underpants

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Thu Mar-31-11 07:29 PM

Original message |

| What caused the US Federal Debt? |

|

Edited on Thu Mar-31-11 07:31 PM by underpants

Good summary. As of March 25, 2011, the Total Public Debt Outstanding of the United States of America was $14.21 trillion and was 97.0% of calendar year 2010's annual gross domestic product (GDP) of $14.66 trillion.<2><3><4> Using 2010 figures, the total debt (96.3% of GDP) ranked 12th highest against other nations.

Causes of change in debt2001 vs. 2009

Causes of Change in Federal Spending as % GDP 2001-2009 from CBO DataAccording to the CBO, the U.S. last had a surplus during fiscal year (FY) 2001. From FY2001 to FY2009, spending increased by 6.5% of GDP (from 18.2% of GDP to 24.7%) while taxes declined by 4.7% of GDP (from 19.5% of GDP to 14.8%). The drivers of the expense increases (expressed as % of GDP) are Medicare & Medicaid (1.7%), Defense (1.6%), Income Security such as unemployment benefits and food stamps (1.4%), Social Security (0.6%) and all other categories (1.2%). The drivers of tax reductions are individual income taxes (-3.3%), payroll taxes (-0.5%), corporate income taxes (-0.5%) and other (-0.4%). The 2009 spending level is the highest relative to GDP in 40 years, while the tax receipts are the lowest relative to GDP in 40 years. The next highest spending year was 1985 (22.8%) while the next lowest tax year was 2004 (16.1%).<47>

2001 vs. 2012

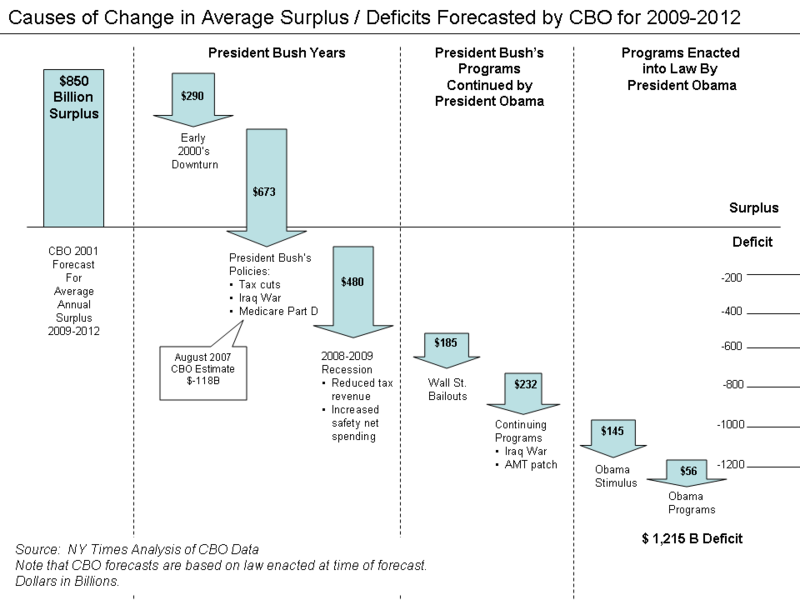

Causes for Changes in CBO Forecasts.The U.S. budget situation has deteriorated significantly since 2001, when the Congressional Budget Office (CBO) forecast average annual surpluses of approximately $850 billion from 2009-2012. The average deficit forecast in each of those years as of June 2009 was approximately $1,215 billion. The New York Times analyzed this roughly $2 trillion "swing," separating the causes into four major categories along with their share:

Recessions or the business cycle (37%); <--- Wall Street, predatory lending, etc.

Policies enacted by President Bush (33%);

Policies enacted by President Bush and supported or extended by President Obama (20%); and

New policies from President Obama (10%).

CBO data is based only on current law, so policy proposals that have yet to be made law are not included in their analysis. The article states that "President Obamas agenda ... is responsible for only a sliver of the deficits", but that he "...does not have a realistic plan for reducing the deficit..."<48> Presidents have no Constitutional authority to levy taxes or spend money, as this responsibility resides with the Congress, although a President's priorities influence Congressional action.<49>

Peter Orszag, the OMB Director under President Obama, stated in a November 2009 that of the $9 trillion in deficits forecast for the 2010-2019 period, $5 trillion are due to programs from the prior administration, including tax cuts from 2001 and 2003 and the unfunded Medicare Part D. Another $3.5 trillion are due to the financial crisis, including reductions in future tax revenues and additional spending for the social safety net such as unemployment benefits. The remainder are stimulus and bailout programs related to the crisis.<50>

2008 vs. 2009The CBO reported in October 2009 reasons for the difference between the 2008 and 2009 deficits, which were approximately $460 billion and $1,410 billion, respectively. Key categories of changes included: tax receipt declines of $320 billion due to the effects of the recession and another $100 billion due to tax cuts in the stimulus bill (the American Recovery and Reinvestment Act or ARRA); $245 billion for the Troubled Asset Relief Program (TARP) and other bailout efforts; $100 billion in additional spending for ARRA; and another $185 billion due to increases in primary budget categories such as Medicare, Medicaid, unemployment insurance, Social Security, and Defense - including the war effort in Afghanistan and Iraq. This was the highest budget deficit relative to GDP (9.9%) since 1945.<51> The national debt increased by $1.9 trillion during FY2009, versus the $1.0 trillion increase during 2008.<52>

