I was looking for something Rush keeps saying about the top 10% pay 40% of the taxes. Anybody know where that info is on a Government site?

http://www.mybudget360.com/how-much-does-the-average-american-make-breaking-down-the-us-household-income-numbers/Posted by mybudget360

How much does the typical American family make? This question is probably one of the most central in figuring out how we can go about fixing our current economic malaise. After all, we dont hear many people saying in todays world that they have too much money.

The median household income in the United States is $46,326. Here in California people have a hard time understanding that yes, 50 percent of our population live on $46,000 or less a year. Even today, all the elixirs and remedies being thrown around fail to focus on income and the big brother of income, solid employment. Dual earner households have a higher median income at $67,348.

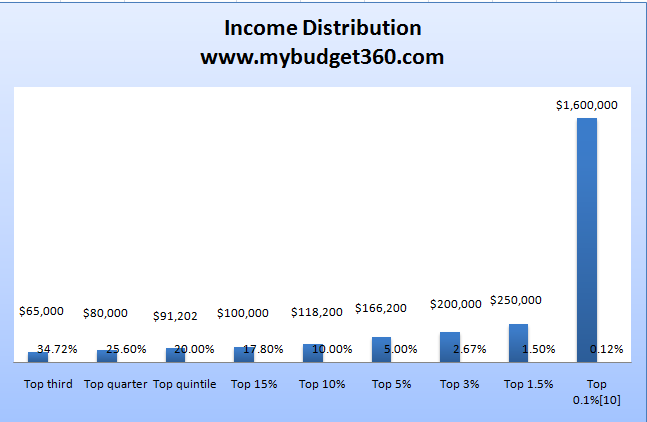

To highlight the massive discrepancy Ive put together a chart showing the household income distribution:

As you can see from the above chart, only 17.8% of all U.S. households make more than $118,200 a year. Only 2.67% make more than $200,000. The fact that only 34% make more than $65,000 is astounding given how expensive other cost of living items have gotten over the past decade. That is why the middle class is feeling squeezed from all different sides.

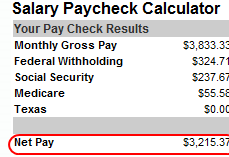

When I put together a budget for a family making $100,000 I received a bit of feedback on both sides. Even though I realized very few people had household incomes in the 6 figure range looking very closely at the data, I can understand why people took issue with a budget that was at that level. I also put together a budget from someone living in California making $46,000 a year and received feedback as well. I think when it comes to income, you can never have too much.

What is even more fascinating, is how even amongst the super wealthy income is not distributed evenly. There are approximately 146,000 (0.1%) households with incomes exceeding $1,500,000 a year. Even at that, the top 0.01% of households had incomes of $5,500,000 and accounted for 11,000 households. The 400 highest tax payers in the nation brought in a stunning $87,000,000 a year. Now that is wealth.

FULL story at link.