http://www.bloomberg.com/news/articles/2015-07-29/we-just-got-some-new-data-on-america-s-student-loan-burden

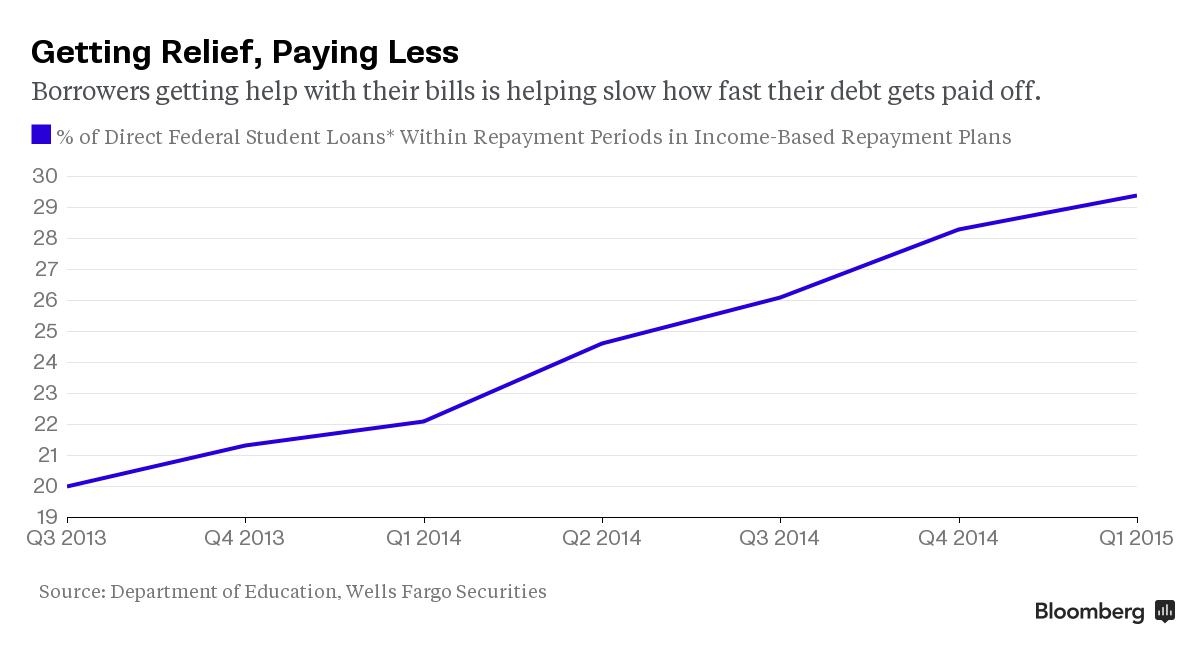

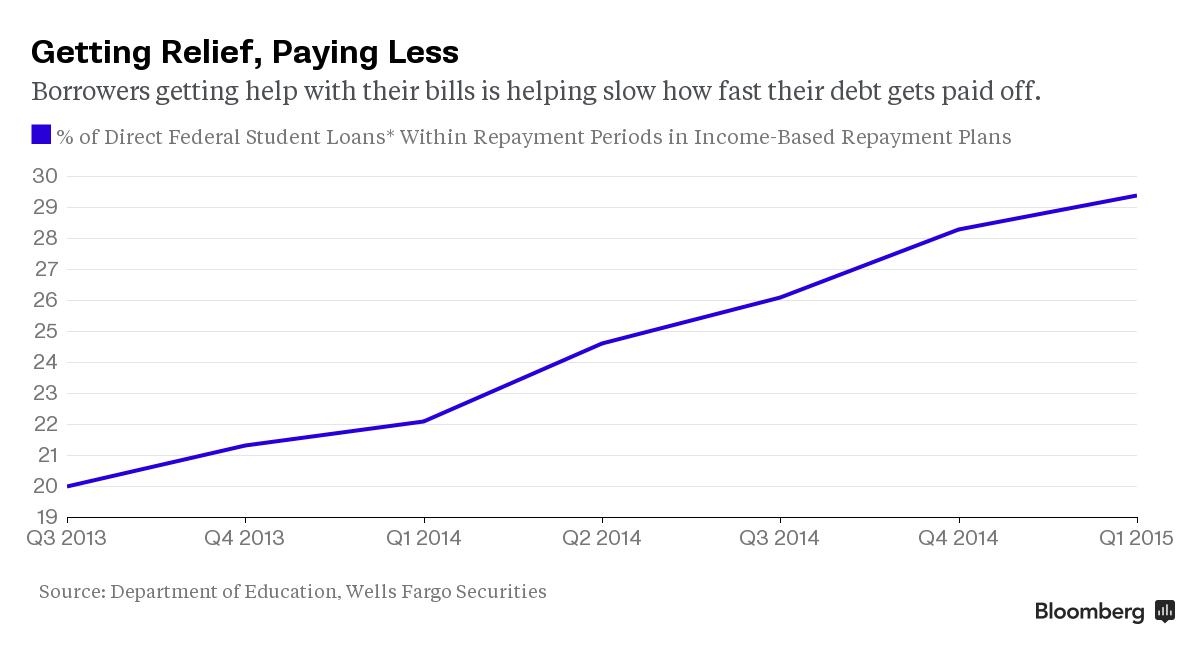

Thanks to a push by President Barack Obama's administration, more and more student-loan borrowers are signing up for income-driven repayment programs, allowing them to pay a fraction of what they would otherwise owe.

That's been making their debt more affordable each month but also longer-lasting (since the balances aren't getting paid down as much or at all and could even increase—although the balances can eventually be forgiven, in some cases after 20 years). The repayment slowdown is filtering into the bond market, where credit graders are now considering downgrades on almost $40 billion of securities tied to government-backed loans because the bonds might not pay off by their promised maturities.

As a result of bond investors getting nervous about potential technical defaults, we're getting some new data from Navient on exactly how many borrowers have been tapping the government programs. Here's how it looks for some of the company's bond trusts holding student loans, according to charts from Deutsche Bank analysts Elen Callahan and Kayvan Darouian:

These securitizations are backed by loans that are 97 percent insured by the government—bond deals that used to be common before Congress passed legislation in 2010 that ended U.S. guarantees of new loans in favor of direct federal lending.

While the use of income-driven repayment plans on direct loans is disclosed by the Department of Education, that's not the case for more than $300 billion of remaining insured ones made under the defunct Federal Family Education Loan Program, or FFELP.

This chart offers previously available data on the increasing use of the plans in the direct loan portfolio, which accounts for most of the nearly $1.2 trillion in federal student loans.

The relief for individual FFELP borrowers is shown to be significant in the new data from Navient, the loan servicer formerly part of a company known as Sallie Mae.

The average new payment by student-loan borrowers in the Navient bonds is about 20 percent of the amount scheduled under full repayment, according to the Deutsche Bank analysts.