Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 30 July 2015

[font size=3]STOCK MARKET WATCH, Thursday, 30 July 2015[font color=black][/font]

SMW for 29 July 2015

AT THE CLOSING BELL ON 29 July 2015

[center][font color=green]

Dow Jones 17,751.39 +121.12 (0.69%)

S&P 500 2,108.57 +15.32 (0.73%)

Nasdaq 5,111.73 +22.53 (0.44%)

[font color=red]10 Year 2.28% +0.02 (0.88%)

30 Year 3.00% +0.02 (0.67%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)And here I thought I'd had bad months before. This one is a killer. Literally.

Well, August probably won't be any better, so it's time to get used to the new normal. Since I never got used to the previous normal, I'm already behind...

Demeter

(85,373 posts)This article establishes that the price of gold and silver in the futures markets in which cash is the predominant means of settlement is inconsistent with the conditions of supply and demand in the actual physical or current market where physical bullion is bought and sold as opposed to transactions in uncovered paper claims to bullion in the futures markets. The supply of bullion in the futures markets is increased by printing uncovered contracts representing claims to gold. This artificial, indeed fraudulent, increase in the supply of paper bullion contracts drives down the price in the futures market despite high demand for bullion in the physical market and constrained supply. We will demonstrate with economic analysis and empirical evidence that the bear market in bullion is an artificial creation. The law of supply and demand is the basis of economics. Yet the price of gold and silver in the Comex futures market, where paper contracts representing 100 troy ounces of gold or 5,000 ounces of silver are traded, is inconsistent with the actual supply and demand conditions in the physical market for bullion. For four years the price of bullion has been falling in the futures market despite rising demand for possession of the physical metal and supply constraints.

A change in quantity demanded or in the quantity supplied refers to a movement along a given curve. A change in demand or a change in supply refers to a shift in the curves. For example, an increase in demand (a shift to the right of the demand curve) causes a movement along the supply curve (an increase in the quantity supplied).

Changes in income and changes in tastes or preferences toward an item can cause the demand curve to shift. For example, if people expect that their fiat currency is going to lose value, the demand for gold and silver would increase (a shift to the right).

Changes in technology and resources can cause the supply curve to shift. New gold discoveries and improvements in gold mining technology would cause the supply curve to shift to the right. Exhaustion of existing mines would cause a reduction in supply (a shift to the left).

What can cause the price of gold to fall? Two things: The demand for gold can fall, that is, the demand curve could shift to the left, intersecting the supply curve at a lower price. The fall in demand results in a reduction in the quantity supplied. A fall in demand means that people want less gold at every price. (Graph 2)

Alternatively, supply could increase, that is, the supply curve could shift to the right, intersecting the demand curve at a lower price. The increase in supply results in an increase in the quantity demanded. An increase in supply means that more gold is available at every price. (Graph 3)

To summarize: a decline in the price of gold can be caused by a decline in the demand for gold or by an increase in the supply of gold.

A decline in demand or an increase in supply is not what we are observing in the gold and silver physical markets. The price of bullion in the futures market has been falling as demand for physical bullion increases and supply experiences constraints. What we are seeing in the physical market indicates a rising price. Yet in the futures market in which almost all contracts are settled in cash and not with bullion deliveries, the price is falling. For example, on July 7, 2015, the U.S. Mint said that due to a “significant” increase in demand, it had sold out of Silver Eagles (one ounce silver coin) and was suspending sales until some time in August. The premiums on the coins (the price of the coin above the price of the silver) rose, but the spot price of silver fell 7 percent to its lowest level of the year (as of July 7).

This is the second time in 9 months that the U.S. Mint could not keep up with market demand and had to suspend sales. During the first 5 months of 2015, the U.S. Mint had to ration sales of Silver Eagles. According to Reuters, since 2013 the U.S. Mint has had to ration silver coin sales for 18 months. In 2013 the Royal Canadian Mint announced the rationing of its Silver Maple Leaf coins: “We are carefully managing supply in the face of very high demand. . . . Coming off strong sales volumes in December 2012, demand to date remains very strong for our Silver Maple Leaf and Gold Maple Leaf bullion coins.” During this entire period when mints could not keep up with demand for coins, the price of silver consistently fell on the Comex futures market. On July 24, 2015 the price of gold in the futures market fell to its lowest level in 5 years despite an increase in the demand for gold in the physical market. On that day U.S. Mint sales of Gold Eagles (one ounce gold coin) were the highest in more than two years, yet the price of gold fell in the futures market.

