| Latest | Greatest | Lobby | Journals | Search | Options | Help | Login |

|

|

|

This topic is archived. |

| Home » Discuss » Latest Breaking News |

|

| ozymandius

|

Wed Feb-03-10 05:43 AM Original message |

| STOCK MARKET WATCH, Wednesday February 3 |

|

Source: du

STOCK MARKET WATCH, Wednesday February 3, 2010 Bush Administration Officials Convicted = 2 Name(s): David Safavian, James Fondren Bush Administration Officials Charged = 1 Name(s): Richard Lopez Razo Financial Sector Officials Convicted since 1/20/09 = 11 AT THE CLOSING BELL ON February 2, 2010 Dow... 10,296.85 +111.32 (+1.09%) Nasdaq... 2,190.06 +18.86 (+0.87%) S&P 500... 1,103.32 +14.14 (+1.30%) Gold future... 1,118 +13.20 (+1.20%) 10-Yr Bond... 3.64 -0.01 (-0.25%) 30-Year Bond 4.56 +0.00 (+0.07%) U.S. FUTURES & MARKETS INDICATORS Market Conditions During Trading Hours      GOLD, EURO, YEN, Loonie, Silver and US$ |

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Wed Feb-03-10 05:47 AM Response to Original message |

| 1. Market Observation |

|

Long Term Perspectives and a Recap of

4th Quarter Real GDP BY RON GRIESS ... "Regressing to the mean" is a term often cited by financial commentators. In truth, market prices spend very little time at a "mean." If our trend line is considered a "mean," the following chart shows just how little time the DJIA has spent at the "mean," especially since 1925. Our friend, Jim Bianco, first shared the following chart with us in the early 1990's. The purpose of the Market Capitalization/GDP calculation is to try to relate the market value of the stock market to GDP. What the chart shows is just how dramatic the "bubble" was at the top in 2000 compared to any other time since 1925. http://www.financialsense.com/Market/wrapup.htm - lotsa charts |

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Wed Feb-03-10 05:50 AM Response to Original message |

| 2. Today's Reports |

|

07:30 Challenger Job Cuts Jan

Briefing.com NA Consensus NA Prior -72.9% 08:15 ADP Employment Change Jan Briefing.com -60K Consensus -30K Prior -84K 10:00 ISM Services Jan Briefing.com 52.1 Consensus 51.0 Prior 49.8 10:30 Crude Inventories 1/29 Briefing.com NA Consensus NA Prior -3.89M http://www.briefing.com/Investor/Public/Calendars/EconomicCalendar.htm |

| Printer Friendly | Permalink | | Top |

| rfranklin

|

Wed Feb-03-10 07:37 AM Response to Reply #2 |

| 22. Planned layoffs rise for first time since July: Challenger Gray |

|

Feb. 3, 2010, 7:31 a.m. EST

Planned layoffs rise for first time since July: Challenger Gray By Rex Nutting, MarketWatch WASHINGTON (MarketWatch) -- Planned layoff announcements at major U.S. corporations increased 59% in January, reaching 71,482 from a nine-year low of 45,094 seen in December, according to the latest job-cut tally by Challenger Gray & Christmas. It was the first month-to-month increase since July, the outplacement firm reported Wednesday. Apple's Co-Founder on His Toyota FrustrationsApple Inc. co-founder Steve Wozniak speaks about the hassles of dealing with his Toyota Prius after the recent recalls. Video courtesy of Fora TV. Layoff plans ran 70% lower than the 241,749 announced in January 2009, which was a seven-year high. Planned reductions for last month were led by retail companies, which announced 16,737 job cuts, and telecommunications companies, which cut 14,010 jobs. Challenger Gray's monthly tally covers only a small fraction of those who lose their jobs each month. Most layoffs are not announced in press releases. According to the government's most recent report, 2.05 million people lost their jobs via layoffs or terminations in November. Through the first 11 months of the 2009, the government counted 25.6 million layoffs. By Challenger Gray's count, companies announced 1.288 million job cuts during 2009. http://www.marketwatch.com/story/planned-layoffs-rise-for-first-time-since-july-2010-02-03 |

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Wed Feb-03-10 05:53 AM Response to Original message |

| 3. Oil hovers above $77 in Asia on demand hopes |

|

BANGKOK Oil prices slipped Wednesday in Asia but held most of the gains from the previous day when economic reports suggested demand for crude could improve.

Benchmark crude for March delivery was down 17 cents at $77.06 a barrel at midday Bangkok time in electronic trading on the New York Mercantile Exchange. The contract jumped more than $2 on Tuesday. The overnight rise in the oil price is the latest swing on the price seesaw over the past two months or so. Prices jumped about 20 percent from mid-December to a 15-month high last month only to slide more than 10 percent through the end of the month. .... In other Nymex trading in March contracts, heating oil fell 0.4 cent to $2.0276 a gallon, and gasoline was unchanged at $2.0186 a gallon. Natural gas fell 1.1 cent to $5.443 per 1,000 cubic feet. http://news.yahoo.com/s/ap/oil_prices |

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Wed Feb-03-10 05:56 AM Response to Reply #3 |

| 4. Oil advance before US energy report |

|

...

Later Wednesday, the US government's Department of Energy (DoE) will publish its snapshot of crude stockpiles for the week ending January 29. "All eyes are back on US fuel inventories today and we expect a small draw in distillates," said VTB Capital commodities analyst Andrey Kryuchenkov. "We also expect higher gasoline stocks with demand for petrol still struggling. Crude inventories could rise on rebounding imports," he added. ... In earlier Asian deals on Wednesday, oil prices pulled back after US industry body the American Petroleum Institute (API) had said Tuesday that there had been a build-up in US crude stockpiles -- indicating weak demand. http://news.yahoo.com/s/afp/20100203/bs_afp/commoditiesenergyoilprice_20100203102415 |

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Wed Feb-03-10 06:00 AM Response to Original message |

| 5. AIG Unit Staff Agrees to $20 Mln Cut (from $100 Mln in bonus cash) |

|

NEW YORK (Reuters) - AIG <AIG.N> said on Tuesday current and former employees of its Financial Products unit had so far agreed to accept cuts totalling about $20 million (12.5 million pounds) in retention payments, short of a $26 million target.

