General Discussion

Showing Original Post only (View all)BANKSTERS Get the Money and NEVER Go to Jail. [View all]

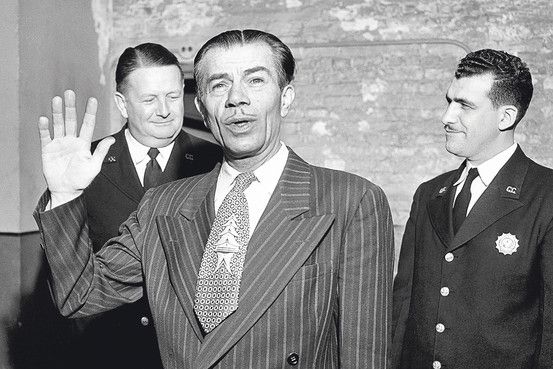

"Hi, DU! I was Willie Sutton. When people asked me, 'Why do you rob banks?' I said, 'Because that's where the money is!' I had no idea I should have gotten into management. Perhaps, after doing my time in Purgatory or the Hot Other Place I can one day be allowed to return topside and really get to work at what I love, get in from the ground floor, so to speak, as a Bankster. They know where the Big Money is. And, like I told the black-horned Cruise Director feller, I really want to do 'God's work,' too."

OK, DU. That quote, I, Octafish, made up. Here's the guy who really wrote the book on the Banksters in "The Best Way to Rob a Bank Is to Own One," William K. Black, who reports that Banksters today want more of a traffic ticket approach to that which Black terms "Control Fraud," corrupt executives looting the banks for their own uses:

Zero Prosecutions Aren’t Few Enough – Wall Street Wants SEC Sanctions Reduced to DMV Points

By William K. Black

Kilkenny, Ireland: November 8, 2014

Wall Street’s full depravity was put on display in Joseph Fichera’s November 6, 2014 op ed in the New York Times. I hasten to add that the reason that the op ed is so revealing is that Fichera is one of the sometimes good guys who, for example, accurately warned that “auction-rate securities” were a dangerous scam and criticized JPMorgan’s odious abuse of Denver. When the Ficheras of the world join in Wall Street’s “race to the bottom” Federal Reserve Bank of New York’s President Dudley’s point about the corrupt culture that characterizes Wall Street is proven irrefutably.

Let’s begin by reviewing the bidding. We have just suffered through the third economic crisis driven by epidemics of control fraud. In two of the crises the financial industry led the fraud epidemics. In the Enron-era fraud epidemic they eagerly aided and abetted Enron’s frauds. In the current crisis we know that U.S. government investigators have found that 16 of the largest banks in the world conspired to falsify Libor, which is used to price $350 trillion in assets. This is the largest cartel in world history by at least three orders of magnitude. Note that all 16 of the banks that participate in creating Libor falsified their statements for the express purpose of falsifying the Libor “fix.” There were no honest banks and there is no reason to believe that if 25 banks participated in setting Libor the results would have differed. The conspirators are not known to have blackballed any bank from participating in “fixing” Libor because of fears that the blackballed bank was led by an honest CEO who would expose and end the conspiracy.

Government investigators have found that over 20 of the largest banks defrauded Fannie and Freddie by selling them vast amount of toxic mortgages through fraudulent “reps and warranties.” Government investigators have found that over 20 of the largest banks defrauded a series of credit unions by selling them toxic mortgages and toxic mortgage derivatives through fraudulent reps and warranties. Government investigators have found other wide ranging frauds by the large banks to (1) rig bids for issuing municipal securities, (2) to foreclose on people through fraudulent affidavits, and (3) by conspiring to falsify foreign exchange (FX) rates. In sum, the leaders of the largest banks in the world are overwhelmingly leading criminal enterprises that commit financial frauds of unprecedented scope and damage. The resulting financial crisis caused by the three most destructive fraud epidemics in history caused over a $21 trillion loss in U.S. GDP and the loss of over 10 million American jobs. Each of those figures is much larger in Europe.

Worse, no senior banker who led the three fraud epidemics has been prosecuted in the U.S. for those crimes. Virtually no senior bankers who led the three fraud epidemics has even been the subject of a civil suit by the U.S. Virtually no senior banker in the U.S. has had his fraud proceeds “clawed back” by the government or the bank. The senior bankers were made wealthy through the “sure thing” of accounting control fraud – with nearly perfect impunity from the criminal and civil law.

This is the setting in which Fichera writes. As a sometimes good guy, one would expect his column to call for the Department of Justice (DOJ) and the SEC to end this impunity and immediately act vigorously to hold the senior bankers personally accountable for leading the frauds that blew up the global economy. Instead, Fichera wrote to urge (1) that the largest banks be treated as “too big to jail,” (2) to decry the “tendency to vilify all Wall Street firms as unscrupulous,” (3) to urge SEC sanctions to be reduced to the level of “DMV” “points,” and (4) to provide that no matter how egregious the fraud the SEC would have no power to remove a Wall Street firm’s license until it committed “multiple” cases of the equivalent of deliberate homicide in which each case could involve deliberately running over millions of investors. Under Fichera’s plan, every dog would get at least one bite – of every investor – which would mean hundreds of thousands of bites. Fichera wants banks to be – officially – entitled to commit securities fraud without effective sanction from the SEC.

CONTINUED...

http://neweconomicperspectives.org/2014/11/zero-prosecutions-arent-enough-wall-street-wants-sec-sanctions-reduced-dmv-points.html#more-8811

Gee. Dr. Black makes some important observations that should be at the front of everyone's mind wondering about justice, let alone how to pay for their kids' college.