How can this be explained? The financial press says that the drop in precious metals prices unleashed a surge in global demand for coins. This explanation is nonsensical to an economist. Price is not a determinant of demand but of quantity demanded. A lower price does not shift the demand curve. Moreover, if demand increases, price goes up, not down. Perhaps what the financial press means is that the lower price resulted in an increase in the quantity demanded. If so, what caused the lower price? In economic analysis, the answer would have to be an increase in supply, either new supplies from new discoveries and new mines or mining technology advances that lower the cost of producing bullion. There are no reports of any such supply increasing developments. To the contrary, the lower prices of bullion have been causing reductions in mining output as falling prices make existing operations unprofitable.

There are abundant other signs of high demand for bullion, yet the prices continue their four-year decline on the Comex. Even as massive uncovered shorts (sales of gold contracts that are not covered by physical bullion) on the bullion futures market are driving down price, strong demand for physical bullion has been depleting the holdings of GLD, the largest exchange traded gold fund. Since February 27, 2015, the authorized bullion banks (principally JPMorganChase, HSBC, and Scotia) have removed 10 percent of GLD’s gold holdings. Similarly, strong demand in China and India has resulted in a 19% increase of purchases from the Shanghai Gold Exchange, a physical bullion market, during the first quarter of 2015. Through the week ending July 10, 2015, purchases from the Shanghai Gold Exchange alone are occurring at an annualized rate approximately equal to the annual supply of global mining output.

India’s silver imports for the first four months of 2015 are 30% higher than 2014. In the first quarter of 2015 Canadian Silver Maple Leaf sales increased 8.5% compared to sales for the same period of 2014. Sales of Gold Eagles in June, 2015, were more than triple the sales for May. During the first 10 days of July, Gold Eagles sales were 2.5 times greater than during the first 10 days of June.

Clearly the demand for physical metal is very high, and the ability to meet this demand is constrained. Yet, the prices of bullion in the futures market have consistently fallen during this entire period. The only possible explanation is manipulation. Precious metal prices are determined in the futures market, where paper contracts representing bullion are settled in cash, not in markets where the actual metals are bought and sold. As the Comex is predominantly a cash settlement market, there is little risk in uncovered contracts (an uncovered contract is a promise to deliver gold that the seller of the contract does not possess). This means that it is easy to increase the supply of gold in the futures market where price is established simply by printing uncovered (naked) contracts. Selling naked shorts is a way to artificially increase the supply of bullion in the futures market where price is determined. The supply of paper contracts representing gold increases, but not the supply of physical bullion.

As we have documented on a number of occasions (see, for example, http://www.paulcraigroberts.org/2014/12/22/lawless-manipulation-bullion-markets-public-authorities-paul-craig-roberts-dave-kranzler/ ), the prices of bullion are being systematically driven down by the sudden appearance and sale during thinly traded times of day and night of uncovered future contracts representing massive amounts of bullion. In the space of a few minutes or less massive amounts of gold and silver shorts are dumped into the Comex market, dramatically increasing the supply of paper claims to bullion. If purchasers of these shorts stood for delivery, the Comex would fail. Comex bullion futures are used for speculation and by hedge funds to manage the risk/return characteristics of metrics like the Sharpe Ratio. The hedge funds are concerned with indexing the price of gold and silver and not with the rate of return performance of their bullion contracts.

A rational speculator faced with strong demand for bullion and constrained supply would not short the market. Moreover, no rational actor who wished to unwind a large gold position would dump the entirety of his position on the market all at once. What then explains the massive naked shorts that are hurled into the market during thinly traded times? The bullion banks are the primary market-makers in bullion futures. They are also clearing members of the Comex, which gives them access to data such as the positions of the hedge funds and the prices at which stop-loss orders are triggered. They time their sales of uncovered shorts to trigger stop-loss sales and then cover their short sales by purchasing contracts at the price that they have forced down, pocketing the profits from the manipulation. The manipulation is obvious. The question is why do the authorities tolerate it?

Perhaps the answer is that a free gold market serves both to protect against the loss of a fiat currency’s purchasing power from exchange rate decline and inflation and as a warning that destabilizing systemic events are on the horizon. The current round of on-going massive short sales compressed into a few minutes during thinly traded periods began after gold hit $1,900 per ounce in response to the build-up of troubled debt and the Federal Reserve’s policy of Quantitative Easing. Washington’s power is heavily dependent on the role of the dollar as world reserve currency. The rising dollar price of gold indicated rising discomfort with the dollar. Whereas the dollar’s exchange value is carefully managed with help from the Japanese and European central banks, the supply of such help is not unlimited. If gold kept moving up, exchange rate weakness was likely to show up in the dollar, thus forcing the Fed off its policy of using QE to rescue the “banks too big to fail.”