American International Group Inc, which was bailed out with a $182.3 billion U.S. aid package, said it had decided to begin making the reduced payments to current and former employees who had agreed to the cuts. An earlier payout was part of the proposals the company had made to the employees. These payments would total $100 million, the Washington Post reported. Although the payout is part of a previously known $195 million award that was due to employees of the AIG Financial Products unit, the news drew a fresh round of criticism from some members of Congress. ... The outrage follows a public outcry last March when AIG paid $165 million to employees of the unit that was behind the insurer's near collapse. Following the criticism, some employees of the unit said they would pay back $45 million from the retention payments they received in March 2009, but AIG got only $19 million back, putting it under pressure from various quarters including U.S. pay czar Kenneth Feinberg to recover the remaining money. AIG asked the unit's current and former employees to make up for the difference by taking cuts from the $195 million in retention payments that were due this March. http://www.nytimes.com/reuters/2010/02/03/business/business-uk-aig.html |

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Wed Feb-03-10 06:20 AM Response to Reply #5 |

| 8. Dinallo: What I Learned at the AIG Meltdown |

|

NYS Insurance Commissioner Eric Dinallo lays out what he sees as the 4 key elements of the AIG collapse:

1. Insurance policyholders at AIG were protected by reserves that each of the insurance companies are required to hold by state regulation;More at The Big Picture |

| Printer Friendly | Permalink | | Top |

| rfranklin

|

Wed Feb-03-10 06:59 AM Response to Reply #5 |

| 18. "AIG's near collapse"...I would say they collapsed and were resucitated by Uncle Sam... |

|

It was sort of a Weekend at Bernie's scenario with Geithner and Bernanke dragging the AIG corpse around town.

|

| Printer Friendly | Permalink | | Top |

| AnneD

|

Wed Feb-03-10 07:57 AM Response to Reply #18 |

| 24. Morning Marketeers... |

|

:donut: and lurkers. Let me get this cyber water cooler started off with a joke before I go. Just think of any 'too big to fail organization'

St. Peter is at the pearly gates doing some book keeping. A bell goes off and he sees a guy waiting to be let in. St Peter press the button , the gates open, and the guy walks in. St. Peter goes back to his book keeping. Again the bell rings, it is the same guy and St. Peter lets him in and goes back to work. This goes in for several times more. The bell rings again. Exacerbated, St. Peter slams the quill pen down and says to the guy,' Do you want in to Heaven or not'. The guy replies ' I really want to stay....... but they keep resuscitating me.' Happy hunting and watch out for the bears. |

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Wed Feb-03-10 06:12 AM Response to Original message |

| 6. Bank of America Said to Pay Bankers Average Bonus of $400,000 |

|

Feb. 3 (Bloomberg) -- Bank of America Corp., the nations largest lender, will pay investment-banking employees bonuses of about $4.4 billion for last year, or an average of $400,000 each, a person close to the bank said.

As much as 95 percent will be paid in stock vesting over about three years, the person said. Those receiving the smallest bonuses will get about half their compensation in cash, paid later this month, the person said. The unit accounts for 10,000 people, or 4 percent of the banks 283,000 workers. Bank of America, the target of political wrath for its acquisition of Merrill Lynch & Co. even as the faltering Wall Street firm handed out $3.6 billion of employee bonuses, reaped a $6.3 billion profit in 2009. This years investment bank bonuses are a third less than $6.5 billion that the combined units would have paid in the peak year of 2006, the person said, citing internal Bank of America calculations. .... The Financial Times cited unidentified people as saying that top Bank of America performers in global banking and markets will receive bonuses of about $5 million, while managing directors will get $2.5 million to $3 million. http://www.bloomberg.com/apps/news?pid=20601087&sid=aB9F9yg63I0o&pos=2 And the siphoning off and concentration of wealth continues... |

| Printer Friendly | Permalink | | Top |

| Tansy_Gold

|

Wed Feb-03-10 07:18 AM Response to Reply #6 |

| 21. They create no wealth, they only steal it from those who do |

|

I am having a marvelous schadenfreude morning. May it be an omen for the rest of the thieves.

The nightmare "new software" foisted on me and my fellow "freelancers" on Monday -- which is primarily a "nightmare" because the company did NO training, produced NO instruction manual, and had NO staff prepared and available for assistance -- crashed their system yesterday. They've been down since at least 3:00 PM MST 2/2/10, not up yet, and I'm cryin' in my beer over it. Had they been a little less greedy, a little less cheap, a little less dismissive of the people who actually do the work for them, this might not have happened. Sometimes Karma can bite ya in the ass --- hard. Tansy Gold, who thinks we need a lot more new smileys than just ESAD and FRSP -- we need a fanged Karma :evilgrin: |

| Printer Friendly | Permalink | | Top |

| tclambert

|

Wed Feb-03-10 02:53 PM Response to Reply #6 |

| 52. I move that any bankers who get a fat bonus must change their title from banker to wanker. |

|

Small change, but important.

|

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Wed Feb-03-10 06:17 AM Response to Original message |

| 7. Bats Plans Second U.S. Stock Market by End of Second Quarter |

|

Feb. 3 (Bloomberg) -- Bats Global Markets, owner of the fourth-largest U.S. stock venue, plans to open a second trading network in late May or June to offer brokerages and investors new incentives and pricing. The International Securities Exchange said its considering another options platform.

Bats Y-Exchange, or BYX, will start trading equities in the second quarter, pending approval by the U.S. Securities and Exchange Commission, Chief Operating Officer Chris Isaacson said in an interview. The public can comment on the proposal from Kansas City, Missouri-based Bats until March 15. Stock markets operated by Nasdaq OMX Group Inc. and Direct Edge Holdings LLC have gained business in the past year from firms seeking to hold down execution costs for low-priced shares. Running a second system lets a market tailor pricing to win different kinds of business. ... Among the four largest U.S. stock-market operators, Bats is the only one that doesnt operate multiple trading platforms. New York-based Nasdaq and Jersey City, New Jersey-based Direct Edge have two, while NYSE Euronext of New York has three. Nasdaq is planning a third venue, using the license it acquired when it bought the Philadelphia Stock Exchange in July 2008. ... Bats said it executed 10.2 percent of U.S. stock trading in January, an increase from 9.3 percent in December. Its 11 owners are Bank of America Corp., Citigroup Inc., Credit Suisse Group AG, Deutsche Bank AG, Getco LLC, JPMorgan Chase & Co., the estate of Lehman Brothers Holdings Inc., Lime Brokerage LLC, Morgan Stanley, Tradebot Systems Inc. and Wedbush Morgan Securities. http://www.bloomberg.com/apps/news?pid=20601109&sid=av6oM.QDDmIw&pos=12 |

| Printer Friendly | Permalink | | Top |

| Festivito

|

Wed Feb-03-10 06:27 AM Response to Original message |

| 9. Debt: 02/01/2010 12,349,463,585,067.42 (UP 70,827,587,100.54) (Mon) |

|

(Up a good bit. Debt seems to jump up big then drop slowly maybe up a little and down a little for days--repeat. Good good day to all.)

