the American Bar Association and a board member of tobacco giant Philip Morris and other companies. In his memo, he detailed a series of possible “avenues of action” that the Chamber and the broader business community should take in response to fierce criticism in the media, campus-based protests, and new consumer and environmental laws.

SNIP...

The overall tone of Powell’s memo reflected a widespread sense of crisis among elites in the business and political communities. “No thoughtful person can question that the American economic system is under broad attack,” he suggested, adding that the attacks were not coming just from a few “extremists of the left,” but also – and most alarmingly -- from “perfectly respectable elements of society,” including leading intellectuals, the media, and politicians.

To meet the challenge, business leaders would have to first recognize the severity of the crisis, and begin marshalling their resources to influence prominent institutions of public opinion and political power -- especially the universities, the media and the courts. The memo emphasized the importance of education, values, and movement-building. Corporations had to reshape the political debate, organize speakers’ bureaus and keep television programs under “constant surveillance.” Most importantly, business needed to recognize that political power must be “assiduously cultivated; and that when necessary, it must be used aggressively and with determination – without embarrassment and without the reluctance which has been so characteristic of American business.”

CONTINUED...

http://www.greenpeace.org/usa/en/news-and-blogs/campaign-blog/the-lewis-powell-memo-corporate-blueprint-to-/blog/36466/

In the process, their greed and lies work to destroy the planet, peace and prosperity. Democracy they flattened long ago.

No. Greed is the opposite of Democratic. (NT)

You are most welcome, LawDeeDah! Ah...Appearances.

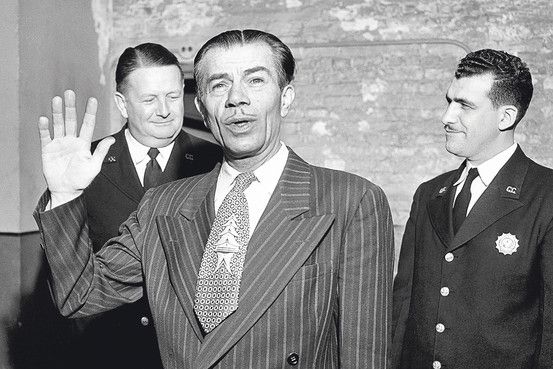

That one does have me wondering. Another WTF from that happened in... Kennebunkport, July 30, 1983: Bill Clinton, George Bush & George Wallace

Wallace and his third wife, the former Lisa Taylor, meet with Vice President George Bush and Arkansas Gov. Bill Clinton at a lobster bake at Bush's residence at Kennebunkport, Maine, July 30, 1983. The third Mrs. Wallace, whom the governor married in 1981, was 30 years his junior and half of a country-western singing duo, Mona and Lisa, who had performed during his campaign in 1968.

CREDIT: AP/Birmingham Post

SOURCE: http://www.cbsnews.com/pictures/george-wallace/13/

George Wallace did all he could to oppose President Kennedy and his administration's policy to integrate public schools, including the University of Alabama.

Something else important to know: Wallace’s running mate in 1968 was Gen. Curtis LeMay, who exhibited insubordination to President Kennedy during the Cuban Missile Crisis. President Kennedy, former CIA analyst Ray McGovern noted, exhibited signs of stress over the possibility of a military coup.

UK newspapers have the guts to ask: ''Why aren't crooked bankers in prison?''

Why aren't crooked bankers in prison? As our banks are fined £2bn for fixing currency rates, clamour grows for dozens of traders to face prosecution* RBS, HSBC, JPMorgan Chase, UBS and Citibank fined in UK and U.S.

* Barclays bank will also be fined but it is still negotiating its punishment

* Bankers were rigging the £3.5trillion-a-day foreign exchange markets

* Anyone found guilty of manipulating the Forex market could face jail

* 30 traders have been sacked or suspended but none have been arrested

* Bankers colluded on forums to share information on clients to make cash

* Traders called themselves the A-Team, Three Musketeers and The Players

* Messages on forums bragged about making 'free money' and bonuses

By JAMES SALMON, DAILY MAIL BANKING CORRESPONDENT

PUBLISHED: 18:09 EST, 12 November 2014 | UPDATED: 19:56 EST, 12 November 2014

Dozens of traders face prosecution after five banks were fined £2.6billion yesterday for fixing currency markets.