The bullion banks’ attack on gold is being augmented with a spate of stories in the financial media denying any usefulness of gold. On July 17 the Wall Street Journal declared that honesty about gold requires recognition that gold is nothing but a pet rock. Other commentators declare gold to be in a bear market despite the strong demand for physical metal and supply constraints, and some influential party is determined that gold not be regarded as money. Why a sudden spate of claims that gold is not money? Gold is considered a part of the United States’ official monetary reserves, which is also the case for central banks and the IMF. The IMF accepts gold as repayment for credit extended. The US Treasury’s Office of the Comptroller of the Currency classifies gold as a currency, as can be seen in the OCC’s latest quarterly report on bank derivatives activities in which the OCC places gold futures in the foreign exchange derivatives classification.

The manipulation of the gold price by injecting large quantities of freshly printed uncovered contracts into the Comex market is an empirical fact. The sudden debunking of gold in the financial press is circumstantial evidence that a full-scale attack on gold’s function as a systemic warning signal is underway. It is unlikely that regulatory authorities are unaware of the fraudulent manipulation of bullion prices. The fact that nothing is done about it is an indication of the lawlessness that prevails in US financial markets.

Paul Craig Roberts, Ph.D., is a former Assistant Secretary of the U.S. Treasury.

Dave Kranzler is a University of Chicago MBA and is an active participant in financial markets.

Demeter

(85,373 posts)The hackers who stole data on tens of millions of U.S. insurance holders and government employees in recent months breached another big target at around the same time -- United Airlines.

United, the world’s second-largest airline, detected an incursion into its computer systems in May or early June, said several people familiar with the probe. According to three of these people, investigators working with the carrier have linked the attack to a group of China-backed hackers they say are behind several other large heists -- including the theft of security-clearance records from the U.S. Office of Personnel Management and medical data from health insurer Anthem Inc.

The previously unreported United breach raises the possibility that the hackers now have data on the movements of millions of Americans, adding airlines to a growing list of strategic U.S. industries and institutions that have been compromised. Among the cache of data stolen from United are manifests -- which include information on flights’ passengers, origins and destinations -- according to one person familiar with the carrier’s investigation.

It’s increasingly clear, security experts say, that China’s intelligence apparatus is amassing a vast database. Files stolen from the federal personnel office by this one China-based group could allow the hackers to identify Americans who work in defense and intelligence, including those on the payrolls of contractors. U.S. officials believe the group has links to the Chinese government, people familiar with the matter have said.

That data could be cross-referenced with stolen medical and financial records, revealing possible avenues for blackmailing or recruiting people who have security clearances. In all, the China-backed team has hacked at least 10 companies and organizations, which include other travel providers and health insurers, says security firm FireEye Inc.

WHICH IS PRECISELY WHY THE NSA MUST DIE

MORE AT LINK

Demeter

(85,373 posts)REMEMBER THE RULE: WHATEVER GOLDMAN SACKS SAYS, THE OPPOSITE IS THE TRUTH!

http://www.bloomberg.com/news/articles/2015-07-29/blankfein-sees-strong-u-s-market-jolt-from-fed-rate-increase

Goldman Sachs Group Inc. Chief Executive Officer Lloyd C. Blankfein said U.S. markets are poised for prolonged growth and will quickly move on after a jolt from the Federal Reserve’s first interest-rate increase since 2006.

“We are in for a longish, positive market,” Blankfein said Wednesday in an interview on Bloomberg Television. “Since the financial crisis, especially in this country, there were a lot of problems, but we chewed through them. Consumers have deleveraged, the banking system has deleveraged, we got the blessing of low energy prices, housing prices started to stabilize and move higher.”

Blankfein, starting his 10th year as Goldman Sachs CEO, spoke in a joint interview with former New York City Mayor Michael Bloomberg that also covered China’s policy challenges and 2016 U.S. presidential candidates. Blankfein, 60, said he would support a moderate who’s open to compromise, without naming a candidate.

He expressed mixed views when asked about his own ambitions for entering government work. “It would be an attractive thing to do, but a very unattractive place to get to,” Blankfein said.

The CEO also said a rate increase from the Fed will still leave the economy facing lower interest rates than usual, with improving growth. The central bank will raise its target rate to 0.5 percent this quarter, according to the median forecast of 74 economists in a Bloomberg survey...

