To keep SS paying full benefits until the 22nd century is LESS than we're spending now in Iraq; is LESS by FIVE TIMES what making bush's tax cuts permanent will cost.

Links:

bush was LYING in 1978 when he said SS would be bankrupt by 1988 if it wasn't privatized.http://www.bushfiles.com/bushfiles/midland.html And in 2001:

Commission Impossible:

Why Bush is abandoning Social Security reformSo when Bush became the latest Republican to back away from the commission, its critics were ecstatic. For months they had warned that conservative-style reform would require either unpopular tax increases or equally unpopular cuts in benefits.

Now it looked like the White House had come to the same conclusion.

http://www.prospect.org/print-friendly/print/V12/22/confessore-n.htmlThen in 2002:

Social Security In The 2002 Elections:

Candidates Won By Renouncing PrivatizationA special Republican Campaign Committee task force instructed candidates there was no way to win votes with the Bush Social Security plan.

http://www.tompaine.com/feature.cfm/ID/6717 Report Predicts Deep Benefit Cuts Under Bush Social Security Planhttp://www.nytimes.com/2002/06/19/politics/19SOCI.html?ex=1105765200&en=9d7a169317235b0e&ei=5070&oref=login&ex=1104987600&en=d93ab4effc7725c1&ei=5070&ex=1103086800&en=02fd1e95887df5be&ei=5070&oref=login&pagewanted=print&position=topAnd now, with no voters to woo in 2004:

Projections in a recent report by the Congressional Budget Office say that the trust fund will run out in 2052. The system won't become "bankrupt" at that point;

even after the trust fund is gone, Social Security revenues will cover 81 percent of the promised benefits.The report finds that

extending the life of the trust fund into the 22nd century, with no change in benefits, would require additional revenues equal to only 0.54 percent of G.D.P.That's less than 3 percent of federal spending -

less than we're currently spending in Iraq. And it's only about one-quarter of the revenue lost each year because of President Bush's tax cuts - roughly equal to the fraction of those cuts that goes to people with incomes over $500,000 a year.

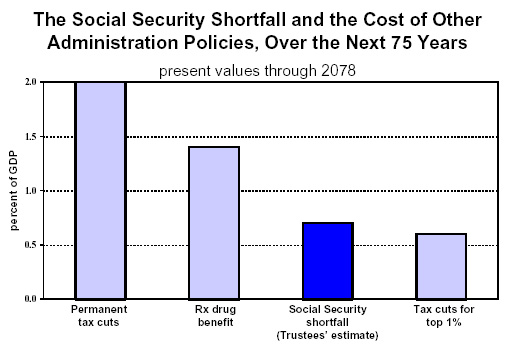

http://query.nytimes.com/gst/abstract.html?res=F70E11F73F550C748CDDAB0994DC404482bush's TAX CUTS, if made permanent, will cost THREE TO FIVE TIMES GREATER than the amount of Social Security over the next 75 years.http://www.thedubyareport.com/socsec1.html

Cost of the 2001/2003 tax cuts, if made permanent; $11.6 trillion

Cost of the new Rx Drug Benefit; $8.1 trillion

Combined cost of Rx drugs and permanent tax cuts; $19.7 trillion

Shortfall, Social Security Trust Fund; $3.7 trillion

http://www.cbpp.org/1-4-05socsec.htm And WHO BENEFITS? Why, Wall Street! By BILLIONS!

Investment Pros See Bonanza in Bush Social Security Planhttp://www.chicagotribune.com/business/chi-0501090320jan09,1,6035889.storyConservatives rarely point to Britain's partial state pension privatization program, because it's been a total disaster.http://www.prospect.org/web/page.ww?section=root&name=ViewWeb&articleId=8997BOTTOM LINE:

And if we DO NOTHING whatsoever then retirees will still get 81% from 2052 onwards.

http://www.truthout.org/docs_04/120804X.shtml With bush's "plan", you'll only get 75% or less from 2042 onwards.

So, as always, doing bush's plan IS WORSE than doing nothing at all.

Gee, what a surprise.