= Held by the Public + Intragovernmental(FICA) = 7,849,809,516,401.30 + 4,499,654,068,666.12 UP 90,319,223,365.33 + DOWN 19,491,636,264.79 Source: Debt to the penny: http://www.treasurydirect.gov/NP/BPDLogin?application=np THINKING IN BILLIONS: Think 3 or 4 dollars per billion in a 309-Million person America. If every American, man, woman and child puts in $3.24 each THAT'S 1B$. A family of three: Mom, Dad, Child: $9.72, ABOUT TEN BUCKS for a 1B$ federal program. I hope that is clear. However, I'd suggest using $3 per 1B$ to underestimate it. Use $4 per 1B$ to overestimate the cost when thinking: Is the federal program worth it? Aid to Dependant Children: 2B$/yr =$8/yr(a movie a year) Family of 3: $24/yr(an hour of bowling) PERSONALIZED DEBT: Every 10 seconds we net gain another American, so at the end of the workday of the report, there should be 308,625,438 people in America. http://www.census.gov/population/www/popclockus.html ON 11/07/2009 08:19 -> 307,879,272 Currently, each of these Americans owe $40,014.41. A family of three owes $120,043.22. (And that is IN ADDITION to their mortgage.) ANALYSIS: There were 21 reports in the last 30 to 32 days. The average for the last 21 reports is 1,814,947,978.83. The average for the last 30 days would be 1,270,463,585.18. The average for the last 32 days would be 1,191,059,611.11. There were 252 reports in 365 days of FY2007 averaging 1.99B$ per report, 1.37B$/day. There were 253 reports in 366 days of FY2008 averaging 4.02B$ per report, 2.78B$/day. There were 75 reports in 112 days of GWB's part of FY2009 averaging 8.03B$ per report, 5.38B$/day. There were 174 reports in 253 days of Obama's part of FY2009 averaging 7.33B$ per report, 5.07B$/day so far. There were 249 reports in 365 days of FY2009 averaging 7.57B$ per report, 5.16B$/day. There were 83 reports in 124 days of FY2010 averaging 5.30B$ per report, 3.55B$/day. Above line should be okay PROJECTION: There are 1,084 days remaining in this Obama 1st term. By that time the debt could be between 13.6 and 17.9T$. It could be higher. It could be lower. HISTORICAL: President's term begins and ends on Jan 20. (Guess who might want to hide the Reagan Bush years. Jan 20 data is missing before 1993.) 01/20/1993 _4,188,092,107,183.60 WJC Inaugural 01/22/2001 _5,728,195,796,181.57 WJC (UP 1,540,103,688,997.97) 01/20/2009 10,626,877,048,913.08 GWB (UP 4,898,681,252,731.43) 02/01/2010 12,349,463,585,067.42 BHO (UP 1,722,586,536,154.34 so far since Obama took office.) FISCAL YEAR DEBT CHANGE, Sep 30 prior year to Sep 30 named year: (One "* " for each 40B$ reached) FY1994 +0,281,261,026,873.94 ------------* * * * * * * WJC FY1995 +0,281,232,990,696.07 ------------* * * * * * * WJC FY1996 +0,250,828,038,426.34 ------------* * * * * * WJC FY1997 +0,188,335,072,261.61 ------------* * * * WJC FY1998 +0,113,046,997,500.28 ------------* * WJC FY1999 +0,130,077,892,735.81 ------------* * * WJC FY2000 +0,017,907,308,253.43 ------------WJC FY2001 +0,133,285,202,313.20 ------------* * * C&B 01-WJC +0,053,598,528,417.78 ------------* WJC 31% of FY, 40% of FY-Debt 01-GWB +0,079,686,673,895.42 ------------* GWB 69% of FY, 60% of FY-Debt FY2002 +0,420,772,553,397.10 ------------* * * * * * * * * * GWB FY2003 +0,554,995,097,146.46 ------------* * * * * * * * * * * * * GWB FY2004 +0,595,821,633,586.70 ------------* * * * * * * * * * * * * * GWB FY2005 +0,553,656,965,393.18 ------------* * * * * * * * * * * * * GWB FY2006 +0,574,264,237,491.73 ------------* * * * * * * * * * * * * * GWB FY2007 +0,500,679,473,047.25 ------------* * * * * * * * * * * * GWB FY2008 +1,017,071,524,649.92 ------------* * * * * * * * * * * * * * * * * * * * * * * * * GWB FY2009 +1,885,104,106,599.30 ------------* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * B&O 09GWB +0,602,152,152,000.60 ------------* * * * * * * * * * * * * * * GWB 31% of FY, 32% of FY-Debt 09-BHO +1,282,951,954,598.70 ------------* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * BHO 69% of FY, 68% of FY-Debt FY2010 +0,439,634,581,555.70 ------------* * * * * * * * * * BHO Endof10 +1,294,085,663,450.25 ------------* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * Linear Projection LAST FIFTEEN REPORTS OF ADDITIONS TO PUBLIC DEBT(NOT FICA): 01/11/2010 -000,226,209,166.36 --- Mon 01/12/2010 +000,163,748,521.92 ------------******** 01/13/2010 -000,144,326,167.15 --- 01/14/2010 -025,105,278,682.17 - 01/15/2010 +057,080,501,160.91 ------------********** 01/19/2010 -000,292,818,574.91 --- Tue 01/20/2010 +001,498,198,188.82 ------------********* 01/21/2010 -031,161,420,148.11 - 01/22/2010 -000,070,049,877.74 ---- 01/25/2010 -000,041,466,126.01 ---- Mon 01/26/2010 +000,973,181,275.87 ------------******** 01/27/2010 +000,063,416,019.94 ------------******* 01/28/2010 -024,245,578,618.07 - 01/29/2010 -000,416,981,206.21 --- 02/01/2010 +090,319,223,365.33 ------------********** Mon 68,394,139,966.06 Total of 15 above reports. Heavy borrowing seems to start after 09/18/2008 while Bush was in power JUST BEFORE fiscal year end. Bush admin borrowed $962,245,245,654.01 in those last 124 days in office crossing two fiscal years. $360,093,093,653.42 in last 12 days of FY2008, and $602,152,152,000.59 in subsequent 112 days before leaving office. For a prettier and more explanatory view of our nation's debt: http://www.brillig.com/debt_clock http://www.usdebtclock.org/ DUer primer on National debt (Debt to the penny keeps changing. Stuff is missing. Best to keep our own history.) LAST REPORT: http://www.democraticunderground.com/discuss/duboard.php?az=show_mesg&forum=102&topic_id=4253003&mesg_id=4253017 |

| Printer Friendly | Permalink | | Top |

| Festivito

|

Wed Feb-03-10 03:49 PM Response to Reply #9 |

| 55. Debt: 02/02/2010 12,360,943,989,345.48 (UP 11,480,404,278.06) (Tue) |

|

(Down a little. Debt seems to jump up big then drop slowly maybe up a little and down a little for days--repeat. Good day all.)