HEAR THE LITTLE WEASEL IN HIS OWN WORDS WITH THE VIDEO AT LINK...MORE TEXT, AS WELL

Demeter

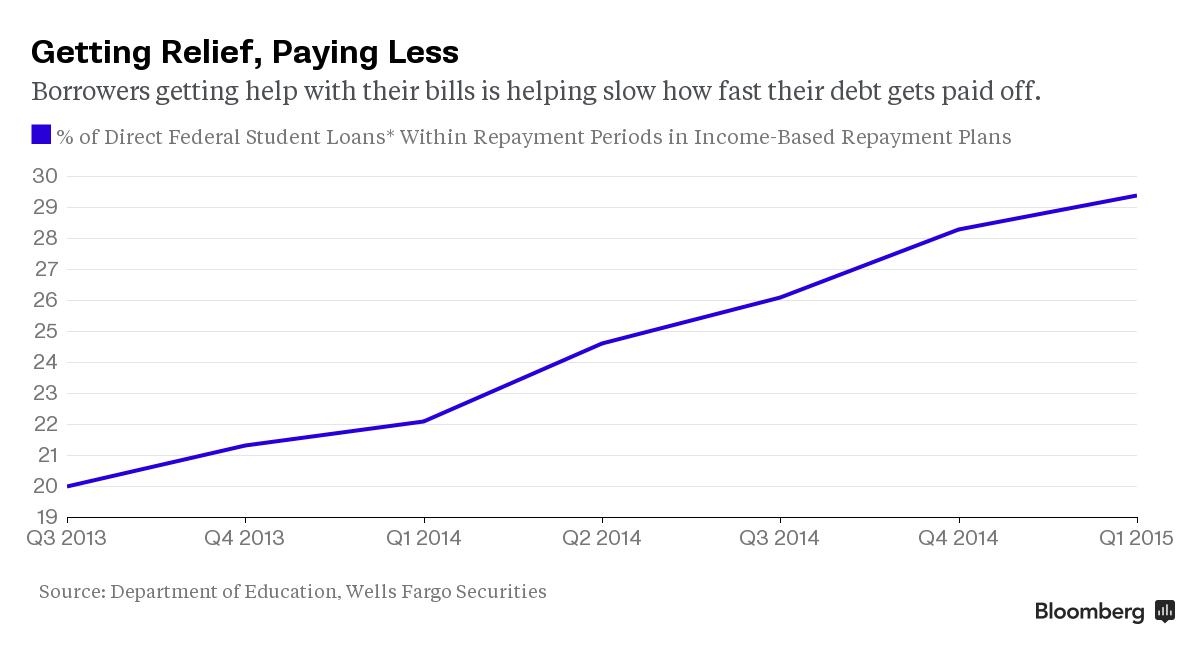

(85,373 posts)Thanks to a push by President Barack Obama's administration, more and more student-loan borrowers are signing up for income-driven repayment programs, allowing them to pay a fraction of what they would otherwise owe.

That's been making their debt more affordable each month but also longer-lasting (since the balances aren't getting paid down as much or at all and could even increase—although the balances can eventually be forgiven, in some cases after 20 years). The repayment slowdown is filtering into the bond market, where credit graders are now considering downgrades on almost $40 billion of securities tied to government-backed loans because the bonds might not pay off by their promised maturities.

As a result of bond investors getting nervous about potential technical defaults, we're getting some new data from Navient on exactly how many borrowers have been tapping the government programs. Here's how it looks for some of the company's bond trusts holding student loans, according to charts from Deutsche Bank analysts Elen Callahan and Kayvan Darouian:

These securitizations are backed by loans that are 97 percent insured by the government—bond deals that used to be common before Congress passed legislation in 2010 that ended U.S. guarantees of new loans in favor of direct federal lending.

While the use of income-driven repayment plans on direct loans is disclosed by the Department of Education, that's not the case for more than $300 billion of remaining insured ones made under the defunct Federal Family Education Loan Program, or FFELP.

This chart offers previously available data on the increasing use of the plans in the direct loan portfolio, which accounts for most of the nearly $1.2 trillion in federal student loans.

The relief for individual FFELP borrowers is shown to be significant in the new data from Navient, the loan servicer formerly part of a company known as Sallie Mae.

The average new payment by student-loan borrowers in the Navient bonds is about 20 percent of the amount scheduled under full repayment, according to the Deutsche Bank analysts.

Demeter

(85,373 posts)“We believe that the probability of default is approaching 100 percent, and that losses given default are substantial,” Moody’s wrote on LAST Wednesday about Puerto Rico’s $72 billion in bonds that were stuffed into numerous conservative-sounding bond funds spread across America’s retirement portfolios. “Bondholder recoveries will be lowest on securities lacking explicit contractual or other legal protections,” the report went on, according to Bloomberg. About $26 billion in bonds fall into this category, issued by entities such as the Government Development Bank, Highways and Transportation Authority, Infrastructure Finance Authority, and Municipal Finance Authority. Investors in these bonds might recover only 35 cents on the dollar.

