| Latest | Greatest | Lobby | Journals | Search | Options | Help | Login |

|

|

|

This topic is archived. |

| Home » Discuss » Latest Breaking News |

|

| ozymandius

|

Thu May-01-08 04:40 AM Original message |

| STOCK MARKET WATCH, Thursday May 1 |

|

Source: du

STOCK MARKET WATCH, Thursday May 1, 2008 COUNTING THE DAYS DAYS REMAINING IN THE * REGIME 265 DAYS SINCE DEMOCRACY DIED (12/12/00) 2657 DAYS WHERE'S OSAMA BIN-LADEN? 2382 DAYS DAYS SINCE ENRON COLLAPSE = 2673 Number of Enron Execs in handcuffs = 19 ENRON EXECS CONVICTED = 10 Enron execs conveniently deceased = 3 Other Arrests of Execs = 54 U.S. FUTURES & MARKETS INDICATORS> NASDAQ FUTURES-----------------------------S&P FUTURES   AT THE CLOSING BELL WHEN BUSH TOOK OFFICE on January 22, 2001 Dow - 10,578.24 Nasdaq - 2,757.91 S&P 500 - 1,342.90 Oil - $27.69/bbl Gold - $266.70/oz. AT THE CLOSING BELL ON April 30, 2008 Dow... 12,820.13 -11.81 (-0.09%) Nasdaq... 2,412.80 -13.30 (-0.55%) S&P 500... 1,385.59 -5.35 (-0.38%) Gold future... 865.00 -11.80 (-1.36%) 30-Year Bond 4.50% -0.06 (-1.36%) 10-Yr Bond... 3.76% -0.07 (-1.73%)       GOLD,EURO, YEN, Loonie and Silver      PIEHOLE ALERT Heads Up! Preliminary info on appearances by Bush & Co. throughout the country. Details & links are added as they become available so check back. And if you know more, are organizing something, or would like to, contact actionpost@legitgov.org For information on protests and other actions Citizens For Legitimate Government  Read more: du |

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Thu May-01-08 04:47 AM Response to Original message |

| 1. Market WrapUp: An Inconvenient Adjustment: |

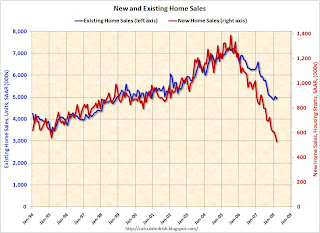

|

The Unofficial Official Recession

BY CHRIS PUPLAVA The advanced estimate from the Bureau of Economic Analysis showed Q1 real GDP coming in at a 0.60% annualized rate, slightly higher than the 0.58% annualized rate seen in Q4 2007. With real GDP still in expansionary territory, the U.S. economy has not entered an official recession, which is defined as two consecutive quarters of negative real GDP growth. Not so fast! Nominal GDP is adjusted by the GDP deflator to measure real GDP growth with the inflation component removed to measure the increase in economic output and not an increase in the level of prices. However, one must take a metric ton, not a grain of salt, when looking at the GDP deflator. The GDP deflator has been consistently below the stated inflation rate as measured by the headline CPI numbers, with a lower GDP deflator leading to a higher real GDP number. Call my a cynic but I cant help but notice the CONVENIENT deviation between the headline CPI inflation rate and the GDP deflator during periods of economic weakness. Remember, a lower GDP deflator leads to a higher real GDP number. Well, it just so happens that the deviation between headline CPI and the GDP deflator often peaks during economic recessions so that the reported real GDP numbers are higher than what they would be if nominal GDP were to be deflated by the headline CPI. ..... Harpers Magazine had an excellent article written by Kevin Phillips highlighting all the governmental changes made to how the CPI is calculated in an article entitled, Hard numbers: The economy is worse than you know.

..... Clearly the economic picture has deteriorated for the average American Consumer. Anyone claiming that the U.S. is currently not in a recession is in pure denial as we are already unofficially in an official recession. The announcement of an official recession is irrelevant at this point as the deteriorating economy will make it abundantly clear to all, regardless of what inflation measure is used to deflate nominal GDP. The consumer is under severe stress and a plummeting labor market will only weigh further on consumption as retail sales are strongly correlated with changes in employment. http://www.financialsense.com/Market/wrapup.htm |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Thu May-01-08 05:27 AM Response to Reply #1 |

| 8. DailyReckoning.com from April 24th |

|

There is so much noise in the financial system, it is hard to think. The papers are full of distractions and absurdities. You can find almost any point-of-view you want. Some argue that central banks are winning...that the stock market hasnt gone down because it is getting ready to go up...and soon, the housing market will bottom out too.

Fears of bank failures recede, says a headline in the Financial Times today. Others argue that the worst is still ahead...that the stock market will melt down...that housing prices will fall another 20%...and that the whole world will go into a monumental downturn. Housing slump may exceed Depression, says a San Diego paper. We take a middle view that financial assets (including paper money), the financial industry, the credit cycle, the dollar-standard monetary system and the U.S.A. itself are in an historic decline...while emerging markets, gold and commodities are in a once-in-a-lifetime upswing. Weve heard about the panic that the doubling of wheat and rice prices is causing in China, India and other Asian countries. But now, reports the Washington Times , this panic is beginning to spill over to Americans. The article goes on to point out that bulk grocery stores, such as Costco, are having to put a limit on how much rice customers in certain states can buy. Americans have gotten a whiff of the high prices and fear that the shortages will spread from overseas, and have begun hoarding necessities such as oil, rice and flour. Commodity prices across the board are at levels not experienced in many of our lifetimes, said CFTC Chairman Walter Lukken. These price levels, along with record energy costs, have put a strain on consumers as well as many producers and commercial participants that utilize the futures markets to manage risks. Resource Trader Alert s Kevin Kerr assets that this profit parade Is the housing market getting worse?... in Nevada, the local press tells us that many erstwhile homeowners are not being very considerate to the new owners. Theyre wrecking the houses before they leave, says the paper, even putting cement down the plumbing. Of course, theyre upset, continues the report, because they feel theyve been roughly handled by the mortgage industry...Meanwhile, in Chicago, Jesse Jackson is in the news; he thinks borrowers have been roughly handled by the mortgage industry too. Hes called for a moratorium on foreclosures. And over the on East Coast, the Washington Post says lenders are being swamped by delinquent loans. Partly because of the risk of bad payers, mortgage approvals have fallen to a 10-year low. But not all the delinquents are homeowners. Many former students, who took out loans to get through college, are finding it hard to pay the money back. Lenders are tightening up on the scholars too. And the Bush Administration is so alarmed at the thought of all the college keg parties that might be canceled; it has proposed to buy student loans from the lenders. Where will it get the money, you ask? From taxpayers, of course. Who are the taxpayers? The parents of the students, obviously. Then, why not let the parents keep their money and pay for their own childrens education? Oh, stop being a silly old fuddy duddy... |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Thu May-01-08 05:50 AM Response to Reply #8 |

| 10. DailyReckoning.com from April 30 |

|

As near as we can figure, most investors think the worst is over. After a correction, stocks are going back up. The dollar too. Gold, meanwhile, is going down. Bernanke, Bush and the whole company of angels and archangels who watch over our economy and our money are winning, they believe.

But the more they win...the more you lose, dear reader. Because there are mistakes that need to be corrected. There are errors that need to be punished. Truth needs to be discovered. And the longer the correction is delayed...the more we live in darkness and error, and the more it costs to fix things. You dont have to be an economist to figure this out. Its just the way the world works. ... reminding ourselves what money really is... When a bank makes an electronic transfer, electrons are the only thing that crosses a street. But those electrons represent pieces of green paper...which, in turn, represent wealth. And what is wealth? It is limited resources...the potential to take up some of the worlds coal, iron, plastic...anything from a ton of wheat to a brand new Mercedes...to some working mans time. The problem, fundamentally, is that the credit expansion of the last 25 years gave too many people too many claims against those limited resources. Then, when they went to exercise those claims against stock market earnings in the 90s...then against houses in the early 00s...and now against oil, rice and gold prices rose. The rising prices sent a phony signal. They convinced investors that there was more demand for dotcom stocks and houses than there really was. And today, theyre signaling an outsize demand for commodities and gold. As money pours into the bubble sector...more and more resources time, capital, things are misdirected away from things people really want and need and into the bubble. Eventually, the bubble pops...losses are taken...and rebuilding can begin a firmer foundation. But wait, we anticipate your question, are you saying that commodities are going to crash too? Yes...of course. Every farmer in the world is working hard to make it happen. Lured by high prices, they are bound to overproduce. They always do. Over-production is, by definition, a mistake. It will need to be corrected, eventually...just as overbuilding of new houses is being corrected...and just as overinvestment in NASDAQ dotcoms needed to be corrected. |

| Printer Friendly | Permalink | | Top |

| TalkingDog

|

Thu May-01-08 08:02 AM Response to Reply #1 |

| 33. A conspiracy of individuals |

|

If a series of unrelated and unconnected people know something is, at the very least, questionable behaviour and each one chooses to put self-interests above what is held as the common good, it becomes a conspiracy of individuals.