= Held by the Public + Intragovernmental(FICA) = 7,849,743,504,000.83 + 4,511,200,485,344.65 DOWN 66,012,400.47 + UP 11,546,416,678.53 Source: Debt to the penny: http://www.treasurydirect.gov/NP/BPDLogin?application=np THINKING IN BILLIONS: Think 3 or 4 dollars per billion in a 309-Million person America. If every American, man, woman and child puts in $3.24 each THAT'S 1B$. A family of three: Mom, Dad, Child: $9.72, ABOUT TEN BUCKS for a 1B$ federal program. I hope that is clear. However, I'd suggest using $3 per 1B$ to underestimate it. Use $4 per 1B$ to overestimate the cost when thinking: Is the federal program worth it? Aid to Dependant Children: 2B$/yr =$8/yr(a movie a year) Family of 3: $24/yr(an hour of bowling) PERSONALIZED DEBT: Every 10 seconds we net gain another American, so at the end of the workday of the report, there should be 308,634,078 people in America. http://www.census.gov/population/www/popclockus.html ON 11/07/2009 08:19 -> 307,879,272 Currently, each of these Americans owe $40,050.48. A family of three owes $120,151.45. (And that is IN ADDITION to their mortgage.) ANALYSIS: There were 22 reports in the last 30 to 33 days. The average for the last 22 reports is 2,254,286,901.52. The average for the last 30 days would be 1,653,143,727.78. The average for the last 33 days would be 1,502,857,934.35. There were 252 reports in 365 days of FY2007 averaging 1.99B$ per report, 1.37B$/day. There were 253 reports in 366 days of FY2008 averaging 4.02B$ per report, 2.78B$/day. There were 75 reports in 112 days of GWB's part of FY2009 averaging 8.03B$ per report, 5.38B$/day. There were 174 reports in 253 days of Obama's part of FY2009 averaging 7.33B$ per report, 5.07B$/day so far. There were 249 reports in 365 days of FY2009 averaging 7.57B$ per report, 5.16B$/day. There were 84 reports in 125 days of FY2010 averaging 5.37B$ per report, 3.61B$/day. Above line should be okay PROJECTION: There are 1,083 days remaining in this Obama 1st term. By that time the debt could be between 13.8 and 18.0T$. It could be higher. It could be lower. HISTORICAL: President's term begins and ends on Jan 20. (Guess who might want to hide the Reagan Bush years. Jan 20 data is missing before 1993.) 01/20/1993 _4,188,092,107,183.60 WJC Inaugural 01/22/2001 _5,728,195,796,181.57 WJC (UP 1,540,103,688,997.97) 01/20/2009 10,626,877,048,913.08 GWB (UP 4,898,681,252,731.43) 02/02/2010 12,360,943,989,345.48 BHO (UP 1,734,066,940,432.40 so far since Obama took office.) FISCAL YEAR DEBT CHANGE, Sep 30 prior year to Sep 30 named year: (One "* " for each 40B$ reached) FY1994 +0,281,261,026,873.94 ------------* * * * * * * WJC FY1995 +0,281,232,990,696.07 ------------* * * * * * * WJC FY1996 +0,250,828,038,426.34 ------------* * * * * * WJC FY1997 +0,188,335,072,261.61 ------------* * * * WJC FY1998 +0,113,046,997,500.28 ------------* * WJC FY1999 +0,130,077,892,735.81 ------------* * * WJC FY2000 +0,017,907,308,253.43 ------------WJC FY2001 +0,133,285,202,313.20 ------------* * * C&B 01-WJC +0,053,598,528,417.78 ------------* WJC 31% of FY, 40% of FY-Debt 01-GWB +0,079,686,673,895.42 ------------* GWB 69% of FY, 60% of FY-Debt FY2002 +0,420,772,553,397.10 ------------* * * * * * * * * * GWB FY2003 +0,554,995,097,146.46 ------------* * * * * * * * * * * * * GWB FY2004 +0,595,821,633,586.70 ------------* * * * * * * * * * * * * * GWB FY2005 +0,553,656,965,393.18 ------------* * * * * * * * * * * * * GWB FY2006 +0,574,264,237,491.73 ------------* * * * * * * * * * * * * * GWB FY2007 +0,500,679,473,047.25 ------------* * * * * * * * * * * * GWB FY2008 +1,017,071,524,649.92 ------------* * * * * * * * * * * * * * * * * * * * * * * * * GWB FY2009 +1,885,104,106,599.30 ------------* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * B&O 09GWB +0,602,152,152,000.60 ------------* * * * * * * * * * * * * * * GWB 31% of FY, 32% of FY-Debt 09-BHO +1,282,951,954,598.70 ------------* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * BHO 69% of FY, 68% of FY-Debt FY2010 +0,451,114,985,833.70 ------------* * * * * * * * * * * BHO Endof10 +1,317,255,758,634.41 ------------* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * Linear Projection LAST FIFTEEN REPORTS OF ADDITIONS TO PUBLIC DEBT(NOT FICA): 01/12/2010 +000,163,748,521.92 ------------******** 01/13/2010 -000,144,326,167.15 --- 01/14/2010 -025,105,278,682.17 - 01/15/2010 +057,080,501,160.91 ------------********** 01/19/2010 -000,292,818,574.91 --- Tue 01/20/2010 +001,498,198,188.82 ------------********* 01/21/2010 -031,161,420,148.11 - 01/22/2010 -000,070,049,877.74 ---- 01/25/2010 -000,041,466,126.01 ---- Mon 01/26/2010 +000,973,181,275.87 ------------******** 01/27/2010 +000,063,416,019.94 ------------******* 01/28/2010 -024,245,578,618.07 - 01/29/2010 -000,416,981,206.21 --- 02/01/2010 +090,319,223,365.33 ------------********** Mon 02/02/2010 -000,066,012,400.47 ---- 68,554,336,731.95 Total of 15 above reports. Heavy borrowing seems to start after 09/18/2008 while Bush was in power JUST BEFORE fiscal year end. Bush admin borrowed $962,245,245,654.01 in those last 124 days in office crossing two fiscal years. $360,093,093,653.42 in last 12 days of FY2008, and $602,152,152,000.59 in subsequent 112 days before leaving office. For a prettier and more explanatory view of our nation's debt: http://www.brillig.com/debt_clock http://www.usdebtclock.org/ DUer primer on National debt (Debt to the penny keeps changing. Stuff is missing. Best to keep our own history.) LAST REPORT: http://www.democraticunderground.com/discuss/duboard.php?az=show_mesg&forum=102&topic_id=4254322&mesg_id=4254343 |