Recovery rates for bonds with stronger investor protections, such as general obligation bonds, would likely range from 65% to 80%, Moody’s said. But those recovery rates, as dire as they seem, only apply if you own the bonds outright. If you own those bonds in a bond fund, the scenario may look much, much worse, according to what UBS just did. Turns out, some of these bonds were underwritten by UBS and stuffed with other Puerto Rico bonds into its own Puerto Rico closed-end bond funds and sold to its own unsuspecting clients. These funds aren’t traded; UBS sets the value. And UBS, despite the well-known problems Puerto Rico has been having for years, wasn’t shy about loading up its clients up with these bonds, apparently, according to Reuters:

And then there was leverage, as recommended by UBS brokers because UBS profits even more, not only in selling the bond funds but also in lending the money:

Since the collapse of Puerto Rico bonds, the funds have become “legal headaches for the firm,” as Reuters put it, with the FBI “investigating allegations about UBS’ sales practices that touted the funds’ high yields and tax advantages.” OK, looks like these funds have become a sordid business. But as unlikely as it may seem, they just now got even more sordid:

UBS sent out a letter to its clients on July 13, and at least one of those incensed recipients must have leaked a copy to Reuters. In this letter, UBS said that it “will also reduce to zero the collateral value assigned to all Puerto Rico closed-end funds shares.”

To zero!

Clients were warned that they can no longer use these funds as collateral for loans, even those loans they used to buy these funds with in the first place. That’s how risky UBS thinks these bond funds are. But UBS sets the value of these funds, and for now, they still have “value,” at least on its website, according to Reuters: “For example, one of the riskiest funds was worth $3.46 per share as of Thursday….” By having the collateral value of their bond funds cut to zero, these clients are looking at a potentially grim situation:

This would nicely top off the sordidness of all this, given how much money these clients have already lost on these bond funds. Consequences?

“This is a real pickle for UBS to say the collateral value assigned to the closed-end fund shares is zero,” Bragança said.

By doing so, UBS is effectively admitting that it sold a bad product and that the funds are too risky for the firm itself, let alone average investors, lawyers said.

So the lawyers are going to get rich. UBS clients might eventually recover a small portion of their original investment and weep over the rest. And UBS will simply brush off the outcome as another “charge from legal settlements,” or something similar, one more in many, and exclude it from its adjusted, pro-forma, non-GAAP, ex-items EPS number, which is all that matters to the hype mongers that analysts have become. And life goes on.

Demeter

(85,373 posts)Perhaps in the morning it will look better. Hope for change!

Demeter

(85,373 posts)New shocking revelations about Greece and the European Financial Dictatorship by Yanis Varoufakis... on how the Troika completely controls the Greek finance ministry mechanisms was included in the recorded conversation between Yanis Varoufakis and the Official Monetary and Financial Institutions Forum. The conversation was a confidential conference call with investors and executives of foreign hedge funds.

The Greek mainstream media chose to stand on the fact that the former minister was preparing a parallel currency project (as every government ought to do during negotiations), but they concealed indirectly that the country has become a colony of the IMF debt, the ECB and the European Commission. Varoufakis' co-speakers said that they are overwhelmed by the degree of control by the troika within the Ministry of Finance, as a result of decisions of previous governments.

The incredible thing is that the General Secretary for Public Revenues, Katerina Savvaidou, ordered an investigation on Varoufakis' plan B (as he owed to do, specially under such financial war conditions) and the mainstream media declared a new war on Varoufakis, but no one bothered to refer to the fact that Greece is literally under financial occupation!

Also, nobody sees anything suspicious to the fact that Savvaidou was senior executive at PwC during the four years it had set up tax avoidance schemes for the largest Greek multinationals! Until June 2014, Savvaidou was a senior in PricewaterhouseCoopers (PwC), one of the so-called Big Four, the major auditing firms in the world, whose name is involved in the scandal of scandals case LuxLeaks.

Obviously, the global financial mafia has expanded its tentacles everywhere and Greece has become a financial warzone. The country tries to gain independence from the EFD. The other European countries should take a close look on Greece to see their dark future inside EFD imposed by the financial mafia.

Info from:

http://info-war.gr/

http://www.newsbomb.gr/

Demeter

(85,373 posts)HERE WE GO AGAIN!

http://www.usatoday.com/story/news/2015/07/29/obama-jack-lew-treasury-secretary-debt-ceiling-letter/30846503/

Treasury Secretary Jack Lew told Congress on Wednesday that the nation should be able to continue paying its bills until at least Oct. 30, but lawmakers need to extend the debt limit because of economic uncertainty.

"Given this unavoidable uncertainty, Treasury is not able to provide a specific estimate of how long the extraordinary measures will last," Lew said in a letter delivered to congressional leaders. The letter arrived on Capitol Hill as the parties prepared for September budget battles that could lead to a government shutdown at the end of the fiscal year on Sept. 30.