No back room discussions, no wink and a nod. Just a failure of society to teach about the social contract that must be maintained if we want to avoid this accumulation of error. Entropy, as someone here is fond of suggesting. That said, I offer a reprise to yesterday's Cowboy theme that might underscore this idea very nicely: The Amazing Rhythm Aces: King of the Cowboys I used to watch you, when I was little. The games I played I learned from you. I kept dreaming, you kept playing. When I woke, you were 62 Say goodbye to the King of the Cowboys. First and last of a dying breed. Say goodbye to the King of the Cowboys chained to a life he doesn't lead. You told the truth. You were always ready. Whether with your gun or with your hand. It was lies but I never knew it. You taught me how to act like a man. Say goodbye to the King of the Cowboys. First and last of a dying breed. Say goodbye to the King of the Cowboys chained to a life he doesn't lead. Say goodbye to the King of the Cowboys. First and last of a dying breed. Say goodbye to the King of the Cowboys chained to a life he doesn't lead. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Thu May-01-08 09:31 AM Response to Reply #33 |

| 50. More Cowboy / Country Music? You KNOW What the Answer to THAT Is, Don't You? |

|

Edited on Thu May-01-08 09:31 AM by Demeter

Desperado, why don't you come to your senses?

You been out ridin' fences for so long now Oh, you're a hard one I know that you got your reasons These things that are pleasin' you Can hurt you somehow Don' you draw the queen of diamonds, boy Shell beat you if she's able You know the queen of hearts is always your best bet Now it seems to me, some fine things Have been laid upon your table But you only want the ones that you can't get Desperado, oh, you ain't gettin' no younger Your pain and your hunger, they're drivin' you home And freedom, oh freedom well, that's just some people talkin' Your prison is walking through this world all alone Don't your feet get cold in the winter time? The sky won't snow and the sun won't shine It's hard to tell the night time from the day You're losin' all your highs and lows Ain't it funny how the feeling goes away? Desperado, why don't you come to your senses? Come down from your fences, open the gate It may be rainin', but there's a rainbow above you You better let somebody love you, before its too late! http://www.geocities.com/Heartland/Prairie/4751/desperado.mid |

| Printer Friendly | Permalink | | Top |

| TalkingDog

|

Thu May-01-08 10:13 AM Response to Reply #50 |

| 65. Other than this...I got nothin' |

|

:evilgrin:

Kid Rock : "Cowboy" (made family friendly as per SMW suggestions) Cowboy...Cowboy Well I'm packing up my game and I'm a head out west Where real women come equipped with scripts and fake breasts Find a nest in the hills, chill like Flynt Buy an old drop top, find a spot to pimp And I'll Kid Rock it up and down your block With a bottle of scotch and watch lots of (something that rhymes with watch) Buy a yacht with a flag sayin' "Chilling the Most" Then rock that b(oat) up and down the coast Give a toast to the sun, drink with the stars Get thrown in the mix and tossed out of bars Then to Tijuana... I wanna roam Find Motown and tell the fools to come back home Start an escort service, for all the right reasons And set up shop at the top of four seasons Kid Rock and I'm the real McCoy And I'm headin' out west sucker...because I wanna be a Cowboy baby With the top let back and the sunshine shining Cowboy baby West coast chilling with the Boone's Wine I wanna be a Cowboy baby Riding at night cause I sleep all day Cowboy baby I can smell a pig from a mile away I bet you'll hear my whistle blowing when my train rolls in It goes (whistle) like dust in the wind Stoned pimp, stoned freak, stoned out of my mind I once was lost, but now I'm just blind Palm trees and weeds, scabbed knees and rice Get a map to the stars, find Heidi Fleiss And if the price is right I'm gonna make my bid boy And let Cali-for-ny-aye know why they call me Cowboy baby With the top let back and the sunshine shining Cowboy baby West coast chilling with the Boone's Wine I wanna be a Cowboy baby Riding at night cause I sleep all day Cowboy baby I can smell a pig from a mile away Yeah...Kid Rock...you can call me Tex Rollin sunset woman with a bottle of Becks Seen a slimy in a vette, rolled down my glass And said, Yeah this (we'll just delete that) fits right in your (volkswagon beetle) No kidding, gun slinging, spurs hitting the floor Call me Hoss, I'm the Boss, with the sauce in the horse No remorse for the sheriff, in his eye I ain't right I'm gonna paint his town red, and paint his wife white HUH Cause chaos, rock like Amadeus Find West Coast (friends) for my Detroit players Mack like mayors, ball like Lakers They told us to leave, but bet they can't make us Why they wanna pick on me...lock me up and snort away my key I ain't no G, I'm just a regular failure I ain't straight outta Compton, I'm straight out the trailer Cuss like a sailor...drink like a Mick My only words of wisdom are just, Radio Edit I'm flicking my Bic up and down that coast and Keep on trucking until it falls in the ocean Cowboy With the top let back and the sunshine shining Cowboy Spend all my time at Hollywood and Vine Cowboy Riding at night cause I sleep all day Cowboy I can smell a pig from a mile away Cowboy With the top let back and the sunshine shining Cowboy With the top let back and the sunshine shining Cowboy Hollywood and Vine |

| Printer Friendly | Permalink | | Top |

| Hugin

|

Thu May-01-08 10:34 AM Response to Reply #50 |

| 67. Ahh, music to my ears, Demeter... |

|

I've been listening to that song off and on since I dug through my cassette tapes and broke out the Linda Ronstadt

a couple of weeks ago. Of course, the Eagles' version is excellent, too. :) |

| Printer Friendly | Permalink | | Top |

| AnneD

|

Thu May-01-08 11:16 AM Response to Reply #67 |

| 69. Good Themes Today... |

|

Looking at and reading the theme for the day is a bit like getting an email postcard. Thanks-I'll be mentally humming the Willie Nelson version of Desperado.

|

| Printer Friendly | Permalink | | Top |

| kineneb

|

Thu May-01-08 01:07 PM Response to Reply #50 |

| 77. had to listen to it |

|

have the Eagles Live CD....yup.

|

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Thu May-01-08 04:54 AM Response to Original message |

| 2. Today's Reports (and it's a doozy of a handful) |

|

Auto Sales Apr

Briefing.com 5.1M Consensus NA Prior 4.9M 00:00 Truck Sales Apr Briefing.com 6.3M Consensus NA Prior 6.2M 08:30 Initial Claims 04/26 Briefing.com 358k Consensus 360K Prior 342K 08:30 Personal Income Mar Briefing.com 0.4% Consensus 0.4% Prior 0.5% 08:30 Personal Spending Mar Briefing.com 0.3% Consensus 0.2% Prior 0.1% 08:30 PCE Core Inflation Mar Briefing.com 0.2% Consensus 0.1% Prior 0.1% 10:00 Construction Spending Mar Briefing.com -1.0% Consensus -0.7% Prior -0.3% 10:00 ISM Index Apr Briefing.com 49.0 Consensus 48.0 Prior 48.6 http://www.briefing.com/Investor/Public/Calendars/EconomicCalendar.htm |

| Printer Friendly | Permalink | | Top |

| UpInArms

|

Thu May-01-08 07:33 AM Response to Reply #2 |

| 29. Initial Claims in at 380,000 - last wk rev'd up 3k |

|

01. U.S. 4-wk. avg continuing claims up 16,750 to 2.98 mln

8:30 AM ET, May 01, 2008 02. U.S. continuing jobless claims up 74,000 to 3.02 million 8:30 AM ET, May 01, 2008 03. U.S. 4-wk. avg. initial jobless claims down 6,500 to 363,750 8:30 AM ET, May 01, 2008 04. U.S. weekly initial jobless claims rise 35,000 to 380,000 8:30 AM ET, May 01, 2008 05. U.S. March consumer prices rise 0.3% 8:30 AM ET, May 01, 2008 06. U.S. March personal savings rate falls to 0.2% 8:30 AM ET, May 01, 2008 07. U.S. March real disposable incomes flat 8:30 AM ET, May 01, 2008 08. U.S. March nominal incomes up 0.3% as expected 8:30 AM ET, May 01, 2008 09. U.S. March core consumer inflation rises 0.2% 8:30 AM ET, May 01, 2008 10. U.S. March real consumer spending rises 0.1% 8:30 AM ET, May 01, 2008 |

| Printer Friendly | Permalink | | Top |

| UpInArms

|

Thu May-01-08 08:22 AM Response to Reply #2 |

| 38. Income gains eroded by inflation in March |

|

http://www.marketwatch.com/news/story/income-gains-eroded-inflation-march/story.aspx?guid=%7B2A365B33%2D49FD%2D42DD%2D88EC%2DC18349BC09FB%7D