Damning transcripts of City workers bragging about making ‘free money’ and laughing at ‘numpties’ not in on their scam were published by regulators.

Calling themselves ‘players’, ‘musketeers’ or members of the ‘A-Team’, the traders congratulate each other on ‘killing it’ with rigged deals.

Incredibly, their corrupt activities continued for more than a year after the authorities started dishing out an earlier £4billion in fines for the fixing of Libor interest rates.

CONTINUED...

http://www.dailymail.co.uk/news/article-2832260/Why-aren-t-crooked-bankers-prison-banks-fined-2bn-fixing-currency-rates-clamour-grows-dozens-traders-face-prosecution.html

Gee. The only reason I can't see our corporate owned monopoly press ask tough questions would be that they are part of the problem,

Yeah. So funny.

Bartcop coined the term "Bush Family Evil Empire" to denote the 60-year pre-eminence of one family in the formation of the political philosophy in the United States, that of the War Party. And, yes, personally, I have tried to chronicle their influence on the ascension of the national security state. At least three generations have held high national office, while also making big money off war and looting the public Treasury. The last president of the United States, a man who wasn't elected fair and square by any stretch of the imagination, actually said: "Money trumps peace" at a press conference. For some reason, not a single "journalist" had the guts to ask him what he meant by that. Since then, we've learned war is so profitable those with access to government secrets are at a distinct advantage over others.

Even if it's undemocratic, isn't that hilarious, greytdemocrat?

Pity the poor Pentagon.

What are they raking in for the nuclear upgrade, a trillion? To start.

PDF for details:

http://cns.miis.edu/opapers/pdfs/140107_trillion_dollar_nuclear_triad.pdf

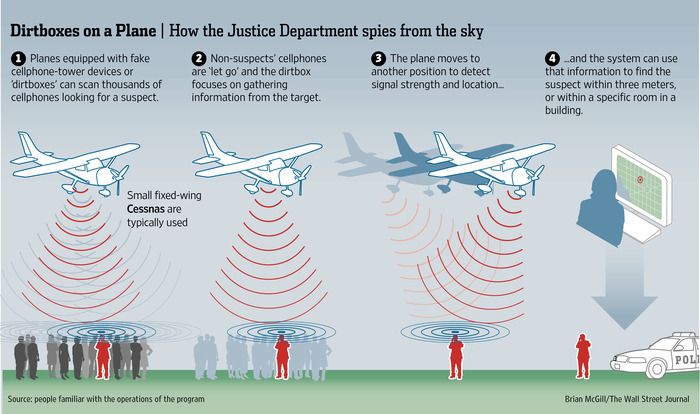

US Agency Using Spy Planes to Fool Cell Phones, Capture Data

Image from Wall Street Journal:

Revealed: US Agency Using Spy Planes to Fool Cell Phones, Capture Data

Newly revealed mass surveillance program by the US government is "inexcusable," says ACLU

byJon Queally, staff writer

CommonDreams, Nov. 14, 2014

According to new reporting by the Wall Street Journal, the U.S. Marshals Service—an arm of the Department of Justice—has been using small aircraft equipped with technology that can mimic the functions of cell towers in order to capture the data contained on phones and mobile devices of people across large areas on the ground below.

Citing those familiar with the program, the Journal report (subscription) reveals how the program's use of so-called "dirtbox" technology is part of "a high-tech hunt for criminal suspects that is snagging a large number of innocent Americans" in a dragnet approach that will remind some of similar techniques known to be used by the National Security Agency and other federal agencies.

The WSJ reporting relates how the Marshals Service operate a fleet of specially-outfitted Cessna airplanes which can take off from "at least five metro-area airports," allowing the aircraft a range that covers "most of the US population."

As GeekWire explains, because the "dirtbox" devices "emulate a cell tower, they can pick up thousands or tens of thousands of signals from other citizens who aren’t being targeted by the Marshals."

CONTINUED...

http://www.commondreams.org/news/2014/11/14/revealed-us-agency-using-spy-planes-fool-cell-phones-capture-data

Gosh. Do you ever get the feeling that maybe, in the eyes of the Police (State), We the People now are all considered "Bad Guys"?

FBI saw threat of mortgage crisis -- in 2004!