Economic uncertainties include projecting how much revenue the government will take in through September tax receipts, Lew said. Still, the Treasury Secretary said special measures his department has been using "will not be exhausted before late October, and it is likely that they will last for at least a brief additional period of time." The U.S. actually hit its statutory debt limit on March 16, when Treasury began utilizing the special measures, Lew said.

The Obama administration and congressional Republicans have clashed over the debt ceiling before, nearly leading to an unprecedented default on government obligations.

Demeter

(85,373 posts)Boeing Co., in its 100th year in business, will consider moving key parts of its operation to other countries if Congress does not vote to revive the Export-Import Bank, which expired last month, Boeing Chairman James McNerney said Wednesday.

“We love making and designing airplanes in the United States, but we are now forced to think about doing it differently,” McNerney said in a talk at the Economic Club of Washington.

The Export-Import Bank charter expired June 30, when Congress failed to renew that federal operating document. However, the Senate voted 64-29 Monday to add an amendment to a highway bill that is being considered that would revive the bank.

“I’m more worried about it today than I ever have been,” McNerney said. “It has been a wildly successful program because what it does is it isolates the quality of the technology being sold and gets off the table all the shenanigans that people could do financially.

“But all the politics associated with the extremists of both parties, particularly the Republican Party, is preventing this thing from getting to a vote,” he said.

According to McNerney, Chicago-based Boeing is the biggest beneficiary of the Export-Import Bank in total dollars lent to other countries to buy U.S. goods, but there are more actual deals for smaller and midsize companies than for big companies. For example, 70% of the value added to Boeing’s airplanes comes from smaller companies manufacturing parts for Boeing, he said.

“Every time a Triple Seven lands in Beijing, it takes seven or eight thousand small businesses to Beijing,” McNerney said. “None of those would have a chance to export without us.” There are only two major commercial aircraft builders in the world because of “the scale of the infrastructure we needed to design and build these things,” according to McNerney. “But I think Airbus and us are facing competition, and, if I had to bet, it would be from China,” he said. “It will be at least a three-man game.”

Demeter

(85,373 posts)I haven't had any ideas yet--brilliant or otherwise.

Demeter

(85,373 posts)The going rate for a stolen identity is about twenty bucks.

Tens of millions of people have lost their private information in data breaches over the past few years. But what happens after that—how the data are leveraged for financial gain—remains murky. Many of those stolen records end up for sale on the anonymous, seedy area of the internet commonly known as the dark web.

Analyzing the sale of those records sheds some light on the vibrant market for stolen identities. On the dark web’s eBay-like marketplaces, the full set of someone’s personal information—identification number, address, birthdate, etc.—are known as “fullz.” We analyzed listings for individual fullz that were put up for sale over the past year, using data collected by Grams, a search engine for the dark web. Our question: How much is a stolen identity worth?

Among tens of thousands of records in the Grams data, we were able to identify more than 600 listings for individual identities—some including credit card information, others without. The listings ranged in price from less than $1 to about $450, converted from bitcoin. The median price for someone’s identity was $21.35.

?w=640

?w=640

The market for your data

Though the transactions are usually illegal, marketplaces on the dark web function much like those on the popular internet. Prices for stolen identities vary based on factors like quality, reliability, robustness, and the seller’s reputation.

The most expensive fullz we examined, from a vendor called “OsamaBinFraudin,” was listed at $454.05. The vendor explained in the listing that this was a premium identity with a high credit score:

hello this ad if for usa profiles that have been freshly created and already currently have 720 credit scores or higher with no current bad history and no fraud alert you can use profiles for your own identity to get loans cars housing anything u can use a identity with perfect credit the profile will come with full name addresses associated with profile ssn dob credit karma login to verfiy credit score price is high because these profiles are pre built and already have high credit scores and you can use these identities as your own long as you like

The second most expensive identity, at $248.22, came with an American Express card that the vendor claimed had a $10,000 limit:

Amex CC Account Fullz Balance 10K

Once you place the order you ll have a first hand Account with American Express Full information Account Simple Login Information User ID Password Billing Information Name Surname Address City Zip Code State Phone Number Birth Day Birth Month Birth Year Place of Birth Social Security Number Mother s Maiden Name Mother s Date of Birth Credit Card Information Credit Card Number Exp Date Name On Card CVV2 ATM Pin CSC Pin E mail Information E mail Address Password

Listings on the lower end were typically less glamorous. They included only the basics, like the victim’s name, address, social security number, perhaps a mother’s maiden name. In these listings, vendors did not offer assurances of good credit scores or credit card limits, and in some cases they were selling identities with “dead,” non-working credit cards. This description of a $2 identity, from vendor “mrq1234,” explains that these are valuable for people in-the-know:

In general, fullz containing credit scores were listed at higher prices. Fullz with dead cards went for considerably lower amounts.