WASHINGTON (MarketWatch) -- Higher prices took away all the income gains U.S. households received in March, the Commerce Department estimated Thursday. Consumer prices rose 0.3% during the month, matching the 0.3% rise in incomes that was expected by economists surveyed by MarketWatch. See Economic Calendar. Real disposable incomes were unchanged in March after accounting for taxes and inflation. Real disposable incomes are up 0.9% in the past year. Read the full report. Consumer spending increased 0.4%, or just 0.1% after adjusting for rising prices. Economists expected a 0.3% rise in spending. The report on personal incomes fleshes out monthly details contained in the quarterly report on gross domestic product released on Wednesday. That report showed consumer spending rose at the slowest pace in seven years during the first three months of the year. See full story. Inflation accelerated during March, pushed by higher prices for services and nondurable goods, such as food and energy. Core prices -- which exclude food and energy -- rose 0.2%, a tick higher than expected. For the past year, consumer prices have risen 3.2%, the slowest year-over-year gain since October. Core prices are up 2.1%, just ahead of the Federal Reserve's target zone. ...more... |

| Printer Friendly | Permalink | | Top |

| UpInArms

|

Thu May-01-08 09:05 AM Response to Reply #2 |

| 46. Construction spending falls 1.1% - April ISM @ 48.6% |

|

01. U.S. March construction spending falls 1.1%

10:02 AM ET, May 01, 2008 03. U.S. April ISM 48.6% vs. 48.0% expected 10:01 AM ET, May 01, 2008 |

| Printer Friendly | Permalink | | Top |

| UpInArms

|

Thu May-01-08 06:55 PM Response to Reply #2 |

| 80. GM U.S. sales down 22.7 pct |

|

http://www.reuters.com/article/businessNews/idUSWNAS128120080501?feedType=RSS&feedName=businessNews

DETROIT (Reuters) - General Motors Corp (GM.N: Quote, Profile, Research) on Thursday reported a 22.7 percent fall in April U.S. auto sales on an adjusted basis, led by a 32 percent decline in truck sales. GM's overall sales fell to 260,922 vehicles in April from 311,687 in the same month a year earlier. The percentage fall was adjusted to reflect two more selling days last month compared with April 2007. Inventory fell to about 824,000 vehicles at the end of April, down about 206,000 vehicles from a year earlier to the lowest level since September 2005. ...more... |

| Printer Friendly | Permalink | | Top |

| UpInArms

|

Thu May-01-08 07:03 PM Response to Reply #80 |

| 83. April auto sales slump as truck sales plunge |

|

http://news.yahoo.com/s/nm/20080501/bs_nm/usa_autosales_dc

DETROIT (Reuters) - U.S. auto sales fell to their lowest annual rate in more than 15 years in April as weak consumer confidence and rising gas prices hit the industry's most profitable vehicles hardest. Sales at Detroit's Big 3 of General Motors Corp (GM.N), Ford Motor Co (F.N) and Chrysler LLC (CBS.UL) -- with their truck-heavy lineups -- were worse than expected, according to data released on Thursday. GM sales fell 23 percent, Ford 19 percent, and Chrysler nearly 30 percent. Asian competitors also struggled, with Toyota Motor Corp (7203.T)(TM.N) posting a 5 percent sales decline, and Nissan Motor Co (7201.T)(NSANY.O) sales dropping almost 2 percent. "No one is immune to the weakness," said Jesse Toprak, analyst at Edmunds.com, an auto industry tracking firm. Auto sales represent one of the first monthly snapshots of U.S. consumer demand, and investors have looked to the reports for evidence of whether the U.S. economy has slipped further toward recession since the start of the year. The leading automakers said preliminary data suggested industrywide sales fell to about 14.7 million units on an annualized basis in April, which would mark the weakest result since the early 1990s. ...more... |

| Printer Friendly | Permalink | | Top |

| UpInArms

|

Thu May-01-08 06:59 PM Response to Reply #2 |

| 81. Consumer spending up mainly because of sharp price increases |

|

http://news.yahoo.com/s/ap/20080501/ap_on_bi_go_ec_fi/economy;_ylt=AuDpQdc2T05rBgaZEU9jaWab.HQA

WASHINGTON - Don't be fooled by a larger-than-expected increase in consumer spending. People aren't buying more — they're just paying more for what they buy. That is raising doubts about whether the 130 million stimulus payments the government began sending out this week will be enough to lift consumers' sagging spirits. The Commerce Department reported Thursday that consumer spending was up 0.4 percent, double the increase economists had forecast. However, once inflation was removed, spending edged up a much slower 0.1 percent. The March reading was the fourth straight lackluster performance and did nothing to alleviate worries that consumer spending, which accounts for two-thirds of total economic activity, remains under severe strains, reflecting an economy beset by multiple problems. Rising food costs, soaring energy prices and falling employment have pushed consumer confidence to its lowest levels in five years. Incomes in March rose a weak 0.3, but after removing inflation, after-tax incomes were flat. ...more... |

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Thu May-01-08 04:57 AM Response to Original message |

| 3. Oil rises as dollar drops after Fed interest rate cut (Econ101 lesson review in ten words) |

|

SINGAPORE - Oil prices rose in Asian trading Thursday as the dollar weakened after the U.S. central bank cut its key interest rate.

The U.S. Federal Reserve said Wednesday it would cut the federal funds rate by a quarter percentage point to 2 percent. Early in Asia, the dollar lost ground against both the euro and yen, although it began to stabilize and strengthen later in the day. "The U.S. (Federal Open Market Committee) meeting and the softer U.S. dollar helped the oil price recover some ground," said David Moore, commodity strategist with the Commonwealth Bank of Australia in Sydney. Light, sweet crude for June delivery added 79 cents to $114.25 a barrel in electronic trading on the New York Mercantile Exchange by midafternoon Thursday in Singapore. The contract fell $2.17 Wednesday to settle at $113.46 a barrel after the U.S. government reported that crude inventories rose more than expected last week. ..... In its weekly inventory report, the Energy Department's Energy Information Administration said crude oil inventories rose 3.8 million barrels, more than double the increase analysts surveyed by energy research firm Platts had expected. http://news.yahoo.com/s/ap/oil_prices |

| Printer Friendly | Permalink | | Top |

| UpInArms

|

Thu May-01-08 07:25 AM Response to Reply #3 |

| 26. EXXON MOBIL'S QUARTERLY NET NEARS $11 BILLION ON HEFTIER EARNINGS FROM OIL AND GAS |

|

http://www.marketwatch.com/news/story/exxon-mobil-tap-30-earnings/story.aspx?guid=%7B47568015%2D8652%2D402A%2DABC0%2DE87FC27C5763%7D

NEW YORK (MarketWatch) -- Exxon Mobil's profit is expected to jump as much as 30% when it reports its first-quarter earnings on Thursday as the oil giant joins the crowded stage of $120 oil, U.S. retail gasoline prices approaching $4 a gallon and flare-ups in the geopolitical scene from Nigeria to the Persian Gulf. Wrapping up the first three months in world history with oil at $100 a barrel and rising fast, Wall Street expects Exxon Mobil (XOM) to boost net income handily to $2.12 a share from $1.62 a share posted in the year-ago quarter. Analysts' most bullish first-quarter profit predictions come in near $12 billion for Exxon Mobil, which remains the largest corporation in the world by market cap and yearly profit. In the year-ago period, Exxon reported net income of $9.3 billion. Meanwhile, No. 2 U.S. integrated oil giant Chevron (CVX: 96.15, +1.41, +1.5%) is on tap to deliver earnings of $2.39 share, compared with $2.18 a share in the year-ago period. The two oil majors will reign over a flurry of energy sector profit updates in recent days, with ConocoPhillips (COP: 86.15, +0.70, +0.8%) and Occidental Petroleum (OXY 83.21, -0.04, 0.0%) powering past Wall Street estimates. With oil prices spiking and gasoline prices up but lagging, conditions continued to favor the exploration and production side of the business in the three months ended March 31. ...more... |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Thu May-01-08 09:51 AM Response to Reply #26 |

| 60. Gouged Out: The Consumer and the Gas Station Operator |

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Thu May-01-08 05:01 AM Response to Original message |

| 4. Costs, weaker economy drive Las Vegas Sands to 1Q net loss |

|

LAS VEGAS - Las Vegas Sands Corp. plans to win back gamblers in Macau and is banking on strong growth from its new resort in Las Vegas after intense competition abroad and dwindling tourism at home led the casino giant to an $11.2 million loss in the first quarter.