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Wed Feb-03-10 06:27 AM Response to Original message |

| 10. Senator Dodd dons his whore garb. |

|

Dodd Calls Obama Plan Too Grand

WASHINGTON The chairman of the Senate Banking Committee warned on Tuesday that the Obama administrations new proposals to rein in Wall Street firms ran the risk of derailing months of delicate negotiations over overhauling financial regulations. ... Mr. Dodd, Democrat of Connecticut, added that the administration was getting precariously close to excessive ambition for the legislation. I dont want to be in a position where we end up doing nothing because we tried to do too much, he said. ... Attempts by big banks to regulate themselves will inevitably fail, Mr. Volcker suggested. When a bank trades for its own account as opposed to the money of its customers it will almost inevitably find itself, consciously or inadvertently, acting at cross purposes to the interests of its customers, he said. The deputy Treasury secretary, Neal S. Wolin, who testified alongside Mr. Volcker, said the proposed ban would apply to any company, foreign or domestic, that owned a bank with federally insured deposits, but would not disrupt the core functions and activities of a banking firm, including lending, asset management, giving financial advice and hedging risks in connection with client-driven transactions. Several Republican senators expressed skepticism about the proposals. Now that raising campaign money is no longer an option - Dodd is now whoring for a job to sweeten his retirement years. When the article says " new proposals to rein in Wall Street firms ran the risk of derailing months of delicate negotiations" - that says to me that Wall Street firms are helping to write their own regulations. |

| Printer Friendly | Permalink | | Top |

| Dr.Phool

|

Wed Feb-03-10 06:32 AM Response to Reply #10 |

| 11. "Derailing months of delicate negotiations". |

|

His employment negotiations, I presume.

|

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Wed Feb-03-10 06:37 AM Response to Reply #11 |

| 13. And the loopholes |

|

I am sure that 200 pages of bold type regulations will be undone with 300 pages of mice type conditions, stipulations and (otherwise) loopholes. This should be a clear indication of who Senator Dodd considers his constituents.

|

| Printer Friendly | Permalink | | Top |

| Dr.Phool

|

Wed Feb-03-10 06:46 AM Response to Reply #13 |

| 14. He'll come up with lots of loopholes. |

|

Just like his HAVA Act. Just enough to accomplish the exact opposite of what it's supposed to do.

|

| Printer Friendly | Permalink | | Top |

| Roland99

|

Wed Feb-03-10 06:48 AM Response to Reply #10 |

| 15. What a disappointment he became. |

|

*sigh*

|

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Wed Feb-03-10 06:51 AM Response to Reply #15 |

| 17. I seem to recall Dr. Phool saying |

|

that Senator Dodd is the stupidest politician he has ever met. Correct, Dr. Phool?

|

| Printer Friendly | Permalink | | Top |

| Dr.Phool

|

Wed Feb-03-10 06:59 AM Response to Reply #17 |

| 19. Dumber than a box of hammers. |

|

Not a clue in the fucking world.

He's top 3 dumb for sure, but, off the top of my head, I can't think of anyone who tops him. |

| Printer Friendly | Permalink | | Top |

| Tansy_Gold

|

Wed Feb-03-10 08:46 AM Response to Reply #19 |

| 28. That's an insult to hammers |

|

Seriously -- maybe it's time for a constitutional amendment limiting the time these buffoons can serve. Something like a lifetime maximum 5 congressional terms or 2 Senate terms but no more than a total of 20 years combined. Then they're out. That would eliminate this lifetime appointment for incumbents, would get new blood in, and would change the seniority-based committee leadership more often.

not that such an amendment would ever pass congress, but hey, a girl can dream, can't she? |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Wed Feb-03-10 08:52 AM Response to Reply #28 |

| 30. I'd Rather Use a Combination IQ and Ethics Test |

|

to be applied EACH TIME a candidate volunteers to run for office. Selection by competitive examination...

|

| Printer Friendly | Permalink | | Top |

| tclambert

|

Wed Feb-03-10 02:57 PM Response to Reply #30 |

| 53. There's already an ethics test. If you have any, you can't play. |

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Wed Feb-03-10 06:33 AM Response to Original message |

| 12. El-Erian Says Retreat in Stocks Will Worsen as Economy Slumps |

|

Feb. 3 (Bloomberg) -- Mohamed A. El-Erian, whose firm runs the worlds biggest mutual fund, said the largest stock market decline in 11 months may worsen amid persistent U.S. joblessness and economic growth that trails analysts forecasts.

Investors have wrongly priced in an orderly withdrawal of stimulus measures, a rebound in bank lending and coordinated government policy to restore growth, the chief executive officer of Pacific Investment Management Co. wrote in a Bloomberg News column. That means Wall Street projections for gains in 2010 may prove incorrect and prices will slump, he said. ... El-Erian, whose firm manages $1 trillion from Newport Beach, California, said in a July 29 interview on CNBC that the rally in U.S. equities was a sugar high that wouldnt be sustained by economic growth. The S&P 500 has climbed 13 percent since then. On Oct. 10, 2008, he said the point of exhaustion for the credit crisis was far away. The S&P 500 decreased 25 percent through March 9, falling in four of five months. ... Pimcos Bill Gross and El-Erian say investors should expect returns that trail the historical average because of more government regulation, lower consumption and a smaller role for the U.S. in the global economy. American gross domestic product may expand 2.7 percent in 2010 and 2.9 percent in 2011 as demand recovers from the first global recession since World War II, based on the median economist forecast from a Bloomberg survey. http://www.bloomberg.com/apps/news?pid=20601087&sid=aKp04HpeyeLU&pos=6 |

| Printer Friendly | Permalink | | Top |

| 54anickel

|

Wed Feb-03-10 07:51 AM Response to Reply #12 |

| 23. This line speaks volumes to me - are they admitting there may have been some ill gotten gain here? |

|

And what does the free-market, laissez-faire, anti-regulation screed say about our society? Damn having rules, just show us the money!!!! :puke:

"...investors should expect returns that trail the historical average because of more government regulation, lower consumption and a smaller role for the U.S. in the global economy." |

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Wed Feb-03-10 06:48 AM Response to Original message |

| 16. FDIC Proposes Tough-Minded Securitization Reforms; Industry Howls |

|

From Yves Smith:

As readers may know, the financial reforms proposed by the Obama administration barely deserve the name. The late-in-the-game efforts to rebrand the effort by putting Paul Volcker in the forefront and patch up one of the gaping holes, that the government is backstopping risky trading businesses (Goldman Sachs has issued FDIC guaranteed bonds) illustrates the typical Obama chasm between rhetoric and action. So it was a pleasant surprise to learn that the FDIC presented a cogent and tough-minded plan for securtization reform at the American Securitization Forum. Surprisingly, I havent seen a write-up at my usual first stop for this sort of thing (Housing Wire) and a search of my RSS reader shows no posts on this advanced proposal of new rulemaking which was made public back in December. ... In addition, this FDIC proposal supports two of my other pet theories. One is that it is possible for regulators to come up with effective reforms if they have the will. This is a cogent and well designed plan. Second is the FDIC is the only Federal banking overseer that takes regulation seriously (the SEC might have once upon a time; it might be possible for it to rebuild that skill. The Fed is beyond redemption here; it is dominated by monetary economists who not only dont know what they dont know, but also are unduly respectful of the wonders of financial markets. The FDIC, by contrast, is not overawed by banksters). ... The FDIC proposed these major changes (these are high-level summaries; comments encouraged): 1. Mortgages must be seasoned 12 months before they can be securitizedThis is an elegant little list. Go now and read. |

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Wed Feb-03-10 07:08 AM Response to Original message |

| 20. Enjoy your day, everyone. |

|

I need to head for the door.