?w=640

?w=640

Easy to navigate

Marketplaces on the dark web, not unlike eBay, have feedback systems for vendors (“cheap and good A+”), refund policies (usually stating that refunds are not allowed), and even well-labeled sections. There are no special codewords to learn, no back-channels that must be sussed out. On the AlphaBay market, for example, one can just click on the button marked “Fraud,” then into subsections like “Personal Information & Scans” or “CVV & Cards.”

?w=640&h=347

?w=640&h=347

It’s impossible to verify whether listings for identities on the black market, including the ones we analyzed, correspond to real people or are themselves fraudulent. It’s also difficult to determine where the data originated. Some vendors claim their fullz come from specific sources (“Limited supply of these ultra fresh Turbo Tax profile[s]”) or allude to vague ones (“This listing is for hacked UK fullz straight out of a payment processor”), but it’s not uncommon for these kinds of claims to be bogus.

In June, for example, a text file was passed around a black market message board, claiming to hold records from the breach of the US government’s Office of Personnel Management, and the nature of the data seemed to line up with the claim. But reporter Brian Krebs later discovered the records had actually come from a different government agency. Usually, we don’t know where data from large breaches ends up, or where black market identities come from, unless someone is arrested.

One such person, who was arrested in 2012 and sentenced to 13 years in prison earlier this month, procured the identities he sold online in one of the largest data breaches on record. Hieu Minh Ngo, a Vietnamese national, obtained access to 200 million records, complete with social security numbers, from a company called Court Ventures, which is owned by Experian.

Ngo’s case proves that the business of stealing identities in vast numbers and selling them through online marketplaces can indeed be extremely lucrative. He netted more than $1.9 million from selling the records, according to a prosecutor at Ngo’s plea hearing....

MORE---UTTERLY APPALLING AND HORRIBLY FASCINATING

Demeter

(85,373 posts)A couple of years ago I wrote a short post InfoBomb.

When a government or corporation collects so much information on a citizenry that the unintentional release, theft, or misuse of it is a catastrophic event.

The most immediate danger from the government collecting data on us isn't that they will use it against us... it is from the damage it will do when they inevitably lose control of it. This analysis was spot on: the failure at the Office of Personnel Management (OPM) is an infobomb.

Chinese hackers were able to steal records on 18 m current and former government employees + sensitive background information submitted by people applying for security clearances. I believe this infobomb has done catastrophic damage to US security. How? Big data + bots (made smarter via AI) will be able to turn this data into a decisive instrument of warfare.

For example: want that guy on the button to stand down?

Call him up with a threat to his family. Threaten to release information on him. Etc.

Worse, through automation this can be done on a scale and with a speed far, far greater than what old school spooks are capable of. Mark my words: This infobomb is a catastrophe. A catastrophe we won't understand the consequences of until the US loses the next big conflict.

PS: If you are interested in seeing how incompetent, unrepentant, pretentious, and dangerous government bureaucrats can be, watch the Director of OPM Katherine "it's not my fault" Archuleta in action. Her behavior is very similar to what we saw from the big bankers after the 2008 meltdown. Her recent Congressional testimony is emblematic of why Wall Street bankers and Washington bureaucrats are the #1 threat to our future prosperity.

Demeter

(85,373 posts)Larry Fink, the CEO of BlackRock, controls about $4.3 trillion in assets (and has influence on how $10 trillion more is allocated). As a point of reference, that is about the size of the entire US economy. Larry sees the world as a tightly interconnected "financial grid." Larry believes that a big part of his job is to know which parts of this global grid represent opportunities and which parts are dangerous. That makes sense. Asset allocation accounts for about ~80% of any big financial fund's performance and BlackRock's extraordinary success implies that Larry has been getting it right for decades.

What's interesting to me is the mindset. For example: Larry dismisses the threats posed by Russia adventures in the Ukraine. Why? He understands that all of the people involved in this conflict are part of his financial grid. He also knows that everyone is utterly dependent on the financial flows coursing through it. They couldn't get through the day at work and at home without it. So, to him, this dependence means that Russia isn't an actual threat, but merely a problem to be dealt with.

In contrast, Larry does see one threat as real and tangible: ISIS. Why?

ISIS isn't connected or dependent on the "grid." Worse, it's growing like a geographical cancer that can severely damage the grid. This idea. The fear that a growing part of the world is being taken off the grid gives guys like Larry nightmares. I don't think he is alone. It apparently gives more people than just Larry nightmares.