The casino company run by billionaire Sheldon Adelson saw its shares fall nearly 9 percent in after-hours trading Wednesday on word of the quarterly loss, which equaled 3 cents per share, compared with a profit of $90.9 million, or 26 cents per share, a year earlier. Excluding items such as losses on sold assets and expenses related to opening new casinos, adjusted earnings totaled $23.6 million, or 7 cents a share for the period ended March 31. That was down from $114.6 million, or 32 cents per share, a year earlier. ..... On a conference call with analysts, Weidner said the company "paid the price" in the first quarter for an earlier decision to increase inventory for Las Vegas tourists rather than conventioneers in 2008. Tourism traffic in Las Vegas has suffered in a weakening economy, and the company saw "lower occupancy than we planned," Weidner said. http://news.yahoo.com/s/ap/20080501/ap_on_bi_ge/earns_las_vegas_sands |

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Thu May-01-08 05:03 AM Response to Original message |

| 5. Consumer may get benefits from a Fed rate pause |

|

WASHINGTON - While the Federal Reserve's aggressive drive to lower interest rates appears to be over, there could be benefits for consumers in other places like some relief from soaring gasoline and food costs.

"With the Fed on hold and the dollar firming, oil and gasoline and food prices may all top out some time in the next few months," said Mark Zandi, chief economist at Moody's Economy.com. On Wednesday, the Fed cut interest rates for a seventh straight time. But the reduction was a much smaller quarter-point move not the half-point and three-fourths-point moves of earlier this year. It pushed the federal funds rate down to 2 percent. ..... As the dollar falls, that tends to drive the cost of oil higher because oil is priced in dollars and producers start demanding higher prices to compensate for a weaker dollar. Those forces are also at work in terms of driving up other globally trade commodities such as metals and food including wheat and other grains. With the Fed lowering the prospects for further rate cuts, the dollar can be expected to stabilize and perhaps rebound from the record lows it had hit in recent weeks against the euro and other currencies. That should help various commodities including oil and food to backtrack from their recent record highs, a process that may have already started. http://news.yahoo.com/s/ap/20080501/ap_on_bi_ge/fed_interest_rates |

| Printer Friendly | Permalink | | Top |

| AnneD

|

Thu May-01-08 08:07 AM Response to Reply #5 |

| 34. Morning Marketeers...... |

|

:donut: and lurkers. Happy Mayday-the International Workers holiday. And speaking of May Day, I don't think the consumer can take any more of these 'helpful' FED rate cuts. Finally, they are signaling something good for a change. That's probably why the markets reacted the way they did. The FED's have been acting like Doc administering chemo to a cancer patient. The chemo killed the patient in the end but by God the patient died cancer free. That may sound crazy but if I had a nickle for every patient that died cancer free-I wouldn't have to wear scrubs ever again.

The 'Recession' and yes it is a recession is widening and deepening. Businesses that aren't housing or finance related are taking hits now and the only folks doing well are the debt collectors. I heard that the auto leases will reset in June and July so that should be another event. A Nursing instructor once told me that a human can only stand so many shocks to the system and that once you start getting a cascade downward-it's impossible to reverse the course. The death certificate may read cause of death-respiratory infection (cold), but the immune system weakened by chemo, diabetes, and heart disease assisted. We've had increased unemployment and underemployment for years now (chemo) but we were getting B12 shots (easy credit) so we looked healthy enough. We caught a cold (inflation) and it's about to put us in the ground (depression). I hope those of you on the SWT had enough leeway to prepare as best you can in your circumstances. I sleep better each night knowing that I have done what I could to prepare. Hubby and I may not have much by some folks standards but we are relatively healthy, have food clothing and shelter, and a tad set aside for a rainy day. We have a great support network of friends and family and are able to help our friends in need. I figure that makes us very rich indeed. I hope this holiday finds you well and counting your REAL wealth, Happy hunting and watch out for the bears. |

| Printer Friendly | Permalink | | Top |

| TalkingDog

|

Thu May-01-08 08:39 AM Response to Reply #34 |

| 42. Or as in my mother's case. |

|

The official cause of death was a "massive stroke". Of course the lung cancer from years of smoking and working in a fiberglass textile mill had metastasized and traveled to her brain. Over 50% of lung cancers spread and develop into brain cancers which is why the John Hopkins protocol suggests prophylactic radiation to the head.

Of course, my mother wasn't being treated at John Hopkins..... Still, the official cause of death wasn't lung cancer, brain cancer or outmoded protocols. Chalk one up for the cigarette industry. (Got nothing against tobacco, it's a perfectly fine medicinal and insecticidal plant) When you get to avoid harsh and practical realities allowed by the wiggle room of parsing terminology and technicalities it can help create a massive denial. I might be flat-footed and stubborn. And reality might choose to beat the hell out of me on a daily basis. But I see that snake in the grass. And I know a hungry wolf is chasing it. Pity the people who have chosen only to look at the Sun and become blind. |

| Printer Friendly | Permalink | | Top |

| AnneD

|

Thu May-01-08 08:41 AM Response to Reply #42 |

| 43. Amen Sister |

|

Amen...

|

| Printer Friendly | Permalink | | Top |

| Demeter

|

Thu May-01-08 09:34 AM Response to Reply #42 |

| 51. My Mother, Too |

|

And she still wanted to smoke until the very end.

|

| Printer Friendly | Permalink | | Top |

| AnneD

|

Thu May-01-08 10:38 AM Response to Reply #51 |

| 68. And speaking of health..... |

|

I saw Elizabeth Edwards. It was on the computer so not really good quality, but to my Nurse eye-she didn't look good. I think she might be turning a corner sooner than we might wish.

|

| Printer Friendly | Permalink | | Top |

| Tansy_Gold

|

Thu May-01-08 02:08 PM Response to Reply #42 |

| 78. My husband, too |

|

Official cause of death, pneumonia. But the lung cancer that had spread to spine and liver, the chemo, the radiation, the paralysis -- it all led to pneumonia.

Now I'm really depressed, as if the horrible job interview yesterday hadn't done enough to lower my spirits. peace to you all Tansy Gold |

| Printer Friendly | Permalink | | Top |

| TalkingDog

|

Thu May-01-08 09:19 AM Response to Reply #34 |

| 48. May celebrations. |

|

Edited on Thu May-01-08 09:21 AM by TalkingDog

The heathens I know have a more....earthy way to greet the Merry Month of May.

The rhyme reads: First of May First of May Outdoor ....... Starts today! Today the young gentlemen will plant the May Pole into the warm, moist fertile soil in honor of the Spring Rites. The young ladies will adorn it with flowers, tie ribbons at the top and in a tradition that is as old as time, the young couples will circle the Pole. Man and woman facing each other in turn and each taking a ribbon, they dance. Twining in and out, each fair sex moving against the smiling circle of the other. Historical documents suggest (including notations by Catholic clergy) that May was a month celebrating fertility in all it's forms. Clergy would grumble and scowl about young couples out "furrowing the fields" and no censure was brought on them by the villagers who were probably having fond May Day reminisces themselves. Now interestingly, this seems to lead to a lot of good luck being attached to June weddings. I'm not sure what causes that. Probably something in the water. |

| Printer Friendly | Permalink | | Top |

| AnneD

|

Thu May-01-08 09:35 AM Response to Reply #48 |

| 52. And if you look at the May Pole |

|

and the way the ribbons are woven when the dance is complete-it looks remarkably like DNA-but that's just the scientist in me. Many a June wedding had a May beginning-no doubt about that. And probably an early spring birth-the chance for greatest survival of the infant. Rural life gives on a more pragmatic, less prudish outlook on these things. Thanks for the chuckle.

|

| Printer Friendly | Permalink | | Top |

| Dr.Phool

|

Thu May-01-08 09:47 AM Response to Reply #48 |

| 57. Beautiful ouside day. |

|

I'm gonna fire up the hawg, ride over to State Farm and give them their extortion payments, make the mortgage payment, and come back and lay in the pool. The water's 88 degrees (solar panel heated).

