The Treacherous Path for Housing - 42 Percent of California Mortgages with Negative Equity: $1 Trillion in Mortgages Submerged Underwater in California. $3 Trillion in U.S. Mortgages Underwater and Risking Foreclosure.

$1 trillion in California mortgages are underwater and swimming in the Pacific Ocean. $3 trillion in U.S. mortgages are in a negative equity position. What this means is borrowers owe more than their home is worth. A few research papers have shown that the number one factor in determining potential foreclosure is being upside down on a mortgage (job loss is up there as well). You can rest assured that all those Alt-A and option ARM mortgages in California are underwater to the point of touching sea bottom. How bad can it get? One area in Southern California, the Inland Empire has an estimate total housing property value of $222 billion. Only problem is there are $238 billion in mortgages attached to these properties. Two enormous counties with negative equity.

Take for example the larger Los Angeles and Orange County areas. We have some $1.077 trillion in housing property yet a total of $311 billion of mortgages are underwater. This does not mean they are currently in foreclosure but the likelihood is extremely high. Given that the Alt-A and Option ARM loans are more prominent in the so-called prime markets, a large number of these loans will implode on first recast. Many are defaulting prior but once the recast hits, it will be game over. Banks know this and that is why they are hiding foreclosed properties from the public view.

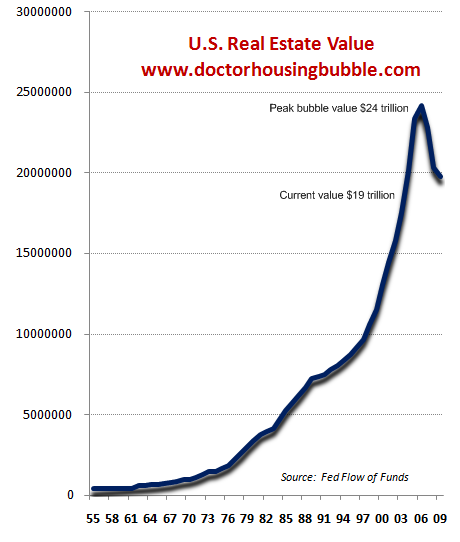

Ill try to make this a comprehensive review of the nationwide housing market and will also focus on issues specific to California since it makes up one-third of the face value of mortgages underwater. First, the main cause of this problem is the real estate crash:

http://www.doctorhousingbubble.com/real-estate-the-treacherous-path-for-housing-42-percent-of-california-mortgages-with-negative-equity-1-trillion-in-mortgages-submerged-underwater-in-california-3-trillion-in-us-mortgages-underwater-an/

http://www.doctorhousingbubble.com/real-estate-the-treacherous-path-for-housing-42-percent-of-california-mortgages-with-negative-equity-1-trillion-in-mortgages-submerged-underwater-in-california-3-trillion-in-us-mortgages-underwater-an/