:hi: |

| Printer Friendly | Permalink | | Top |

| tclambert

|

Wed Feb-03-10 08:22 AM Response to Original message |

| 25. That cartoon reminded me of the movie The In-Laws |

|

--the funny version from 1979 with Peter Falk as CIA agent Vincent Ricardo, and Alan Arkin as dentist Sheldon Kornpett. The quote that relates to the cartoon:

Vince Ricardo: I was in the jungle - the bush we called it - for approximately nine months... Sheldon: Nine months! That must have really been something! Vince Ricardo: It was. I saw things... They have tsetse flies down there the size of eagles. I think they went on with the tsetse flies carrying off little children and how tragic that was for the parents to watch. IMDB doesn't have the rest of that quote. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Wed Feb-03-10 08:44 AM Response to Original message |

| 26. A Good Guy in D.C.? |

|

http://brucekrasting.blogspot.com/2010/02/good-guy-in-dc.html

Edward DeMarco, the acting head of FHFA, wrote a letter to some heavy hitters in Washington. Sen. Dodd-Banking, Sen. Shelby-Banking, Congressman Frank-Financial Services and Bachus-Financial Services. The letter was a cry for help. I sincerely hope that these important legislators do not ignore this SOS. If they do, some irreversible damage will have been done. Hundreds of billions of dollars are at stake. Even more significant, the direction of the government's future role in the mortgage market is going to be shaped by the corporate Execs at Fannie and Freddie. There could not be a worse outcome. DeMarco laid it all on the line. He described the terrible mess that Fannie and Freddie are in. His words: These calls on taxpayer funds are troubling to all of us. There was a significant amount of information provided regarding all of the new management at F/F. Those that are dirty from the past are all gone. Both Fannie and Freddie have new private sector Boards of Directors that meet regularly. There was a discussion that it had been agreed that both F/F would not do anything new. As I was reading this I was getting the sense that in some ways DeMarco was mocking the charade that is happening. We have two private sector entities with all of the trappings of Boards and high priced corporate talent. And at the same time these two dogs are sucking down taxpayer money at the rate of $10B a month. Losses are now expected to exceed a half a trillion. Why do we need fancy Boards and big buck talent to accomplish that? The important sentence comes in the summary: The only (alternative) FHFA may implement today under existing law is to reconstitute the two companies under their current law That is polite Washington speak. What Mr. DeMarco said between these lines was If you guys dont get off your ass and pass some new legislation I am going to be forced to take us down a road that we should not go down. I dont have a choice in this. I think this is a big mistake. Please do something to stop this. I dont want to be the guy that puts the mortgage giants on a path that will end very badly. We have made this mistake before with the GSEs. I dont want to make it again. Please help, before it is too late Mr. DeMarco should have addressed this letter to Tim Geithner. Nothing can happen with the GSEs without strong leadership from Treasury. And we have a nincompoop running the shop. On the urgent need to address the problems with the D.C. lenders Weak Tim said on NPR recently: "I don't think we're going to be able to legislate that until that process can start, until next year, because it's just a complicated thing to get right." This problem is too complicated for the current Treasury Secretary? The head of the FHFA is urgently calling for help; Congress is frozen over health care and the changing political reality. Where is the leadership that is needed? There is none. There is a reason for that and that reason needs to be addressed. This letter points to one of a dozen issues that need attention from an effective T.Sec. Heres a plan for Tim, Chris, Barney, Rich and Spence. Finish the job. The conservatorship is a joke and a private sector GSE approach has already proved a disaster. Privatize these dogs. Get it over with. Then merge the two of them. Create a good bank and a bad bank. Do what you have to with the bad bank and dont ever, ever make the mistakes of the past with the good bank. Get rid of that high priced talent that is costing so much and doing so little. De-list these deadbeats. That would save $20mm a year. Get rid of those big Boards and their do nothing new meetings. And if youre looking for someone to run this mess, consider Edward DeMarco. Hes the only one who has spoken the truth about the Agencies for years. Listen to him. |

| Printer Friendly | Permalink | | Top |

| Robbien

|

Wed Feb-03-10 02:31 PM Response to Reply #26 |

| 50. The Secretive "Blob" On Capitol Hill That's Blocking Any Hope Of Financial Reform |

|

A secret club of current Senate staffers and Wall Street lobbyists is dragging down the chances for meaningful financial reform.

Staffers on the powerful Senate banking committee are part of what is known as "The Banking Blob," a person familiar with the matter told us. The Banking Blob is made up of current banking committee staffers and former staffers who are now bankers or lobbyists. They frequently socialize together, often organizing happy hours and parties. "They move in a pack. They socialize together," the person says. "Hell. They even inter-marry." The Blob is made up of both Republican and Democratic staffers. Outsiders tend to think the Blob members view themselves as "cooler" than other Capitol Hill staff members. Often a job on the banking committee leads to a well-paying job for a Wall Street firm or a position at a K-Street lobbyist law firm. "The very worst example of the revolving door in Congress," is how the person described the Blob. "The idea that these people would actually develop legislation that Wall Street opposes" is a joke, the person said. "They are genetically incapable of doing it." http://www.businessinsider.com/the-secret-banking-blob-on-capitol-hill-that-destroys-the-possibility-of-financial-reform-2010-2 DeMarco doesn't have a chance against these cool kids. Get rid of high priced talent that does so little? Ha! these guys are vying to get those jobs for themselves. |