I'll spend some quality time with my dog. We had to have his big sister put down last night.:cry: |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Thu May-01-08 10:00 AM Response to Reply #57 |

| 64. Condolences to You and Dog, Doc. |

|

Been there, done that, don't ever want to do it again.

|

| Printer Friendly | Permalink | | Top |

| TalkingDog

|

Thu May-01-08 10:22 AM Response to Reply #57 |

| 66. So sorry. Love your boy for me. They grieve too. n/t |

| Printer Friendly | Permalink | | Top |

| AnneD

|

Thu May-01-08 11:21 AM Response to Reply #57 |

| 70. So sorry to hear it..... |

|

It's painful losing a companion and playmate. They know and have a sense of these things. I wonder how much undersanding there is-but they have a sense.:grouphug:

|

| Printer Friendly | Permalink | | Top |

| Mojorabbit

|

Thu May-01-08 01:00 PM Response to Reply #48 |

| 76. Yes |

|

this is my hubby's favorite pagan holiday. :) I am preparing the feast for tonight.

|

| Printer Friendly | Permalink | | Top |

| antigop

|

Thu May-01-08 09:35 AM Response to Reply #34 |

| 53. "the only folks doing well are the debt collectors."....and locksmiths |

|

A friend said that NPR interviewed a locksmith (I think it was Florida) --- said business was booming, but he felt sorry for those who have lost their homes.

|

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Thu May-01-08 05:05 AM Response to Original message |

| 6. Starbucks to slash U.S. store openings |

|

LOS ANGELES (Reuters) - Starbucks Corp said on Wednesday it would slash U.S. coffee store openings through 2011 to cut costs in the face of weak U.S. sales and to focus more on growth abroad.

The company, which warned last week of the worst economic environment in its history, said U.S. customer visits had slowed but estimated growth in international business profit margins over the next few years. Investors and analysts have been pushing for Starbucks to cut plans for U.S. expansion. ..... On Wednesday, the coffee shop chain posted fiscal second-quarter net income of $108.7 million, or 15 cents per share, compared with $150.8 million, or 19 cents per share, a year earlier. http://news.yahoo.com/s/nm/20080430/bs_nm/starbucks_dc |

| Printer Friendly | Permalink | | Top |

| UpInArms

|

Thu May-01-08 06:51 AM Response to Reply #6 |

| 21. Fewer latte runs sends Starbucks 2Q profit down 28 percent |

|

http://news.yahoo.com/s/ap/20080501/ap_on_bi_ge/earns_starbucks

SEATTLE - Starbucks Corp. is dialing back expectations for its U.S. stores in light of economic uncertainty but has a three-year plan for snazzy new drinks and future profit growth fueled by aggressive international expansion. As expected, the company said Wednesday its fiscal second-quarter profit sank 28 percent as U.S. consumers responded to rising food and gas prices by making fewer latte runs. The coffee purveyor slashed 30 additional store openings from its already-scaled-back plan for 2008 and said it will open fewer than 400 stores per year in 2009 through 2011. International openings will increase at a far faster clip, though, with 975 this year and a projected 1,300 in 2011. Starbucks expects to have 21,500 stores worldwide by the end of fiscal 2011. Starbucks' financial goals for the coming years reflect worries about a protracted U.S. economic downturn and rely on international stores — particularly ones run by licensed partners rather than Starbucks itself — to drive profit. ...more... |

| Printer Friendly | Permalink | | Top |

| Tansy_Gold

|

Thu May-01-08 07:47 AM Response to Reply #6 |

| 31. Handwriting on the wall? |

|

If Starbucks is "focus(ing) more on growth abroad," doesn't that suggest that the economies "abroad" are healthier and, indeed, growing, while ours is not?

Just a thought. Tansy Gold |

| Printer Friendly | Permalink | | Top |

| TalkingDog

|

Thu May-01-08 08:14 AM Response to Reply #31 |

| 35. Not a better economy, just a bigger untapped market. |

|

Even in a bad economy new businesses start and thrive.

There might still be enough cache to the name overseas or enough ex-pats willing to shell out for a taste of home (as I did once in England and a happened upon KFC) to expand into new territory, however slowly that happens. The current marketing paradigm is grow or die. Any farmer or any forest can tell you that won't work. There is a natural cycle to land and growth. It's more along the lines of: fertile and fallow. Produce, then rest, retrench and produce again. Not as profitable in the short term, but done with consideration it is, at the very least, sustainable. My prediction is that the Marine Corps motto might come into vogue soon: Adapt and Overcome. |

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Thu May-01-08 05:25 AM Response to Original message |

| 7. Fed needs tough chief in Paul Volcker mould (editorial) |

|

BTW - This is an editorial that I can really embrace.

What got us into our financial pickle? Most academics are prisoners of the Efficient Market Hypothesis that assumes man acts rationally and efficiently in economic matters in ways that can be caught in elegant mathematical models. Ben Bernanke, chairman of the Federal Reserve, shares this view completely, and Alan Greenspan, his predecessor, when it suits him. In such a convenient world, there can be no bubbles and no crashes. A related belief is that sensible, disciplined control of money supply will drive away all ills, including the madness of crowds, and, therefore, a sensible central banker is all powerful. Unfortunately, both concepts are complete illusions. First, we live in a behavioural jungle where markets can crash 23 per cent in a day without any defining event, price/earnings ratios in Japan can rise to 65 times and the value of land under the Emperor's palace really can equal California's. Second, central bankers do not always do the right thing, often because that would involve great career risk. Being slapped by a Senate subcommittee for saying "irrational exuberance" is bad enough. Taking away punch bowls and risking being seen as holding the pin when the bubble pops is even more dangerous stuff. ..... Both Mr Bernanke and Mr Greenspan have trouble seeing bubbles. When Mr Bernanke describes an 80-year US housing bubble as "merely reflecting a strong US economy", we might wonder about his statisticians or his competence. But, really, it is about belief. He is not looking for bubbles to exist in his theoretical world. ..... Finally, when shall we stop appointing as Fed chairmen either academic economists - out of touch with the messy real world? - or lightweight commercial economists and find someone with solid banking experience? Would a banker with even a hint of John Pierpont Morgan in him have allowed such a sad deterioration of credit and banking standards? Where was Mr Volcker when we needed him? Fired for doing unpleasant but necessary things. So perhaps we get the Fed we deserve. Let me end with Mr Greenspan's full and contrite repentance: "I have no regrets on any of the Federal Reserve's policies that we initiated back then." http://news.yahoo.com/s/ft/20080429/bs_ft/fto042920081601541458 |

| Printer Friendly | Permalink | | Top |

| Ghost Dog

|

Thu May-01-08 05:47 AM Response to Original message |

| 9. Major financial marketplaces open on International Workers' Day |

|

Edited on Thu May-01-08 05:51 AM by Ghost Dog

can be found in USA, UK, Japan, Australia.