A top official warned of widening loan fraud in 2004, but the agency focused its resources elsewhere.By Richard B. Schmitt

Los Angeles Times Staff Writer

August 25, 2008

WASHINGTON — Long before the mortgage crisis began rocking Main Street and Wall Street, a top FBI official made a chilling, if little-noticed, prediction: The booming mortgage business, fueled by low interest rates and soaring home values, was starting to attract shady operators and billions in losses were possible.

"It has the potential to be an epidemic," Chris Swecker, the FBI official in charge of criminal investigations, told reporters in September 2004. But, he added reassuringly, the FBI was on the case. "We think we can prevent a problem that could have as much impact as the S&L crisis," he said.

Today, the damage from the global mortgage meltdown has more than matched that of the savings-and-loan bailouts of the 1980s and early 1990s. By some estimates, it has made that costly debacle look like chump change. But it's also clear that the FBI failed to avert a problem it had accurately forecast.

Banks and brokerages have written down more than $300 billion of mortgage-backed securities and other risky investments in the last year or so as homeowner defaults leaped and weakness in the real estate market spread.

SNIP…

Most observers have declared the mess a gross failure of regulation. To be sure, in the run-up to the crisis, market-oriented federal regulators bragged about their hands-off treatment of banks and other savings institutions and their executives. But it wasn't just regulators who were looking the other way. The FBI and its parent agency, the Justice Department, are supposed to act as the cops on the beat for potentially illegal activities by bankers and others. But they were focused on national security and other priorities, and paid scant attention to white-collar crimes that may have contributed to the lending and securities debacle.

Now that the problems are out in the open, the government's response strikes some veteran regulators as too little, too late.

Swecker, who retired from the FBI in 2006, declined to comment for this article.

But sources familiar with the FBI budget process, who were not authorized to speak publicly about the growing fraud problem, say that he and other FBI criminal investigators sought additional assistance to take on the mortgage scoundrels.

They ended up with fewer resources, rather than more.

CONTINUED…

http://articles.latimes.com/2008/aug/25/business/fi-mortgagefraud25

The Incredible Con the Banksters Pulled on the FBI

By William K. Black

Posted on August 16, 2013

EXCERPT...

The FBI was desperate to address the mortgage fraud catastrophe in 2007. The irony was that it was vulnerable to political attack because it had been so right, so early about mortgage fraud. The FBI warned publicly in September 2004 that mortgage fraud had become “epidemic” and predicted that it would cause a financial “crisis” if it were not stopped. By 2007, however, the FBI had assigned only 120 FBI agents nationwide to investigate the epidemic of mortgage fraud that had grown massively since the FBI warnings. As I have explained on many occasions (and will reprise briefly in my fourth column in this series) that pittance of agents was assigned to relatively minor mortgage frauds because, as I describe below, the (Mortgage Bankers Association) conned the FBI into defining out of existence the control frauds. With no assistance from the banking regulators, and an industry collapsing in an orgy of mortgage fraud that the FBI had warned about but could not understand or effectively stop given the death of criminal referrals by the financial regulators an overwhelmed FBI turned for industry expertise to the MBA. It was a disastrous choice – and the FBI has refused to end the partnership with the perps.

SNIP...

Given the fact that the CEOs of large fraudulent lenders are criminally liable for tens or even hundreds of thousands of acts of mortgage fraud we should be seeing our prisons overrun with elite white-collar criminals. Instead, the DOJ has no convictions of the elite bankers who led the control frauds that caused the crisis.

CONTINUED...

http://neweconomicperspectives.org/2013/08/the-incredible-con-the-banksters-pulled-on-the-fbi.html

BANKSTERS Get the Money and NEVER Go to Jail.

"Hi, DU! I was Willie Sutton. When people asked me, 'Why do you rob banks?' I said, 'Because that's where the money is!' I had no idea I should have gotten into management. Perhaps, after doing my time in Purgatory or the Hot Other Place I can one day be allowed to return topside and really get to work at what I love, get in from the ground floor, so to speak, as a Bankster. They know where the Big Money is. And, like I told the black-horned Cruise Director feller, I really want to do 'God's work,' too."