The Obama Administration also made four significant accounting changes to more accurately report the total spending by the Federal government. The four changes were: 1) accounting for the Wars in Iraq and Afghanistan (overseas military contingencies) in the budget rather than through the use of supplemental appropriations; 2) assuming the Alternative Minimum Tax will be indexed for inflation; 3) accounting for the full costs of Medicare reimbursements; and 4) anticipating the inevitable expenditures for natural disaster relief. According to administration officials, these changes will make the debt over ten years look $2.7 trillion larger than it would otherwise appear.<53>

http://en.wikipedia.org/wiki/United_States_public_debt#Causes_of_change_in_debt |

ozone_man

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Thu Mar-31-11 07:44 PM

Response to Original message |

| 1. Clinton's elimination of Glass-Steagall. |

|

Priceless!

Obama is running a ~$1.5T deficit for past two terms and for the foreseeable future. He owns that.

|

Democrats_win

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Thu Mar-31-11 08:00 PM

Response to Reply #1 |

| 4. Please note: Citi bank broke Glass-Steagall first. |

|

Edited on Thu Mar-31-11 08:15 PM by Democrats_win

In his book, Griftopia, Rolling Stone reporter Matt Taibbi points out that before Glass-Steagall was repealed, Citi bank broke this law buy buying Travelers insurance. They were trying to force the issue! Phil Gramm and his cronies led the way. Of course Clinton should never have signed the repeal. Nevertheless, we should always include Citi bank and Graham cracker Phil along with Clinton.

edit: Taibbi spelled with two b's

|

doc03

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Thu Mar-31-11 07:49 PM

Response to Original message |

| 2. Wall Street bailouts are $185 billion? I thought is was more like |

|

$700 billion. Stimulus $145 billion, wasn't it more like $800 billion. it seems like none of the numbers the government comes out with jive. Like the TARP has all been paid back and even showed a small profit. If that is so way wasn't the deficit reduced because of those funds?

|

snappyturtle

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Thu Mar-31-11 07:56 PM

Response to Reply #2 |

| 3. Thank you! I wonder about those points too. There's so much I |

|

really don't understand because like you say the numbers don't jive...depends on where I look!

|

bhikkhu

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Thu Mar-31-11 08:11 PM

Response to Reply #2 |

| 7. From what I heard yesterday: |

|

of the TARP funds that went to banks (which was the largest part of the program), the last bit was repaid just the other day, so net cost to taxpayers was zero, or perhaps some gain on interest paid. There are still outstanding funds that went to automakers in exchange for preferred stock, which will be considered paid when the stocks are sold one way or another. And then some went to AIG, which has done some repayment but is still working out the details of the balance.

Overall, it was a hugely successful program, in spite of the risks, which probably saved hundreds of thousands of jobs and supported a few points of GDP through a critical period. Any other president would have gotten massive credit for the whole thing...

|

doc03

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Thu Mar-31-11 11:37 PM

Response to Reply #7 |

| 8. If that money was paid back were the heck did it |

|

go. If $700 billion was paid out in TARP funds in 2009. Why wasn't the deficit reduced by $700 billion or even $1 billion when the money was paid back? Does that money just go down another rat hole. I have seen I don't know how many different figures for TARP like the $185 billion in this post up to $700 $800 or $900 billion. Same goes for the Stimulus I have seen the cost of it quoted as $125 billion in this OP up to $1 trillion.

|

JDPriestly

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Fri Apr-01-11 12:30 AM

Response to Reply #7 |

| 14. Who got stuck with the bad mortgages? |

|

I think that the US government still takes the losses on those. That is not part of the TARP as I understand it. Do you know how that works?

|

bhikkhu

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Fri Apr-01-11 12:36 AM

Response to Reply #14 |

|

I know enough accounting to follow some of it, and to understand how some of the things work that seem troubling otherwise, but I haven't read much about the mortgage problem. I'd guess that, like much of it, guarantees to reduce risk during recapitalization were involved more than purchases, or things were folded into fannie or freddie in some complicated way...

|

JDPriestly

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Fri Apr-01-11 01:53 PM

Response to Reply #16 |

|

I think you will find that the American government ends up footing the bill for the bad mortgages. That is how they kept the banks afloat. That is also the reason that mortgage companies are not lowering the prices on foreclosed houses to the point that people can really afford to or qualify to buy them. There is a huge backlog of houses waiting to be foreclosed.