Also, Canada, NZ. (All quite flat, except the Nikkei down 0.6%.) Currency markets, of course, in effect, never close... That's all, folks. :hi: http://flag.blackened.net/daver/anarchism/mayday.html http://en.wikipedia.org/wiki/International_Workers%27_Day |

| Printer Friendly | Permalink | | Top |

| AnneD

|

Thu May-01-08 11:28 AM Response to Reply #9 |

| 71. Ghost Dog... |

|

Happy May Day...I think it is a bigger holiday in Europe than here.:hi:

|

| Printer Friendly | Permalink | | Top |

| Demeter

|

Thu May-01-08 05:59 AM Response to Original message |

| 11. Investors Retreat From Mutual Funds |

|

Edited on Thu May-01-08 06:00 AM by Demeter

http://www.nakedcapitalism.com/2008/04/investors-retreat-from-mutual-funds.html

The Financial Times reports that mutual funds got off to a very bad start this year, with 24 of the 25 biggest managers seeing a decline in funds. Note first that the article is not discussing individual funds (e.g. Magellean) but fund families (e.g. Fidelity). Note second that the fall isn't simply the result of declines in market values, but actual withdrawal of funds, but this apperas to be largely the result of investors moving heavily into cash. The article suggests that this is due to a loss of investor confidence. Another factor that may have contributed around the margin is a rise in withdrawals from 401 (k) plans (and presumably also IRA rollovers), a sign of rising consumer stress. But it does not yet appear that raiding capital to support consumption is a significant component of this decline.... ...Retail and institutional investors pulled $100bn from US, European and Japanese equity funds during the quarter, according to Strategic Insight. The trend is accelerating a shift in the money management industry, as investors move away from equity funds, which have been the industrys profit mainstay, towards either low-margin options such as short-term cash and indexed funds, or high- margin alternative investments such as hedge funds, private equity and hard assets. Long-term assets do not include money market funds, which have seen big inflows. Several money managers, such as Fidelity, have large money market funds which are offsetting their outflows, although money market funds are low-margin products and do not provide long-term investor loyalty. Fidelity had a drop of long-term assets of close to 10 per cent for the quarter, as investors continued to pull funds from the former market leader despite a lift in performance in its funds. |

| Printer Friendly | Permalink | | Top |

| DemReadingDU

|

Thu May-01-08 06:05 AM Response to Original message |

| 12. National Century trial Columbus Ohio - convicted executive wants new trial |

|

4/30/08 New evidence should lead to new trial, convicted National Century exec says A Columbus-area executive convicted of involvement in an alleged $3 billion fraud is asking he get set free or at least be given a new trial based on evidence he says federal prosecutors withheld. James Dierker, a former marketing executive found guilty of wire fraud in March, filed a motion Tuesday for acquittal and new trial based on what he says is newly discovered evidence. The 40-year-old Dierker and four others were found guilty in March on charges of conspiracy, fraud and money laundering for their roles in a fraud that plunged Dublin-based National Century Financial Enterprises Inc. into bankruptcy, resulting in as much as $3 billion in missing investor funds. Dierker denied the charges and testified in trial that he knew nothing of any fraud. He is currently under house arrest and faces up to 65 years in prison. In his latest court filing, Dierker alleges the U.S. government withheld Securities and Exchange Commission documents from his attorneys that would have bolstered his defense. The motion alleges the SEC discovered that National Century's auditing firm PriceWaterhouseCoopers LLP, and its predecessor Coopers & Lybrand LLP, failed to conduct a 1998 audit of National Century's books according to Generally Accepted Accounting Principles and Generally Accepted Auditing Standards. The filing goes on to allege the SEC found that auditing firm Deloitte & Touche, the successor to PriceWaterhouseCoopers, failed to properly evaluate financial red flags in National Century's 1999 books. Believing the opinions of outside auditors, Dierker thought National Century operated above board, the motion says. Assistant U.S. Attorney Douglas Squires declined to comment on the motion. The government has 20 days from the date of Dierker's motion to file a response. National Century was once the nation's largest financier of health-care providers. It specialized in buying their receivables at a discount for quick cash, then packaging the receivables as asset-backed bonds to sell to investors. National Century collapsed into bankruptcy in 2002, forcing other medical businesses to fail and prompting the U.S. Department of Justice to begin looking into the company's failure. http://www.bizjournals.com/columbus/stories/2008/04/28/daily23.html link backwards to previous articles... http://www.democraticunderground.com/discuss/duboard.php?az=show_mesg&forum=102&topic_id=3281287&mesg_id=3281326 |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Thu May-01-08 06:08 AM Response to Original message |

| 13. Planning and Investing in an Uncertain Economy |

|

http://www.nakedcapitalism.com/2008/04/planning-and-investing-in-uncertain.html

Reader Benjamin sent me this query, and I thought I'd be so bold as to hazard an answer, and anticipate that others will have valuable perspective to contribute: I... would like to see some macro advice for your younger readers, like myself. If I'm parsing commentary correctly, I may be graduating (2011, 2012) at the tail end of a big depression. Could you spare a few paragraphs of prediction or caution for younger readers at some point this week? Most of your commentary tends to favor an older and more savvy investing body but I venture that a look at a bigger picture targeted at my demographic would be fun to write (and hey, at least I'd read it avidly). Topics to consider: buying in at the housing market's bottom; alternate routes to building equity ('cause now I'm leery of the housing market as a vehicle); and traps that unsavvy investors like recent college grads might fall into. You didn't ask for advice on the career front, but unless you have a trust or are likely to inherit a substantial amount, your ability to support an investment strategy will depend on the level and stability of your income. I think the biggest change your cohort faces, and one mine is confronting with considerable pain, is lack of not merely job security but of obvious career paths. There are some exceptions; white collar careers such as medicine, law, and accounting that have managed to restrict entry via professionalization (education, licensing, ongoing requirements to maintain one's standing) are ones where you have a good shot at using the same fundamental skill set for your entire career. But for many in those fields, the earnings potential is not what it used to be. McKinsey requisitioned a study from Yankelovitch around 2000. It said that the average college graduate would have 13 jobs before he retired. A more recent study (can't recall the source) claimed it would be 11 jobs by age 38. The latter doesn't sound credible, but it's may be reasonable to assume the level might have risen from the 2000 estimate. So the cliche about developing a portfolio of skills, sadly, is good advice. One thing I now recognize in retrospect is high flier career paths are a double edged sword. While they offer a certain level of credibility ("oh you did/worked for so and so?"),The problem is that people early in their careers look at the upside, and often fail to consider what their options are if they are not as successful as they hope to be or discover they really don't like the work all that much. if you continue on these tracks beyond a certain level, you often wind up with very narrow skills (for instance, what happens to people who structured CDOs? The dot com bust similarly saw a lot of people having to find work in fields new to them). Some who go this route nevertheless are able to move from one "track' to another (some investment bankers have become CFOs at large companies, for instance; law firm partners can be hired by their clients as general counsel), but moves like that include an element of luck and good personal chemistry. That is a long winded way of saying most people underestimate employment risk. So most people (yours truly included when I was young) do not put away enough money to carry them between jobs. For someone in their twenties, six months of expenses; that amount has to go up as you get old, both because it takes longer for more seasoned people to find work and older people tend to develop higher fixed cost levels, This disaster money should be invested VERY conservatively. The above probably doesn't strike you as novel, but I'd be remiss in not saying it. In planning, it is also important to know yourself, both in terms of possible career choices and investing, You are less likely to do well at something if you don't have an affinity for it. Again, that no doubt seems pedestrian, but people can do an amazing job of talking themselves into career and investment choices that don't suit them because they are swayed by what people around them are doing. For instance, I had convinced myself at the start of my career that making money was what motivated me, but that was because it was the right answer in interviews for the sort of job I had set my sights on. After gong down other paths based on acting out of surface motives, I got a better understanding of what really did and didn't work for me, and it was very different than what I had believed. The more you can do to get an understanding of your own MO can you tolerate frequent, intense intraday pressure? How much autonomy do you need? How good at and tolerant of politics are you? Are you good at functioning in chaotic environments or do you like structure? Most people spent a lot of time thinking about their skills and strengths, when understanding what sort of environment they prefer is often given short shritf. To your immediate question: it is well nigh impossible to give advice on how to think about investing in 2010 or 2011, beyond some generalizations. By then, it should be clearer what the trajectory for the US and world economy is. That will make it easier to think about who winners and losers might be. By then, the idea of "house as investment" might have been wrung out of the American psyche. Your home is first and foremost where you live. Real estate is always local, You may see opportunities that are attractive, but be very strict on looking at the after tax cost of ownership versus rental, Robert Shiller determined that the real returns to residential real estate were 0.4%. The first apartment I bought was cheaper after taxes than renting, and that was in Manhattan. The other question is how much do you like investing? You can be a reader of this blog and actually not like investing, I write this blog and I hate investing (despite doing well via a risk-avoidant strategy, which BTW in this case does not mean a high allocation to cash, although that is tempting). The markets are too irrational and volatile for my taste (and Benoit Mandelbrot, the French mathematician, has shown that markets are far riskier than standard theories lead us to believe. His and similar work is acknowledged in theory and ignored in practice). And how much risk can you take, really? Standard recommendations are for young people to invest heavily in stocks, and reduce their allocation as they get older, But in a bad bear market, stocks can fall 50% (if memory serves me right, the S&P fell 47% peak to trough in the dot com bust). Can you take that? Diversification by asset class is important, but a lot of things are touted as asset classes by clever fund managers, In a crisis all correlations move to one. Commodities are considered to be a good addition to a model portfolio because they have positive skewness (although they are also hugely volatile, and those markets are far smaller than securities markets, so new cash inflows can have a big impact), Income averaging is a good idea. Vanguard funds are a very good idea. Fees will eat away at what seem to be promising investment returns. The big argument for holding stocks as opposed to investment funds is if you are investing in a taxable account. Mutual funds trade with sufficient frequency that they are tax inefficient. If you hold stocks, you can do better after tax, but you have to be prepared to leave them alone for years. Ben Grahman's little book, The Intelligent Investor, is very much worth reading. It gives some commonsensical guidelines (you'd need to update them for the existence of index funds) but the most important is either spend very little time on investing, do a few simple things with your money or make it your second job. Anything in the middle is worse, for you will overtrade and reduce your returns. IMO IT IS EXTREMELY UNLIKELY THAT 2012 WILL MARK THE END OF THIS CRASH AND BURN--IT MIGHT BE THE END OF THE BEGINNING, BUT NO MORE THAN THAT. REALITY MIGHT START TO PENETRATE THE THICKHEADS AT THAT DATE, AFTER KNOCKING FOR DECADES....BUT WHETHER ANYONE IN AUTHORITY WILL GRASP THE NETTLE FIRMLY IS DOUBTFUL AT BEST. MY NATIVE OPTIMISM HAS FINALLY DIED A LONG BRUTAL AND PAINFUL DEATH. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Thu May-01-08 06:14 AM Response to Original message |