OK, DU. That quote, I, Octafish, made up. Here's the guy who really wrote the book on the Banksters in "The Best Way to Rob a Bank Is to Own One," William K. Black, who reports that Banksters today want more of a traffic ticket approach to that which Black terms "Control Fraud," corrupt executives looting the banks for their own uses:

Zero Prosecutions Aren’t Few Enough – Wall Street Wants SEC Sanctions Reduced to DMV Points

By William K. Black

Kilkenny, Ireland: November 8, 2014

Wall Street’s full depravity was put on display in Joseph Fichera’s November 6, 2014 op ed in the New York Times. I hasten to add that the reason that the op ed is so revealing is that Fichera is one of the sometimes good guys who, for example, accurately warned that “auction-rate securities” were a dangerous scam and criticized JPMorgan’s odious abuse of Denver. When the Ficheras of the world join in Wall Street’s “race to the bottom” Federal Reserve Bank of New York’s President Dudley’s point about the corrupt culture that characterizes Wall Street is proven irrefutably.

Let’s begin by reviewing the bidding. We have just suffered through the third economic crisis driven by epidemics of control fraud. In two of the crises the financial industry led the fraud epidemics. In the Enron-era fraud epidemic they eagerly aided and abetted Enron’s frauds. In the current crisis we know that U.S. government investigators have found that 16 of the largest banks in the world conspired to falsify Libor, which is used to price $350 trillion in assets. This is the largest cartel in world history by at least three orders of magnitude. Note that all 16 of the banks that participate in creating Libor falsified their statements for the express purpose of falsifying the Libor “fix.” There were no honest banks and there is no reason to believe that if 25 banks participated in setting Libor the results would have differed. The conspirators are not known to have blackballed any bank from participating in “fixing” Libor because of fears that the blackballed bank was led by an honest CEO who would expose and end the conspiracy.

Government investigators have found that over 20 of the largest banks defrauded Fannie and Freddie by selling them vast amount of toxic mortgages through fraudulent “reps and warranties.” Government investigators have found that over 20 of the largest banks defrauded a series of credit unions by selling them toxic mortgages and toxic mortgage derivatives through fraudulent reps and warranties. Government investigators have found other wide ranging frauds by the large banks to (1) rig bids for issuing municipal securities, (2) to foreclose on people through fraudulent affidavits, and (3) by conspiring to falsify foreign exchange (FX) rates. In sum, the leaders of the largest banks in the world are overwhelmingly leading criminal enterprises that commit financial frauds of unprecedented scope and damage. The resulting financial crisis caused by the three most destructive fraud epidemics in history caused over a $21 trillion loss in U.S. GDP and the loss of over 10 million American jobs. Each of those figures is much larger in Europe.

Worse, no senior banker who led the three fraud epidemics has been prosecuted in the U.S. for those crimes. Virtually no senior bankers who led the three fraud epidemics has even been the subject of a civil suit by the U.S. Virtually no senior banker in the U.S. has had his fraud proceeds “clawed back” by the government or the bank. The senior bankers were made wealthy through the “sure thing” of accounting control fraud – with nearly perfect impunity from the criminal and civil law.

This is the setting in which Fichera writes. As a sometimes good guy, one would expect his column to call for the Department of Justice (DOJ) and the SEC to end this impunity and immediately act vigorously to hold the senior bankers personally accountable for leading the frauds that blew up the global economy. Instead, Fichera wrote to urge (1) that the largest banks be treated as “too big to jail,” (2) to decry the “tendency to vilify all Wall Street firms as unscrupulous,” (3) to urge SEC sanctions to be reduced to the level of “DMV” “points,” and (4) to provide that no matter how egregious the fraud the SEC would have no power to remove a Wall Street firm’s license until it committed “multiple” cases of the equivalent of deliberate homicide in which each case could involve deliberately running over millions of investors. Under Fichera’s plan, every dog would get at least one bite – of every investor – which would mean hundreds of thousands of bites. Fichera wants banks to be – officially – entitled to commit securities fraud without effective sanction from the SEC.

CONTINUED...

http://neweconomicperspectives.org/2014/11/zero-prosecutions-arent-enough-wall-street-wants-sec-sanctions-reduced-dmv-points.html#more-8811

Gee. Dr. Black makes some important observations that should be at the front of everyone's mind wondering about justice, let alone how to pay for their kids' college.

Profile Information

Gender: MaleMember since: 2003 before July 6th

Number of posts: 55,745