For example. Three men were arrested in New York this week, and will likely serve long prison sentences. They weren't arrested because they were plotting an attack on the US or any other site in any meaningful way. Instead, they were arrested because they planned to leave the US. They tried to drop off the grid by emigrating to ISIS and the government put them in jail for trying it. It's an interesting twist.

Demeter

(85,373 posts)Here's an interesting US systempunkt -- a systempunkt is the point in a big network where even a small attack would cause the entire network to fail. This systempunkt would enable a prepared individual the unique ability to shut down a large part of the US without shedding a drop of blood. For example, this attack has the ability to:

Put any company into a complete panic in less than an hour.

Generates hundreds of false arrests and armed police searches -- all done with a high risk of fatal injury.

It even has the ability (with some careful planning) to shut down all US schools (k-12 and colleges), hundreds of airline flights, and many government offices for a couple of days.

Auto-dialing Panic

How is an attack like this possible? It's possible due to a flaw in the US communications system (due to corporate corruption), new tech (not really new, but cheaper and more ubiquitous), and an overly sensitized population. These combine to make it possible for anyone to send threats and other misleading messages to thousands of specific people and organizations in a very short period of time, and in a way that minimizes capture. Here's more detail:

Economic Corruption (amoral companies). Fortunately for the attacker, there's no system in place to stop this from happening. The phone system is completely open to short term manipulation. NOTE: We see this every day. Most US households (particularly elderly households) get slammed with a half dozen robocalls (many of them are dangerous scams from abroad that attempt to defraud them of every penny they have) every single day. Despite the damage this does, the US phone monopolies won't do anything about it. Worse, the system is so badly managed, it's even possible for robocalling software to manipulate the "caller ID." This makes it possible for attackers to spoof targets with fake "Police Department" to "local" caller IDs.

Extreme reactions. Based on a phone threat alone, nearly all US schools and all government offices will evacuate and send home their personnel. Further, the ability to configure threats to specific locations and attach fake caller IDs provides the ability amplify and extend the duration of these evacuations and armed responses.

What does this mean?

Warfare is in transition. New tech and new threats are emerging every day. In many cases, simply doing the right thing (in this case, protecting US households from phone scams/spam), can blunt the effectiveness of the attack. In others, it takes an understanding of where modern warfare is going (not where it has been) in order to anticipate these threats and tweak the system in ways that blunts their potential for damage.

Unfortunately, I don't see this happening. The governmental and economic system we have isn't that good at doing the right thing. Worse, the security system we pay so much for, is only good at stopping the repetition of the types of attack that have already happened, not the attack that will happen. Why? Our national security system is simply unwilling to study warfare seriously.

2014-08-04

PS: Robocalling software is very easy to acquire and run now. There are even smartphone apps that can do this on stolen phones.

Hotler

(13,520 posts)It's been running on the USA network and is on its 5th or 6th episode. I think it is quite good.

It's about cyber-security and hackers. Christian Slater is in it.

Demeter

(85,373 posts)Can you give us more detail tomorrow?

mahatmakanejeeves

(67,136 posts)Source: Department of Labor, Employment and Training Administration

Read More: http://www.dol.gov/opa/media/press/eta/eta20151481.pdf

News Release

TRANSMISSION OF MATERIALS IN THIS RELEASE IS EMBARGOED UNTIL

8:30 A.M. (Eastern) Thursday, July 30, 2015

UNEMPLOYMENT INSURANCE WEEKLY CLAIMS

SEASONALLY ADJUSTED DATA

In the week ending July 25, the advance figure for seasonally adjusted initial claims was 267,000, an increase of 12,000 from the previous week's unrevised level of 255,000. The 4-week moving average was 274,750, a decrease of 3,750 from the previous week's unrevised average of 278,500.

There were no special factors impacting this week's initial claims.

The advance seasonally adjusted insured unemployment rate was 1.7 percent for the week ending July 18, an increase of 0.1 percentage point from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending July 18 was 2,262,000, an increase of 46,000 from the previous week's revised level. The previous week's level was revised up 9,000 from 2,207,000 to 2,216,000. The 4-week moving average was 2,255,250, a decrease of 750 from the previous week's revised average. The previous week's average was revised up by 2,250 from 2,253,750 to 2,256,000.

UNADJUSTED DATA

....

The total number of people claiming benefits in all programs for the week ending July 11 was 2,300,027, an increase of 21,802 from the previous week. There were 2,618,115 persons claiming benefits in all programs in the comparable week in 2014.

Demeter

(85,373 posts)I have had enough reality for a while....

Mermaids? Legends? Mother Goose? Brothers Grimm? Tolkien? Harry Potter?

Something, anything....

How about Hillary or Trump being the next Preznit?

Or would those be nightmares?

Demeter

(85,373 posts)I can't do nightmares, I'm too traumatized already.