| 14. Jeremy Grantham: "Immoral Hazard" and the Loss of Standards |

|

http://www.nakedcapitalism.com/2008/04/jeremy-grantham-immoral-hazard-and-loss.html

Its not that the former Fed boss Greenspan was incompetent that is remarkable. Incompetence is common enough after all, even in important jobs. Whats remarkable is that so many people dont seem, even now, to get it. Do people just believe high-quality self-justifying blarney? Or is it just that they apparently want to believe that critical jobs in a great country attract great talent by divine right. Sometimes, of course, they do, but sometimes the most important jobs even that of a presidency or a Fed boss end up with mediocrities.... Paul Volcker inherited about as big a mess as we have today. He worked out what he had to do and did it with unusual lack of concern about what Congress thought of the necessary pain involved and the number of enemies he might make. He paid the price for forthright behavior by being replaced, despite a record for correct and tough behavior that makes for the most invidious comparison today. When Volcker was replaced, by the way, he did not moan and groan but like an old soldier quietly disappeared. There were no high-profi le announcements about the economy or any $300,000-an-evening appearances paid for by financial firms. Greenspan came onto my radar screen in the late sixties as a seller of economic and financial advice to the investment industry. To be brutally honest, he was considered run of the mill by anyone I knew then or have met later who knew his service then. His high point in most memories, certainly mine, was a famous call in January 1973 that, it can, a few days before a market decline of over 60% in real terms, second only to the Great Crash in a century, accompanied also by a bitter recession. This was one of the first of a long line of terrible prognostications for which he has remarkably not been remembered, except by a handful of us amateur historians. Then in the mid-seventies he disappeared into some government job, of which I was barely aware, until he re-emerged with a bang in 1987, without as far as I can find having done anything documentably very well. And we can agree that at least occasionally people can indeed prove their effectiveness beyond doubt.....We can all wonder at the incredible vision, drive, organizational skill, and willingness to sacrifice resources that were required by the Manhattan Project and compare it to the rudderless or even deliberate avoidance of leadership of the greatest issues today: climate change and energy security. We can only wonder what a Manhattan Project aimed at alternative energy might have accomplished by now, had it been started 15 years ago. What we have had in lieu of vision, leadership, and backbone is a series of easy paths taken. At the time that Paul Volcker broke the back of inflation in the early 1980s, the recognition that risk and leverage had consequences was baked into the pie: if you were to take excessive risk you had better win the bet. If you missed the target, the expected result would be more or less total failure, and that seemed then and for decades earlier a reasonable law of nature. Now in contrast we get ready to celebrate the 20th anniversary of the era of the Great Moral Hazard. Slowly at first, but with steadily growing traction, the idea was planted that asset bubbles would be tolerated, but consequences of their bursting would be moderated or avoided entirely by increasingly vigorous actions sometimes, like now, bordering on the hysterical. This is to say that if all went well, enormous profits could be made by speculators largely the great financial firms, including some formerly conservative blue chip banks by riding and leveraging the bubbles. If all went badly, then the costs would be passed on to others. The idea that occasional economic setbacks might benefit the system in the long run was one of the early ideas to disappear. Yet if you prop up weak sisters who would otherwise fail and in failing present their more efficient competitors with extra growth, you must surely weaken the system. Desperation pricing from weak firms who simply should not exist can weaken the profitability of a whole industry, as it has for the airlines. The average efficiency of most industries is reduced with at least some effects on our global competitiveness. With a slightly lower average return on equity, the ability to reinvest drops so that, in this world of moral hazard where recessions are few and mild, GDP growth is a little less than it might have been.... The defense of bailouts is that the alternative is ugly.But surely the penalties for excessive risk taking, issuing flaky paper, passing it on often in its entirety to others, and not even understanding the consequences of the low grade paper that you yourself issue should be ugly. Yes, of course, we would like to punish the excessive risk takers goes the line, but we cant do it without hurting the innocent economy. But we will never know what can be absorbed if the penalties are always removed by a bailout. In more traditional times, say, from 1945 to 1985, the economy could absorb substantial punishment from recessions and still grow faster than it has done in the last 10 years. The real incompetence here goes back over 20 years: the refusal to deal with investment bubbles as they form, combined with willingness, even eagerness, to rush to the rescue as they break. Its almost as if neither Greenspan nor Bernanke allows himself to see the bubbles. Greenspan was always conflicted and contradictory about whether bubbles could even exist or not. Bernanke, in contrast, has more of the typical academics certainty that the established belief in market efficiency is correct and therefore investment bubbles must be merely the product of investors overheated imaginations. It would be convenient to have such an important role as Fed Chairman filled by someone who actually deals with the real world, messy or not, that is given to inconvenient bursts of euphoria and riddled by considerations of career and business risk, which modify behavior far away from economic efficiency.... As discussed many times in the investment business, pessimism or realism in the face of probable trouble is just plain bad for business and bad for careers. What I am only slowly realizing, though, is how similar the career risk appears to be for the Fed. It doesnt want to move against bubbles because Congress and business do not like it and show their dislike in unmistakable terms. Even Fed chairmen get bullied and have their faces slapped if they stick to their guns, which will, not surprisingly, be rare since everyone values his career or does not want to be replaced à la Volcker. So, be as optimistic as possible, be nice to everyone, bail everyone out, and hope for the best. If all goes well after all, you will have a lot of grateful bailees who will happily hire you for $300,000 a pop. By the way, that such payments to prior Fed officials are in themselves a moral hazard and an obvious conflict of interest that could moderate their prior behavior, is apparently too crude an accusation even to have surfaced yet. Well it should surface. Selling services to financial interests whose fates have been in your hands should simply not be tolerated as acceptable or ethical behavior by a former Fed Chairman. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Thu May-01-08 06:19 AM Response to Original message |

| 15. Did Robert Rubin Jeopardize Financial Stability to Protect Goldman Sachs? |

|

http://www.prospect.org/csnc/blogs/beat_the_press_archive?month=04&year=2008&base_name=did_robert_rubin_jeopardize_fi