My daughter and her husband would like to buy a house in the neighborhood in which they have been renting. There are lots of houses on sale, some of them foreclosures, but the prices are way too high. The banks have no incentive to lower the prices.

|

girl gone mad

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Fri Apr-01-11 12:40 AM

Response to Reply #7 |

|

The banks that payed back TARP loans were allowed to do so by covering those loans with money funneled from other bailout programs and from tax forgiveness schemes, like the $38 billion tax break that was given to Citigroup. http://www.businessinsider.com/citigroup-gets-huge-new-38-billion-bailout-wiping-out-all-of-the-taxpayers-profits-2009-12 |

Democrats_win

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Thu Mar-31-11 08:06 PM

Response to Original message |

| 5. What a great graph! Also info about accounting change is great! |

|

I bet a lot of Americans don't realize that Obama decided that it was dishonest not to include the wars in the budget. So he added them and, of course the federal debt looks much worse. To me, the biggest question of the past few years is how did we go from the federal defict of a few hundred billion to one-point-two trillion? This graph shows it.

Now if we could just get the Democrats to raise taxes on the rich....

|

Telly Savalas

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Thu Mar-31-11 08:08 PM

Response to Original message |

| 6. That chart doesn't make sense |

|

While the economic downturn of the early 2000's caused some of the deficit back then and this deficit spending has contributed to a portion of our current debt, it doesn't impact the current deficit as this chart insinuates.

Moreover it's double-counting the impact of the Iraq War, unless it's suggesting that Obama is now spending more on it than Bush did.

Also, Bush had nothing to do with the 2010 and 2011 budgets. If something like Part D continues to be underfunded that's not his fault, it's the fault of the current Administration and Congress. I have a huge mancrush on Peter Orzag, but his unwillingness to take responsibility for this is silly.

|

doc03

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Thu Mar-31-11 11:38 PM

Response to Reply #6 |

Taitertots

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Thu Mar-31-11 11:53 PM

Response to Original message |

| 10. Decades of excessively low taxes is the main reason n/t |

doc03

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Fri Apr-01-11 12:15 AM

Response to Reply #10 |

| 11. I think the tax rates are fine, do you have any idea how many |

|

people work under the table and pay practically no tax? I think we should do away with the IRS period and come up with a value added tax or sales tax.

|

Taitertots

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Fri Apr-01-11 12:28 AM

Response to Reply #11 |

| 13. Low wage cash workers are not a contributing factor |

|

The historically low tax rates for the top 1% income takers, regressive SS taxation, and regressive service taxes are the main cause of the deficit/debt.

Return to true progressive taxation and the budget problems disappear. There is no problem, except the politicians refusing to tax the rich because they depend on their money.

|

doc03

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Fri Apr-01-11 12:41 AM

Response to Reply #13 |

| 18. Oh they aren't, I know lots of (small business people) that |

|

work for cash and make a damn good income better than I ever did. I worked for a large company and tax was taken out of my check before I ever saw it. I have an attorney friend that does pretty damn good bartering with clients.

|

hifiguy

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Fri Apr-01-11 03:18 PM

Response to Reply #13 |

|

Edited on Fri Apr-01-11 03:18 PM by hifiguy

|

JDPriestly

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Fri Apr-01-11 12:33 AM

Response to Reply #11 |

| 15. doc03, I don't think we should entirely do away with the income tax, |

|

but I agree that we need a VAT tax which could also be imposed on Americans' international transactions of all kinds at the point at which payments are made from bank accounts or credit cards. No VAT on food or children's clothing or prescription medicines would be appropriate in my view. But on everything else, we should have a VAT. And we need to put a VAT on phone services.

|

doc03

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Fri Apr-01-11 12:46 AM

Response to Reply #15 |

| 19. The thing with the income tax the more you raise the rates |

|

the more loopholes the rich will find to get out of it. Did you see the repoert on 60 minutes last week about the companies hiding their income off shore? Say you raise the tax on those $100 million CEOs, a CEO doesn't have to live in the USA do his job.

|

JDPriestly

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Fri Apr-01-11 02:22 PM

Response to Reply #19 |

| 22. I lived abroad for many years. If the CEO is an American citizen |

|

and lives abroad, then he may have to pay some American taxes. I'm not sure what the law on that is now, and I believe it depends on whether you pay the taxes in the other country. We never earned enough to pay both foreign and American taxes, but at least when I lived abroad, people who were earning good money were subject to American taxes.

|

hifiguy

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Fri Apr-01-11 03:17 PM

Response to Reply #11 |

| 23. Both of which are brutally regressive. |

|

But I suppose it's better to have the little people paying taxes than the people who actually have all the money... :sarcasm:

|

Rex

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Fri Apr-01-11 12:27 AM

Response to Original message |

| 12. It was Clinton's impeachment that got us here. |

|

Reagan getting away with violations of the US Constitution didn't help.

|

Zorra

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Fri Apr-01-11 01:55 PM

Response to Original message |

| 21. The short , primary answer is Ronald Reagan and his masters nt |

hifiguy

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Fri Apr-01-11 03:20 PM

Response to Reply #21 |

Obamanaut

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Fri Apr-01-11 03:21 PM

Response to Original message |

| 26. Overspending. Wasteful spending. Preparing an inadequate budget, and |

|

not even living within that budget.

That's pretty much what causes individual debt, so this is the same on a much larger scale.

|

DU

AdBot (1000+ posts)     |

Sat Apr 20th 2024, 02:35 AM

Response to Original message |