| Printer Friendly | Permalink | | Top |

| UpInArms

|

Wed Feb-03-10 08:45 AM Response to Original message |

| 27. dollar watch |

http://quotes.ino.com/chart/?acs=NYBOT_DX&v=i Last trade 79.048 Change +0.034 (+0.04%) Daily Sound Bites 02.03 http://www.dailyfx.com/forex/fundamental/article/daily_sound_bites/2010-02-03-1206-Daily_Sound_Bites_02_03.html  ...more... Will Currency Markets ‘Smile’ on the US Dollar? http://www.dailyfx.com/forex/fundamental/article/special_report/2010-02-03-1100-Will_Currency_Markets__Smile__on.html The US Dollar is likely to rise against most major currencies in 2010 according to a "smiling" model of the greenback’s performance at the beginning, middle and conclusion of major recessions in the United States. The ‘Dollar Smile’ Hypothesis Intuitively, one would suppose that the US Dollar should decline if the United States falls into a deep recession as the Federal Reserve cuts interest rates to stimulate economic growth, making the greenback unattractive relative to other currencies. However, a theory originally advanced by Stephen Jen, then an economist with Morgan Stanley, suggests something quite different. His logic goes as follows: Phase 1: When the United States – the world’s largest economy and consumer market – falls into a deep recession, investors fearful that the downturn will spread globally sell off their holdings of risky assets (stocks, commodities) and move capital into the relative safety of cash and government bonds. The economic and geopolitical primacy of the United States along with the unmatched sophistication and liquidity its capital markets means that the cash and bonds of choice in this scenario are the Dollar and US Treasuries. This means that the greenback should rise if the US begins to experience a deep-enough recession to warrant fears of worldwide contagion. Phase 2: As the pace of decline in economic activity invariably begins to slow, the markets become hopeful that the worst is over and capital begins to shift out of Dollar-denominated safe haven assets and back toward higher-risk and higher-return investments, sending US unit lower from its peak amid the crisis. Phase 3: Finally, as economic recovery in the United States begins to gain momentum, investors start to speculate that the Federal Reserve will need to raise interest rates (which were surely lowered amid recession) to rein in building inflationary pressure, sending the US Dollar higher once again. Broadly speaking, history seems to bear out Mr Jen’s hypothesis. As illustrated in the chart below, data going back to 1970 shows that the US Dollar Index (an average of the greenback’s value against six of its top counterparts) is higher when US Gross Domestic Product growth rates are either sharply above or below the average of other G7 nations; it is lower when the difference in growth rates declines, revealing a “convex” relationship or a “smile”:  ...more... now that is really stoopid |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Wed Feb-03-10 08:50 AM Response to Original message |

| 29. NYT Talks Global Power Without a Clue |

|

http://www.prospect.org/csnc/blogs/beat_the_press_archive?month=02&year=2010&base_name=nyt_talks_global_power_without

The NYT had an article on how the U.S. is likely to wane as a global power, without ever once mentioning the trade deficit. It even quoted Larry Summers, the head of President Obama's National Economic Council saying: "How long can the worlds biggest borrower remain the worlds biggest power? without mentioning the trade deficit. If the United States government had a large budget deficit, but no trade deficit, then it would mean that the money was being borrowed domestically. In this story, the United States government could be the world's largest borrower, but it would mean that its population was the world's largest lender. What would matter in terms of its international position would be its relative rate of productivity growth (which has been respectable in recent years). However, the United States has been running large and unsustainable trade deficits in recent years because of the over-valued dollar. The trade deficits, not the budget deficits, have caused the country to become the world's largest debtor that Mr. Summers complained about. If the dollar and GDP were both at their current levels and the budget was completely balanced, we would be borrowing just as much money from abroad as we are today. Failing to discuss either the trade deficit or the value of the dollar in this context was an enormous oversight. --Dean Baker COMMENTS (5) It's still a really depressing budget. If we had Series EE savings bonds that paid 6% interest so that Americans were able to invest in them to finance the debt, I'd feel much better about it. It worked to pay off WWII. All that debt was financed by Americans. Posted by: LJM | February 1, 2010 10:43 PM Is there any causal relation between the budget deficit, private savings, and the trade deficit. In my econ class we learned that they all equal zero, but I know that's just an accounting identify, not an explanatory model. What would happen if politicians decided to balance the budget tomorrow? I know that would have a large contractionary effect. Would that simply play out as less investment, offsetting things and keeping the accounting identity balanced? Or would that have any impact on the trade deficit? Posted by: graeme | February 1, 2010 11:10 PM The importance of ignoring the trade deficit in order to bring an end to "entitlements" as we know them and thus balance the budget on the backs of the lower orders cannot be overstated. We are repeating the pattern seen toward the end of previous empires. We have learned nothing... Posted by: bobbyp | February 2, 2010 12:27 AM You speak of a "respectable" relative rate of productivity growth in recent years. But, given the skyrocketing rates of income and wealth maldistribution, isn't that little more than fewer people doing more work for less money? Posted by: Michael Fiorillo | February 2, 2010 5:24 AM No one really knows what the US trade deficit is. The numbers are a fuzzy guess at best. The US does not tax exports like other nations do, so doesn't reliably count exports. It is a best guess. For instance, a ship full of cows may be priced in hamburger units. In the eighties when CDs where actually shipped instead of burned locally, a crate of CDs was priced in weight of plastics. (All those Micheal Jackson Thriller CDs or Windows software ones were priced at far less than a penny apiece.) Shipments of raw goods like iron ore, or wheat can be reasonably factored by weight. But not finished goods. which are either not counted or priced to cheapest unit or weight of materials. The trade gap figures have always been negative even when we export a lot. It isn't a number to worry about. Mainly because it isn't a real figure. If it was in some past years it would have definitely been positive. If it was an accurate number we'd all be speaking Chinese by now. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Wed Feb-03-10 09:00 AM Response to Original message |

| 31. McKinsey Says Deleveraging Will Exert Drag on GDP Growth |

|

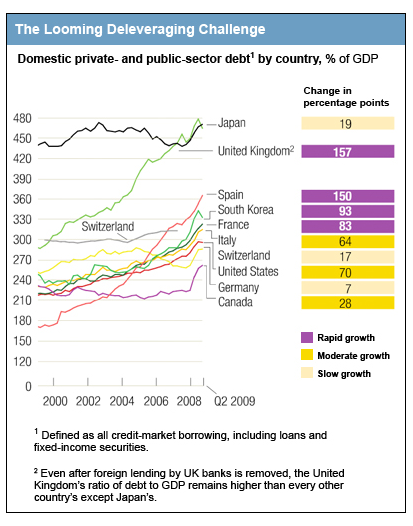

International consulter Mc Kinsey is another mainstream thinking business that takes a seat in the orchestra of doom, fearing years of gloom:

The specter of deleveraging has been haunting the global economy since the credit crunch reached crisis proportions in 2008. The fear: an unwinding of unsustainable debt burdens will drag down growth rates for years to come. So far, reality has been more benign, with economic growth recovering sooner than expected in some countries, even though the financial sector is still cleaning up its balance sheets and consumer demand remains weak. New research from the McKinsey Global Institute (MGI), though, suggests that the deleveraging process may just be getting under way and is likely to exert a significant drag on GDP growth.1 Our study of debt and leverage2 in ten mature and four emerging economies3 indicates that some sectors of the economies of five countriesCanada, South Korea, Spain, the United Kingdom, and the United Stateswill very probably experience deleveraging. Whats more, our analysis of deleveraging episodes since 1930 shows that virtually every major financial crisis after World War II was followed by a prolonged period in which the ratio of total debt to GDP declined significantly. The one exception was Japan, whose bursting asset bubbles in the early 1990s touched off a financial crisis followed by many years...  |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Wed Feb-03-10 09:06 AM Response to Reply #31 |

| 32. MSNBC Says Fed Showered Banks with $23.7 Trillion |

|

http://prudentinvestor.blogspot.com/2010/02/msnbc-says-fed-showered-banks-with-237.html

The numbers in the American bank bailout charade are ballooning and MSM begin to take notice. MSNBC pushed the tally to $23.7 Trillion in secret handouts to banks who never stopped weighing up their exexcutives and dealmakers in gold at bonus time. http://www.youtube.com/watch?v=lDJc0PZV-Bk&feature=player_embedded VIDEO: This video was uploaded to Youtube last weekend. Enjoy a rabid TV presenter accusing the Fed of handing out a stunning $23.7 Trillion to the poor banks. The story lacks an explanation as to how they arrived at this 14-digit estimate. |

| Printer Friendly | Permalink | | Top |

| Tansy_Gold

|

Wed Feb-03-10 09:19 AM Response to Reply #31 |

| 35. And what growth would that be? |

|

As far as I'm concerned, an economy that is still shedding far more jobs than it's creating is not a "growing" economy.

