Banks Clamp Down on Small Business Loans, Jeopardizing Jobshttp://www.nakedcapitalism.com/2009/10/banks-clamp-down-on-small-business-loans-jeopardizing-jobs.htmlSmall businesses have fair weather friends.

Policymakers love to extol entrepreneurship. And in the last business cycle, even in the upswing, large corporations shed jobs while mid-sized and particularly small businesses added them. But when things get ugly, the best connected players get the breaks, and the little guy is left out in the cold.

The latest evidence is an amusingly schizophrenic set of headlines in the New York Times. A story by Eric Dash tells us, Pace Slows on Losses for Banks:

Just a year ago, many of the nations biggest banks were in such bad shape that their losses threatened to topple the financial system.

Today, by all appearances, their vast problems seem to be easing: a seven-month rally in financial stocks has driven the shares of Citigroup and other troubled behemoths up sharply. And the economy has shown modest improvement, slowing losses that only recently threatened the survival of some big banks

.

There is more pain to come, but they have enough Band-Aids and tourniquets to slow or cut off the bleeding, said David A. Hendler, a financial services analyst at CreditSights in New York.

In fairness, the article is only cautiously optimistic, but it still has a the worst is over subtext.

But the article by Peter Goodman on small business lending makes clear that the banks are not taking any chances:

Many small and midsize American businesses are still struggling to secure bank loans, impeding their expansion plans and constraining overall economic growth, even as the country tentatively rises from its recessionary depths.

Most banks expect their lending standards to remain tighter than the levels of the last decade until at least the middle of 2010, according to a survey of senior loan officers conducted by the Federal Reserve Board. The enduring credit squeeze appears to reflect an aversion to risk among lenders confronting great uncertainty about the economy rather than any lingering effects of the panic that gripped financial markets last fall

..

Some 14 percent of small businesses found loans harder to secure in August than in July, according to the most recent survey by the National Federation of Independent Business. Among companies borrowing regularly, less than one-third reported that all their credit needs were being met.

Yves here. Notice the great uncertainty about the economy. Translation: We dont see signs of recovery in our local market.

The article cites economists who argue that the banks are being unduly risk averse, yet are also going to be hit by commercial real estate losses. Um, if your equity base might shrink, it isnt exactly a sound move to expand your balance sheet.

The article neglects to tie in two other issues: credit cards and CIT. Credit cards are an important, often the only , source of funding for small businesses (the Small Business Administration deems any business with fewer than 500 employees as small, but the low end of that range can seldom get bank loans. One colleague who had a 100 employee businesses maxed out his credit card three separate occasions to keep his venture afloat). So the scarcity and higher cost of credit card funding has a direct impact on many small companies.

CIT, another key source of funding to smaller enterprises, looks destined to file for bankruptcy. What is remarkable is that this takedown is arousing so little hue and cry. Goldman, one of CITs creditors, will do better if CIT fails, to the tune of $1 billion. Oh, yes, the firm claims it has merely hedged its risks, that all it will get is what it would have earned over the life of the facility if CIT survived. If you believe that, I have a bridge Id like to sell you. An acceleration of income is more valuable that waiting for it to come in. If nothing else, you get to pay yourselves bonuses on it now. And if CIT is like a pretty much every other recent bankruptcy, there are more CDS outstanding than cash bonds, meaning more winners if it is dead rather than alive (although Id be curious to know who were the protection writers on these policies).

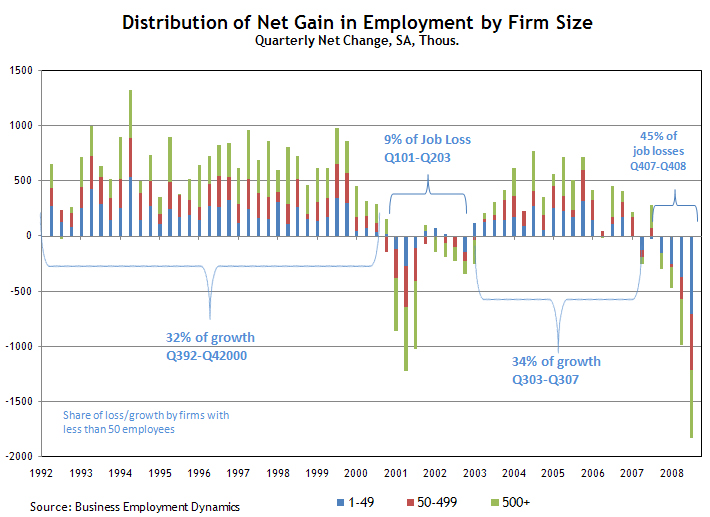

In case you had any doubts that small businesses were the engines of job growth, Robert Oak at the Economic Populist gives a good recap.

65% of the jobs created in the last 16 years came from small enterprises. And they are now shedding workers at an unprecedented rate: http://www.economicpopulist.org/content/small-business-and-jobs

http://www.economicpopulist.org/content/small-business-and-jobsIn Q2, 2009, small business loans were down 57%.

Typically half of all small businesses fail in the first 5 years. Yet in this recession, small business bankruptcy rates increased 81% from Jun 2008 to June 2009.

So, anyone else seeing a catch-22 here on job creation? Anyone else seeing U.S. small business needs a government sponsored venture capital group, to offer grants, resources, guidance to stop the small business hemorrhage?

Forget manipulative tax credits on new hires (well, don't forget it, it's one minor good idea). Create a government sponsored venture capital team that literally listens to business plans, proof of concept demonstrations and helps small businesses grow. Fix the SBA. The SBA is obviously not doing that great of a job, with a 50% fail rate under normal economic conditions. It's also obvious the U.S. needs major job growth and business engine growth initiatives, since the America now needs an astounding 250,000 jobs per month for 5 years just just to get back to a 5% unemployment rate!

We need so much more to foster job creation, innovation and good old fashioned success as fast as possible. Just enabling more debt ain't gonna cut it on this one. If Soros can do it, start a venture capital fund with strict conditions, but also help and guidance, so can the U.S. government.