That is what he claims, according to the NYT. The NYT reports that Rubin claims that he was considering imposing stricter margin requirements on futures trading when he was leaving Goldman Sachs to take a top position in the Clinton administration. According to the article, Rubin claims he abandoned the plans when the Chicago Board of Trade told him we will make sure Goldman Sachs never trades another future on the C.B.O.T. if this went ahead. A spokesperson for the company that now owns the C.B.O.T. denies that any such threat was ever made, but this is an incredibly important news story. The implication is that a top official in the Clinton administration, who subsequently became Treasury Secretary, altered regulatory policy based on a threat made against his former firm. If such a threat was actually made, then it should have been reported to the F.B.I. and some people connected with the C.B.O.T. should be sitting in jail right now. If Mr. Rubin was actually prepared to alter regulatory policy to serve his former firm, then he clearly had conflicts of interest that made him unqualified to hold a top government position. This issue merits investigation not only to determine whether Robert Rubin acted improperly, but also to determine whether it is common practice for government officials to alter policy to serve the interests of their former employers. The fact that Robert Rubin would have no qualms claiming to the NYT that he dropped a regulatory proposal to protect Goldman Sachs, suggests that such behavior is common. --Dean Baker |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Thu May-01-08 06:23 AM Response to Original message |

| 16. Tin Cups and Ponzi Boyz |

|

http://wallstreetexaminer.com/blogs/winter/?p=1593 On the question of foreign central banks, I spotted this item showing that of late it has been Russia who has been engaging USD buying interventions to stem the appreciation of the Rouble, (another defacto pegged currency). This operation in effect buys more overpriced USD securities and puts even more Roubles into the Russian economy to do so. MOSCOW, April 25 (Reuters) - Russias central bank has bought about $20 billion on the forex market this month to prevent the rouble from appreciating against the dual currency basket, First Deputy Chairman Alexei Ulyukayev said on Friday. Dealers said Fridays trade volumes at Moscows MICEX exchange reached $10.3 billion, with the central bank purchasing about $6 billion. Next we see the familiar pattern of these countries trying to control their Mad Max inflations with monetary rather than currency policy. These countries tighten, the US eases, and the cheapened USDs come rushing in for exchange. Note however the discussion about allowing the Rouble to appreciate. By how much is the question. Increasing bank capital set asides is a rouble sterilization operation. On Thursday, Ulyukayev said the central bank was ready to tighten monetary policy because foreign capital inflows have picked up again and inflation accelerated to 14 percent in April. Ulyukayev, who chairs the Bank of Russias monetary policy committee, said the bank may soon raise interest rates but did not rule out the use of rouble appreciation or an increase in the amount of capital banks have to set aside... These Dollar recycling and intervention operations are entirely a function of the needs and timing of the enabling country (Russia in this instance) and not the US. If Russia decides, say on a Friday, to engage in this conduct, it has little if anything to do with US Treasury or GSEs finance needs of the moment. It is entirely a function of the internal policy decisions of the FCB. I think that is why the indirect participations at the auctions have been so erratic. So if the the US Treasury or Fannie Mae were to show up next week with a big tin cup, it may be tough shit Ponzi Boyz. Or if Ponzi Boyz were lucky, it may be that the FCBs generically had the need that day. However, with the kind of storm the palace inflations these countries are now experiencing, their real and proper need is currency appreciation, and halting USD recycling and by extension local currency printing. That way, some of the inflation can be transmitted off on the US, and other USD holders. Its hard to see why Russia in particular would even care about those consequences for Americans. Buying USD securities at puny interest rates then becomes a hot potato right as US financings are gathering steam. The fact that FCB demand for US securities is so artificial and self directed will make these financings extremely difficult to conduct. Also discussed in the backside of the podcast was the prospect for the Fed to start aggressively monetizing the Treasurys finance onslaught. I have little doubt that some of this will be attempted, especially when the Ponzi Boyz cant time these new debt offerings with foreigners needs. Also the broker-dealer network is too strained to hold the bag on tens of billions of routed marked down US Treasury notes. But the effect of monetizations will be limited and in my thinking very overrated. The amounts required are just too large. It is like going into battle against tanks and artillery with a 22 caliber. There are big problems with it as well, and one are traders (Berserkers). Once these Berserkers spot a few serious coupon passes, watch the swift and immediate reaction. And you thought $120 oil, and $5 milk was bad? The other problem is that FCBs hold $2.254 trillion (just custodial holdings) in US securities already. They will have to be kept sedated. Rattle even a few of those holders at the margin and rates could get hiked a couple percent over night. The Ponzi Boyz do have a few tried and true short term Godfather protection racket tricks that could also be employed, especially with incidents in the Middle East. The idea is to get the USD holders there into a tizzy and panic them into the safety of US Treasuries and agencies. A version of this was produced last week, but had little effect. Perhaps something much bigger is in store? Dont be too surprised if we get a whodathunk in that score. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Thu May-01-08 06:28 AM Response to Original message |

| 17. Real House Prices / The changing housing cycle and its implications for monetary policy |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Thu May-01-08 06:38 AM Response to Reply #17 |

| 19. Why Haven't Existing Home Sales Fallen Further? |

|

http://calculatedrisk.blogspot.com/2008/04/why-havent-existing-home-sales-fallen.html

The first graph compares New Home sales vs. Existing Home sales since January 1994.  Clearly new home sales have fallen faster than existing home sales. Based on various reports, it appears new home builders cut their prices quicker than most existing home sellers. So why have new home sales fallen faster than existing home sales? There could be a number of possible explanations: Perhaps new homes were more overpriced than existing homes, so the larger price cuts haven't been enough to motivate buyers. Or maybe there was more speculative buying in the new home market. During the boom, many buyers could put down 1% or less and hold a house for 6 to 9 months; essentially a call option on the house. But if that was the reason, wouldn't new home sales have increased quicker than existing home sales during the boom? It appears the ratio of sales tracked pretty closely from '94 through '05. Or maybe all the REO sales (bank Real Estate Owned) are boosting the number of existing home transactions. Note: It is my understanding that banks taking possession of foreclosed properties are not counted in the NAR's existing home sales report, but the resale of REOs are counted. Whatever the reason - and I'm always a little skeptical of the NAR's numbers - existing home sales are still above the normal range. .....more at link.... This suggests that sales of existing homes could fall significantly more in 2008. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Thu May-01-08 07:37 AM Response to Reply #19 |

| 30. From RGE Monitor Newsletter |

|

It is quite an eventful week in terms of data releases in the U.S. It kicked off yesterday with the S&P Case-Shiller home-price index and the consumer confidence index by the Conference Board showing rapidly falling home prices and rising consumer worries about jobs and incomes. Today we will all follow with attention the advance estimate of Q1 real GDP growth and the FOMC decision. Thursday the ISM Manufacturing index among other reports will grab the attention of markets and analysts. The important employment report will then close the week on Friday. We are in the third year of the U.S. housing recession and the bottom does not seem to be in sight yet. Housing starts (and completions) are falling but not yet fast enough to offset the sharper fall in demand (home sales) and therefore to insure a fast absorption of the rising home inventories that keep putting downward pressure on prices. In fact, more dismal news came yesterday from the S&P Case-Shiller home price index now down almost 15% from its peak according to which not only do house prices across the nation's biggest cities continue to fall but they are actually accelerating on their way down. Take a look at: How Much Will U.S. Housing Prices Fall and How Long Will the Downturn Last?, Is the Worst Over Or Is the U.S. Housing Recession Getting Worse? and Are U.S. Homes Empty? A Look at the Homeowner Vacancy Rate While the end of the housing recession is nowhere in sight, Q1 might officially mark the first quarter of negative real GDP growth since 2001, or will it? Estimates for real economic growth for Q1 range from a negative -1.3% all the way to a positive 1.5%. Optimists argue that improved net exports and the strong rebound in inventories in Q1 after large declines in Q4 will sustain growth; but such excessive inventory build-up would bode poorly for Q2 growth. On the other hand, housing woes, the retrenchment in consumption and slowdown in business investment call for weak or possibly negative growth. The consensus foresees weak but positive GDP growth of 0.3%. Stay tuned for the Q1 real GDP numbers and the market reaction today! While spikes in jobless claims and higher long-term unemployment show a sharp slowdown in hiring, lay-offs especially in the financial sector have also intensified in the recent weeks. Unemployment has also increased in states hard hit by housing, financial and auto woes. As the effects of the financial crisis are spreading to other sectors of the economy, the labor market is only expected to deteriorate further in the coming months, after a three-month consecutive payroll decline in Q1 2008. Given that labor market is a lagging indicator and subject to slow recovery, stronger job losses ahead, especially in high-paying sectors will weigh down heavily on the liquidity-constrained consumers. |

| Printer Friendly | Permalink | | Top |

| kickysnana

|

Thu May-01-08 09:39 AM Response to Reply #19 |

| 54. I heard of two people this week who are in a "take almost any offer" situation here in MN. |

|

At this point they are hoping to "break even." One has left the country, the other had to move to assisted living because of health problems. Their homes have been on the market since last year. NO offers. People are looking at the foreclosures, thinking bargains.

|

| Printer Friendly | Permalink | | Top |

| Demeter

|

Thu May-01-08 06:31 AM Response to Original message |

| 18. Distance Tariffs On Fossil Fuel Trade Impacts By Kent Welton |

|

http://www.opednews.com/articles/opedne_kent_wel_060326_distance_tariffs.htm