But hey, what do I know? I'm just Tansy Gold |

| Printer Friendly | Permalink | | Top |

| InkAddict

|

Wed Feb-03-10 09:08 AM Response to Original message |

| 33. Casino to loosen the slots (of time) |

|

I didn't catch this yesterday here, but did you all see this from yesterday afternoon?

http://online.wsj.com/article/BT-CO-20100202-713669.html?mod=WSJ_latestheadlines NYSE To Change Regular Session Closing Procedures Feb. 22 For the first time in more than a decade, the New York Stock Exchange will change the way it winds down trading during the close of the regular session. Beginning around Feb. 22, the targeted start date, the stock exchange will give traders five extra minutes to place unrestricted market-on-close and limit-on-close orders on any stock--until 3:45 p.m. EST. From then until the market closes at 4 p.m., the NYSE will publish every five seconds which stocks have buy or sell imbalances of 50,000 shares. Currently, the exchange only releases that information every five seconds during the last 10 minutes of trading and every 15 seconds between 3:40 and 3:50 p.m. And traders submitting orders to offset that imbalance -- purchasing shares of a company with a sell imbalance, for instance--have a new option. While previously traders could only submit orders to correct the imbalance as it was first published by the NYSE, they can now freely submit buy or sell orders on the stocks in focus until the close, with the NYSE accepting the orders that balance out trading. Because heavy trading can sometimes flip whether a stock is being more aggressively bought or sold at the end of the day, the new "closing offset order" allows traders to help correct that imbalance if it changes several times before the close. Additionally, traders will now have eight extra minutes--until 3:58 p.m.--to cancel any orders made in error. The exchange said the changes are designed to better channel the last-minute orders that help reduce market volatility and provide additional data to market watchers. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Wed Feb-03-10 09:13 AM Response to Original message |

| 34. Tom Hoenig For Treasury |

|

http://baselinescenario.com/2010/02/01/tom-hoenig-for-treasury/

The White House is floating, ever so gently, the notion that they are open to nominations for the position of Tim Geithners Successor. Its not clear if they mean this job is likely to be advertised formally sometime in 2012 or 20 minutes after the November midterms. Nor is it obvious if this is a real request for proposals it could be just an effort to make critics put up or shut up. Fortunately, there is an entirely plausible successor already in waiting, ready now or whenever the president finally realizes the need to fundamentally change banking policy. Tom Hoenig, president of the Kansas City Fed, is best known for three things. 1. Hes currently the only senior Fed official who has been outspoken (or even spoken out) against banks that are undoubtedly Too Big To Fail (TBTF). Hoenig has been a beacon of clarity on this issue over the past year. Compared with central bank officials and almost everyone else Hoenig stands out as a model of straight thinking and a proponent of tough action. With his disarming but no nonsense approach, he is the perfect person to take on the likes of Lloyd Blankfein (Goldman Sachs) and Vikram Pandit (Citigroup) both in the corridors of power and in the nitty gritty of their rather sordid business models. Hoenig is a career bank supervisor and nobodys fool. Blankfein and Pandit are just two more guys who run banks that have gone bad. You know how that movie ends. 2. Hoenig, who sits on the Federal Open Market Committee, is also an inflation hawk at least by todays standards. This makes some would be supporters including fans of his attitude on TBTF rather wary of advancing his name (e.g., as chairman of the Fed Board). This hesitation is understandable although likely mistaken; you dont keep the federal funds rate essentially zero for long when nominal GDP is growing at more than a 6 percent annual rate. In any case, the issue is irrelevant for the Treasury job. The Treasury Secretarys responsibility in a modern administration is to run financial sector policy, meaning bailouts and how to avoid them. Peter Orszag has the budget and Ben Bernanke (gulp) holds the monetary tiller. What we desperately need is someone who can sort out our largest banks. 3. Tom Hoenig is almost certainly a Republican, although as head of a regional reserve bank the full range of his views, outside of banking and money, are not widely known. Paul Krugman reasonably points out that if he (Krugman) were nominated for the Fed (or Treasury or anything else), this would likely run into trouble in the Senate. Hoenig is a completely different kettle of fish, appealing to sensible Democrats and Republicans yes, there are a few who increasingly worry about massive banks and their electoral implications. And while financial sector policy is job one, serious efforts to address the budget led by people of all ilk with a strong grip on economic realities also lie in our future. Either that or the republic will perish. Not a tough choice in the end, but it does need to involve at least a few Republicans. There will be objections to be sure. * Hes just a regional Fed governor. True, but so was Tim Geithner. * Hell be captured by Big Finance, just as Geithner was. Spend some time with Tom Hoenig before you jump to this conclusion. * The market will react negatively, because it will sense the era of unlimited bailouts is drawing to a close. Sure, but thats the point. * Hes a Republican. See point 3 above, and remember that President Obama offered Senator Judd Gregg (R., New Hampshire) the position of Commerce Secretary at the beginning of his administration. Theres also the question of whether Tom Hoenig would take the job. He doesnt seek it and no doubt doesnt need the hassle and the heartache. So it would be a question of how he is asked and what powers he is given. With the right job description and enough protection from the very top, Hoenig is not the kind of person who shrinks from the opportunity to help his country back onto safer ground. Hes not a politician and hes not a banker. But he knows the politics of central banking and what bankers of any size and kind get up to. Joe Kennedy, first head of the SEC, was by all accounts a poacher turned gamekeeper. Tim Geithner sees himself as a gamekeeper, but he is undone by the belief that the principal poachers are decent and honorable folk who mean no ill. Tom Hoenig is just a plain spoken old-fashioned gamekeeper. Not many of them are left, but you only need one. By Simon Johnson |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Wed Feb-03-10 09:42 AM Response to Original message |

| 36. axpayers Help Goldman Reach Height of Profit in New Skyscraper |

|

http://www.bloomberg.com/apps/news?pid=20601109&sid=aaLwI2SKYQJg&pos=14